The Covid-19 pandemic has accelerated structural trends that were already reshaping the global commercial property investment landscape. One of these trends is the continued shrinking of the investable universe, with a huge chunk of the retail sector now seen as uninvestable. Hotels and even parts of the office market are being viewed more cautiously by property investors.

As such, buyers are looking for other market segments subject to the same structural tailwinds enjoyed by industrial and apartments in which they can deploy capital. One niche that has featured multiple times in the many webinars we’ve all listened to since March is life sciences. But what is this niche and what is the potential size of the prize for property investors?

The term life sciences refers to the pharmaceuticals, biotech and medical technology industries, and a focus on the treatment and prevention of disease. But it is not just the search for a Covid-19 vaccine that has thrust the sector into the spotlight: advancements in technology, data capture and analysis, as well as a rapidly aging population in the developed world, means that huge amounts of capital have been raised and invested in the sector. Crunchbase reports that as of mid-August, the amount raised through IPOs by North American companies in the life sciences sector had already exceeded the total for 2019.

The nature of the industry and the research being undertaken means life sciences companies tend to group in certain locations, often linked to universities: Oxford and Cambridge in the U.K., Munich in Germany, and San Francisco and Boston in the U.S. are home to large life sciences clusters.

For property investors, the characteristics of the sector presents certain challenges. Investors have to balance the ability to gain scale and provide the specialist space for a wide range of tenants, with the ability to make a return on capital. Historically, ownership has tended to be institutional or involve specialist players.

