In this Placer Bytes we dive into Neiman Marcus’s bankruptcy and Allbirds offline expansion.

The Thing about Neiman’s

Neiman Marcus officially emerged out of bankruptcy in late September, a major feat for the brand and its loyal customers. But, looking at the numbers for the brand does little to inspire confidence that a fundamental turnaround is in store.

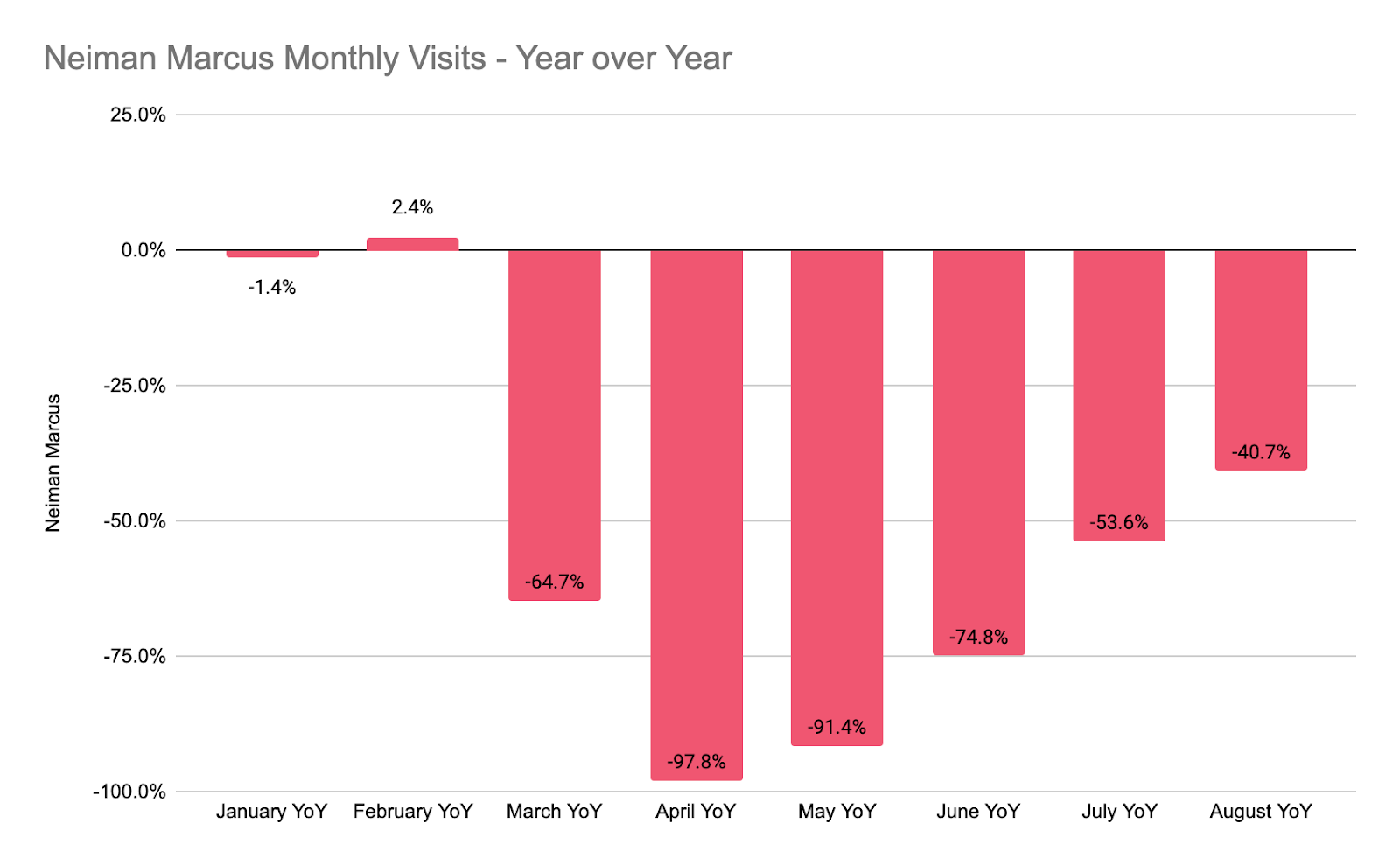

Even before the pandemic brought store activity to a halt, Neiman Marcus had a mixed start to 2020 with visits down 1.4% in January and up just 2.4% in February even with an industry-wide, late-month surge and an extra day of February due to leap year. But, visits have been rising with consistent growth each month bringing the brand closer to 2019 levels. And although this has been widely aligned with overall trends in the department store space, the move out of bankruptcy included discussions of a significant shift to eCommerce.

