On the whole, June was a significant step forward for the wider fast food industry, but the month did show signs that leading brands may not be in the clear just yet.

June’s Rebound

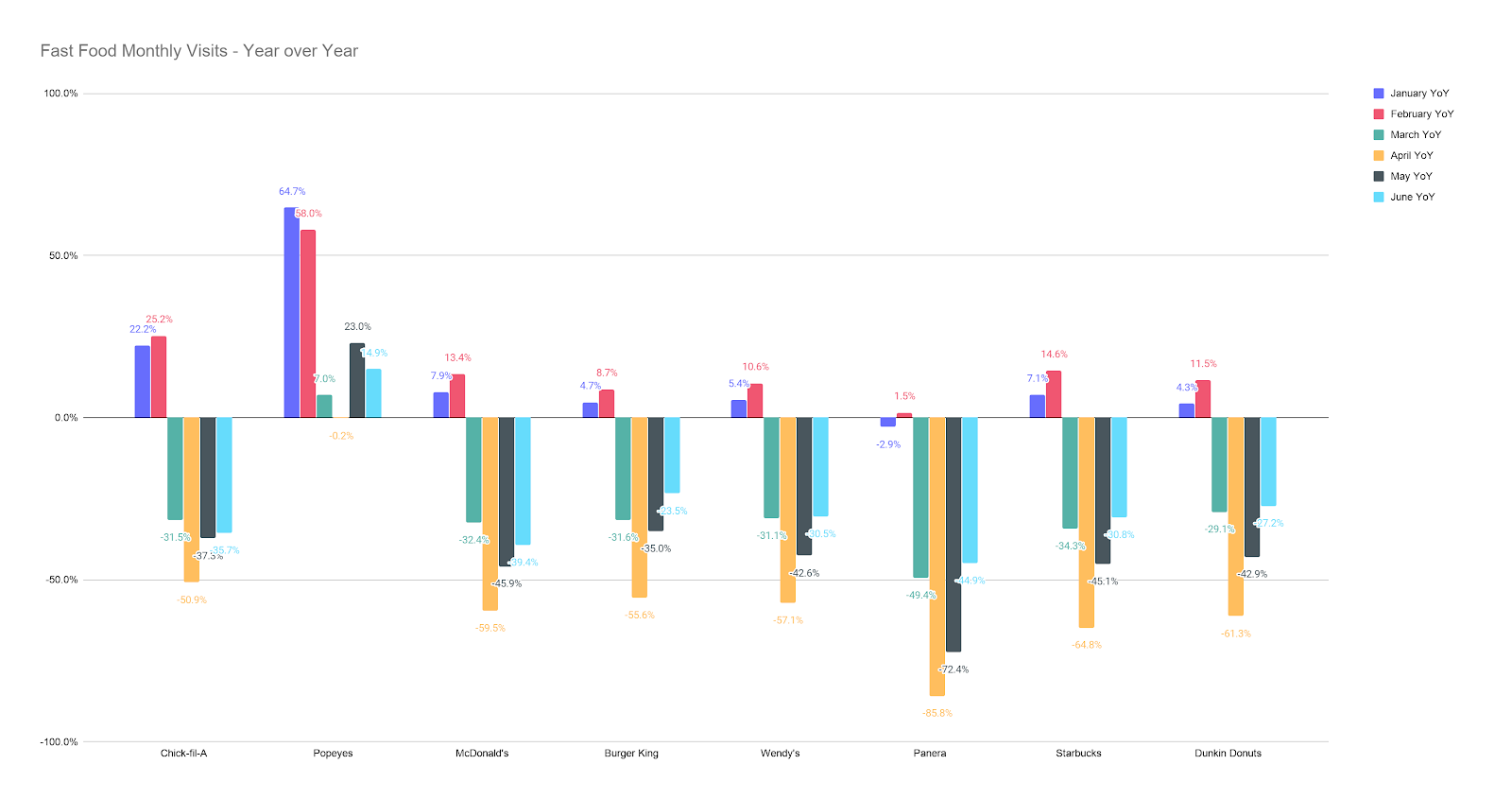

Analyzing eight top brands across the fast-food sector saw June bring a further push to the overall sector’s recovery. The group saw an average year-over-year decline of 27.1% in June, a significant improvement on visits that were down an average of 37.3% year over year in May and 54.4% at the pandemic’s shutdown peak in April.

