The Missed Payment Rate Hits New High of 32 Percent in July

For the millions of Americans struggling from the economic fallout of the coronavirus pandemic, June began to offer the hope of light at the end of the tunnel. During the month, all 50 states either partially or fully reopened their economies, allowing businesses to hire back millions of employees who had recently been laid off. As a result, the national unemployment rate dropped to 11 percent, down from a high of nearly 15 percent in March. More recently, however, the number of new coronavirus cases has surged, and reopening plans have been paused or rolled back throughout the country, making clear that effects of the pandemic are far from behind us. This continued economic hardship is having serious implications for housing security. For the fourth straight month, a historically high number of renters and homeowners were unable to pay their full housing bill.

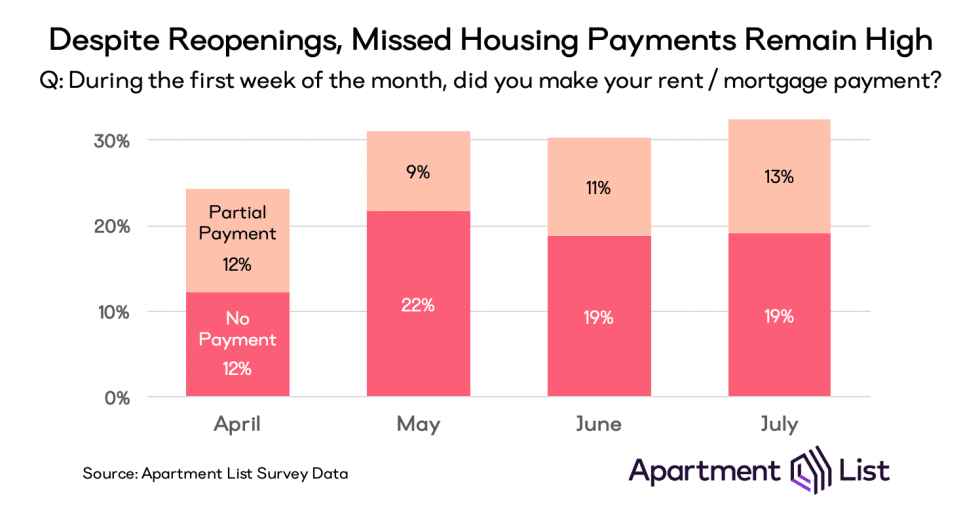

Since April, our team has surveyed renters and homeowners about the impact of the pandemic on their employment and their ability to afford housing.1 In early April, the percentage of Americans unable to make a full on-time housing payment jumped to 24 percent, then rose to 31 percent in May. This missed payment rate has since stabilized, dipping slightly to 30 percent in June before ticking back up to 32 percent in July. During the first week of this month, 19 percent of Americans had made no housing payment, while an additional 13 percent paid only a portion of their monthly bill.

It continues to be the case that the majority of payments missed in the first week of the month are made up with late payments. 89 percent of respondents reported that they had paid their June bill in full as of the first week of July. This is consistent with the end-of-month payment rate for prior months.

