Source: https://www.placer.ai/blog/placer-bytes-bevmo-acquired-burlington-rising-and-dollar-tree-recovering/

In this Placer Bytes, we dove into the BevMo acquisition, Burlington’s pre-holiday pace and Dollar Tree’s latest offline performance metrics.

BevMo Gets Acquired

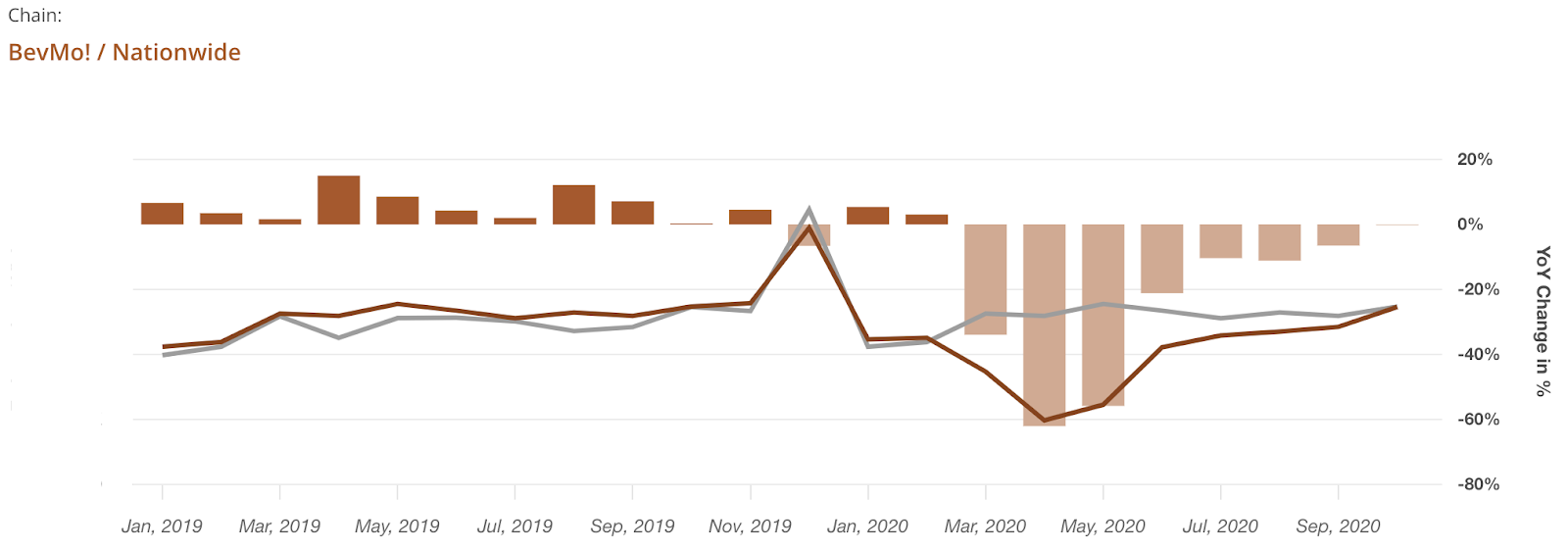

Recently, goPuff announced the acquisition of specialty beverage chain BevMo, and it is as fascinating an acquisition as there has been in 2020. On the one hand, BevMo is an exceptionally exciting retail chain in its own right. The brand has been recovering effectively with visits going from down 21.2% year over year in June, to down just 0.2% in October. And the pace is accelerating with visits up 4.0% year over year the week beginning October 26th.

But a valuable retail chain is only a piece of the value goPuff is looking to gain. They also want access to distribution centers that will help bring its micro fulfillment efforts ever closer to more consumers. And herein lies the more complex picture. To maximize this acquisition, goPuff will need to both allow the retailer to do what it does best, while simultaneously using the space to improve its micro fulfillment distribution. This means finding a way to balance both efforts so that each channel can thrive. Should goPuff prove capable on this front, this could be a turning point driving many more online oriented brands to make acquisitions with the aim of improving distribution and vice versa.

