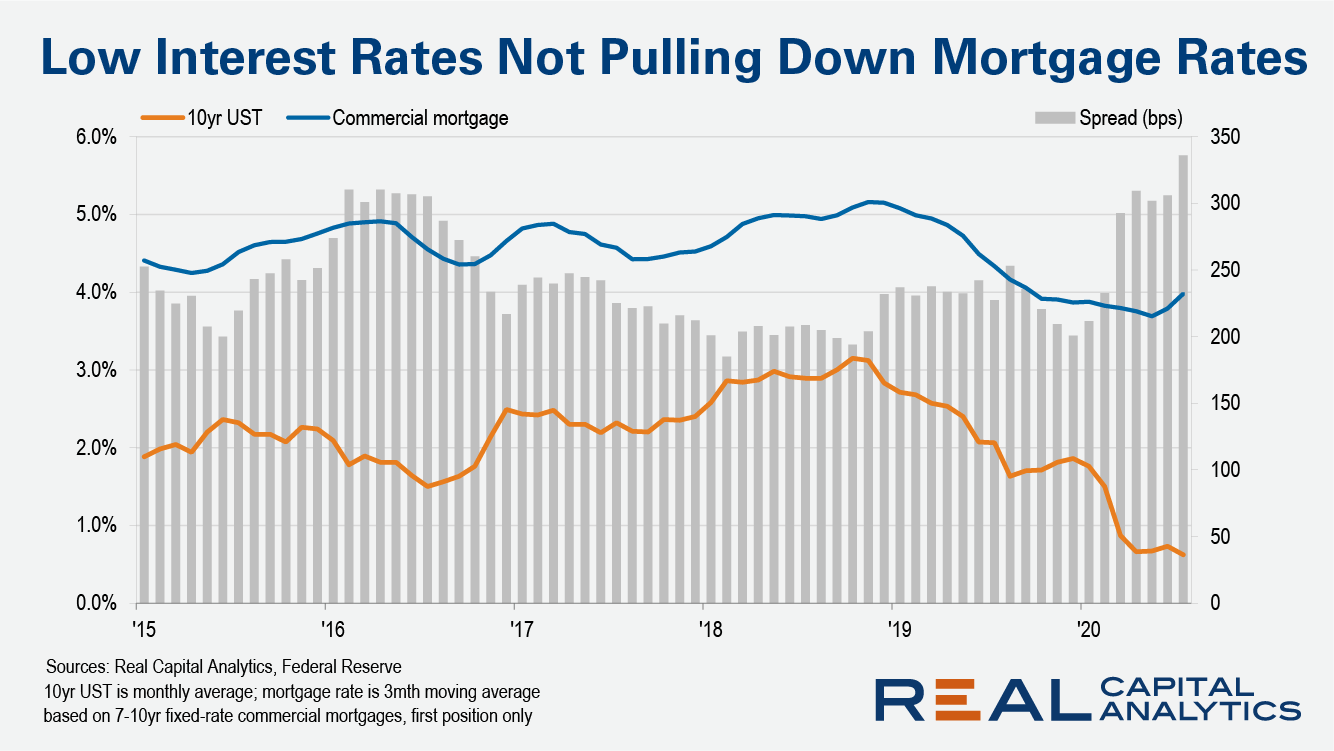

The 10yr US Treasury has averaged less than 1% every month since March 2020. Commercial mortgage rates have barely budged despite this sustained low level for the interest rate environment. In any normal period, low interest rates would be a positive sign for commercial real estate investment.

Interest rates remaining at such a low level over a sustained period is a sign of weakness in the economy. Investors normally benefit from declines in both cap rates and mortgage rates in periods of falling interest rates. The US Capital Trends report, released today by Real Capital Analytics, shows that these low rates have not inspired new acquisitions, with national sales activity down 68% year-over-year in August and down 36% for the year to date.

While interest rates have fallen, commercial mortgage rates have varied little, averaging 3.8% since March. Granted, a year earlier commercial mortgage rates averaged 4.7%. Even with more favorable financing costs however, potential buyers are fearful to step up to higher prices in the face of struggling tenants and a hazy picture on future income trends.

The lenders themselves are acting with some element of caution in the current environment. The spreads between commercial mortgage rates and the 10yr US Treasury are not at record high levels seen following the Global Financial Crisis, but they are at the highest levels seen over the last five years. Also, figures in the US Capital Trends report show that some of the most aggressive lenders in 2019 have started originating loans with lower LTVs in 2020.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.