Introduction

In the month since our last housing payments survey, the number of new daily cases of COVID-19 in the US has steadily trended downward, though it remains at a concerning level. As the rate of new infections improves, the process of “reopening the economy” has resumed in many parts of the country, and some furloughed workers have returned to their jobs. The US brought back 1.4 million jobs in August, but the unemployment rate remains at 8.4 percent. And for those who remain unemployed, the expiration of the expanded unemployment benefits provided by the CARES Act has compounded financial concerns.

With millions of Americans continuing to struggle with housing costs, the CDC has issued a temporary halt in evictions through the end of the year, to replace the earlier patchwork of federal, state, and local protections that have now expired. As the situation rapidly evolves, widespread difficulty with housing costs has been a troubling constant. Despite a slight improvement in this month’s data, 29 percent of Americans failed to pay their rent or mortgage in full during the first week of September, and 8 percent had not completed their August payment by the end of the month.

On-time rent payments improve slightly to best rate since June

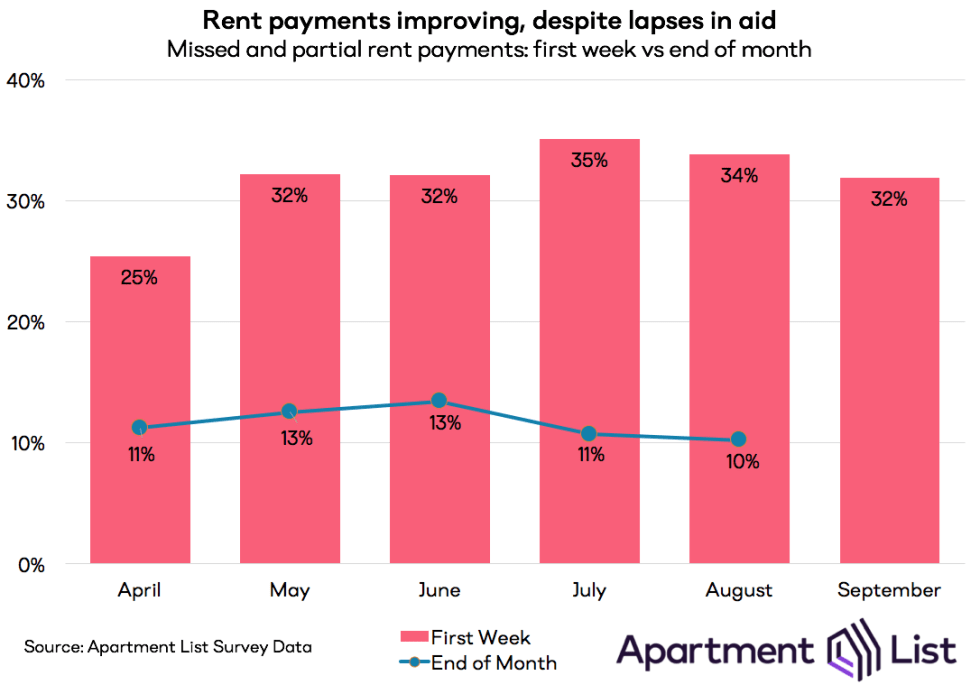

68 percent of renters made an on-time rent payment in the first week of September, the second straight month showing minor improvement and the highest on-time payment rate since June. Given the recent lapse in expanded unemployment benefits, it may have reasonably been expected that missed rent payments would exhibit a notable worsening this month, and so even the modest improvement that we observe could be considered a pleasant surprise. That said, it may be the case that some renters who are continuing to struggle have moved back in with family or friends and are simply no longer appearing in our sample.

Although one-in-three renters did not pay their rent in the first week of the month, we continue to find that the majority of these missed payments are made up with late payments by the end of the month. As of the first week of September, 10 percent of renters had not yet paid their August rent in full. Based on the consistency of this trend in prior months, we expect that nine-in-ten renters will pay their September rent in full by the end of the month.

The improvement over the past month was even more pronounced for homeowners – 73 percent made an on-time payment in the first week of September, up from 68 percent in August. The first-week payment rate for homeowners in September is the best that we’ve seen since the first month of our survey in April. Homeowners are also more likely than renters to complete their housing payments by the end of the month, with only 7 percent having failed to make a full mortgage payment for August as of the first week of September.

