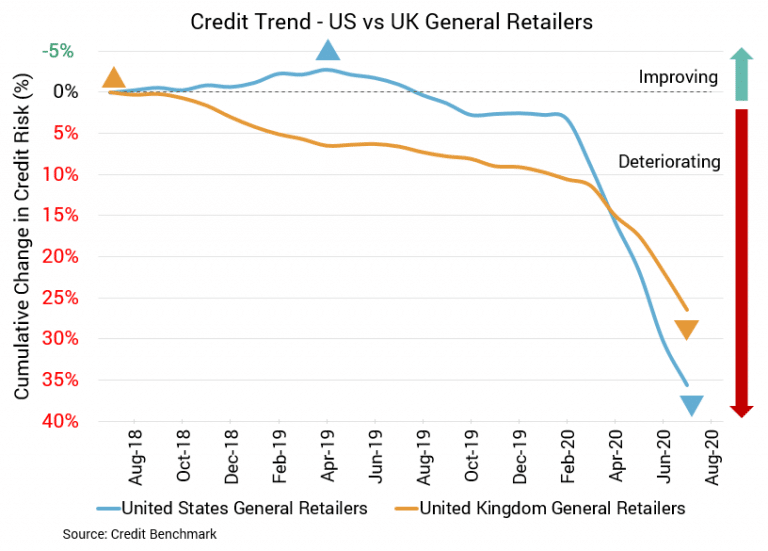

Except for a few lonesome doves, general retailers in the US continue to struggle. Sales have returned to pre-pandemic levels, but the composition is different and recent sales recoveries were lower than anticipated. Consumer spending increases have been moderate. Something similar can be said for UK retail and for UK consumer spending. COVID-19 remains an issue for each country. Credit quality for each is sliding month after month. A change in direction in the near future seems unlikely unless the underlying dynamics improve.

UK Retail Sector Sees Credit Downgrade

US General Retail Firms

The persistent credit deterioration for the US retail sector that began earlier this year continues. In the most recent update, credit quality for US general retail firms is down 4% from the month prior, 11.5% from two months prior, and 17.3% from three months prior. Longer term, credit quality has dropped by 32% in six months and 37% from the same point last year. This deterioration in credit quality is reflected in rising default risk. Average probability of default is now 56 bps, and this compares to 53.8 bps the prior month, 50.3 bps two months prior, and 47.8 bps three months prior. It was 42.4 bps six months prior and 40.9 bps at the same point last year. The overall CBC rating for this aggregate is bb+, with about 78% of firms at a CBC rating of bbb or lower.

UK General Retail Firms

Credit deterioration also continues for the UK retail sector. The most recent update shows a slide in credit quality of 4% from the month prior, 8% two months prior, and 10% from three months prior. Credit quality has dropped by 15.4% in six months prior and 18.7% from the same point last year. Average probability of default has increased to 81 bps, compared to 77.9 bps the month prior, 75.2 bps two months prior, and 73.6 bps three months prior. It was 70.2 bps six months prior and 68.3 bps at the same point last year. This aggregate has been in a worse credit position than its US counterpart over this period. The overall CBC rating for this aggregate is bb, a shift down from the previous bb+. About 92% of firms have a CBC rating of bbb or lower.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.