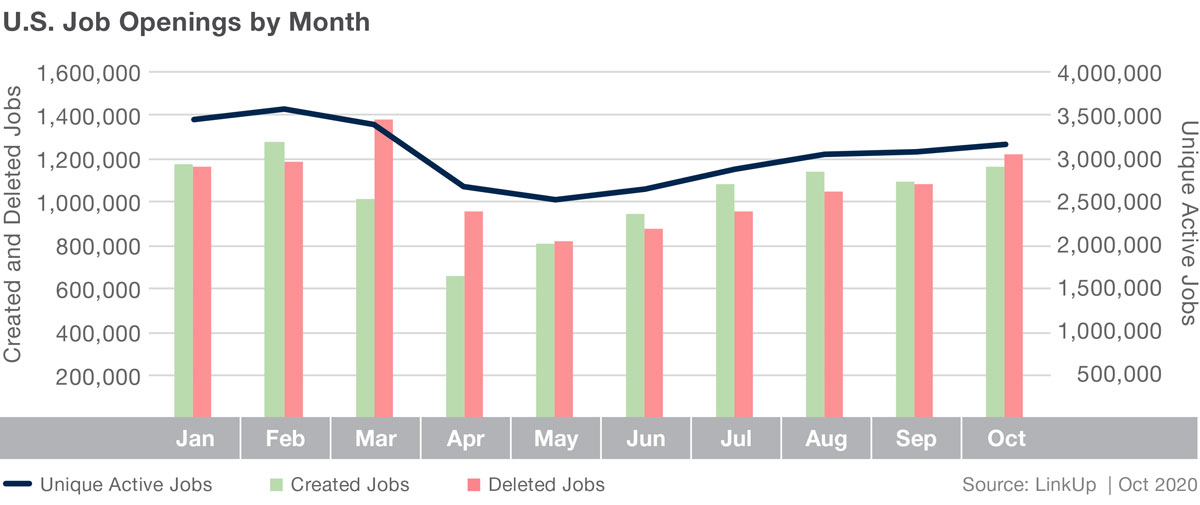

Overall, October job listings appear to mirror the modest increases we witnessed in September. The most striking change can be seen in created job listings which were up 6% in October, after a flat September. Deleted job listings largely held steady, finishing the month at 12%, just slightly above September’s increase of 11%.

The state that saw the biggest increase in job listings was Oregon, up 7%, in large part due to Walmart doubling their listings in the state last month. The biggest decline was observed in NM (down nearly 10%), though SD, WY, and MT were not far behind. It is noteworthy that these states with the largest declines in job listings are also witnessing some of the highest COVID positivity rates in the country.

As we close in on the end of 2020 and consider October’s job listings in the context of the year as a whole, it’s clear recovery is in progress. Job listings are now up to 88.5% of pre-COVID levels (October vs. February), though the rate of increase has slowed significantly. New job openings rose 76% nationally between May and August, though only 5% since August 30th, and with a high degree of variance across the country.

As COVID cases continue to climb, many states are reconsidering the more relaxed policies of summer and fall and making adjustments for the long winter ahead. We’re watching how this impacts the economy and job growth in the fourth quarter.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.