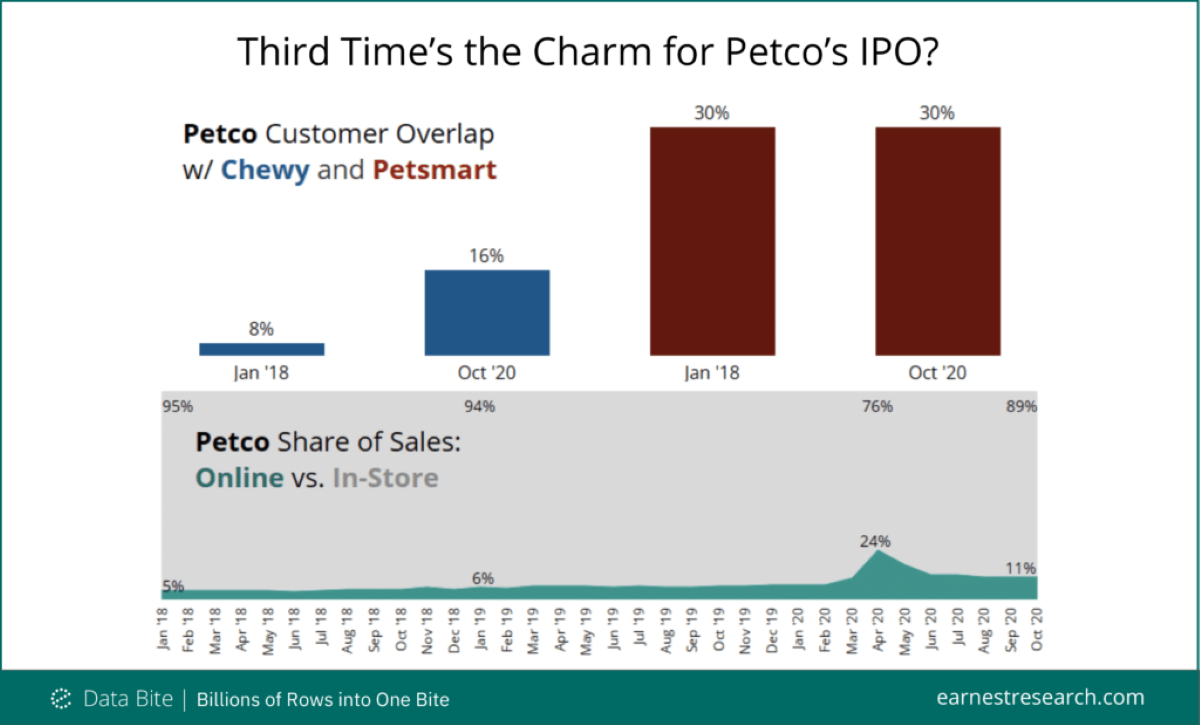

With news of Petco planning to IPO (again) we looked at how they’ve performed against their main competitor, PetSmart.

It’s interesting to note that the overlap of Petco shoppers also shopping at PetSmart’s online-only brand Chewy—while doubling from Jan’18 to Oct’20—is still relatively small at 16% and can be explained by Chewy’s still-growing customer base. The overlap of Petco shoppers also shopping at the PetSmart brand has remained flat at 30%.

We also looked at the share of Petco sales by channel. While online peaked at 24% of share in April, and remained elevated at roughly double pre-COVID levels, it’s clear the vast majority of Petco shoppers still prefer shopping for pet supplies in-person. Note: pet stores were deemed essential while many other retailers were forced to shut down during the spring.

While other traditional brick-and-mortar retailers face headwinds and are increasingly pivoting online, pet supplies appears to be an in-person exception, with Petco holding their own.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.