In July, we broke down the relative recoveries of outdoor and indoor shopping centers and found that, perhaps unsurprisingly, the former were recovering faster. The combination of shoppers’ concerns about COVID, limitations on which retailers were reopening, and other factors gave outdoor centers an advantage during the early stages of the recovery.

Yet, indoor malls were still showing signs of their unique strengths: the ability to drive visits from farther distances, and to keep those visitors in their locations longer. And this is a critical advantage because it unlocks the full power of indoor shopping centers to provide more than just revenue, but also uniquely-effective marketing and cross-shopping opportunities.

So, how are things looking now? We dove back into the same index of shopping centers to see if there has been a shift in the numbers.

Recovery Period Still Privileging Outdoor Shopping Centers

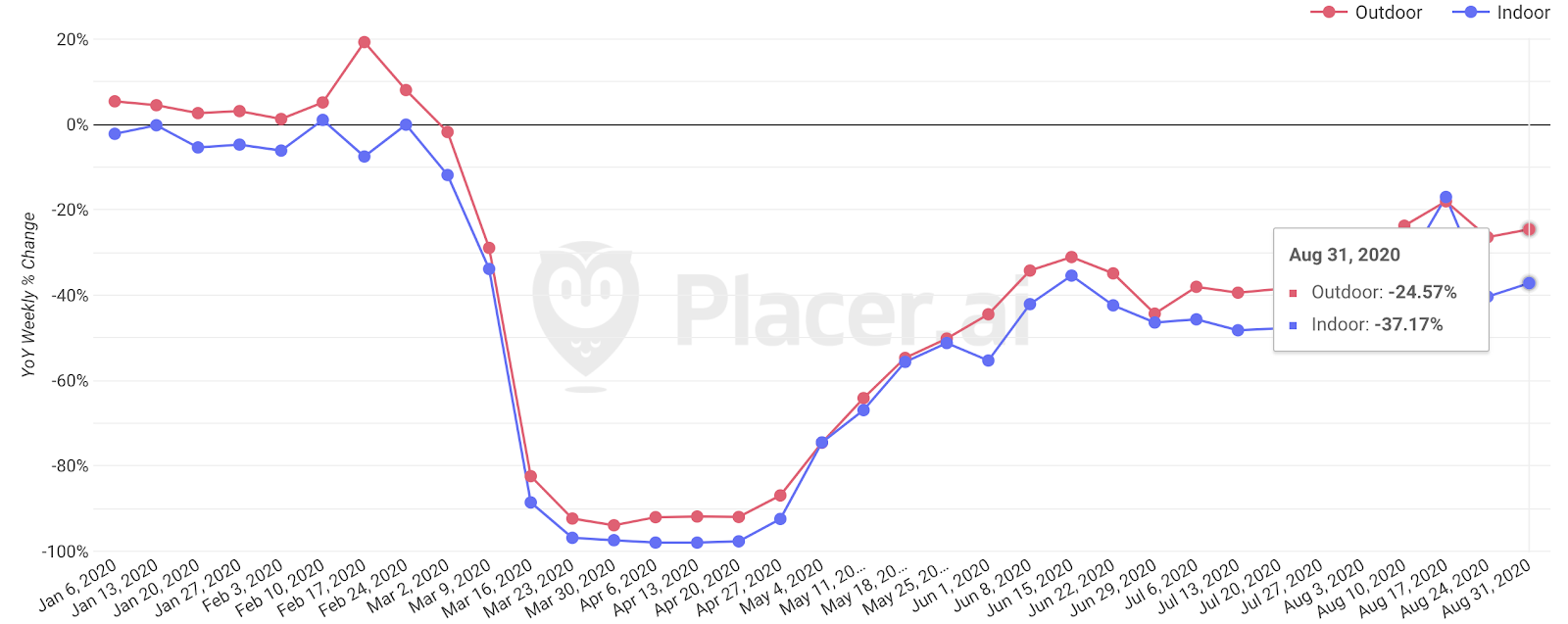

In terms of overall customer visits compared to 2019 levels, outdoor shopping centers have remained far closer to “normal.” The week beginning August 31st saw visits down 24.6% for outdoor centers, while indoor malls were down 37.2%. Yet, this marked an improvement, for both, from early June. Outdoor centers improved from 34.2% down the week beginning June 8th, while indoor centers improved to 42.1% down that same week, a near 5.0% improvement.

