In this post, we dive deep into McDonald’s and express some of the reasons we believe the brand is poised for an exceptional bounce back. But, because At Home has been so exceptional of late, we couldn’t dedicate the full blog to McDonald’s and left some space to laud this rising home goods giant.

McDonald’s Rising Back

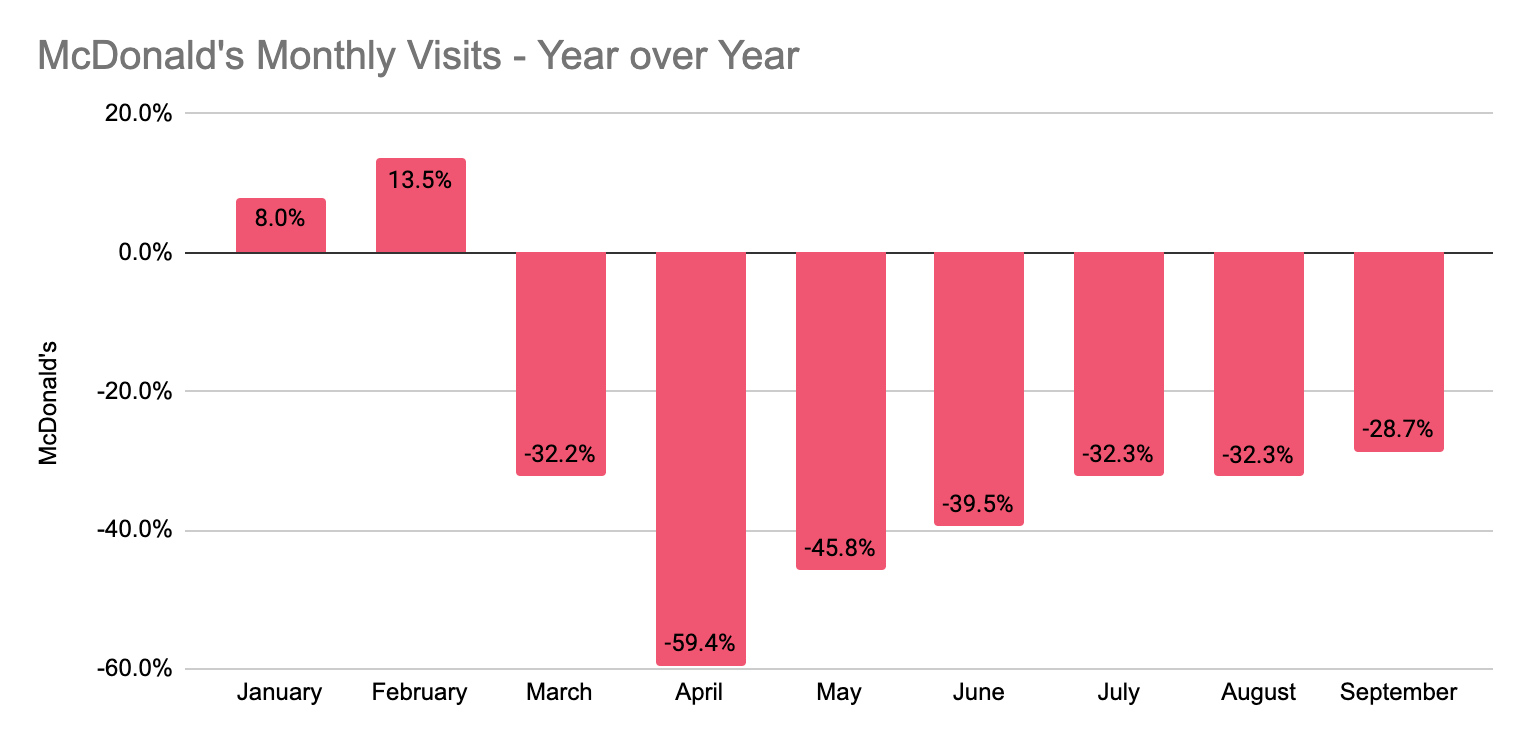

Yes, McDonald’s visits are down, just like most other fast food and restaurant brands. However, there are a large number of reasons to feel exceptionally confident about its current recovery pace and a future that could be even brighter. Looking at monthly visits since the start of 2020 shows the brand kicking off the year strong, seeing visits up 8.0% and 13.5% year over year. Obviously, the pandemic had a significant effect. Visits found their nadir in April, with foot traffic down 59.4% year over year. Yet, since that point, the brand has steadily progressed towards 2019 levels with monthly visits down just 28.7% in September year over year.