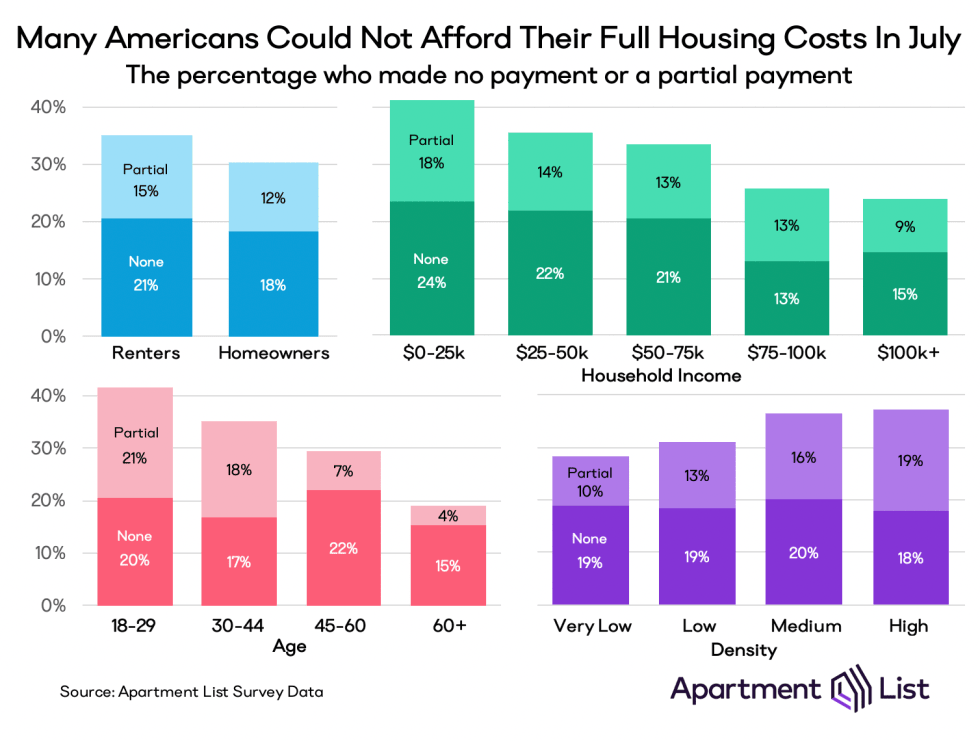

More than 1-in-3 Renters Did Not Pay July Rent On Time

July brought a continuation of several trends observed over the previous three months. Renters continue to struggle more than homeowners, however both groups are widely affected; this month, 36 percent of renters and 30 percent of homeowners failed to make full on-time payments. Naturally, younger and lower-income households have more trouble than older and wealthier ones; for those under 30 years old and those making less than $25,000 annually, the missed payment rate exceeded 40 percent in July. Missed payments also remain correlated with population density, and in medium- and high-density areas where the early spread of the virus compounded the existing stress of high housing costs, over one-third of residents are still finding it difficult to pay their bills.

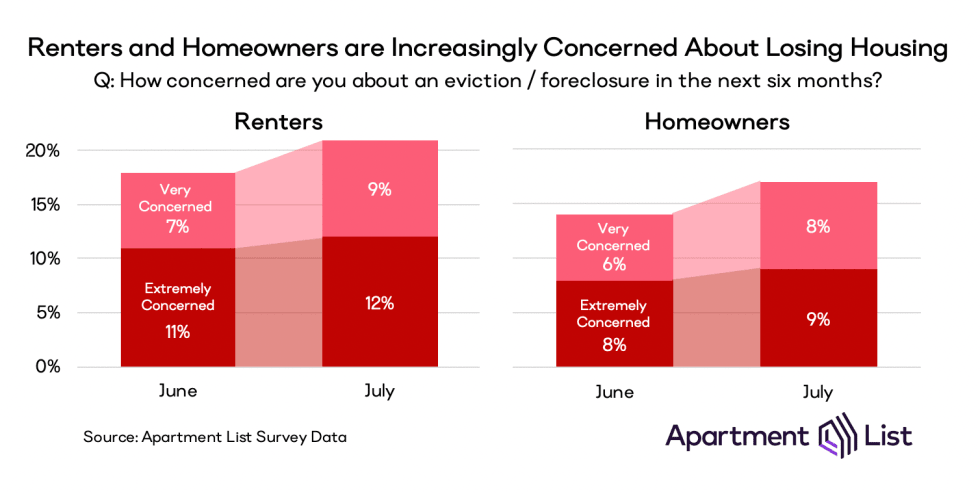

Americans Are Becoming Increasingly Concerned About Evictions & Foreclosures

As overdue bills pile up, there is growing concern that a wave of evictions and foreclosures will hit the housing market. Short-term displacement bans were established across the country at the outset of the pandemic, but many of these protections are now reaching their original expiration dates. In response, federal protections have been extended through the end of August, and some smaller jurisdictions have extended eviction bans as far forward as 2021.2 But some parts of the country are allowing protections to expire even as COVID cases rise, allowing landlords to file eviction notices to those who are delinquent on their payments.3

While eviction protections today vary dramatically from place to place, our survey shows widespread and growing concern about housing insecurity. From June to July, the share of renters who are either “very” or “extremely” concerned about being evicted rose from 18 percent to over 21. Similarly, the share of homeowners concerned about foreclosure ticked up from 14 percent to 17 percent.