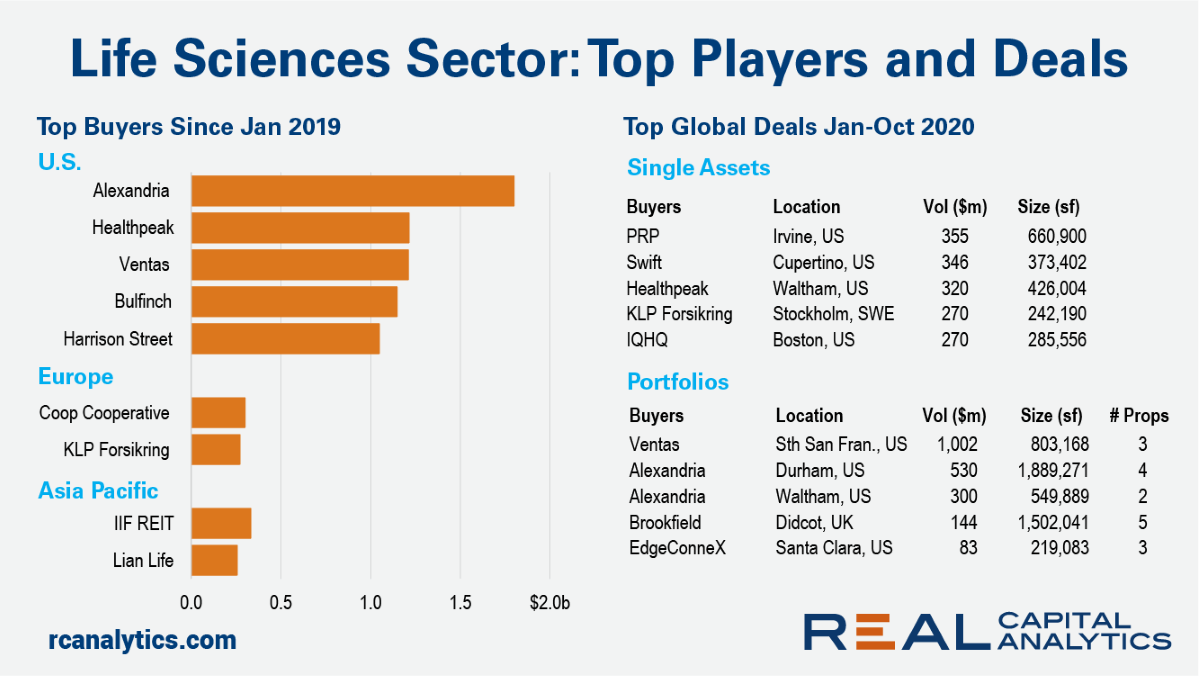

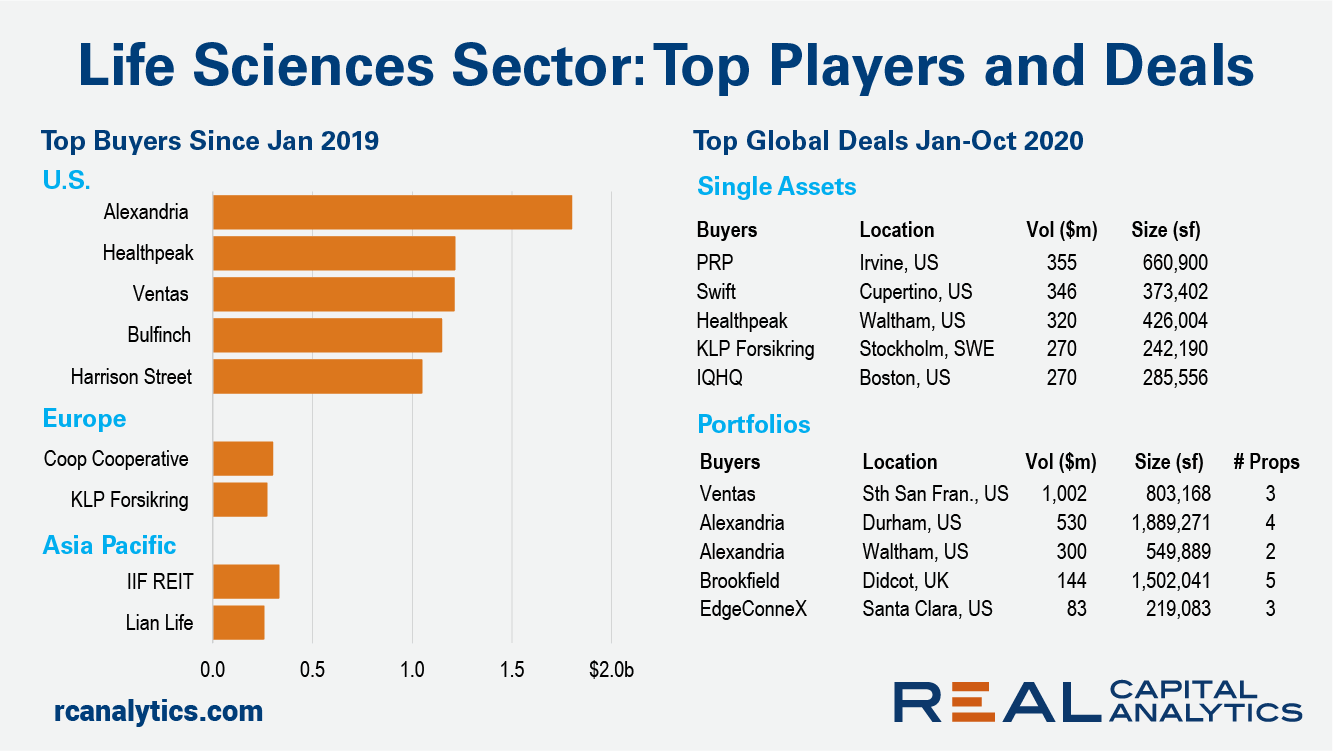

One example of a specialist is US REIT Alexandria which focuses on the life sciences sector with a multibillion-dollar portfolio in seven defined clusters: Boston, San Francisco, San Diego, Seattle, New York, North Carolina and Maryland. The other biggest owners are a mix of the generalists such as CBRE GI, Blackstone, Morgan Stanley and Brookfield, and specialists such as Healthpeak and Ventas.

On the property investment side, Real Capital Analytics data shows that $10 billion of life sciences property has sold so far in 2020 through early November. This equates to 1.9% of the total invested in income-producing commercial real estate. In comparison, $14.7 billion was recorded in 2019, which was 1.4% of the total. Clearly then, the sector is still a relatively small slice of the global pie, lying somewhere between data centers and student housing in terms of total transacted in the last five years. (RCA tracks life sciences properties using the R&D characteristic of buildings.)

The biggest deal completed through the third quarter of 2020 was Alexandria’s acquisition of the Karlin Palmer portfolio in the Research Triangle Park in Raleigh/Durham, North Carolina for $615 million. In October, Chicago-based Ventas acquired a three-building portfolio in San Francisco for around $1 billion.

Acquisitions of existing property are not the only route to market. Real Capital Analytics data shows that another $9 billion of life sciences property is currently under construction in the U.S. alone. Of this, over $2.5 billion is through a mix of projects in the Boston metro area, another $1.2 billion in San Diego, and $1 billion is in Austin.

RCA’s holdings database quantifies the scale of the opportunity, at least in terms of existing stock. Data shows activity related to around 4,700 life sciences properties worldwide, which is about 1.5% of the total office and industrial holdings. The U.S. is by far the biggest market globally, nearly 30 times the size of the next largest market, the U.K., followed by China, France, and the Netherlands.

Given the relative scarcity of existing stock, Brookfield’s recent acquisition of 50% of the 700-acre Harwell Science Park near Oxford perhaps provides a blueprint for other players who want to access the sector: partner with existing players and provide capital for expansion and development while retaining the asset management and technical expertise through the existing ownership.

However investors access the sector, through equity or debt, construction or acquisition, there is clearly positive momentum towards any involvement in the life sciences and we expect to see more capital targeted at this niche sector over the medium- to long-term.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.