Burlington Rising

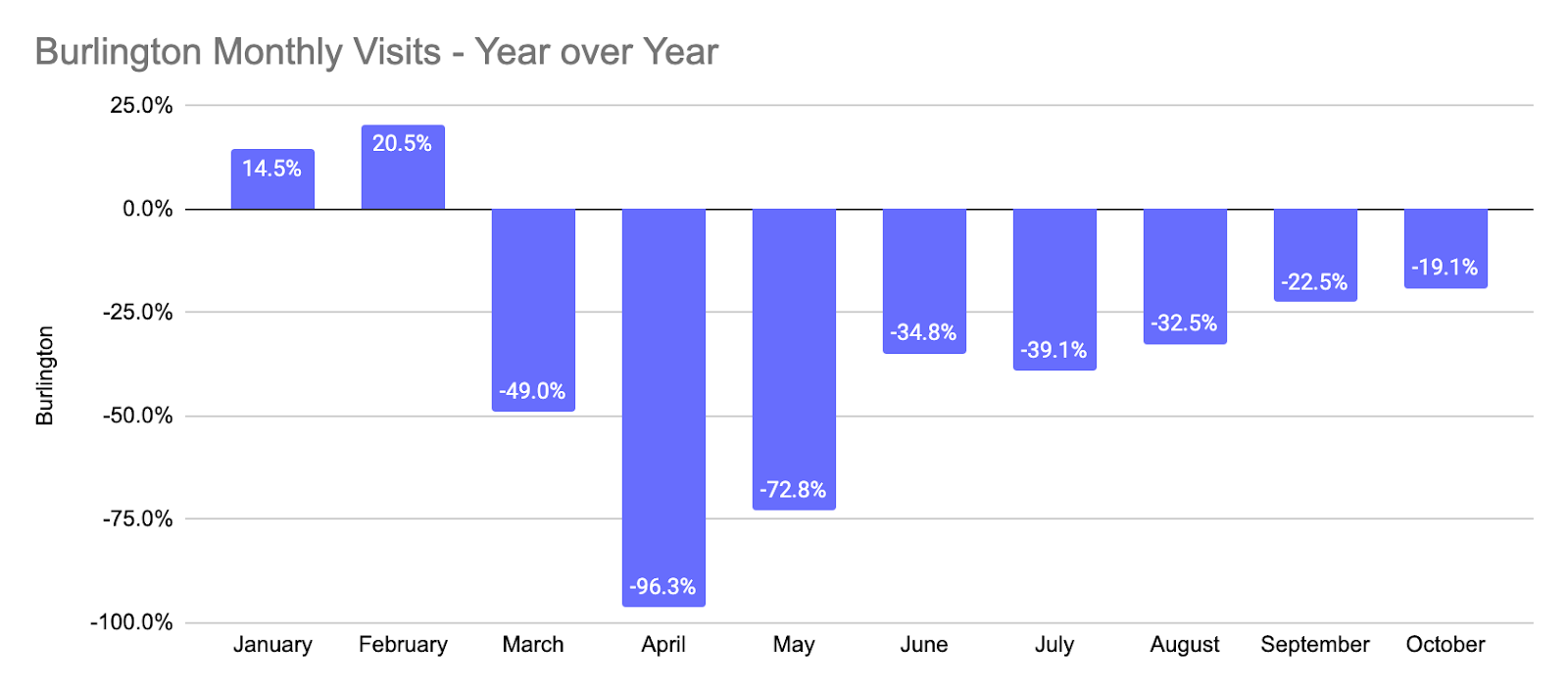

Visits to Burlington locations nationwide are on the rise with October marking the brands best month in terms of year-over-year visits since the onset of the pandemic. Visits were down 19.1%, a significant improvement on August and September visits that were down 32.5% and 22.5% year over year respectively, even though these were the strongest relative performances in their own right. And the timing could not be better as Burlington heads into a critical holiday period that will likely privilege its value offering in the apparel sector.

But looking at regional visit breakdowns actually creates more optimism, especially when analyzing the states with the highest numbers of locations. While nationwide visits were down 19.1% in October, they were down 21.8% and 24.9% respectively in California and New York. These are the states with the first and fourth most locations of any state in the US, indicating that as these areas recover, the overall numbers could see a rapid rise.

