Source: https://www.placer.ai/blog/placer-bytes-apparel-recoveries-for-lululemon-macys-and-nordstrom/

In this Placer Bytes, we dive into the recoveries of Lululemon, Macy’s, and Nordstrom to check on the status of some of apparel’s biggest brands.

Lululemon Showing Signs of Hope

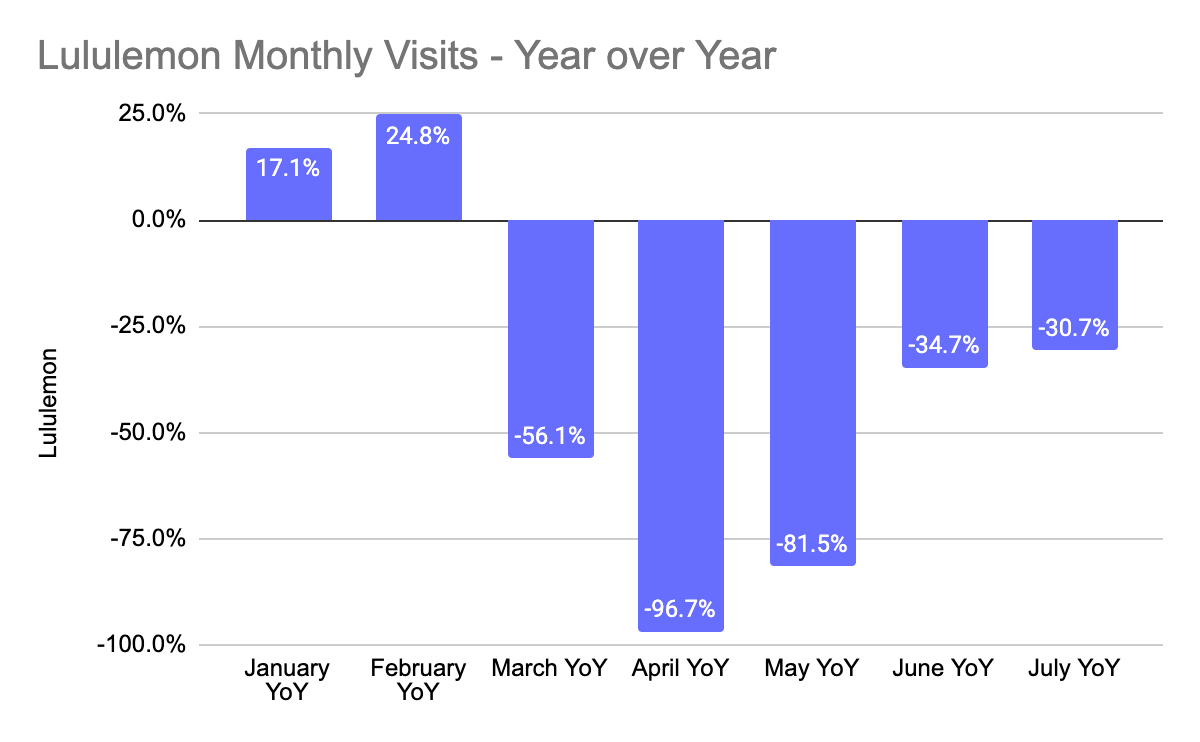

Heading into 2020, Lululemon was the darling of offline apparel and with good reason. Visits in January and February were up 17.1% and 24.8% respectively, continuing a trend of massive growth. Yet, the pandemic posed more than just a short term threat to the brand. Though athleisure is a stronger sector, the combination of higher prices compared to competitors and an orientation towards experiential elements created a real-long term risk.