Mixed Picture

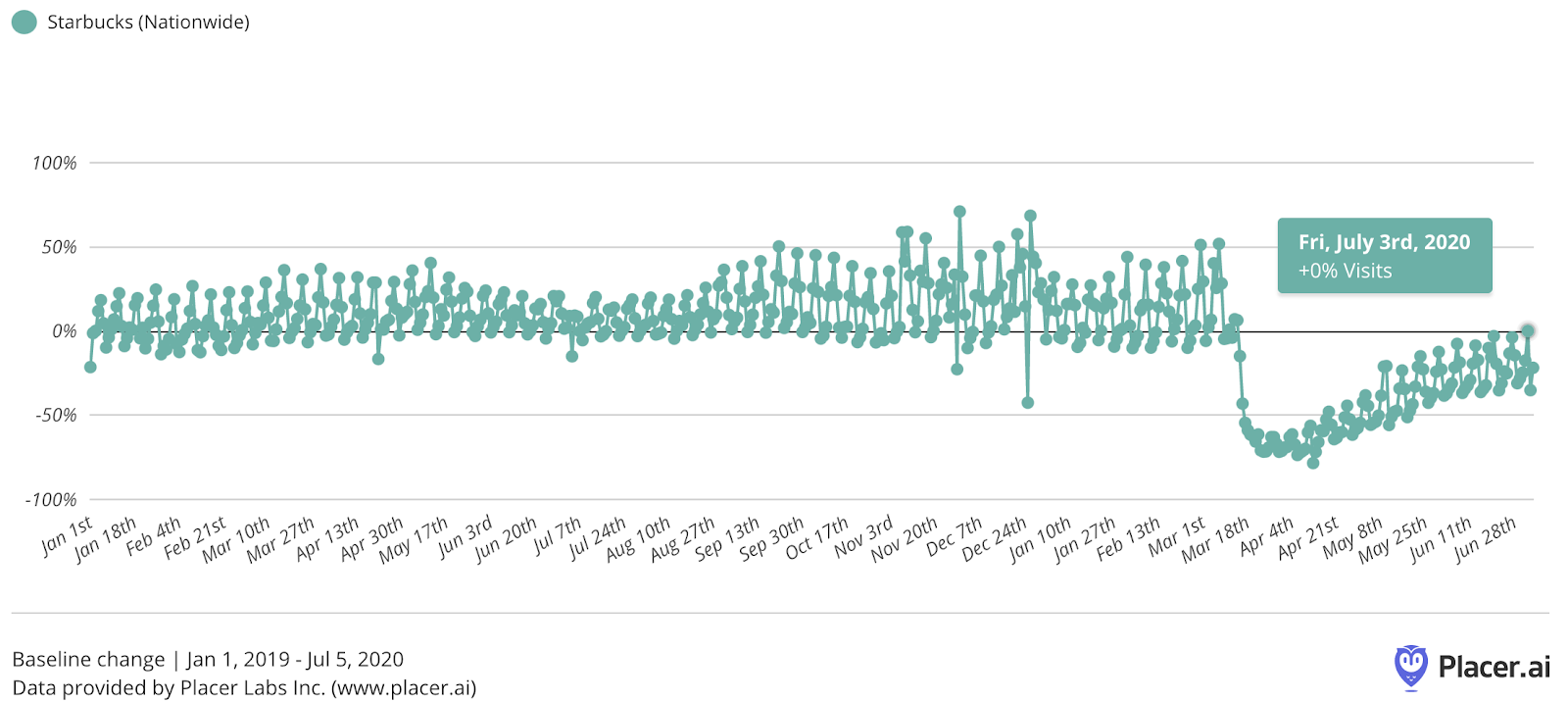

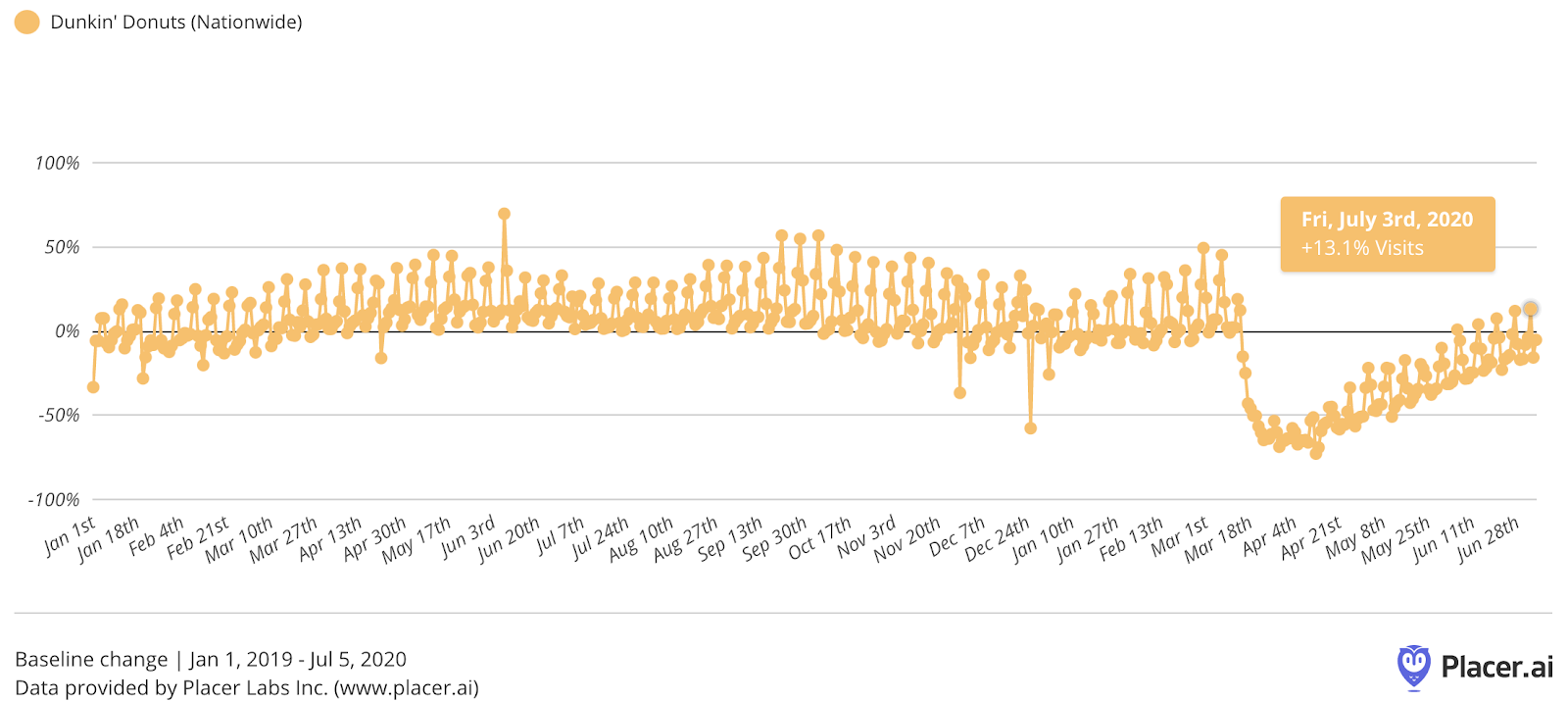

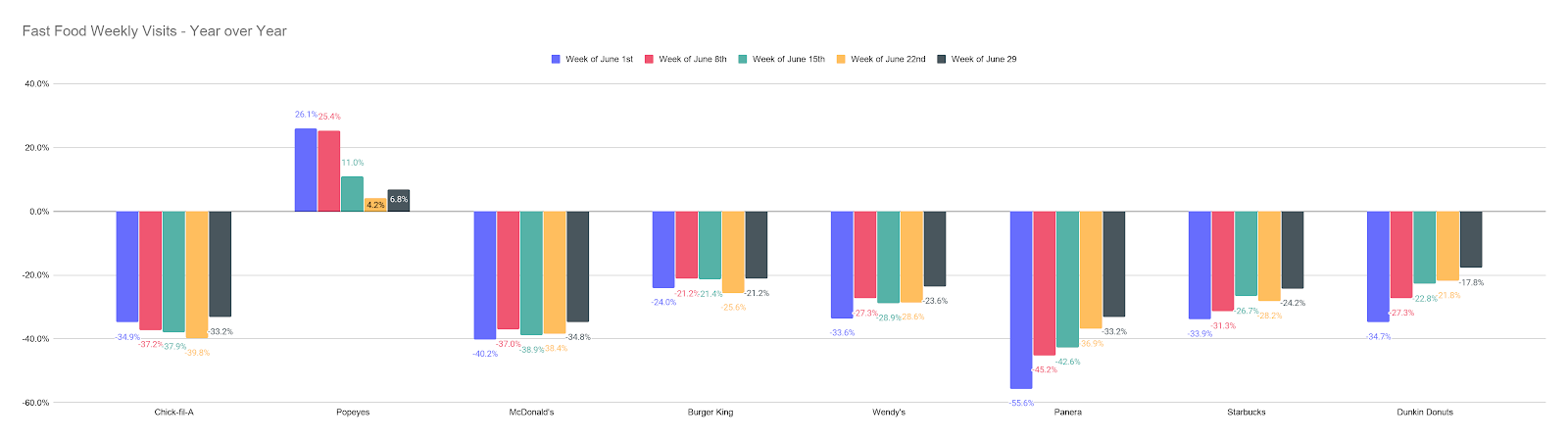

While the overall situation in June was an improvement from May, a more mixed picture of the recovery comes into focus when analyzing year-over-year weekly data. Brands like Starbucks and Dunkin’, who had been hit especially hard by the continued closures in key states like New York, saw an ongoing recovery throughout the month. The week of June 29th even saw Starbucks and Dunkin’ pull within 24.2% and 17.8% of 2019 numbers for the equivalent week.

In fact, Starbucks saw July 3rd visits come in even with the daily baseline for the period from January 2019 through July 5th, 2020, making it the best performing day for the brand since March 14th.

Dunkin’ saw the same pattern with visits rising to its highest point since March 14th with the mark falling just 4.2% lower than the equivalent day’s visits in 2019.

Yet, brands like Chick-fil-A, Popeyes, Burger King, and McDonald’s saw weekly visits either stagnant or declining in terms of year-over-year change throughout much of June. But the week of June 29th did bring an uptick across the board with all eight brands seeing an end of June and early July boost. Should this pattern hold, the fast-food resurgence could find an even stronger pace in the summer.

What does the future hold?

The impact of the back to school season is anybody’s guess. Kids at home and economic uncertainty could boost value-for-money fast-food visits or a COVID resurgence could limit the pace of recovery. Chicken wars could ignite in August again, or another brand could launch a new item that sets the sector aflame. Yet, it does appear that the fast-food sector is well on its way to recovering with a strong summer season ahead.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.