Critically, the latest week did not mark the high point for either. Both segments saw their best period for visits coming the week beginning August 17th, with indoor malls down just 17% year-over-year. And this was actually the strongest year-over-year decline number for either type of shopping center since the pandemic struck in early March. That same week, foot traffic at outdoor centers was down just 18%.

Caliber of Visits Still Favor Indoor

This seasonal push for indoor shopping centers during the summer’s back-to-school shopping season is something we saw play out in other metrics as well.

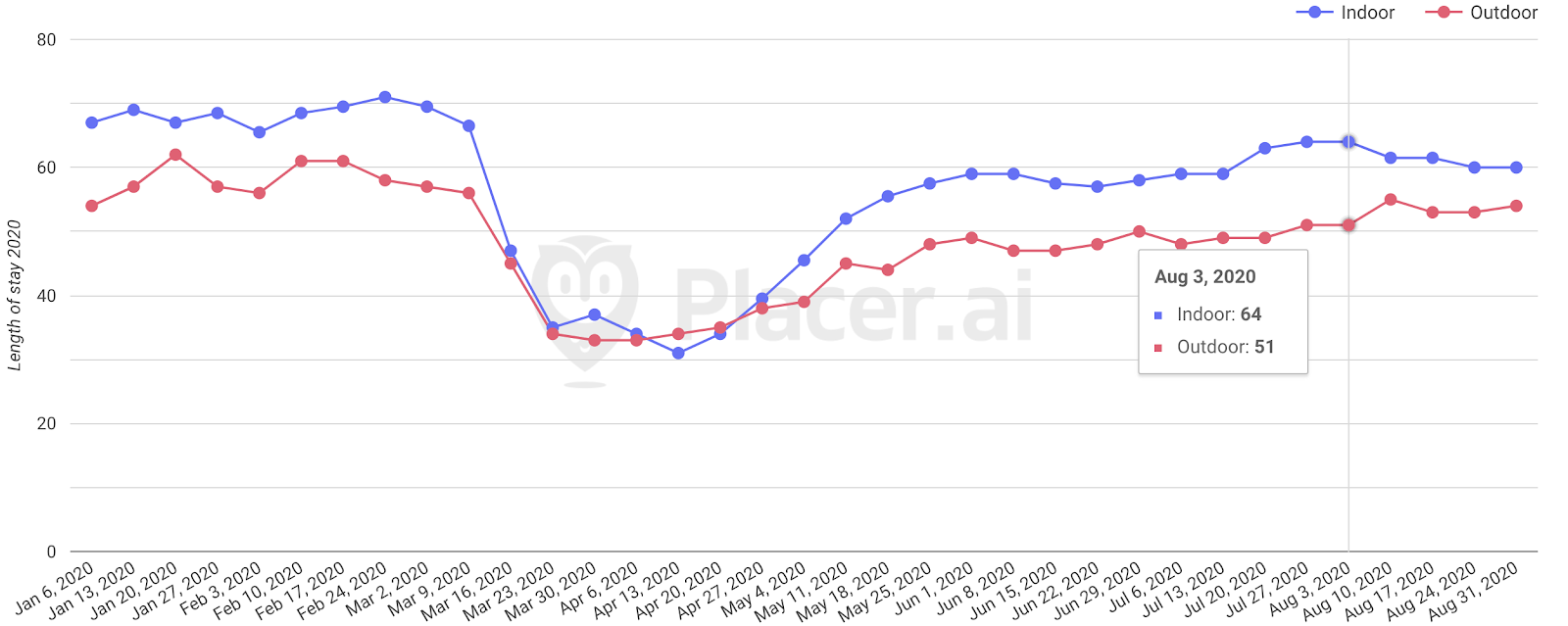

While outdoor centers again proved to be better at driving overall visitor numbers, the “type” of visit still differed greatly. Looking at the week beginning August 31st, visits to indoor centers were 11.1% longer than those to outdoor centers. And while this was down from being 25.5% longer the week beginning June 8th, durations shortened after indoor centers saw strength in early to mid-August. During this period, visits were 25.4% longer — almost the exact same level above they had been in early June.

