July and August are two of Europe’s most important months for hotels with travellers spread across the continent on summer holidays. However, it is no secret that summer looks much different this time around for Europe due to the global impact of the COVID-19 pandemic.

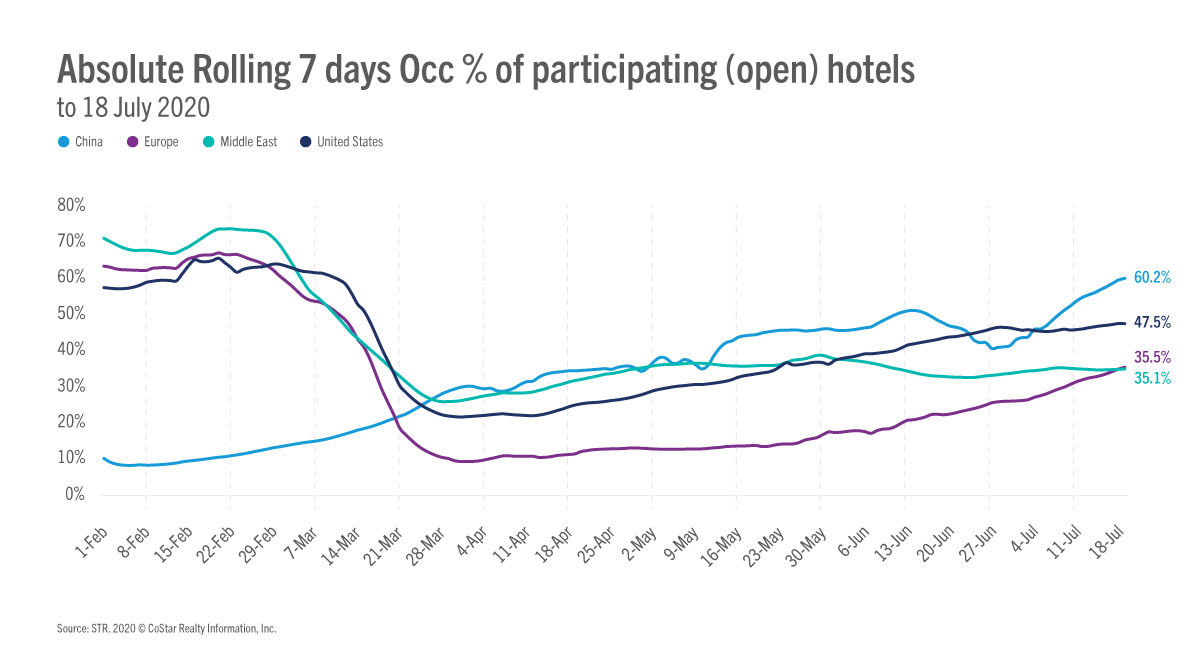

Europe was riding a successful wave with eight consecutive years of RevPAR growth as of the end of 2019. Fast forward through the devastating impact of a global pandemic, and the continent is Europe is behind in its recovery in comparison with other regions around the world. As seen in the chart below, Europe recorded the largest fall in occupancy and remained at a low point without showing signs of life until the end of May.

The continent has also been hit with a higher ratio of closed hotels as many countries only recently reopened—the U.K. for instance, reopened for hotels on 4 July. China and the United States are ahead in occupancy recovery with each experiencing a less prolonged low point, quick reopening of hotels, and leisure demand returning faster thanks to a larger domestic travel base and less reliance on international travel.

Europe hotels reopen, but will guests return?

