There are few sectors that rely on the back-to-school season to the same extent as office and school supply leaders. From Office Depot to mass merchandise leaders like Walmart, the season can drive huge returns.

So, how has this season played out within the context of the COVID recovery?

2019’s Banner Season

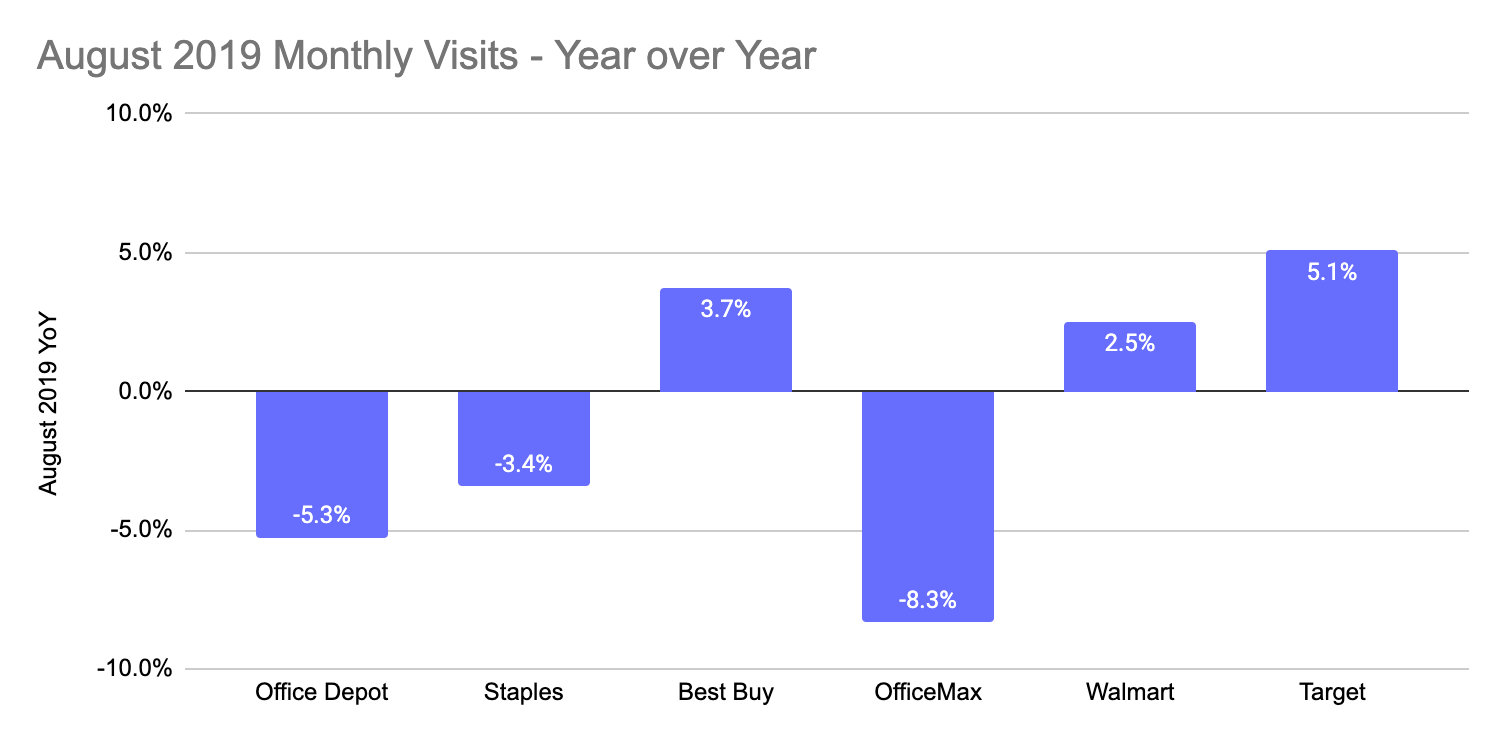

Context is key to understanding performance, and understanding 2019’s back-to-school season goes a long way in helping to frame the current results being seen. Walmart, Target, and Best Buy all saw significant visits increases year over year in August 2019, with these numbers proving to be all the more impressive considering they marked increases on existing seasonal peaks.

And even brands like Office Depot and Staples, which saw declines year over year, saw a strong season. Though these were visit decreases, they were actually much more limited than other months when these drops were closer to 10% year over year – a result of store closures and a general sector decline.

