The COVID-19 pandemic has had a big effect on the mortgage market. Along with a drop in mortgage rates to a record low, the jumbo-conforming mortgage rate spread has also been affected. Before 2013 mortgage rates for jumbo loans were higher than for conforming loans. However, in 2013 the rate-difference fell, and jumbo rates have averaged 5 basis points lower than conforming during 2013-2019. The jumbo-conforming mortgage rate spread has widened during the pandemic to the highest level in seven years.

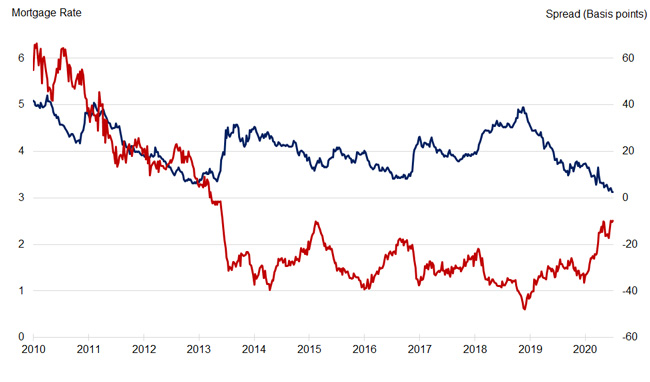

Figure 1: Mortgage Rate versus Jumbo-Conforming Spread

Correlation Coefficient: -0.65 (April 2013 – June 2020)

An increase in GSE guarantee fee, a reduction in the GSE funding advantage, and portfolio lenders’ desire to hold jumbo loans explain much of the variation in the jumbo-conforming spread in the past.[1] Movement in interest rates may also help explain some of the variation in the jumbo-conforming spread, especially since 2013. The mortgage rate and the jumbo-conforming rate spread are inversely correlated (Figure 1).[2] For example, as the mortgage rate dropped during the first eight months of 2019 the spread has gone up. As the mortgage rate dropped the refinance application volume jumped up; because of a limited secondary market for jumbo loans and cutbacks in staffing at many lenders, bottlenecks in jumbo-loan production were reflected in a rise in the spread. Moreover, during the pandemic the mortgage rate dropped further reaching a series of record lows as the Federal Reserve eased monetary policy to curb the economic crises. Thus, the drop in mortgage rates during the pandemic has been one reason the unadjusted spread has gone up (but still below zero).

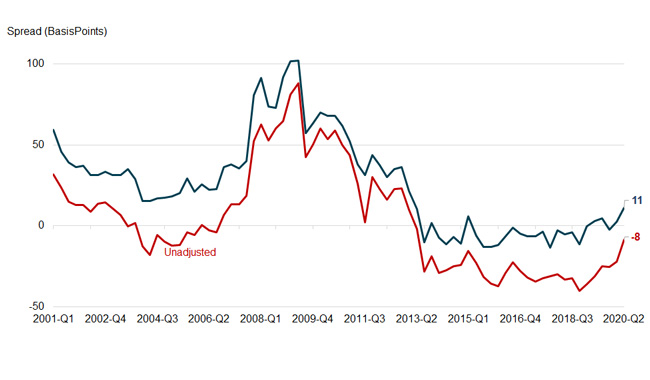

Figure 2: Adjusted Quarterly Jumbo-Conforming Spread Estimates, 2001 Q1-2020 Q2 (Average 2013 – 2019 was -5 Basis Points)

However, after controlling for borrower and loan credit risk, home location, and loan size characteristics, the spread is above zero (Figure 2).[3] The overall pattern of adjusted spread followed the pattern of unadjusted spread. The adjusted estimates show that the spread reversed from negative 8 basis points (with no adjustments for differences in attributes) to 11 basis points for the adjusted estimate in the second quarter of 2020. The adjusted spread widened by 8 basis points from the second quarter of 2019 to the second quarter of 2020. The refinance boom as a result of a record low mortgage rate and lenders’ increased caution in the jumbo market because of economic uncertainty are likely behind the rise in the spread during the pandemic.[4] The Q2 2020 mortgage rate spread was the highest since Q2 2013.

