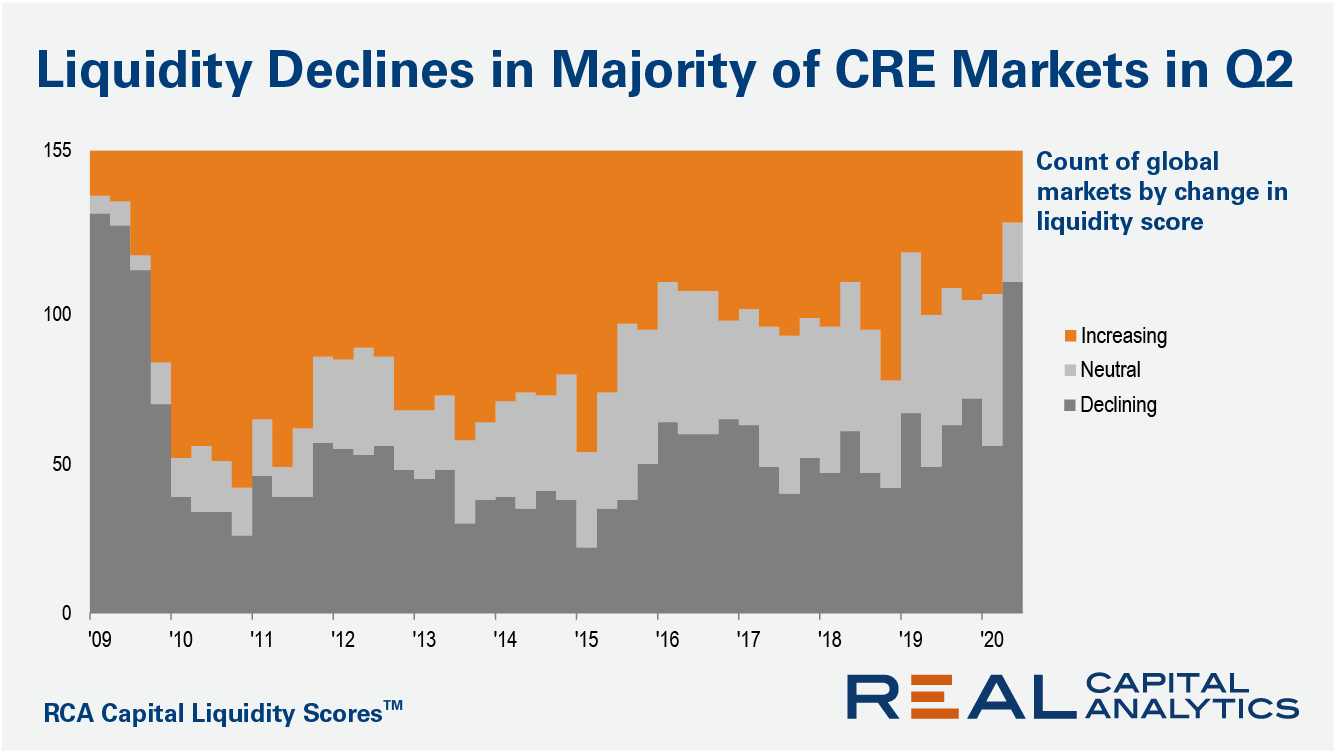

Market liquidity fell in 111 of 155 global commercial real estate markets in the second quarter of 2020, according to the midyear update of the RCA Capital Liquidity Scores. The count of markets posting lower quarter-on-quarter levels of liquidity is the worst since the Global Financial Crisis.

The liquidity crunch was most pronounced in the Americas, where the greatest proportion of markets posted a drop in liquidity. Here, 58 of 64 markets registered a lower liquidity score from the first to the second quarters of 2020, amid coronavirus lockdowns and economic interruption. In Europe, the Middle East and Africa (EMEA), liquidity scores in 37 of 63 markets declined and in Asia Pacific, 16 of 28 markets dropped.

Manhattan slipped down the ranks of the world’s most liquid markets. It registered at the number three position, marking the first time since 2011 that the market has dropped out of the top two spots. Central Paris and Berlin were the world’s most liquid commercial property markets at midyear.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.