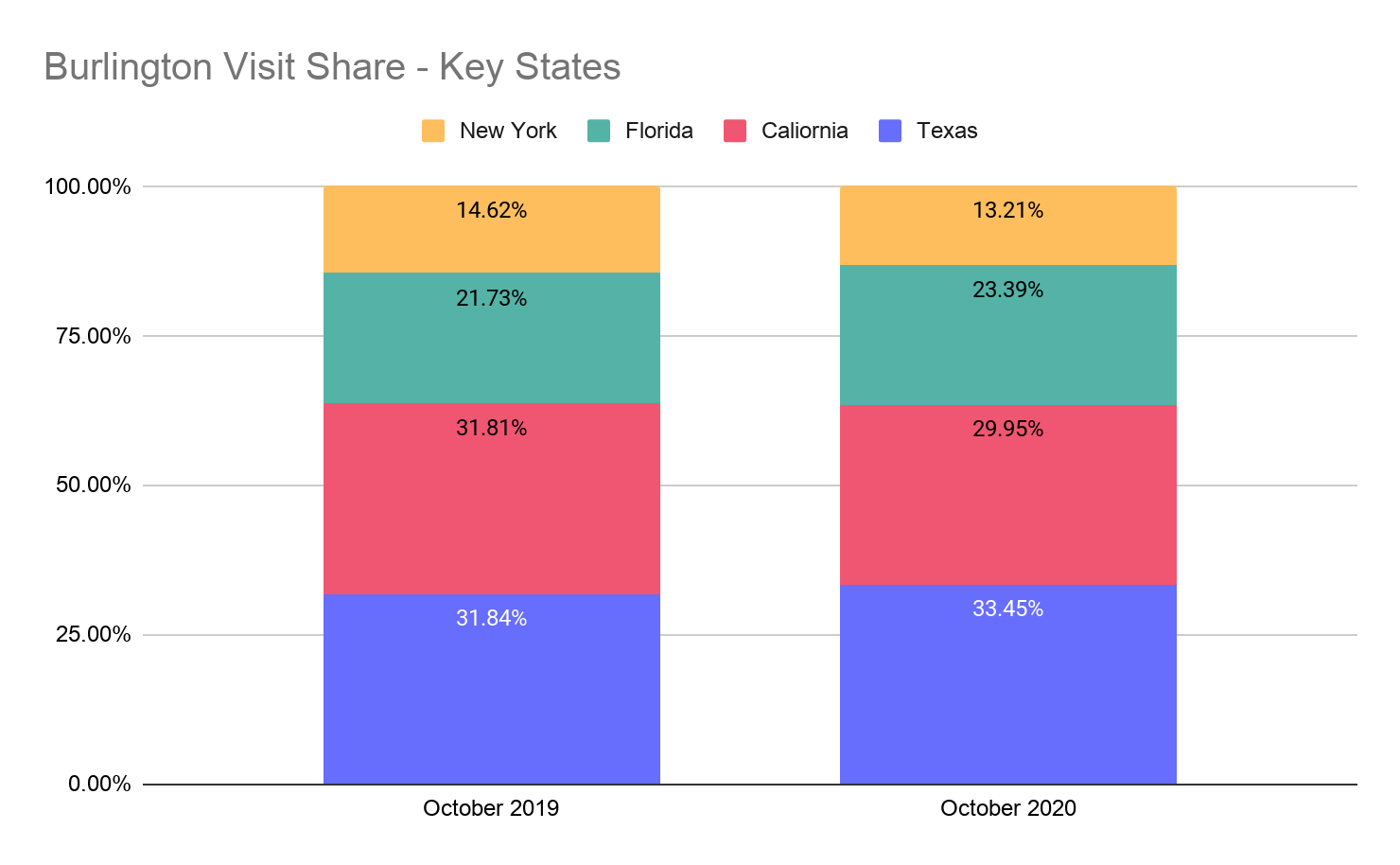

This idea is further borne out when looking at state level visit share among the four between October 2019 and October 2020. Should this levelling out continue, Burlington could see an especially strong recovery during the holiday season.

Dollar Tree Hitting 2019 Levels Soon?

Dollar Tree visits look to be rebounding again after the brand was within 1.7% and 1.8% of 2019 levels in July and August respectively. After a September that saw the visit gap grow back to 6.3% year over year, visits in October were down just 3.4% year over year.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.