Source: https://www.placer.ai/blog/placer-bytes-grocery-surprises-heavyweight-dominance-and-floor-decor/

In this Placer Bytes, we dive into grocery chains we’ve yet to touch on including Sprouts, Weis, and Winn Dixie. Then we take a moment to appropriately laud the offline retail giants and break down Floor & Decor’s rebound.

Grocery: Sprouts, Weis and Winn-Dixie

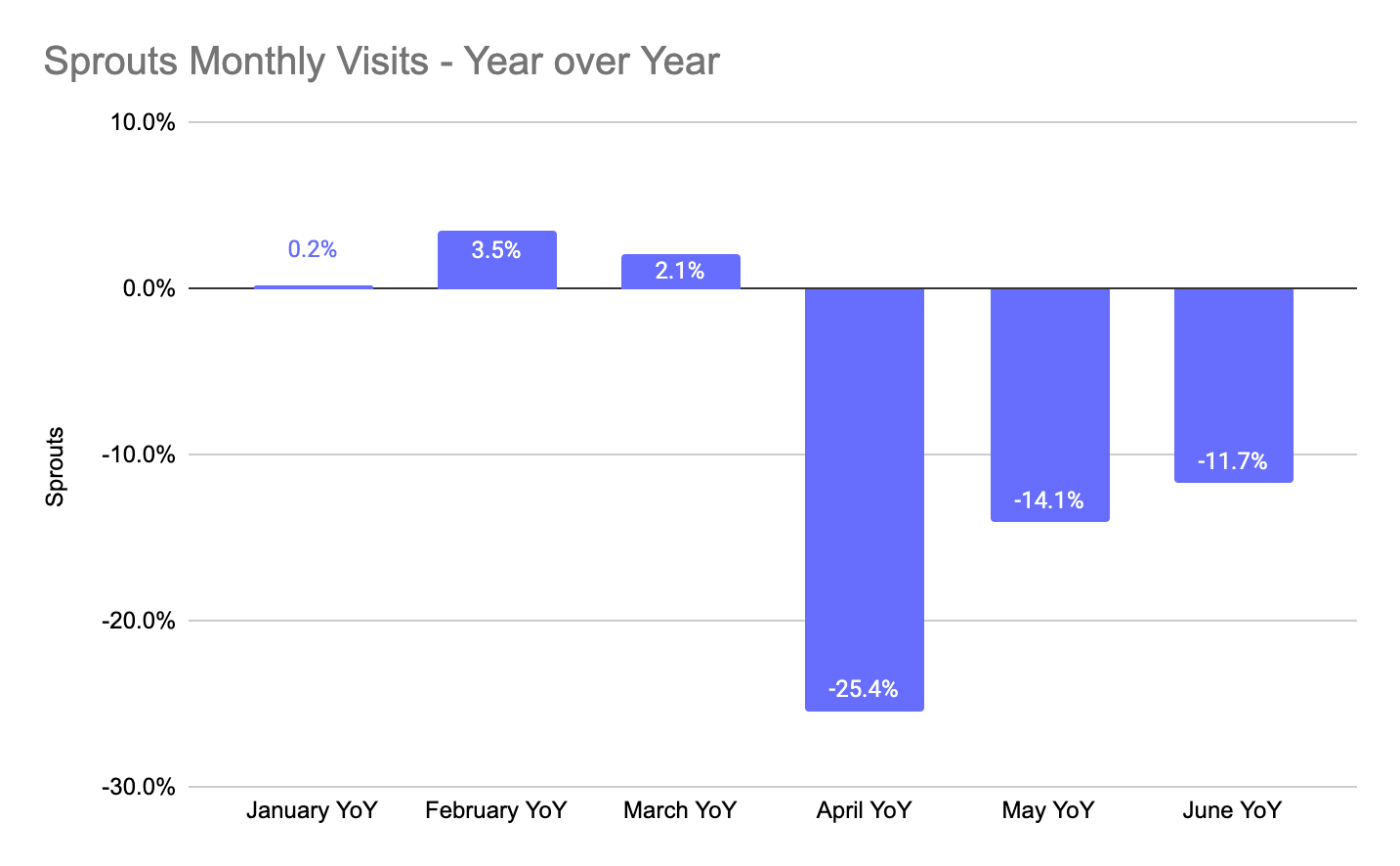

Sprouts was a brand in the midst of a very strong run heading into 2020. Between 2018 and 2019, the brand saw visitor growth of 3.2% and 2020 kicked off with small, but respectable year- over-year visit increases of 0.2%, 3.5%, and 2.1% for January, February, and March respectively. But perhaps most impressively, they’ve rebounded hard and fast, as the recovery unfolds with visits down just 11.7% year over year in June, compared to a low point of 25.4% down in April.

