Heading into what will likely be a particularly unique holiday season, there is a group of retailers that seem to be impervious to the effects the wider retail ecosystem is experiencing offline. And while this group certainly includes more than two brands, it is headlined by Walmart and Target. The shift to mission driven shopping only compounded their existing strength incentivizing visitors to spend even more time at these locations – a trend boosting visits and basket sizes.

So how are these brands really performing ahead of the coming holiday season?

Diving into Walmart’s Distributed Strength

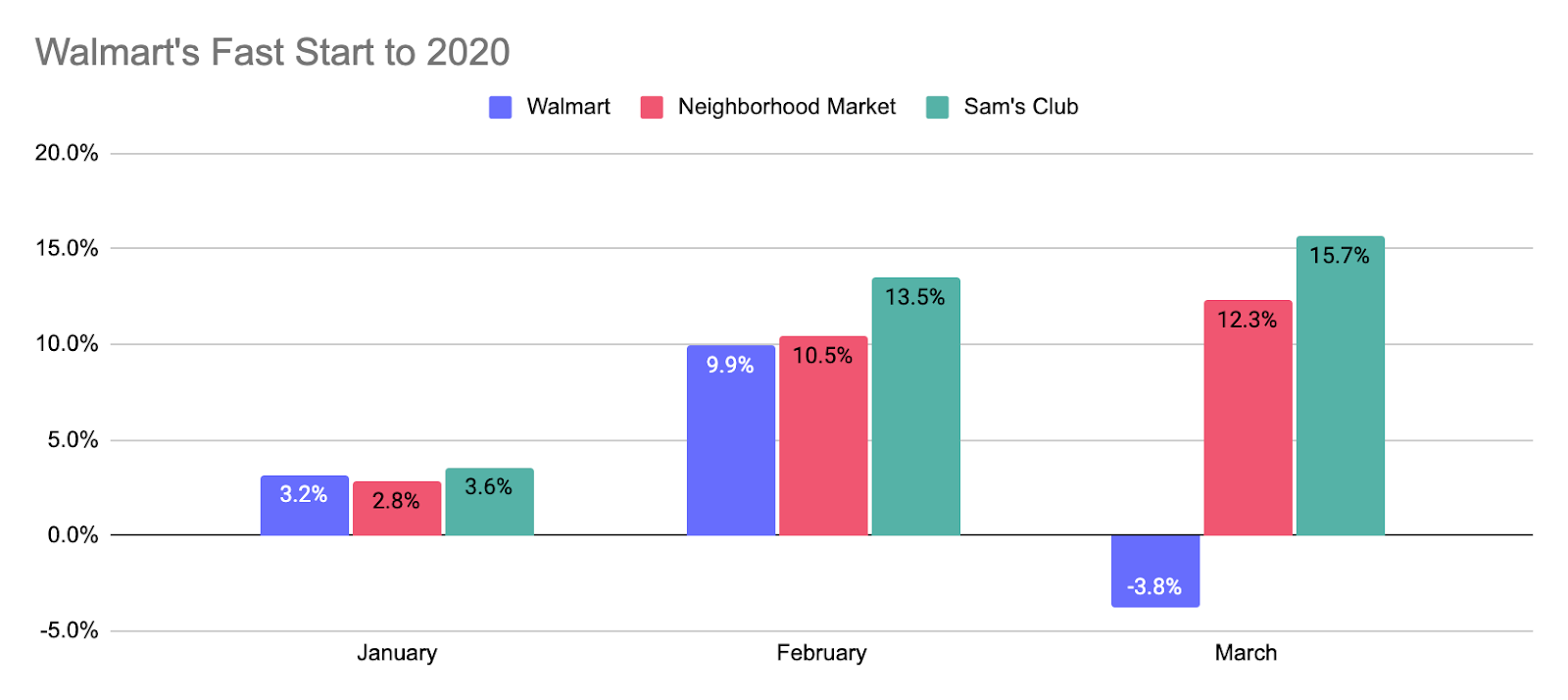

Looking at Walmart Supercenters, the Neighborhood Market brand and Sam’s Club, all three kicked off 2020 with strength with January and February showing year over year visit growth across the board. At the time, the supercenter strength had essentially come to be seen as a given and the interesting jump was Sam’s Club increases of 3.6% and 13.5% in January and February respectively.

