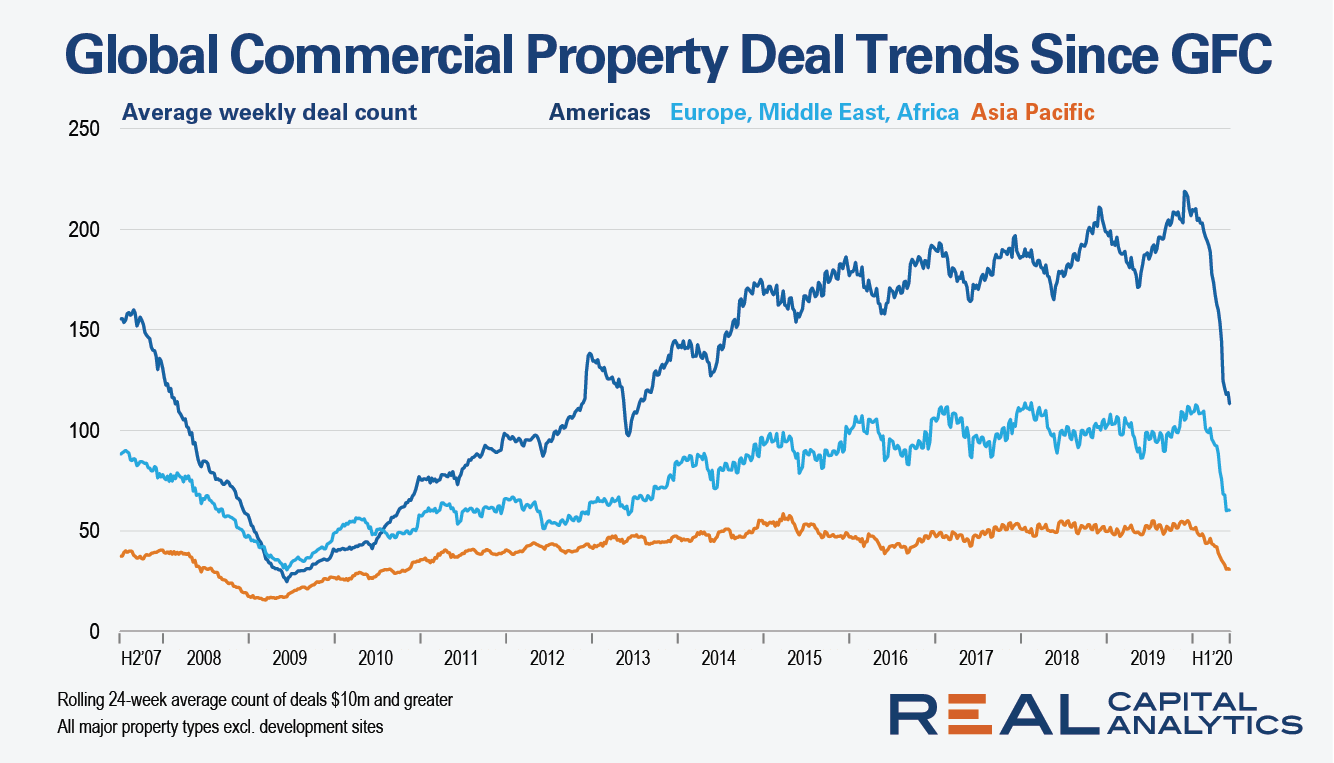

The speed and depth of the current drop in global commercial real estate activity is worth putting into historical context. In the chart below we plot the average weekly deal count for the three global zones since late 2007, before the last worldwide crisis upended the commercial property market.

Prior to the Global Financial Crisis, the number of deals completed in a typical week was above 150 in the Americas, a little under 100 for Europe, Middle East, Africa (EMEA) and around 40 in Asia Pacific (APAC). Commercial real estate activity in both EMEA and the Americas slid to a low point in the middle of 2009. APAC had already trickled to just a handful of weekly deals at the start of 2009, staying at a low ebb for six months.

It took five years for the Americas to return to pre-GFC levels. The trend continued upward — albeit with the usual seasonality — to reach an average of more than 200 deals per week at the end of last year. EMEA suffered amid the European debt crisis that followed the GFC and tailed the America in its rebound. APAC reached a peak of deal flow in 2011 and hovered around that level through the end of last year.

The severity of the current decline is unprecedented in its speed. From the close of 2019 to the end of H1 2020, average deal count in the Americas dropped by almost 50%; the decline of the same magnitude took 11 months during the GFC. For EMEA, the H1 2020 drop of nearly 50% took 17 months. APAC’s 2020 downturn of around 45% took 10 months.

On a slightly brighter note, as of mid-summer — which is usually a slower period for dealmaking in the Americas and EMEA — deal flow is still more abundant than it was during the worst of the GFC drought.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.