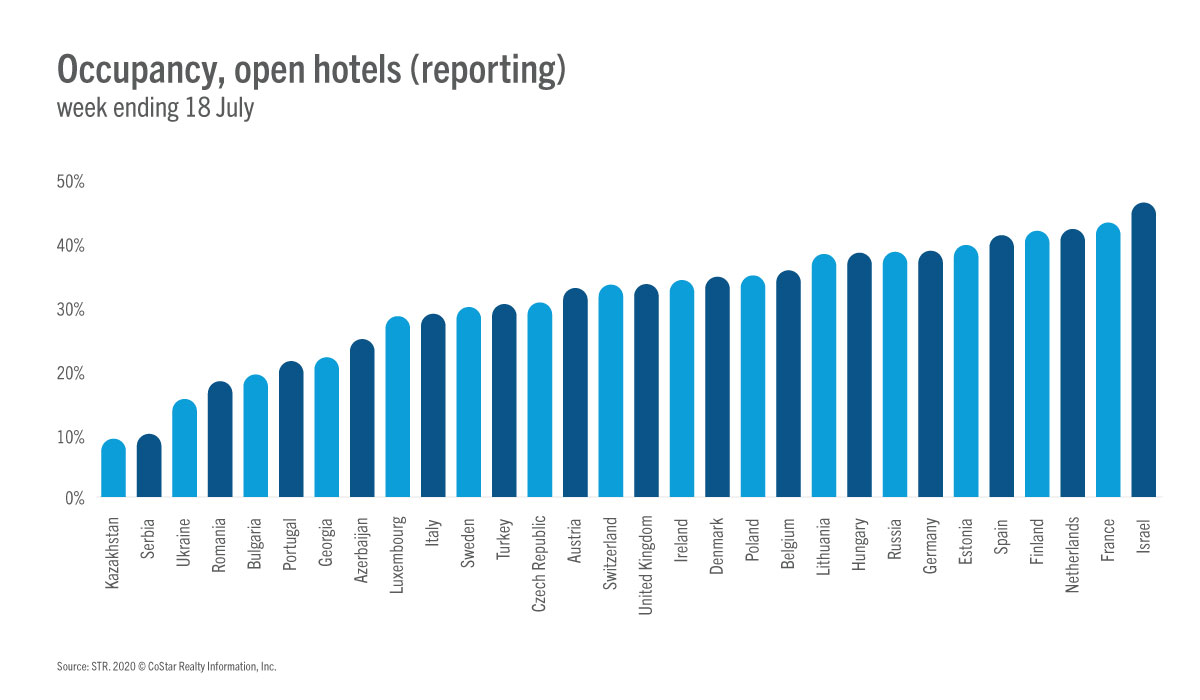

Occupancy (for reporting hotels) for the week ending with 18 July shows that most European countries are somewhere between 20-40% in occupancy, indicating that there is demand flowing into hotels, but at a limited rate for most countries. Of the key markets in Europe, France, Netherlands and Spain have led the way with occupancy above 40% for the most recent week. Spain reopened its borders to the rest of Europe in recent weeks, and its largest European source market, the United Kingdom, included Spain on its no quarantine-upon-return list. That ease of travel between the two countries has played a role in Spain’s rising occupancy level. However, the U.K. has since removed Spain from its list of no quarantine on arrival, so we may see some change in the next couple weeks of data.

Two weeks after the reopening in the U.K., occupancy was at 33.2%, up from roughly 25% the week before hotels reopened. This indicates a slow return of demand.

What type of destination is seeing the most demand?