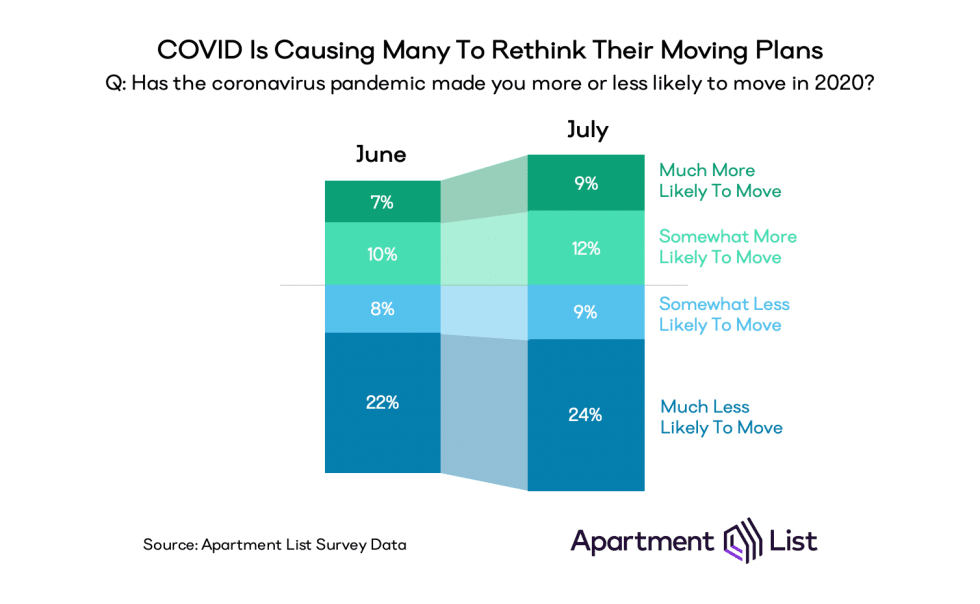

Coronavirus Is Having A Greater Impact On People’s Moving Plans

According to last month’s survey, the financial fallout from the pandemic is simultaneously encouraging and discouraging moving. Loss of income has left some households with no choice but to move to a more-affordable home. For others, the costs associated with moving now seem overly burdensome, leading them to stay put. We also find that the virus itself is continuing to have a major impact on moving plans, with many reporting they are less likely to move because they do not believe it is safe to do so. Meanwhile, the opportunity to work remotely is inspiring some to consider locations that, prior to the pandemic, were not feasible because of work constraints.

This month’s survey shows that the pandemic’s impact on migration is deepening in both directions. The share of Americans who say that they are more likely to move this year due to the pandemic increased from 17 to 21 percent, while the share who say that they are less likely to move increased from 30 to 33 percent. Health risks continue to be the biggest factor discouraging moves, and the percentage who cite safety concerns rose from 37 percent to 44 percent. As for those considering a move, the opportunity to work from home is becoming more of a driver. 23 percent say it’s playing a role in their decision, up from 19 percent last month.

Income loss continues to be a major driver as well. One-third of those who have experienced a layoff are now considering a move, compared to just to 16 percent of those who have had no major disruption to their job. High-density city residents remain the most likely to move (33 percent), but increased likelihood of moving is becoming more common across the board. Even in rural parts of the country, the share who reported increased interest in moving rose from 12 percent in June to 16 percent in July.

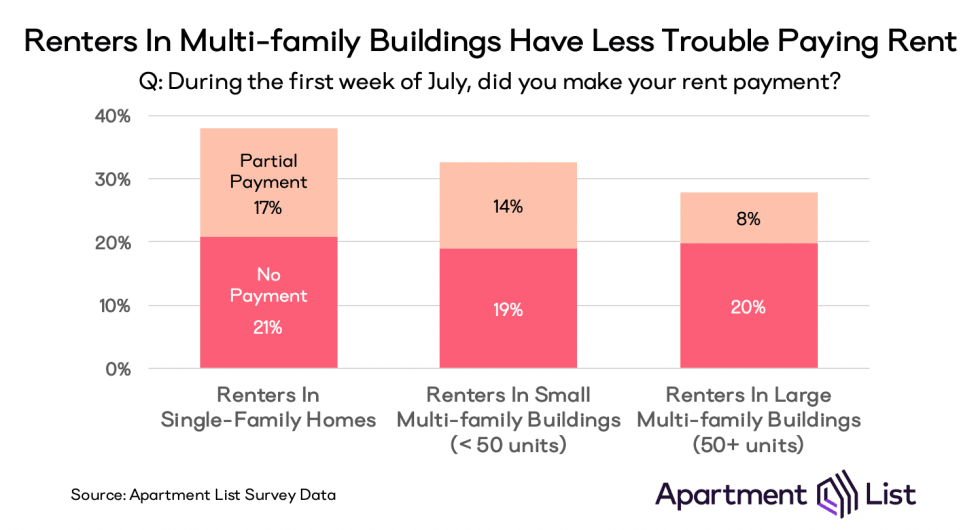

Renters in Large Multi-family Buildings Have Less Trouble Paying Their Bills

While homeownership in America is largely concentrated in single-family homes, renters occupy a wider variety of housing types.4 In our survey, 90 percent of homeowners live in a single-family home, compared to just 47 percent of renters. The remainder live in multi-family buildings ranging from small units (e.g., duplexes) to massive apartment complexes. In July, we found that renters in single-family homes had the most difficulty affording their housing; 21 percent made no payment, while another 17 percent made a partial payment. The missed payment rate was lower for residents of small-to-medium-sized multi-family buildings with fewer than 50 units (33 percent) and was lowest for those in large multi-family buildings containing 50 or more units (28 percent).

Conclusion

Economic reopenings swept the nation in June and provided some unemployment relief, but did little to ease the housing payment crisis. Despite some Americans getting back to work in June, the rate of missed housing payments actually increased. Looking forward to July, the majority of states have either paused or are reversing their scheduled reopenings. If local displacement bans are allowed to expire before local economies begin to recover, the missed payments we have been tracking over the past four months could lead to a wave of downgrade moves as renters and homeowners seek more affordable housing. Already we are witnessing unprecedented declines in rent prices as demand for expensive housing wanes.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.