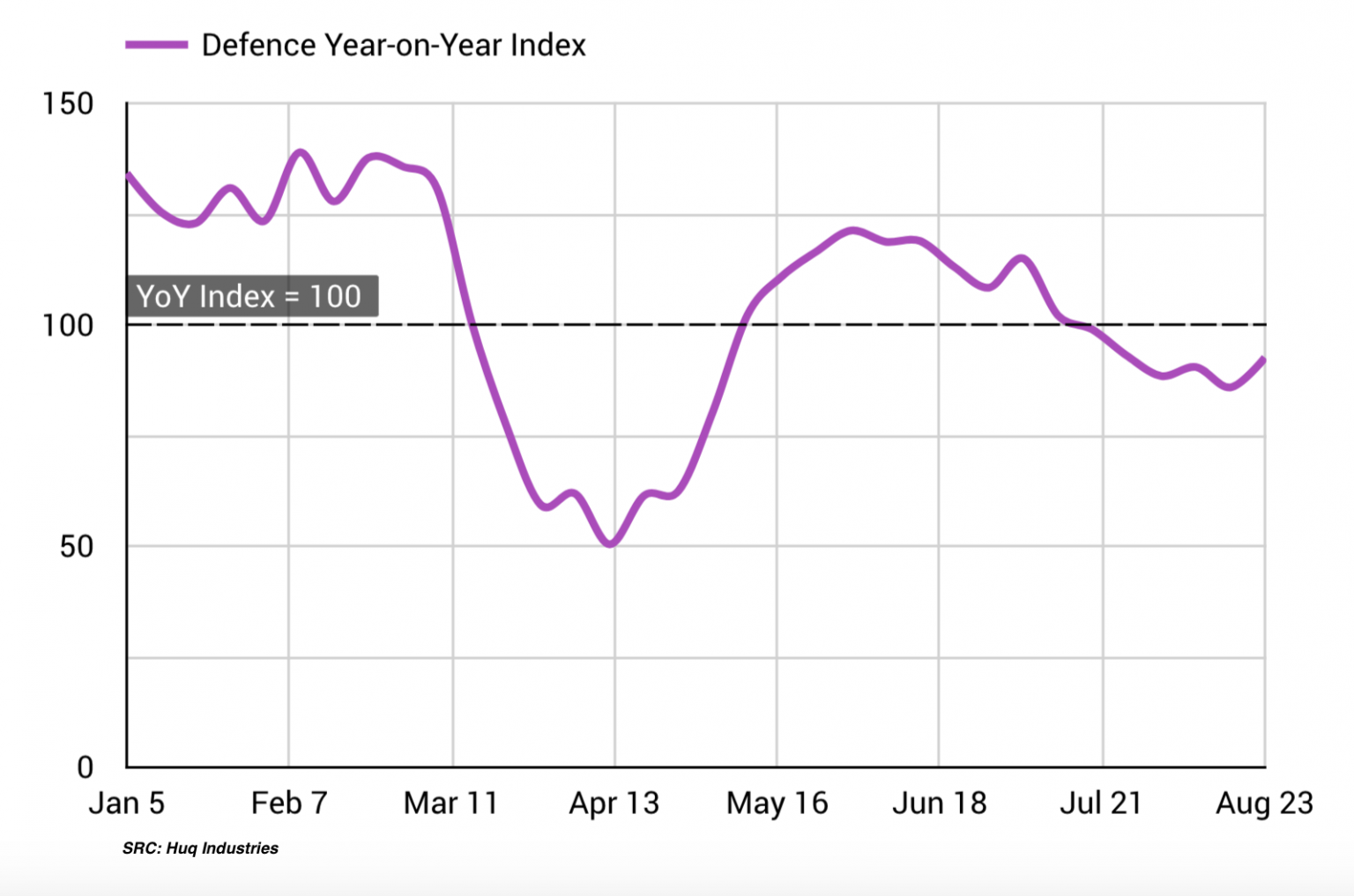

It’s been a dramatic year for both discretionary and staple manufacturing across Europe with every sector seeing sharp drops in March and varying levels of recovery since. However, according to high-frequency geo-data, no sector has had more dramatic few months of highs and lows than Defence.

Huq’s Big-6 Industrials Index, which measures footfall to more than 750 of Europe’s production facilities across Defence (BAE Systems, MBDA, Safran, Thales and others), Biotechnology, Chemicals, Automotive, Aerospace and Food Production, has seen a near-100% disparity between Defence’s series high and low in 2020.

Manufacturing productivity in the sector started the year on a high, touching 38% higher than equivalent levels in 2019 before dropping to a series low of 50% over March and April. In the immediate aftermath of lockdown it has seen yet another rise and fall – rebounding quickly to almost 25% higher than the 2019 average in May and June before dropping back again during July and August.

The data invites questions as to why Defence production has seen such sharp fluctuations; Did the year start on a high due to increasing geo-political tensions? Was the sharp rise in May due to the release of pent-up demand? Finally, is the recent drop due to pent-up demand being satisfied or fears of a second wave?

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.