Throughout 2020 scheduled airlines have been looking for glimmers of hope in a recovery, but it looks like the last hope of the year Thanksgiving will be memorable this year for all the wrong reasons. The summer season saw a small spike in demand and then a rapid settling back to the new normal demand levels; labour day showed a similar pattern and the end of year holiday currently looks like being worse than both of those events.

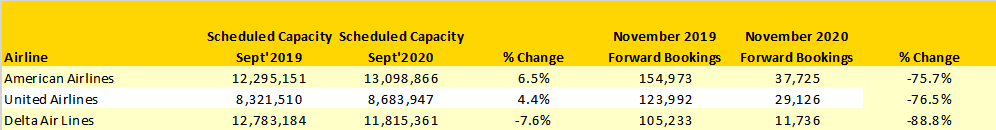

Using a combination of forward booking and schedules data we have compared the current number of bookings for each of the US majors against November last year; in both cases we have used the number of bookings held in September as a fixed point, thereby providing a consistency of measurement. The results are stark!

For two of the majors, current bookings for November are running at just 25% of those reported at this time last year whilst for Delta Air Lines forward bookings are only at 12% of last year’s level for November. Clearly booking data changes every day but two factors also play on this data; quite how many of these bookings are vouchers being redeemed and precisely how much was paid for each booking. A triple whammy of fewer bookings, vouchers being used, and low yields just compound the misery for the carriers.

Table 1- Comparison of Unweighted Booking Data For US Major Carriers, Nov’20 Versus Previous Year

Of course, carrier capacity is being cut every few weeks by the airlines as they shave off capacity to around 50% of last year’s levels and we should certainly expect a lot of the current published capacity to be cut soon. However, for every potential passenger booking into the Thanksgiving period the current schedules would suggest that they have a one in two chance of their plans having to change as airlines cut schedules. Who can plan against such a backdrop.

So which airline do you choose from a schedule consistency perspective?

Regular Capacity Changes Inevitable

In today’s operating environment airlines have to make regular adjustments to their schedules, doubts around the continuation of the CARES Act package just add to the daily challenges of secondary spikes, quarantines, state lockdowns and damaged consumer confidence.

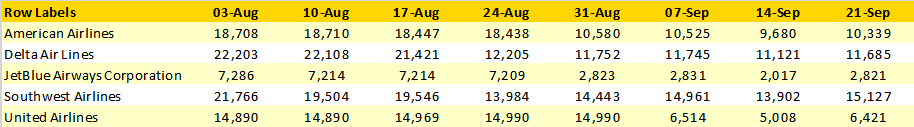

Taking next week’s schedules as a fixed point in time we have tracked back the planned capacity of the US majors across their domestic networks and there is a pattern of when each airline adjusts their schedules. Delta Air Lines appear to be the first mover adjusting their schedules some six weeks before the week of travel which of course provides the greatest clarity for the traveller.

Southwest Airlines appear to be making adjustments at five weeks whilst American, JetBlue are giving four weeks’ notice leaving United Airlines either playing the best game of brinkmanship with a three-week schedule change or hoping for the market to always recover. There is of course a commercial advantage from holding out as long as possible before making schedules changes but equally that can create a higher degree of frustration for anyone booking in the six to three week booking window. Either way, airlines can’t win!

Table 2 – Major Schedule Changes By Week from US Majors For Travel W/C 28th September 2020

In normal times every airline seeks to balance a reasonable level of forward bookings and cash generation against the opportunity to sell as many seats at the last minute at a higher yield; it’s called revenue management. In the current market with no clarity around a recovery and consumer confidence shattered it looks like the last hope amongst the US carriers for some strong revenues in November will not materialise.

Perhaps that is a message the airlines should be making very clear as discussions continue around supporting one of the most valuable parts of the US economy; aviation.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.