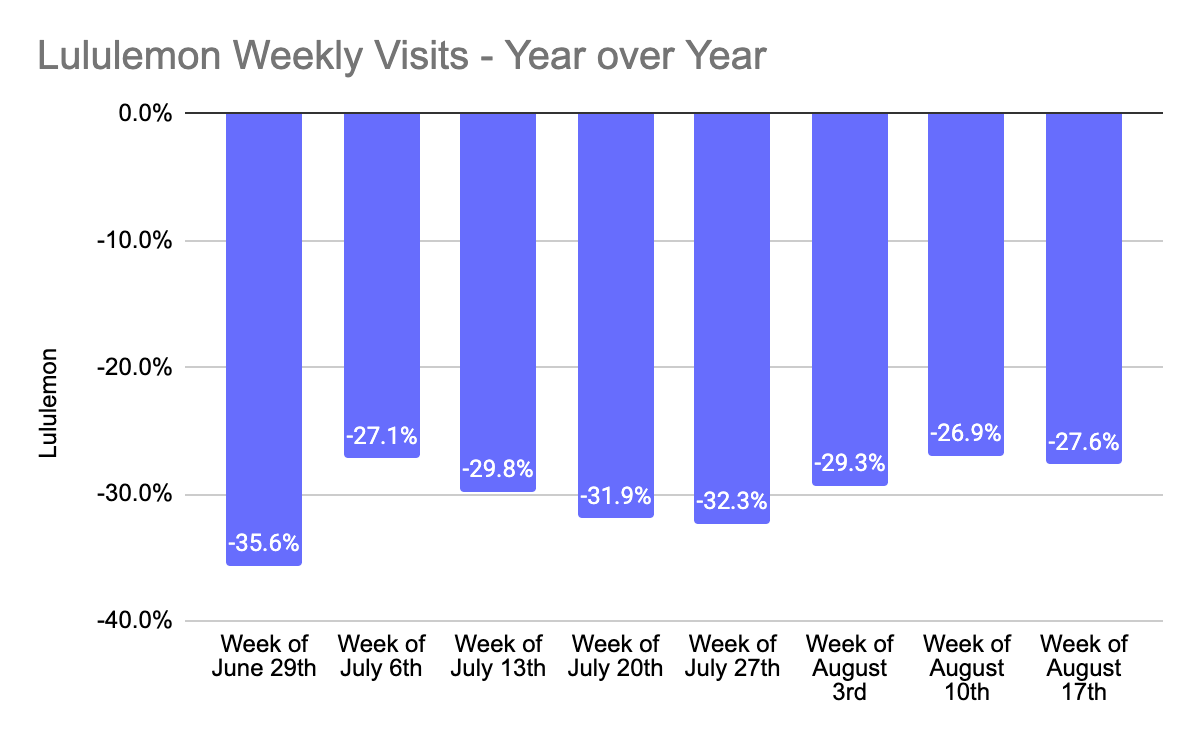

Yet, it looks like Lululemon’s offline comeback is happening. Since the week beginning July 6th, every week has seen week-over-week growth. And even adding seasonality into the mix, numbers are improving. Visits the weeks beginning August 3rd and 10th were down 29.0% and 26.2% year over year, respectively with the latter marking the highest year-over-year traffic since late June.

Lululemon’s growth is especially impressive considering one of the brand’s core risk areas – high density of stores in major cities. While similarly oriented “urban” brands like Whole Foods have taken a harder hit relative to their sector, Lululemon is actually outperforming the wider apparel space – which was down 30.2% year over year the week of August 10th – even with this disadvantage. The result could expose Lululemon’s true strength, and its further growth potential into newer locations.

Hope in Department Stores?

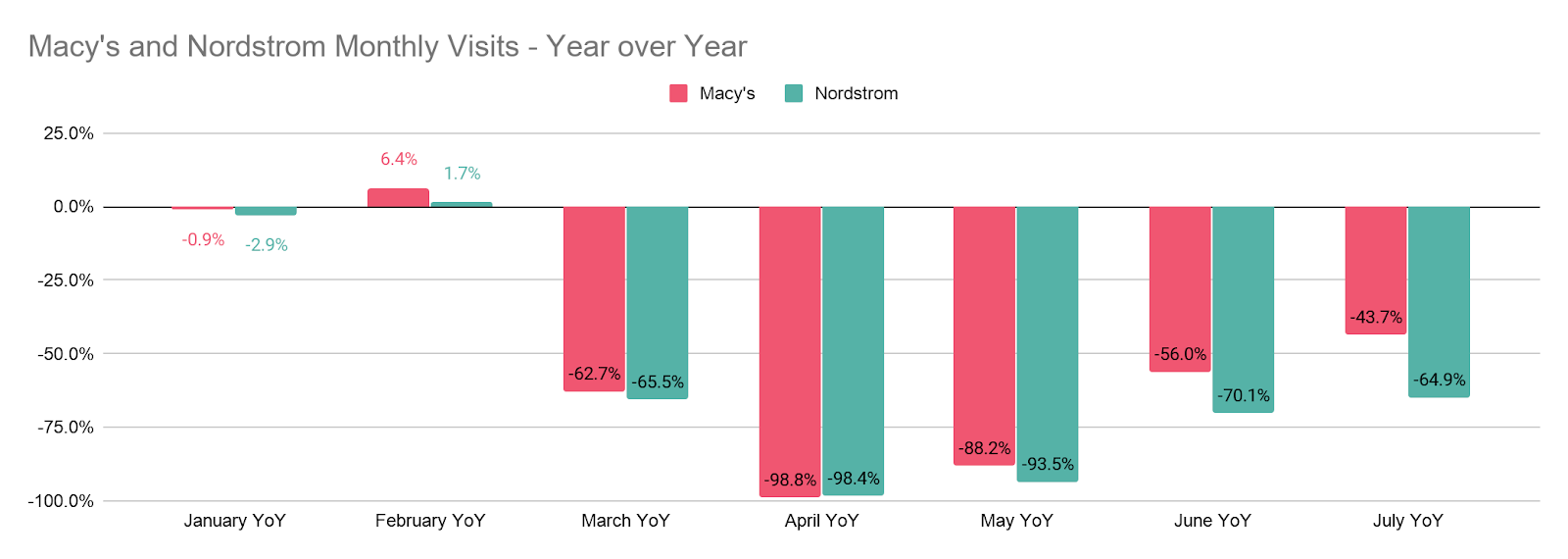

There wasn’t tremendous enthusiasm for department stores before COVID hit, and the joint impact on malls and apparel in general, have created a uniquely challenging environment for these brands. But the early recovery data does reveal some important factors that could define the sector’s leaders in the coming years.