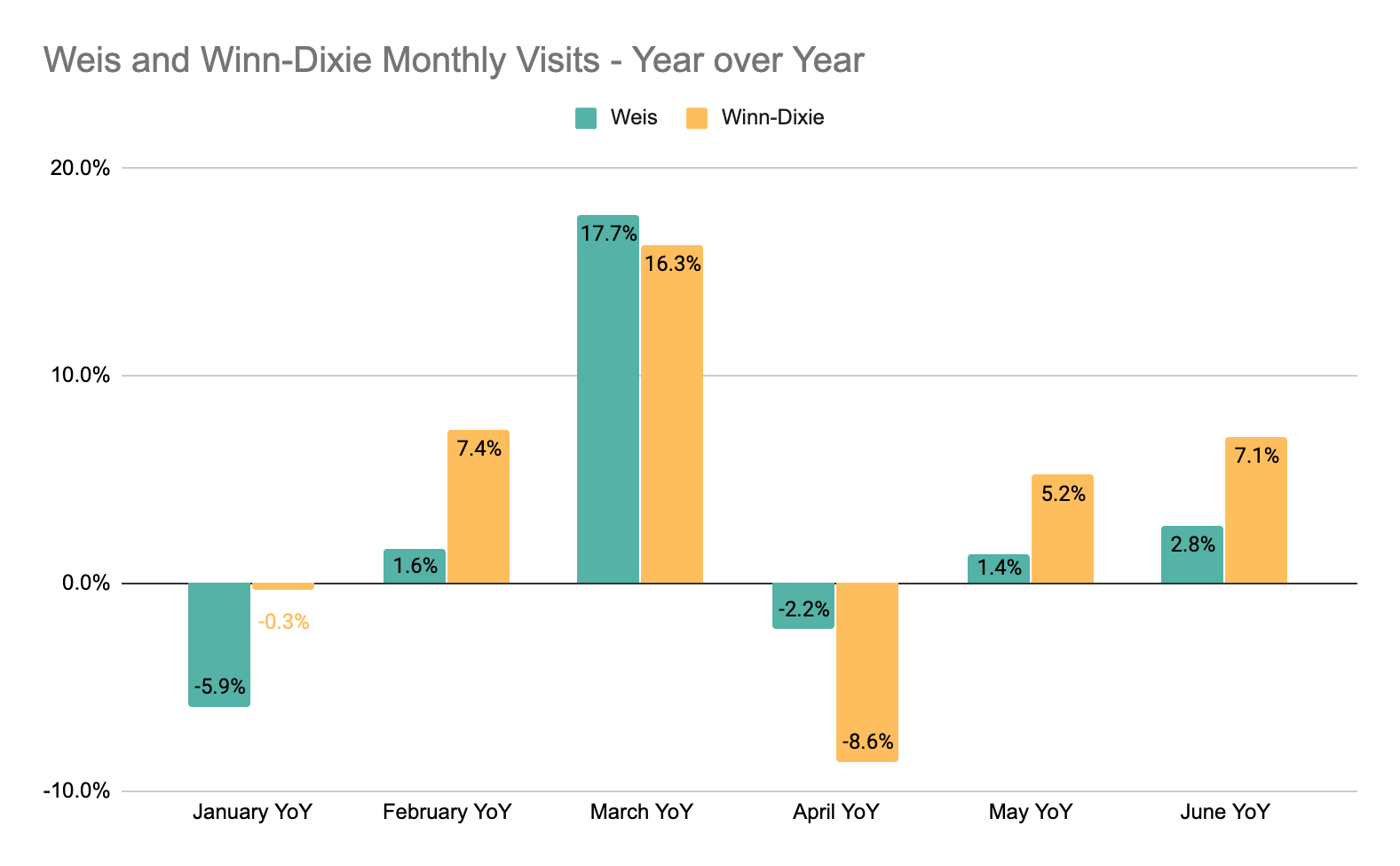

Yet, even more fascinating has been the performance of Weis and Winn-Dixie, two regional grocery chains that had been experiencing tougher times. The two brands had seen year-over-year traffic declines of 2.5% and 6.1% respectively between 2018 and 2019, and both kicked off 2020 with year-over-year declines in January. But, it does look like the pandemic provided them a needed boost, alongside other traditional grocers. Apart from the height of the pandemic in April, both brands have seen year-over-year growth in all other months including strong June results of 2.8% year-over-year growth for Weis and 7.1% for Winn Dixie.

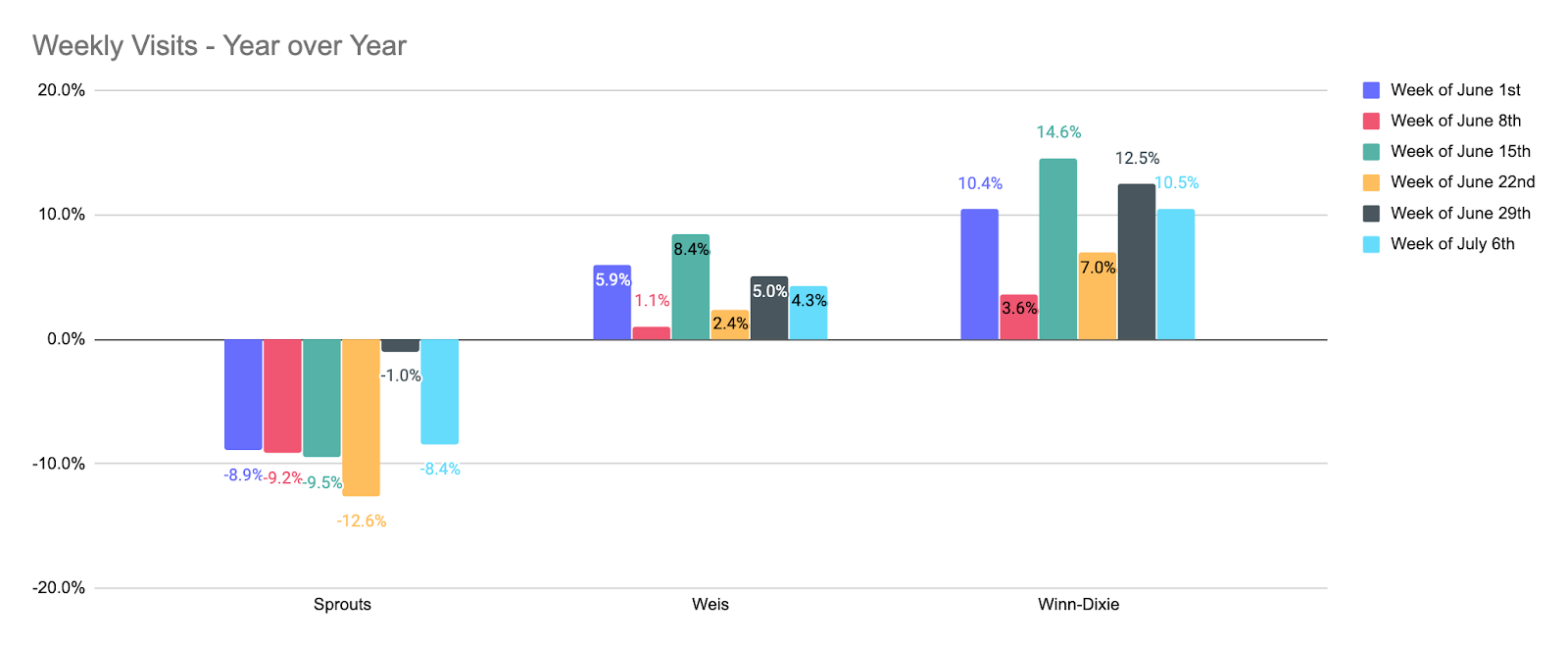

And the improvements are still coming for all of these brands. While Sprouts is being impacted by resurgences of cases in California and Texas, two of its largest states for locations, the grocer is still seeing progress. For the weeks of June 29th and July 6th, the brand saw an average decline of 4.7%, an improvement on overall June numbers even amidst the rise in cases. The same was true for Weis and Winn Dixie which saw visit averages for those two weeks of 4.6% and 11.5% growth year over year. A continuation of this trend would push both brands even farther ahead then they had been in June. This data further deepens the notion that the crisis has reinforced the importance and centrality of traditional grocers.