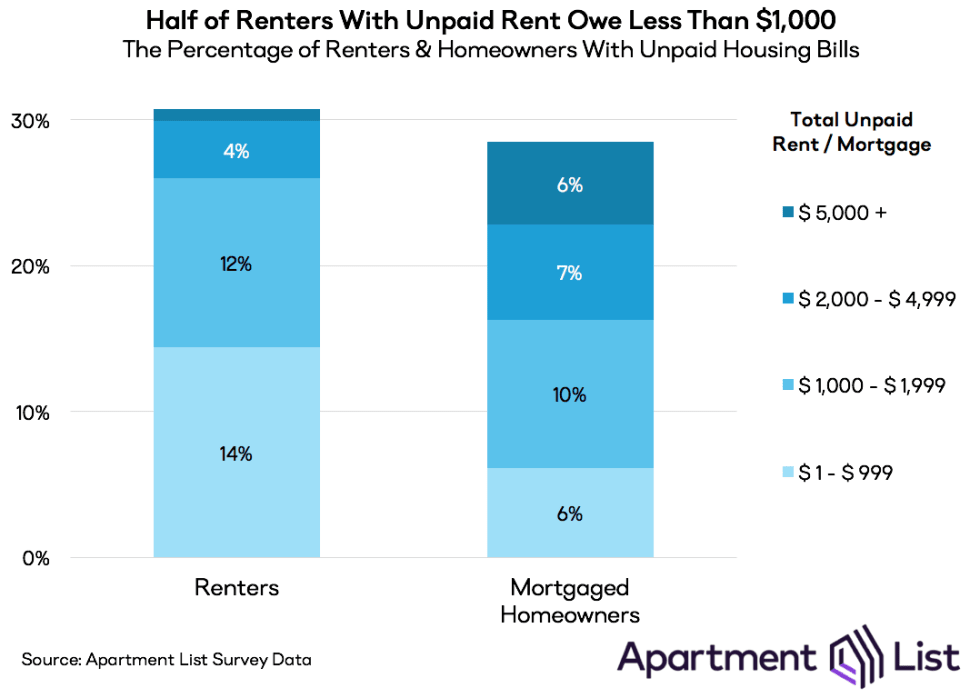

Many still struggling to catch up on rent from prior months

Despite the slight improvement in September payments, many renters are still worried about unpaid rent obligations from prior months. One-in-three renters started September with outstanding back rent owed, nearly unchanged from August. Among those with unpaid rent bills, close to half owe their landlords less than $1,000, while just five percent of all renters owe more than $2,000. These results indicate that another round of stimulus payments of a scale similar to those that went out earlier this year could help a significant share of renters catch up on their rent.

Relative levels of rent debt remained stable month-over-month. This indicates that even as they continue to struggle, renters are working hard to find ways not to fall further behind. In many cases, landlords also appear willing to allow their tenants some flexibility. Among renters who owe unpaid rent, two-in-three have inquired about renegotiating their lease or setting up a payment plan. Among renters who have made these requests, three-in-four have either reached an agreement with their landlord or are in the process of negotiating. Just one-in-four have been denied. During a time of falling rents and elevated vacancy risk, it seems that many landlords would prefer to keep their existing tenants, even if it means offering some concessions.

A lower share of homeowners have accumulated unpaid housing debt during the pandemic. However, the homeowners who have missed housing payments tend to owe more, with six percent of all homeowners owing at least $5,000. Homeowners generally have more clearly defined options for creating flexibility in their payments. Many lenders have implemented standardized plans for mortgage forbearance, while negotiations between renters and their landlords tend to be more ad hoc.

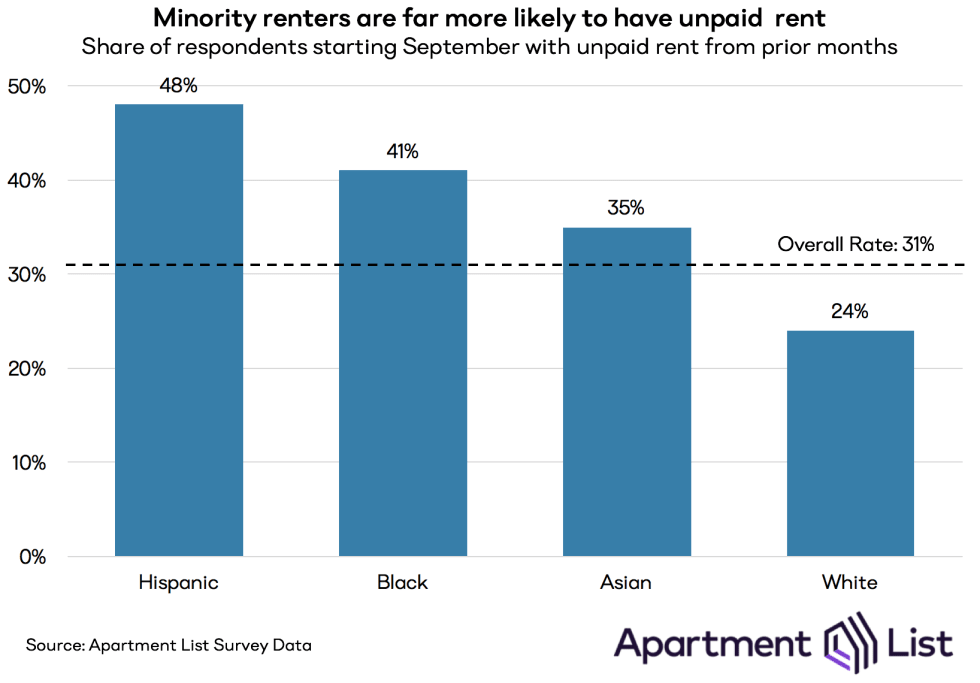

Rent struggles illuminate racial disparities

The pandemic has exacerbated long-standing concerns around financial instability and housing insecurity. These challenges, however, have not affected all segments of the population evenly. Segmenting our survey data by race illuminates significant variation in the prevalence of unpaid housing bills. The share of white renters with unpaid rent is well below the overall rate at 24 percent. Meanwhile, Black and Hispanic renters are far more likely to owe unpaid rent, with rates of 48 percent and 41 percent, respectively.