Admittedly, the first weeks of October have actually seen this gap grow with visits down an average of 32.5% for the weeks beginning September 28th, October 5th and October 12th, though this is largely related to a normal seasonal trend that sees visits dip during this period. Even more, this slight dip back is no match for the reasons for optimism.

Morning Opportunities

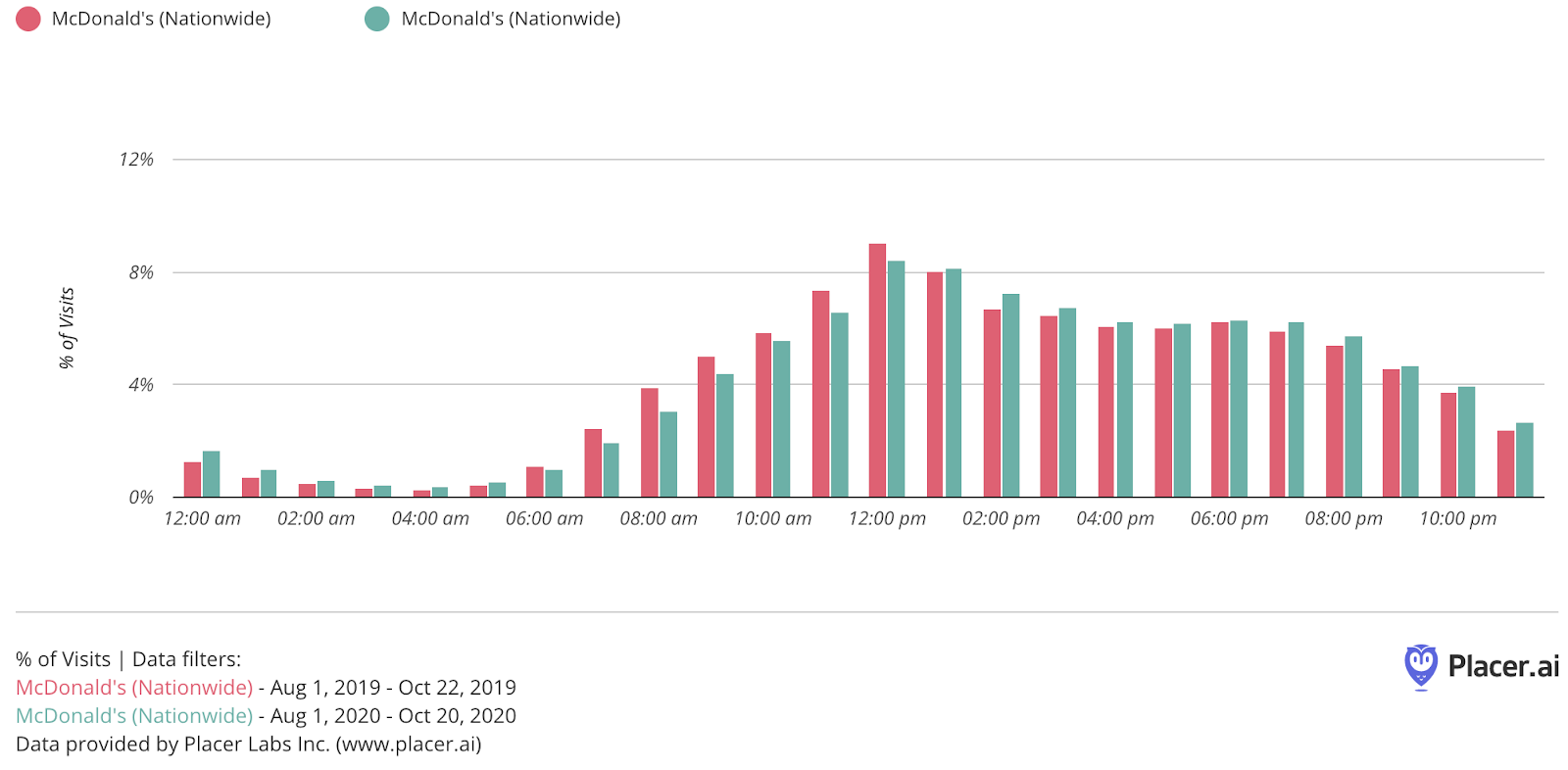

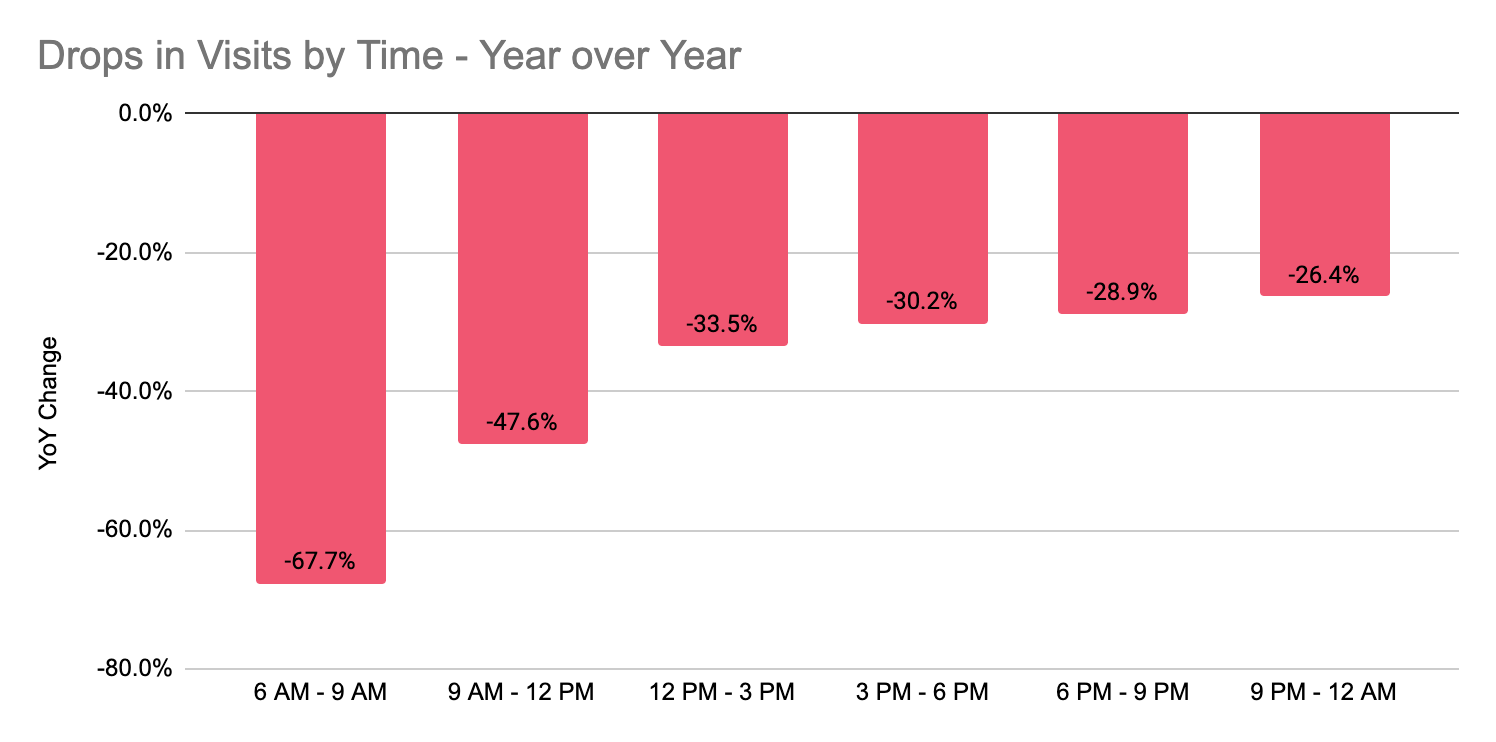

The data also suggests that even these relatively minor gaps can be quickly addressed when a greater sense of ‘normalcy’ returns. Morning visits are a key piece of the McDonald’s puzzle and this is an area that has been severely impacted. The ability to grab breakfast or a coffee before work is a huge asset that makes McDonalds such a unique all-day powerhouse. And removing this element hurts. The overall proportion of morning visits in the period between August and October 20th dropped by 3.2% year over year. So even as visits fell overall, morning visits fell even more. This idea is further validated by customer journey data that shows the proportion of McDonalds visitors stopping by immediately prior to work dropping from 8.3% to 4.3% year over year.

But the unique nature of the limitation is made all the more clear when looking at declines in absolute numbers by time. Visits during the morning hours were down 67.7% year over year while times in afternoon were down just over 30% – aligned with decline numbers for the period. So, essentially, though McDonald’s visits have been down around 30% year over year in recent months, they are operating without one of their key periods almost entirely. It’s like asking an athlete to play with an arm tied behind their back and expecting a ‘normal’ performance. As normal work and school routines do increasingly return, McDonalds could see a dramatic visit recovery and the stop-in for breakfast or coffee could be a huge reason why.

