2020 was a banner year for madness in the retail sector, but even amid the pandemic that upended much of the ecosystem, there were bright spots. And none shined brighter than the home improvement sector led by industry giants Home Depot and Lowe’s.

Huge Year-over-Year Growth Continues

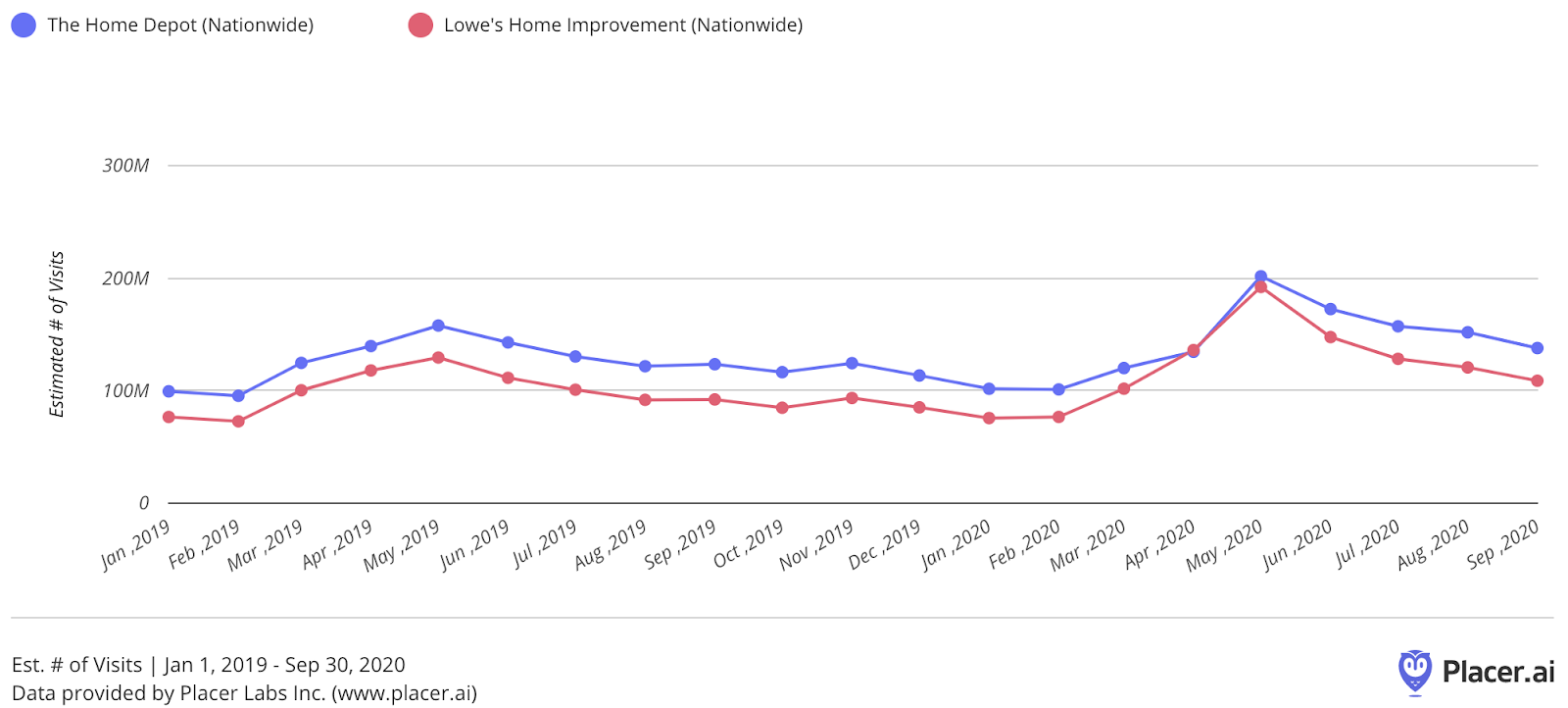

When Home Depot and Lowe’s saw huge growth numbers during the spring, the thought was that the sector was enjoying a perfect storm of positive factors. They were essential retail, the normal seasonal peak for this group was during the spring and we had all been given ample time to finally dive into our DIY tasks because of the lockdown.