The Kings of Retail

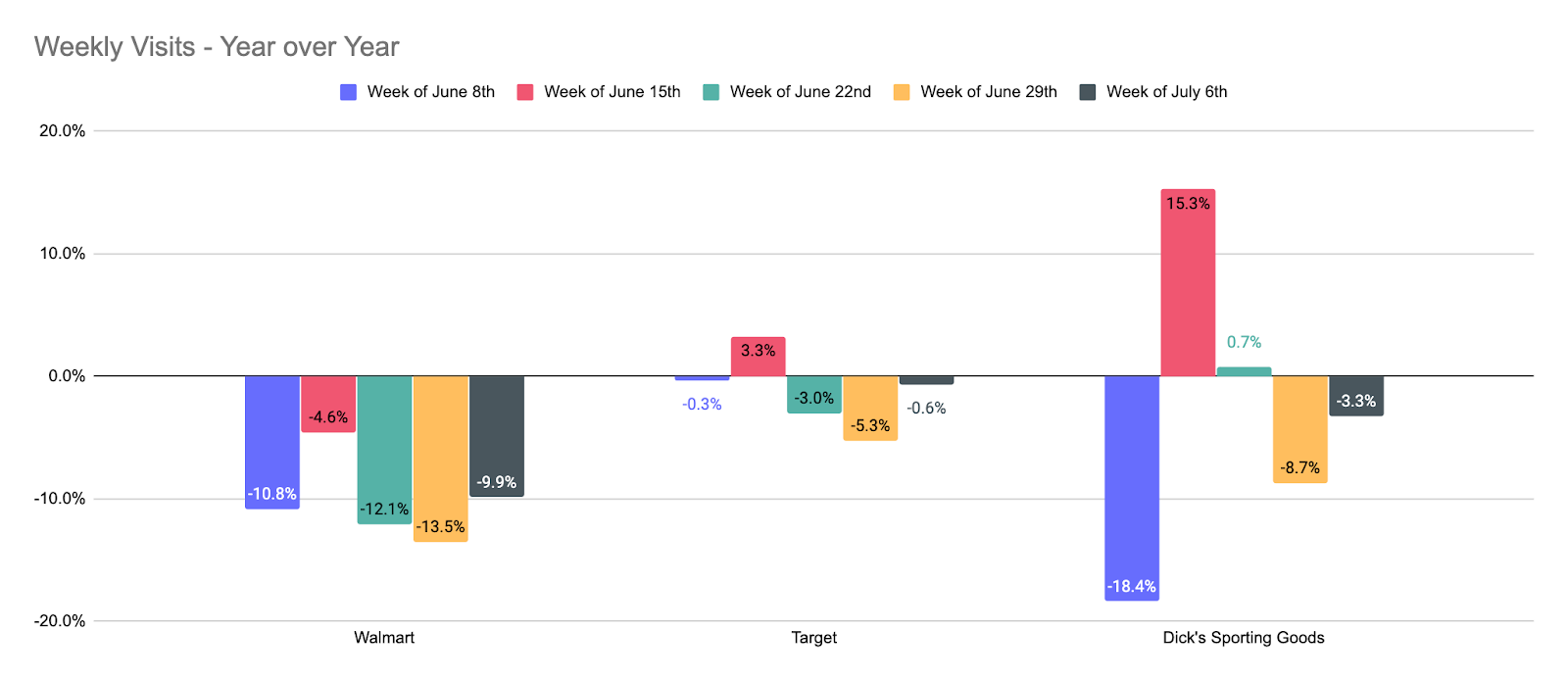

For Target, Walmart, and Dick’s Sporting Goods, the resurgence has been especially tough. The hardest-hit states, Texas, California, and Florida, are all in the top four in terms of location density for these brands. Yet, for all three, visits are hanging steady, if not already flirting with year-over-year growth. Critically, the fact that declines remain is important, if nothing else then to help us properly contextualize the year-over-year decreases other brands are experiencing. However, the ability of these brands to sustain healthy visit numbers in this environment is nothing short of remarkable, further enhancing its status at the top of the offline retail mountain.