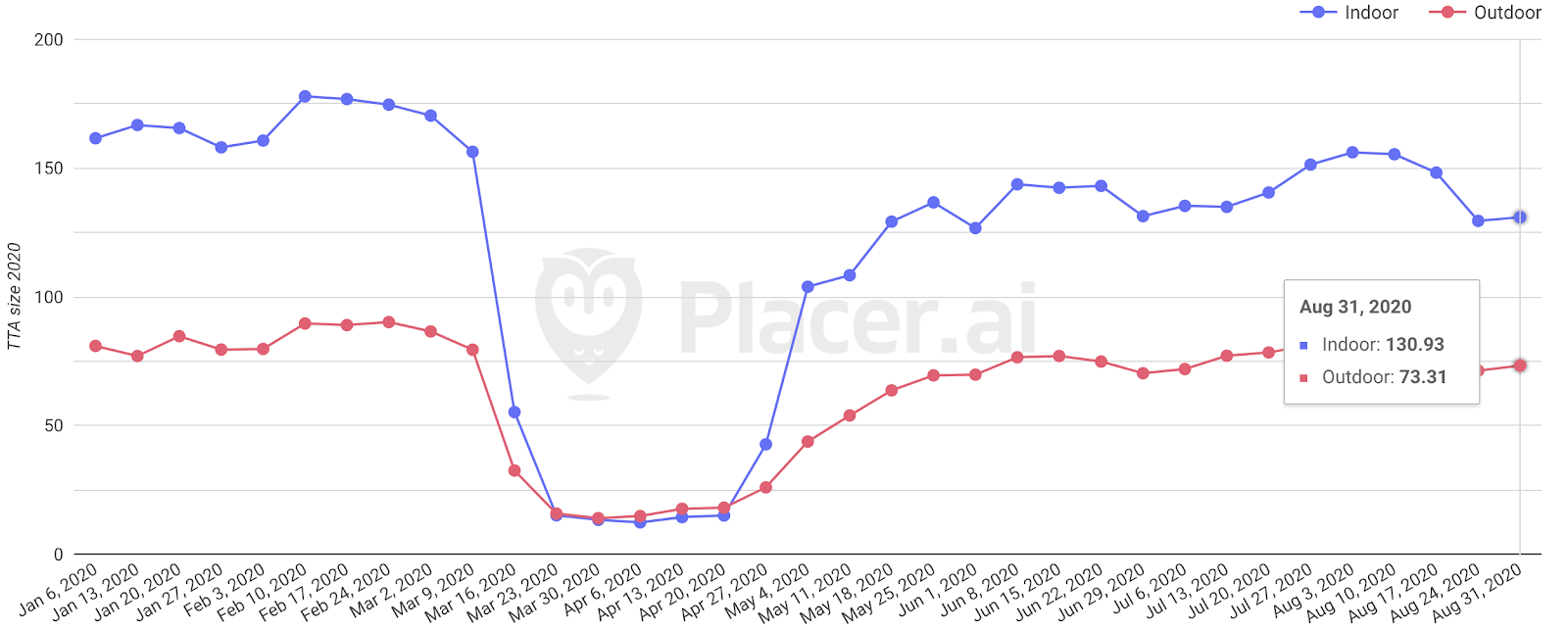

Additionally, shoppers traveled from longer distances to visit indoor shopping centers. The True Trade Area of indoor malls was 78.6% larger than that of outdoor centers during the week of August 31st. This was slightly narrower than the 87.8% gap in early June. But during the weeks in early and mid-August, there were gaps that were almost identical to those seen in June, with the week of August 3rd showing a difference of 25.4% in True Trade Area size.

Why Does this Matter?

These numbers go a long way in explaining a critical trend that could define the next few years of offline retail. Classic mall retailers, like Macy’s, have already announced that they’ll be trying out new outdoor shopping center formats. That makes sense, as the company looks to diversify its reach and approach in order to drive more visits and revenue.

But the opposite could happen, too. Outdoor-oriented retailers could come indoors because there are features that the traditional mall can provide that other centers simply can’t. From marketing reach, to cross-shopping potential, to access to different types of customers, malls have a clear value that they bring to the retail sector. And this will be compounded by the entry to new DTC and product-oriented brands that will likely try to establish retail space in shopping malls first due to their customer reach.

The Future State

Some shopping malls will likely close in the near future. But it doesn’t mean that the shopping mall itself is a dead retail concept.

Malls will evolve, adding new tenants and different types of space. They will, however, need to develop a mix that includes more complementary mall experiences and less direct competition. That is becoming increasingly likely. The exit of older, established retailers is going to force mall management to think differently, and those that adapt could lead the way in driving a new, improved, and certainly more exciting future for a dated retail format.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.