And the pace did appear to be dying down, until there was another jump in August. Instead of normalizing, the success lingered and August saw huge year-over-year growth numbers for both brands with Home Depot seeing a year-over-year visit increase of 23.9%, while Lowe’s saw a jump of 30.2%. Finally, September seemed to mark the end of this crazy, extended visit surge with visits up just 10.7% and 17.0% year over year for Home Depot and Lowe’s respectively.

New Holiday Peaks?

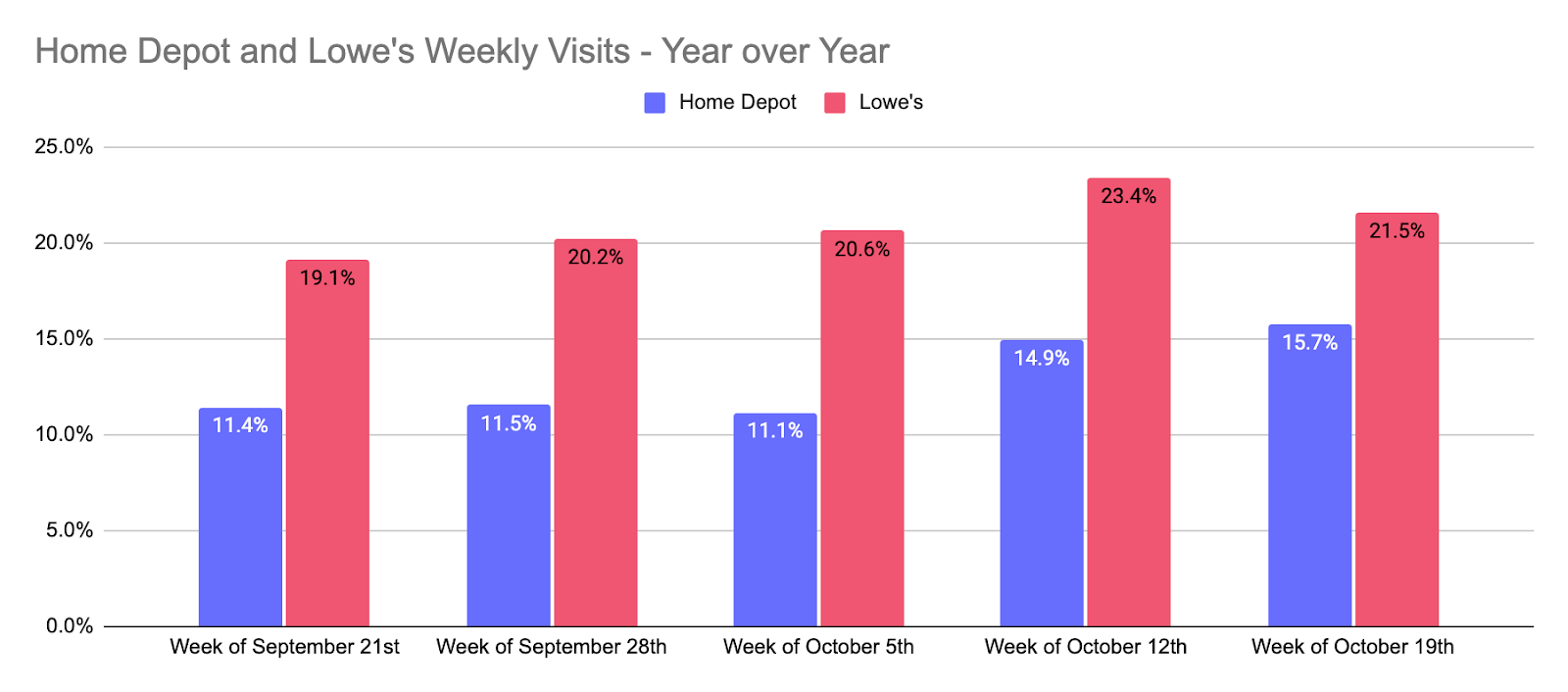

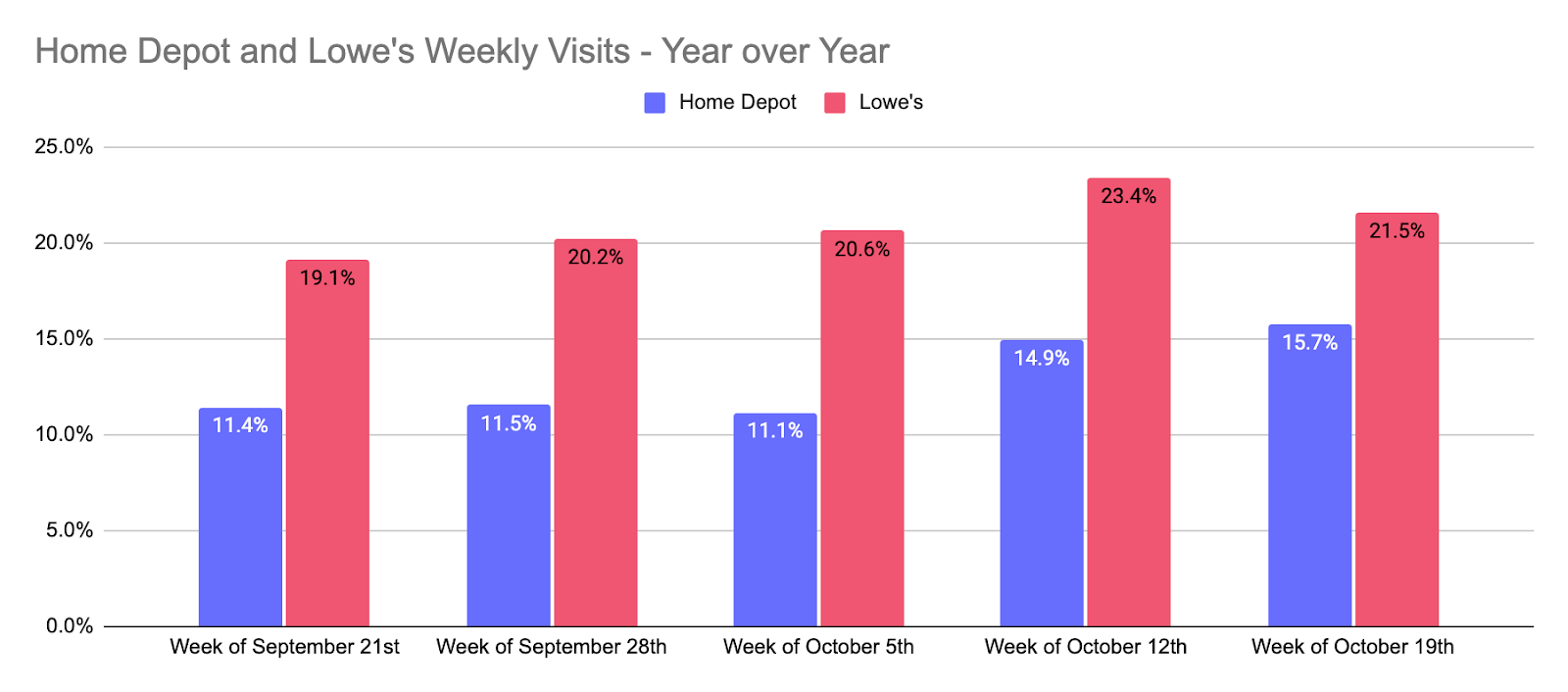

But amazingly, after this second dip, it does appear visits are again back on the rise heading into what could be an enormous holiday season for these chains. Looking at the weeks beginning October 12th and 19th, Home Depot saw average year-over-year visit growth of 15.3% while Lowe’s saw an increase of 22.5%, far ahead of the September pace. And this drove October visits that were up 15.7% and 23.9% year over year for Home Depot and Lowe’s respectively. So while we have gone far beyond any reasonable expectation of what this sector can achieve in 2020, the holiday season appears poised to only add value.

Shifts in Market Share?