Floor & Decor

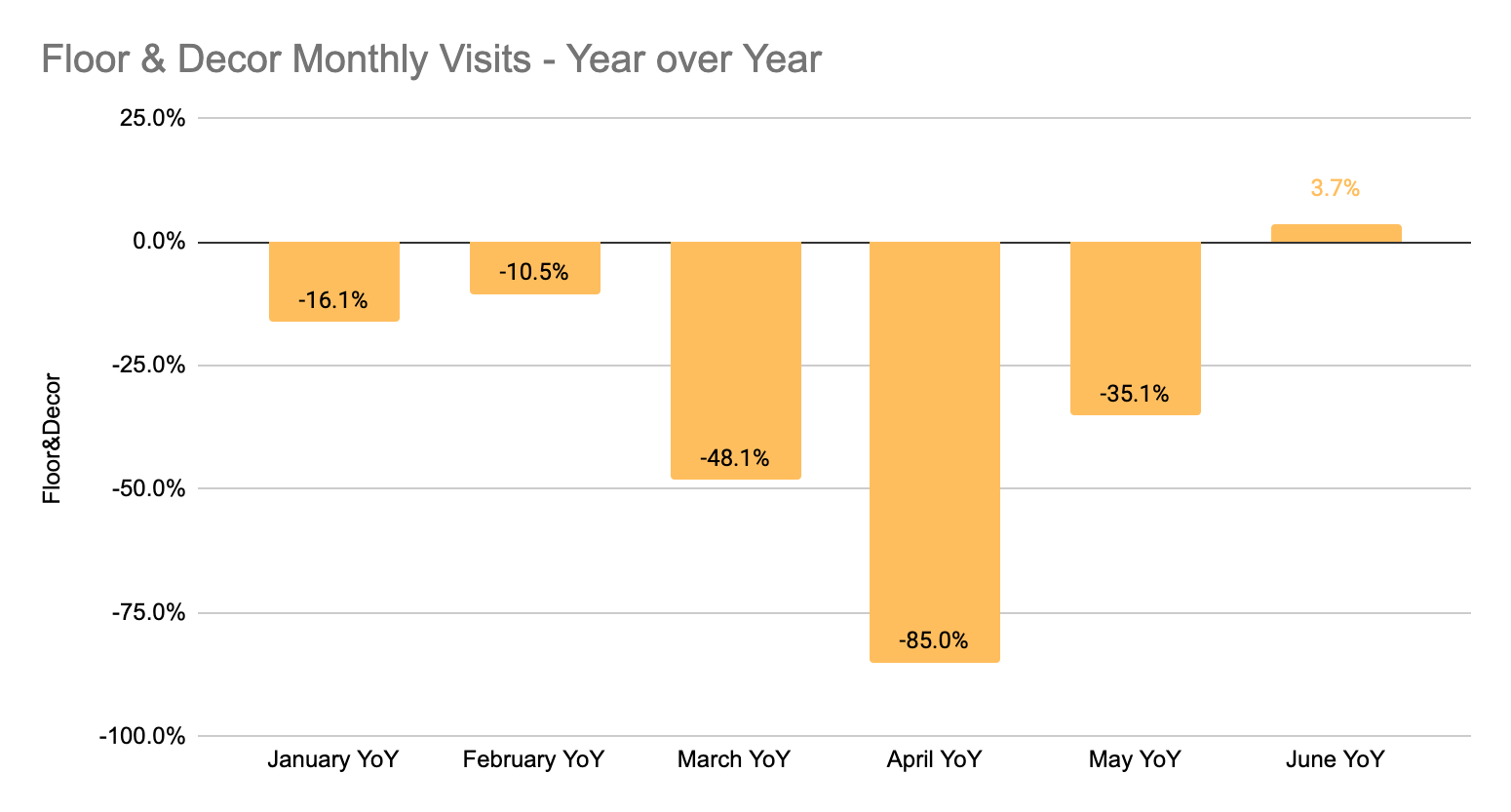

While the bigger players in the home improvement and home goods spaces get more of the focus, alongside the bankruptcies hitting the sector, players like Floor & Decor are enjoying a strong rebound. And this may be one of the biggest signals of the sector’s wider ongoing potential. Floor & Decor was experiencing visit declines all year. Visits in January and February were down 16.1% and 10.5% respectively year over year and this was before COVID related closures. But the company is back on the rise with visits in June 2020 up 3.7%.

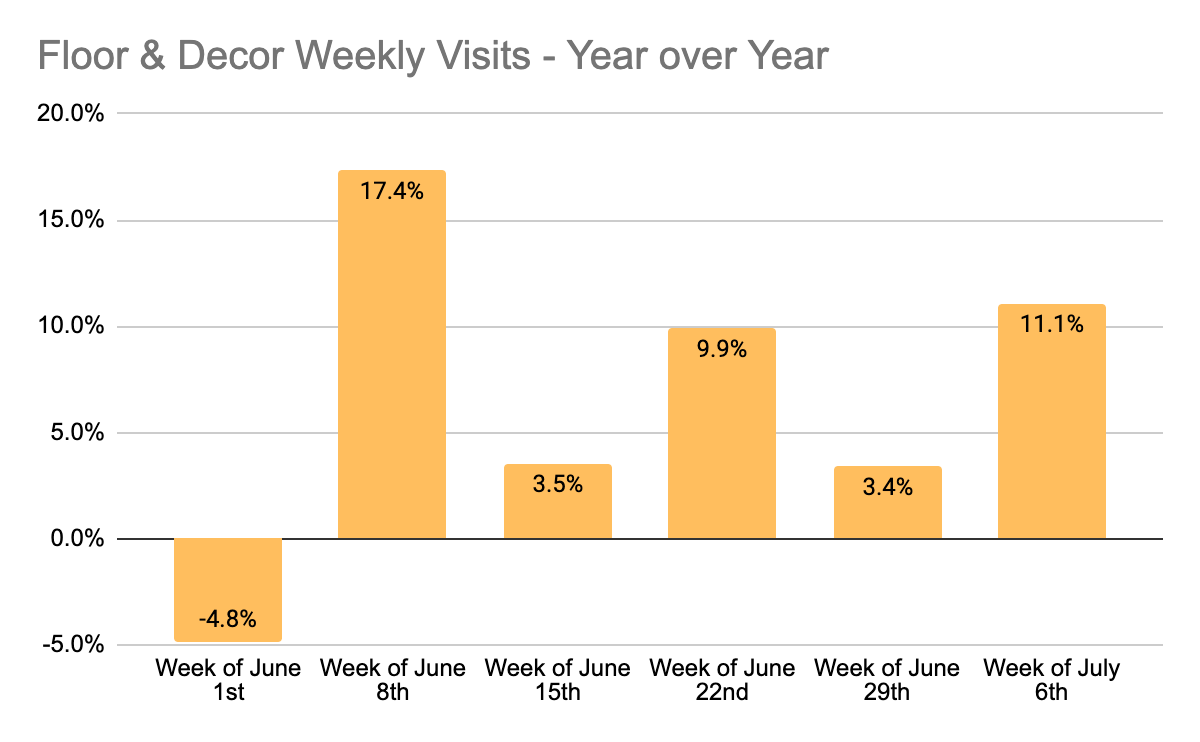

And the pace is not slowing down. Weekly visits have been up year over year since the first week of June and following subdued growth on the week of July 4th, visits were up 11.1% year over year the week of July 6th. Does this guarantee future growth? No. Does it help establish a bull case where an industry-wide boost and closures among competitors creates a powerful opportunity for extended success? Yes.

Will the rise of the traditional grocery continue to boost brands like Weis and Winn-Dixie? Can retail’s giants continue their dominance? Will the rise of the Home Improvement tide continue to lift all boats?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.