Understanding the Declines

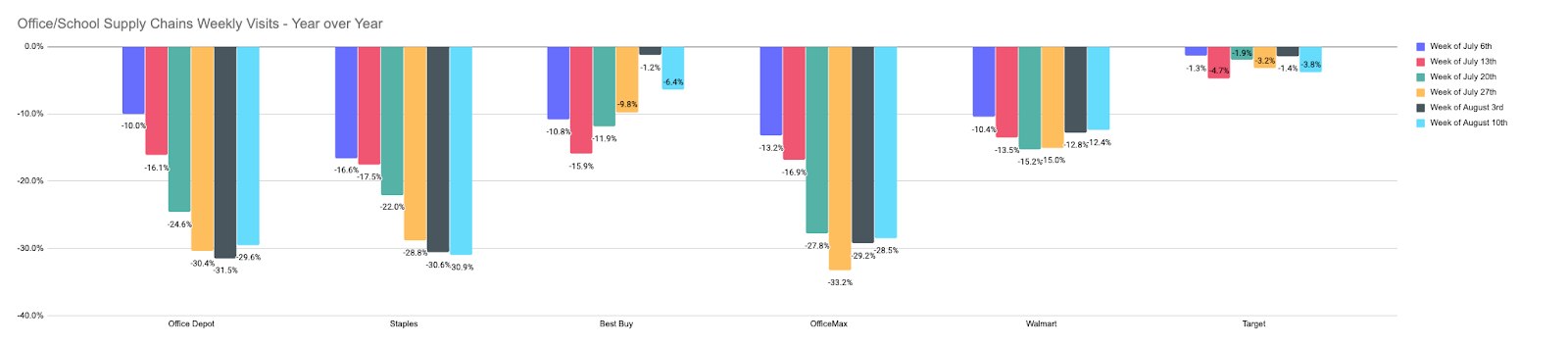

And this is critical context for understanding why 2020 year-over-year data looks the way it does. Brands like Staples and Office Depot are feeling the strain of the pandemic to a large extent because of the heights they normally reach during this period. Uncertainty around school openings and the economic situation is clearly impacting their normal peak.

Conversely, it makes the more limited declines for Best Buy, Walmart, and Target all the more impressive. The three have seen relatively minor impacts on their visit rates, even when compared to one of their annual peaks. It would have been fair to expect that these brands would all have seen significant drops at an increasing velocity, but they managed to remain stable.

The Recovery

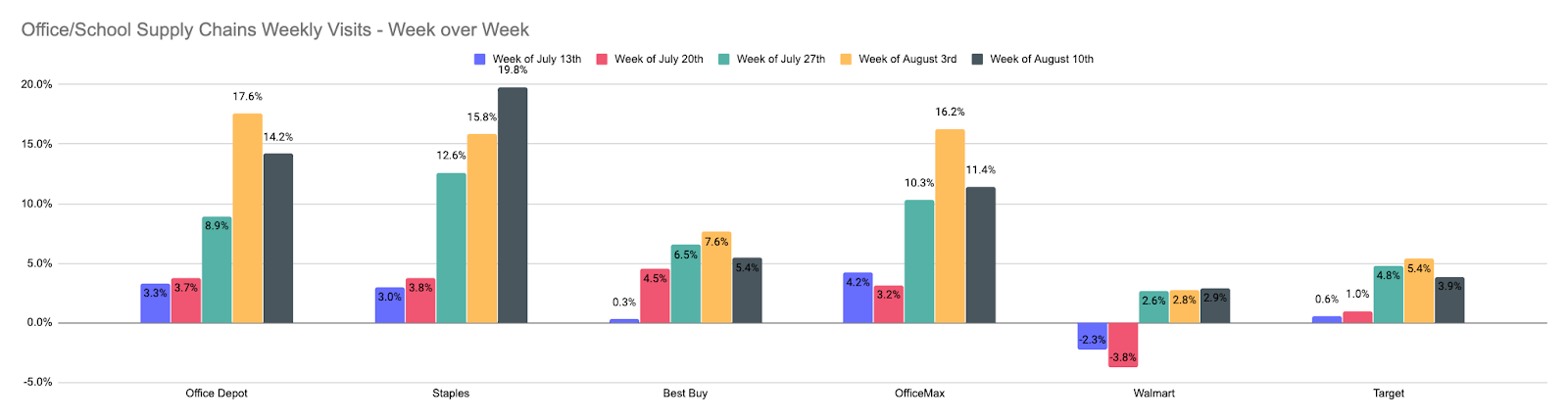

And nowhere is the recovery more evident for these brands than in their week-over-week data. All of the brands analyzed have seen growth since the week beginning July 27th, signifying a strong momentum to the overall retail recovery. So, while the pinnacle of the back-to-school season will likely be lower than in 2019, the peak is still taking place, giving a needed boost to this sector.

The Walmart Effect

The one massive risk for Staples and Office Depot in particular could be coming from mass merchandise players like Walmart and Target. Looking at visit duration in August 2019 and comparing it to 2020 shows that Walmart has seen time in-store increase by 4.5%. This is a very significant increase, especially when considering the massive numbers of visitors that Walmart locations see. It indicates that shoppers are looking to accomplish more with each visit, something that benefits Walmart and its incredibly wide variety of offerings. On the other hand, this could hurt a brand like Office Depot or Staples who otherwise might have benefitted from a shopping trip that included multiple stops.

Conclusion

Leaders in the office and school supply sectors are likely not going to match the heights they reached in 2019 offline. Yet, they are clearly in the midst of a significant recovery. And although Walmart, Target and Best Buy look to be bouncing back with strength, more focused retailers are seeing a new risk. Brands like Walmart and Target benefit from a wider selection that appeals to a shopper looking to do more with each visit. In this environment, players like Staples need to do more to show why they are worthy of a visit, especially considering the current environment.

However, they are also enjoying a situation where the home office’s importance has been raised to new heights. This could provide them with a more extended opportunity that is less dependent on a single season.

Will Office Depot and Staples thrive in this new situation? Will Target and Walmart dominate this space with their wide selection?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.