For example, Macy’s wider distribution positioned it to be less impacted by COVID resurgences – even though they happened in key states. And by July 2020, visits were down 43.7%, a huge bump from May, when they were down 56.0% year over year.

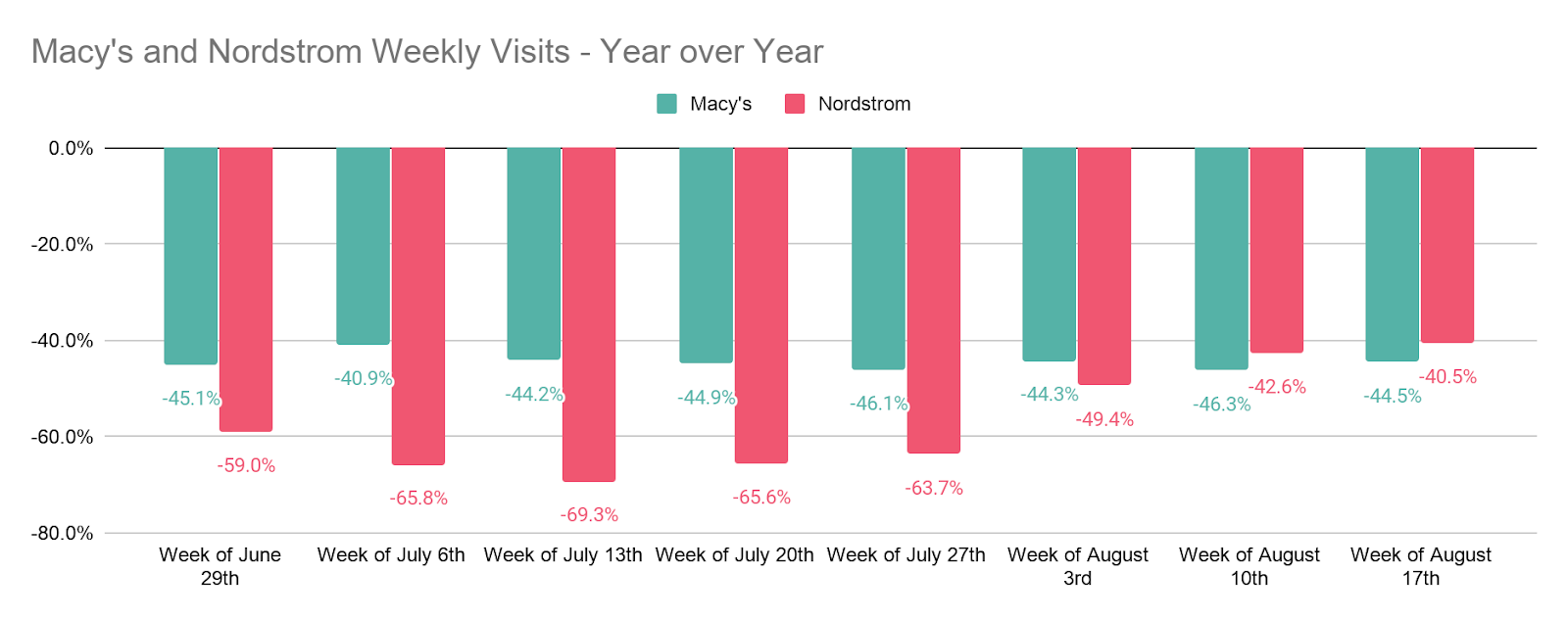

But Macy’s visit growth does look to have stalled as it copes with different regions being impacted by COVID, well, differently. The result has been mixed returns with weeks of growth followed by declines. On the other hand, Nordstrom with a more limited regional focus has benefited hugely from key states like New York reopening. Since the week beginning July 13th, every week has shown week-over-week growth as visits pull ever closer to 2019 levels.

And this could continue to be a key theme that impacts brands across a range of sectors. A wide regional distribution helps to offset the depth of decline but can also limit full recoveries. Conversely, a tighter regional distribution creates a real risk of fuller collapse, while opening powerful windows for growth when the pandemic moves in the right direction. With the likelihood that COVID could make its impact felt deep into 2020, this could be a key element that defines 2020 success.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.