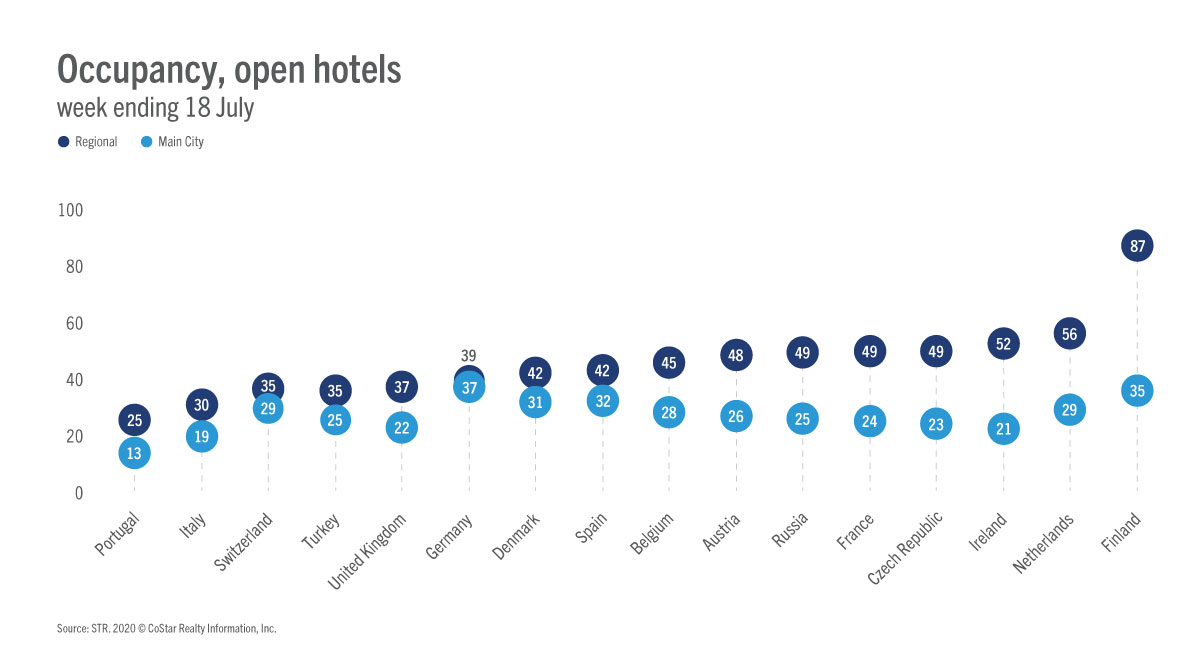

When comparing regional vs. main city markets, we see a divide with the main cities lagging in their recovery. Growth in occupancy for these countries as a whole is underpinned by regional destinations as travellers swap city experiences for regional leisure destinations. Germany is the country with the narrowest gap in occupancy between regional and city locations. Spain, which saw significant COVID-19 outbreaks in Barcelona and Madrid, have seen travellers favoring trips to coastal destinations in place of the country’s main cities.

What about ADR?

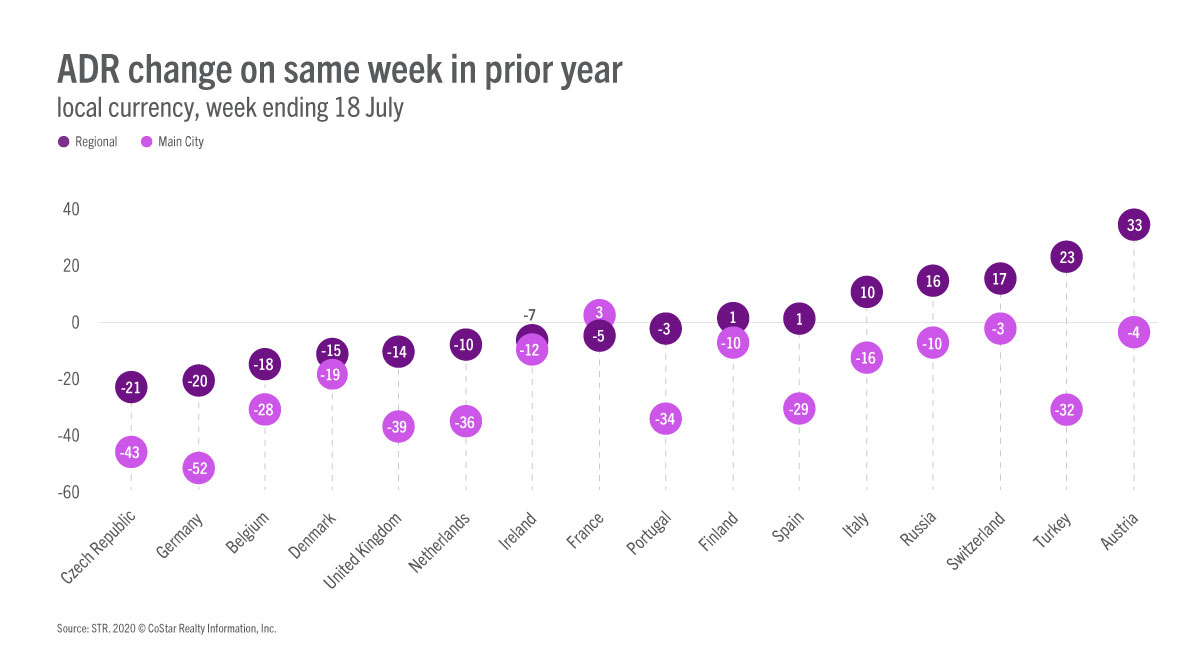

Those markets that have seen a higher recovery in occupancy are seeing less pressure on rates.

A great example is the U.K.—regional markets saw a 14.0% decline in ADR for the week ending 18 July, while London saw a decline of 39.2%.

Conclusions

Europe’s recovery is underway with visible week-over-week growth in occupancy. However, the continent remains behind key regions and countries around the world. On a positive note, regional markets are driving performance for countries across the continent as consumers swap city breaks for more spacious and less crowded destinations. The latest development with the U.K. removing Spain from its no quarantine on arrival list is worth noting and may affect Europe’s recovery timeline if more countries join in restricting travel to Spain.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.