This piece of the story is important, as the focus of the organization will go a long way to determining its ability to successfully rebound over time. And interestingly, it will bring to the forefront key questions about what purpose the brand’s offline footprint serves. While a stronger digital effort can hardly be a negative, the bigger question may center around the way the brand leverages its core offline assets. When analyzing cross-shopping patterns from early 2019 through early 2020 to avoid pandemic trends, interesting insights appear. The upscale Neiman Marcus unsurprisingly sees the highest levels of cross-shopping with other department brands like Macy’s and Nordstrom with 53.0% and 45.7% of its visitors also having frequented one of those brands in that period. The next high-end department brand on the list is Bloomingdale’s with a 19.3% visitor overlap.

And what comes in between? A large mix of off-price leaders and top retailers. Diving into Neiman Marcus Last Call locations further solidifies this point, with Macy’s again in the top spot followed closely by Marshall’s (45.5%), T.J. Maxx (45.3%), Ross (41.8%), and Kohl’s (35.1%). The overlap here is far less with other high-end brands with Nordstrom seeing only 26.3% of those customers visit a location and Bloomingdale’s seeing just 9.8%.

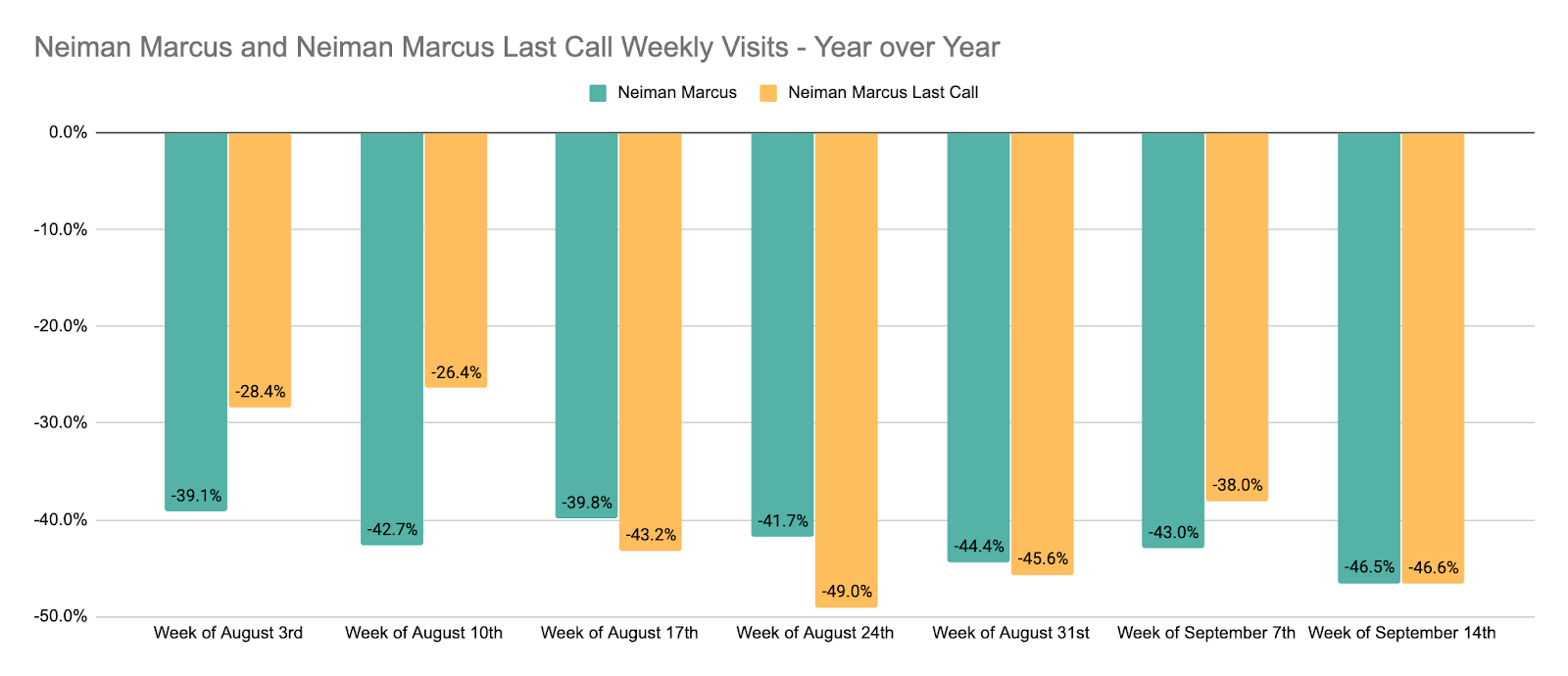