In addition to being more likely to rent, Black and Hispanic households are also more likely to work in service occupations where layoffs and furloughs have been most heavily concentrated. As of the first week of September, 25 percent of white survey respondents had not yet made a full on-time rent or mortgage payment for the month. This rate for both Black and Hispanic respondents stands at a distressing 43 percent, while Asian respondents fall between these extremes with a first-week missed payment rate of 30 percent. As our society continues to grapple with the reality of systemic racial inequities, these data offer yet another reminder of how starkly these disparities play out in the housing market.

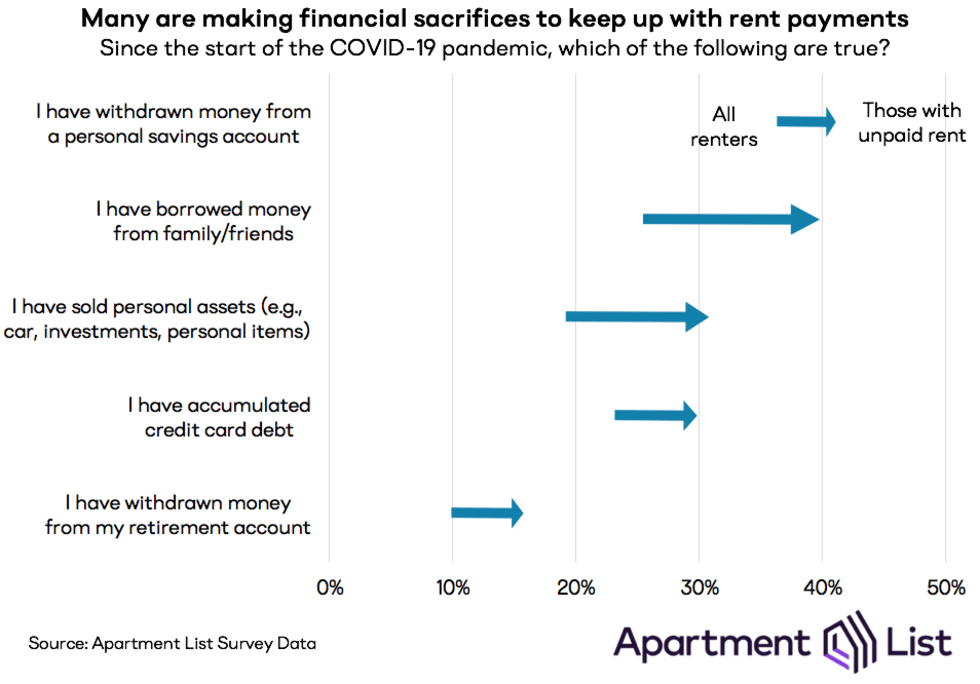

Keeping up with rent requires significant sacrifices

Weighed down by unpaid rent and mounting concern about future evictions, many renters are making significant financial sacrifices to keep up with rent payments. 58 percent of the renters we surveyed say that they have cut their spending since the start of the pandemic, while an even larger share (63 percent) have taken more extreme measures, such as drawing on savings, borrowing, or selling assets.

36 percent of all renters have drawn money from their personal savings since the start of the pandemic, while one-in-four have accumulated new debt either on a credit card or by borrowing from family or friends. One-in-ten have withdrawn money from a retirement account; these transactions generally entail significant penalty fees and are usually treated as a last resort. As expected, each form of financial sacrifice that we asked about is more prevalent among renters with outstanding unpaid rent. That said, the high overall rates indicate that even those who have managed to stay current on rent may not be in great financial health. Renters are more likely than homeowners to have made each of the sacrifices we asked about, with the exception of withdrawing retirement savings (likely because fewer renters have such savings to draw on).

Here too, we observe differences in how financial strain impacts different segments of the population in different ways. When we break down responses by race, we find that Hispanic and Black respondents are least likely to say that they have cut spending since the start of the pandemic (49 percent and 52 percent, respectively, compared to 59 percent of white respondents). This likely reflects that Black and Hispanic households were operating with less disposable income at the start of the pandemic. With less discretionary spending to cut and fewer savings to draw on, these households are more likely to turn to other sources. Black respondents are most likely to have borrowed money from family or friends (28 percent compared to the overall rate of 18 percent) and Hispanic respondents are most likely to have sold assets (23 percent compared to 16 percent overall).

Conclusion

As the COVID-19 pandemic continues to disrupt all aspects of daily life, making housing payments remains a struggle for a startlingly high share of Americans. Although this month’s data represents a slight improvement, nearly one-in-three survey respondents started this month with unpaid rent or mortgage owed from a prior month. In order to meet their financial obligations amid heightened economic uncertainty, renters and homeowners alike are making a variety of financial sacrifices as a direct result of the pandemic. Although the CDC’s recent pause on evictions has delayed the worst outcomes, missed housing payments remain a major concern in today’s economy.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.