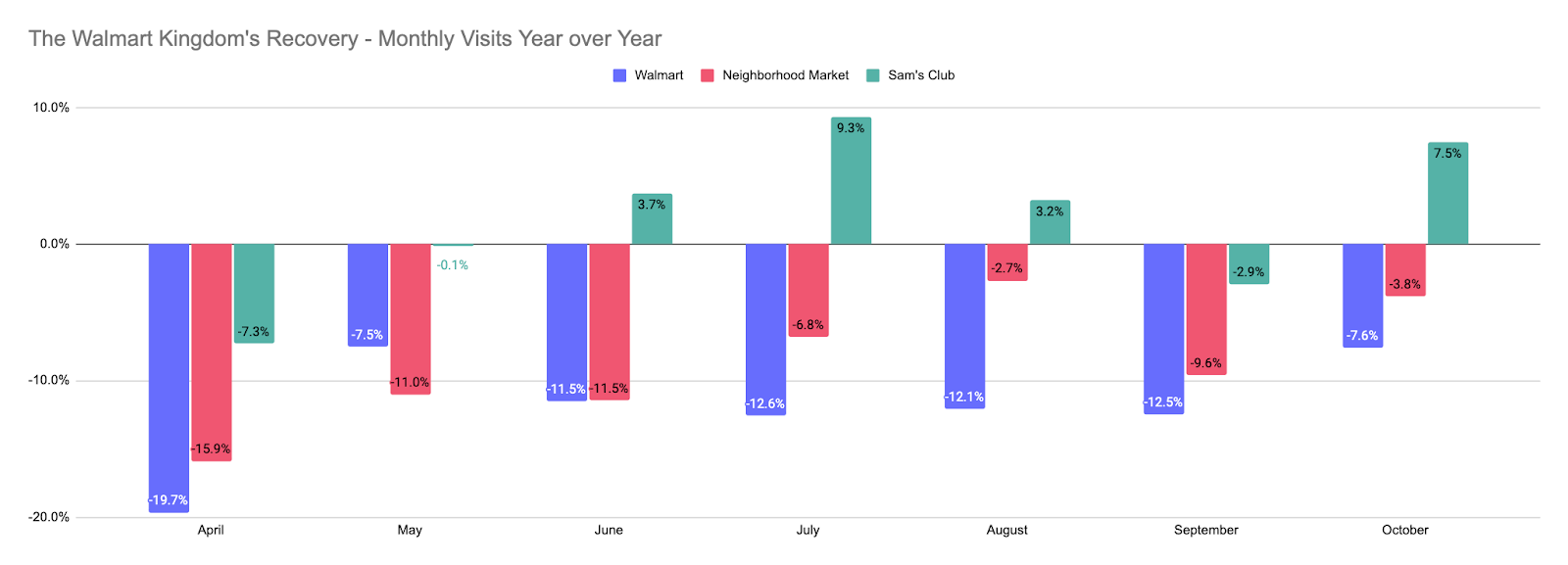

Yet, the impressiveness of these brand’s strong starts to the year may actually pale in comparison to the even more impressive nature of their recoveries. Over the last six months, Sam’s Club has seen an average year over year traffic increase of 3.5% – a run that has improved its position within the wider wholesale club sector. And this period ended with October visits up 7.5% heading into a holiday season that could prove to be a boon for the wholesale club space.

At the same time both Walmart Supercenter and Neighborhood Market locations have been trending up with October seeing the second smallest visit gap with 2019 levels for both since the pandemic made its impact felt in April. This is especially exciting for Walmart’s Supercenter chain considering the visit increases are not coming at the expense of visit duration. Even while visits have been down, Walmart’s basket size has been growing substantially, something that was indicated by an increased time of visit. And while the visit gap shrunk significantly in October with visits down just 7.6%, visit duration actually grew by over 14%. This indicates that Walmart could be already be enjoying the value of an extended holiday season, where the brand looks to spread the holiday spirit over a longer period of time to offset the loss of Thanksgiving shopping.