So why does this matter? As Neiman looks to realign itself, it has different alternatives for approaching the market. On the one hand, it can and should utilize its flagship brand to drive high-end visitors with a focus on personal shopping and high levels of customer centricity, elements that could be especially valuable in the coming months. But it also has an off-price asset that could be utilized more effectively instead of being abandoned. Off-price is one of the hottest sectors in retail and yet, Last Call has seen visit rates very similar to those of Neiman Marcus. This screams opportunity, as locating Last Call locations more effectively could help drive visits and an expansion of the brand’s market reach.

Allbirds Expanding

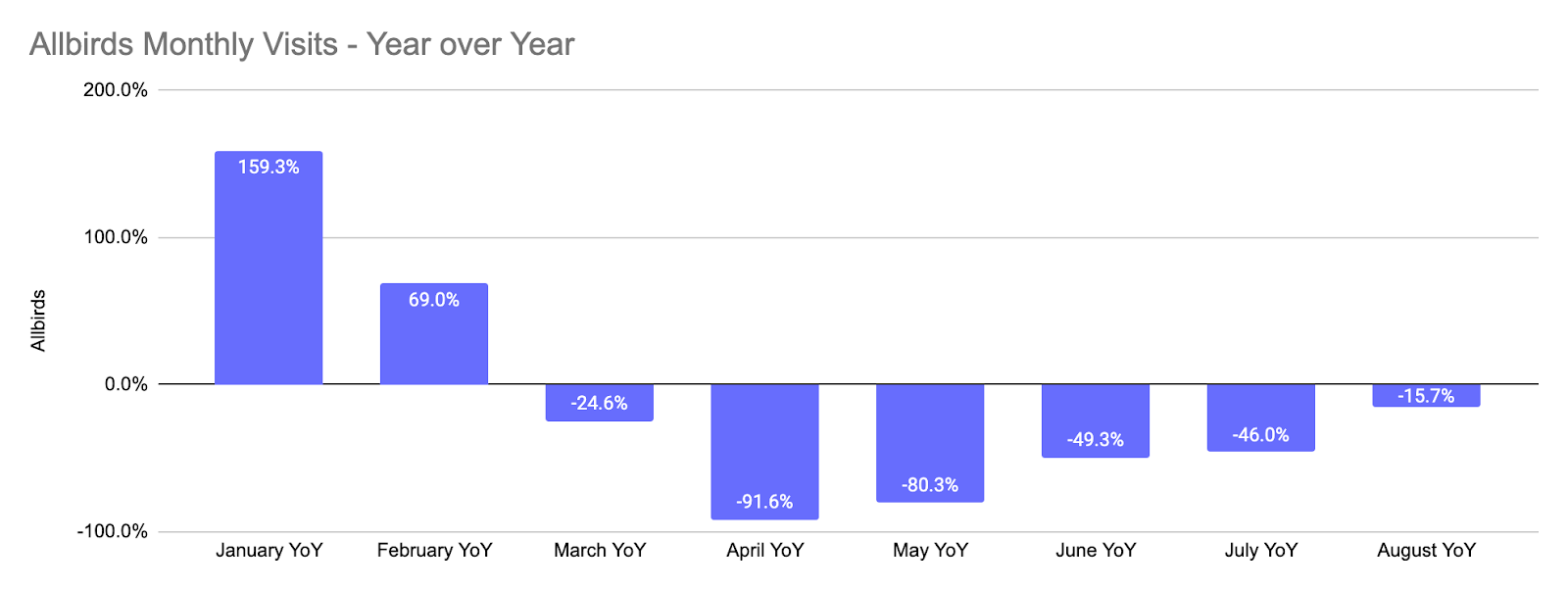

A top DTC company is expanding its offline presence — color us not surprised. This is a trend we’ve been discussing constantly since late 2019. In fact, it was one of our big trends for 2020. And here again, it makes all the sense in the world. Allbirds announced a $100 million series E with much of that going to driving new physical locations.

Why? Because owning your offline presence enables a unique mix of revenue, marketing, and logistics benefits that can help a retailer be more profitable and expand its reach. And considering the pace that Allbirds was on in early 2020, visits to owned locations were up 159.3% and 69.0% in January and February, respectively. The decision couldn’t come at a better time. With many overextended retailers looking to shut locations in the coming months and year, Allbirds could be positioned to be growing at just the right time.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.