At Home Continues to Impress

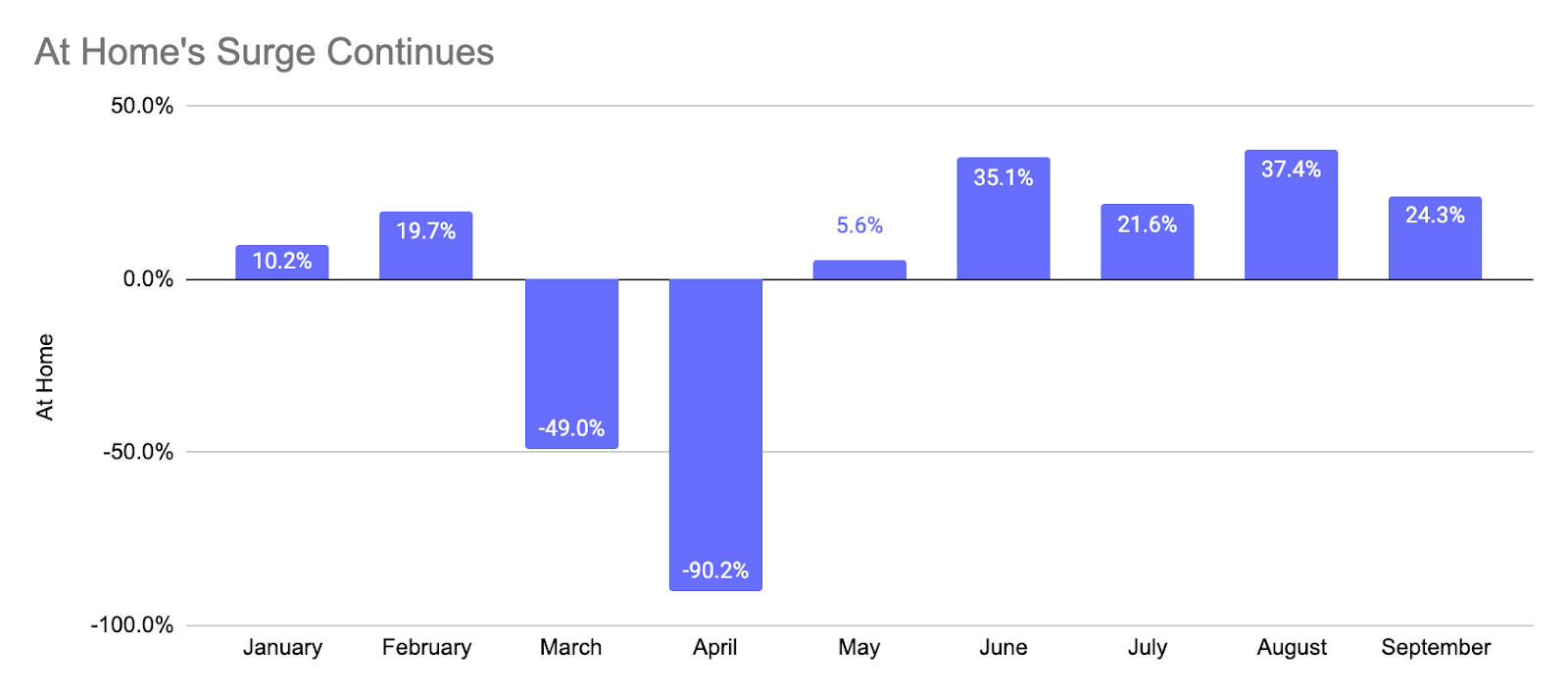

If they handed out Oscars for home improvement brands, Home Depot and Lowe’s would end the year holding trophies – and deservedly so. But the dark horse in this fictitious award season is At Home. The brand saw visits drop 90.2% year over year in April without the protection of essential status. But instead of seeing a slow and steady recovery, it simply bounced back immediately to pre-pandemic strength.

While January and February averaged year-over-year visit growth of 14.9%, the last five months from June through September have averaged a staggering 24.8% year-over-year visit increase – and this is including a May that was up just 5.6% because of the recovery. Simply put, in a year when many were forced to stay at home, the brand At Home has provided a critical resource for upgrading our respective homesteads.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.