Target’s Timing

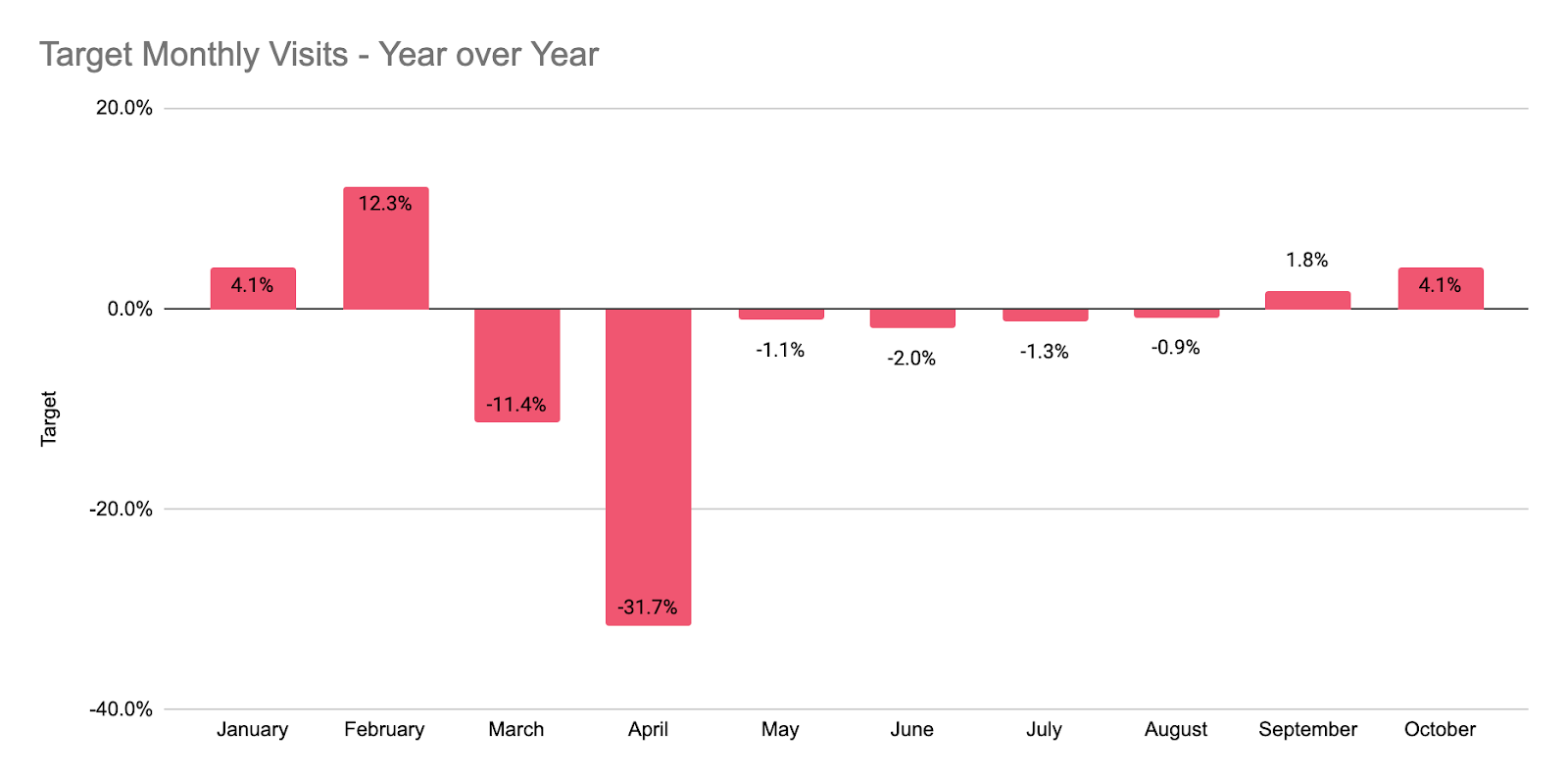

Incredibly, Target’s recovery performance has been equally strong. After major traffic growth in early 2020, the brand saw visits drop 11.4% and 31.7% respectively in March and April year over year. But since that point, visits never dropped lower than 2.0% compared to 2019 levels, even during the summer back to school season, when the comparison was to an especially strong 2019 period.

And recent months have proven to be even stronger with visits in September and October up 1.8% and 4.1% respectively year over year, and visit durations up nearly 5% year over year in October. The timing is exceptional heading into a holiday season that seems perfectly suited to serve Target’s strengths. The brand has proven effective at benefitting from online surges, is less Black Friday dependent than many other brands and is very well suited to mission driven shopping.

The result? A brand positioned to show its full strength heading into a critical retail period.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.