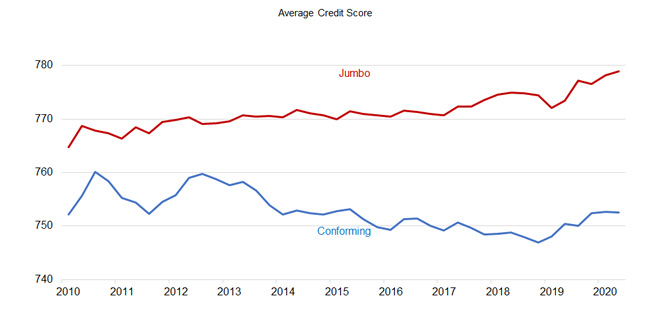

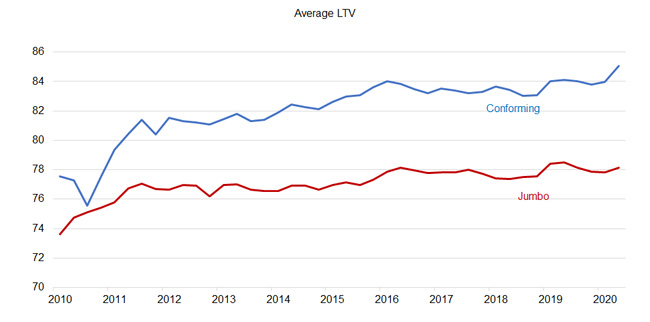

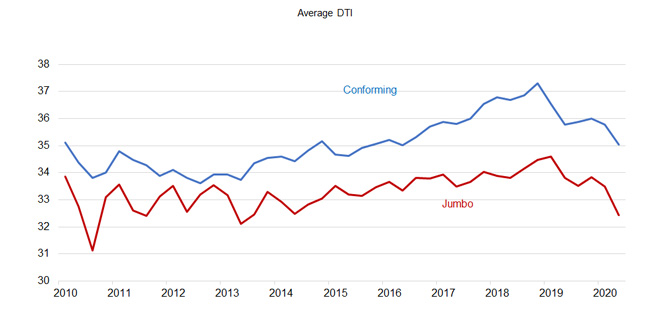

Figure 3: Averages Credit Risk Variables for Homebuyers with 30-Year Fixed Conventional Mortgages

In general, today’s jumbo loans have a higher credit underwriting standard than conforming loans (Figure 3). Nearly all jumbo loans were full doc and made to prime borrowers, lowering credit risk across two dimensions. Comparing jumbo and conforming loans originated in 2020, jumbo loans had higher average credit scores by 26 points, lower LTV by 7 percentage points and lower DTI by 2 percentage points. These differences help account for much of the jumbo-conforming spread over the past several years.

Despite the higher-standard of jumbo loans and risk-based pricing, the spread was higher during the pandemic as lenders were curbing their appetite for jumbo loans.[5] With the market uncertainty and an increased risk, in addition to the surge in refinance applications, some lenders even suspended offering jumbo loans. As per MBA, jumbo credit availability fell by about 59% compared with pre-pandemic.[6]

©2020 CoreLogic, Inc. All rights reserved.

[1] See AEI working paper https://www.aei.org/research-products/working-paper/jumbo-rates-rates-causes-implications/

and https://www.corelogic.com/blog/2018/08/why-are-jumbo-loans-cheaper-than-conforming-loans.aspx

[2] Only 30-year fixed-rate conventional home-purchase loans were included for both conforming mortgage loans and jumbo mortgage loans for this analysis.

[3] Figure 2 plots the estimates for the jumbo-conforming spread from the regression equation ran for each quarter. For detail please see https://www.corelogic.com/blog/2018/10/jumbo-conforming-spread-risk-location-scale-economies-affect-rate.aspx

[4] In general, lenders typically retain the risk because the secondary mortgage market for jumbo mortgages is less developed than for conforming.

[5] Risk-based pricing is the process through which lenders tend to charge premiums for higher-risk mortgages and lower rates for lower-risk loans.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.