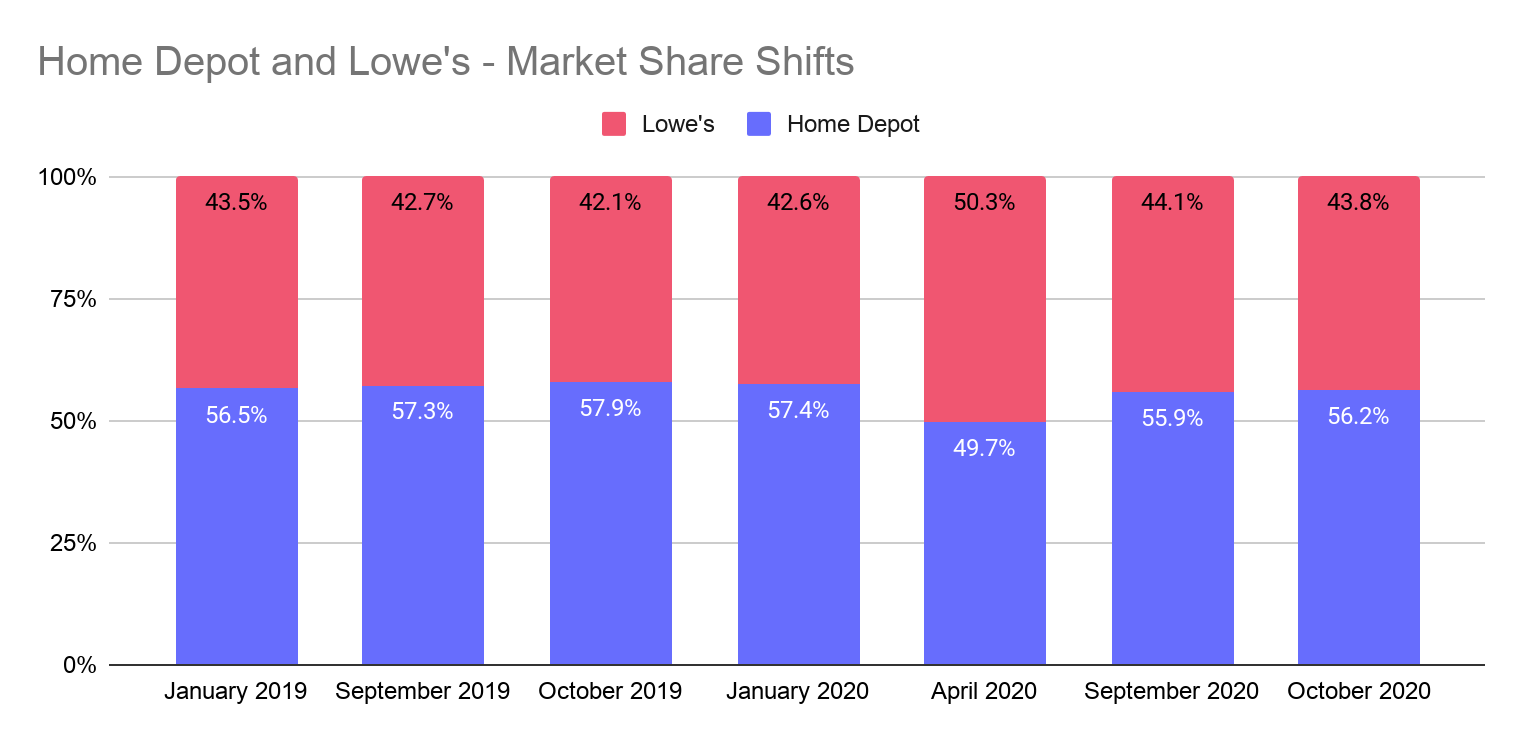

And the jumps are making this sector incredibly exciting as Lowe’s may finally be proving capable of making a run at the Home Improvement throne. Where Home Depot had held 56.5%, 57.3% and 57.9% of the overall market in January, September and October of 2019 respectively, Lowe’s actually surpassed Home Depot in April holding 50.3% of the overall visits to the group. Yet, this was largely due to external factors like the level of restrictions Home Depot had in place in April and its geographic distribution.

And as a result, when Home Depot did fully reopen the visit split normalized quickly, with Home Depot holding 55.9% and 56.2% of the overall visits to the two retailers by September and October of 2020 respectively. And this plays in to a similar trend we saw last year where Home Depot enjoyed a much stronger Q4 performance in 2019 than Lowe’s, and should it see the same in 2020, its overall lead may actually grow. However, if Lowe’s can prove capable of sustaining its surge through the holiday season, this battle of giants may start to get interesting.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.