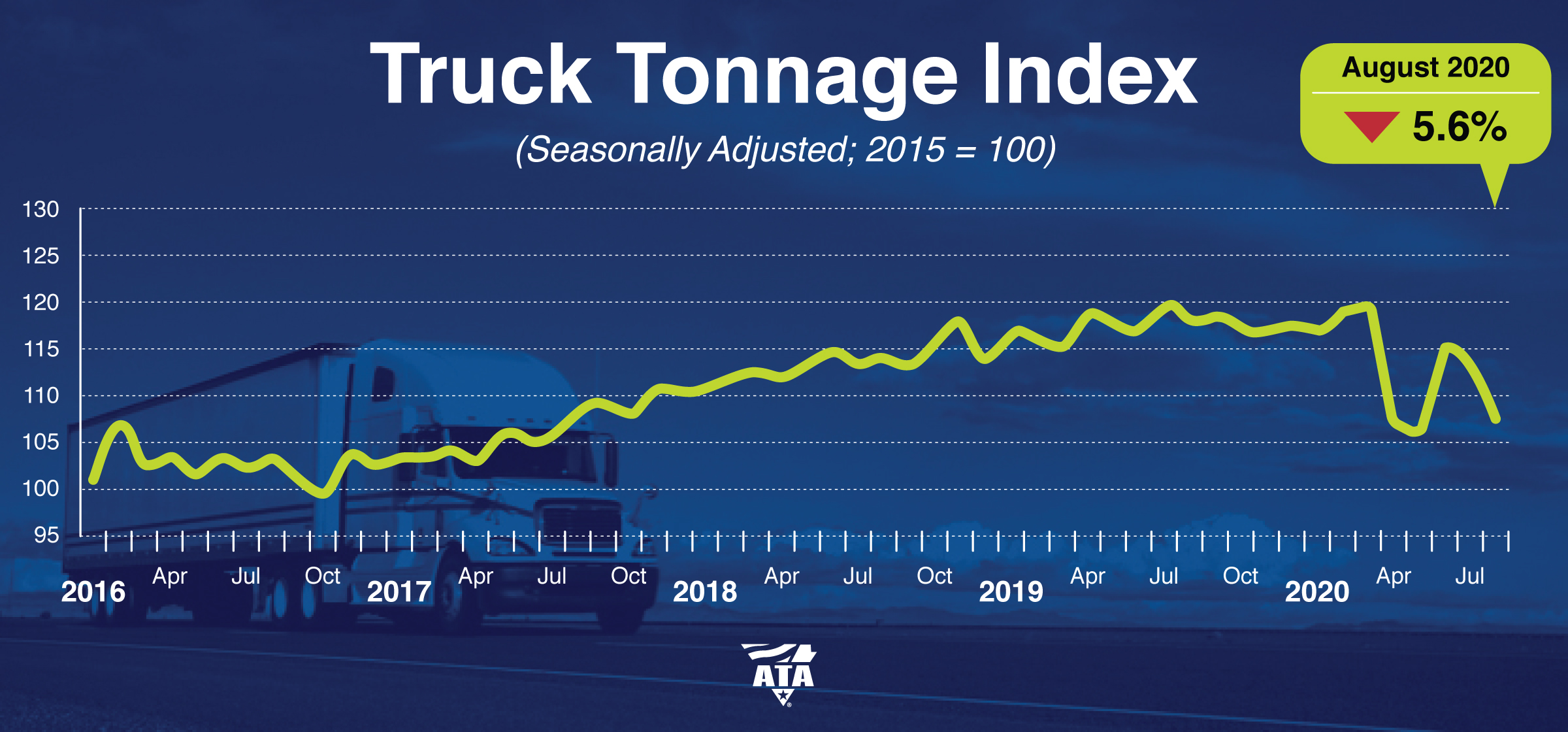

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 5.6% in August after declining 1.4% in July. In August, the index equaled 107.5 (2015=100) compared with 113.9 in July.

“The August softness suggests that freight is very uneven in the trucking industry,” said ATA Chief Economist Bob Costello. “The trucking sectors that haul for the industrial and energy industries are not seeing the surge in freight like the consumer side of the economy. The industrial loads tend to be heavier, so they count more in a tonnage calculation than most consumer-related loads. Fleets hauling for retailers are generally seeing strong freight volumes. Carriers hauling heavier industrial products generally saw softer volumes in August.”

July’s decrease was revised up to -1.4% from our August 18 press release.

Compared with August 2019, the SA index contracted 8.9%, the fifth straight year-over-year decline. Year-to-date, compared with the same period in 2019, tonnage is down 3.4%.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 112.8 in August, 3.9% below the July level (117.3). In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

Trucking serves as a barometer of the U.S. economy, representing 72.5% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.84 billion tons of freight in 2019. Motor carriers collected $791.7 billion, or 80.4% of total revenue earned by all transport modes.

To learn more about the data behind this article and what American Trucking Associations has to offer, visit https://www.trucking.org/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.