Lending Shoots Up Another 17 Percent in Third Quarter of 2020 As U.S. Braces for More Impacts from Coronavirus Pandemic; Dollar Amount of Home-Purchase Loans Spikes 35 Percent Over Second Quarter; Down payments and Mortgage Amounts Rise To New Highs in Third Quarter

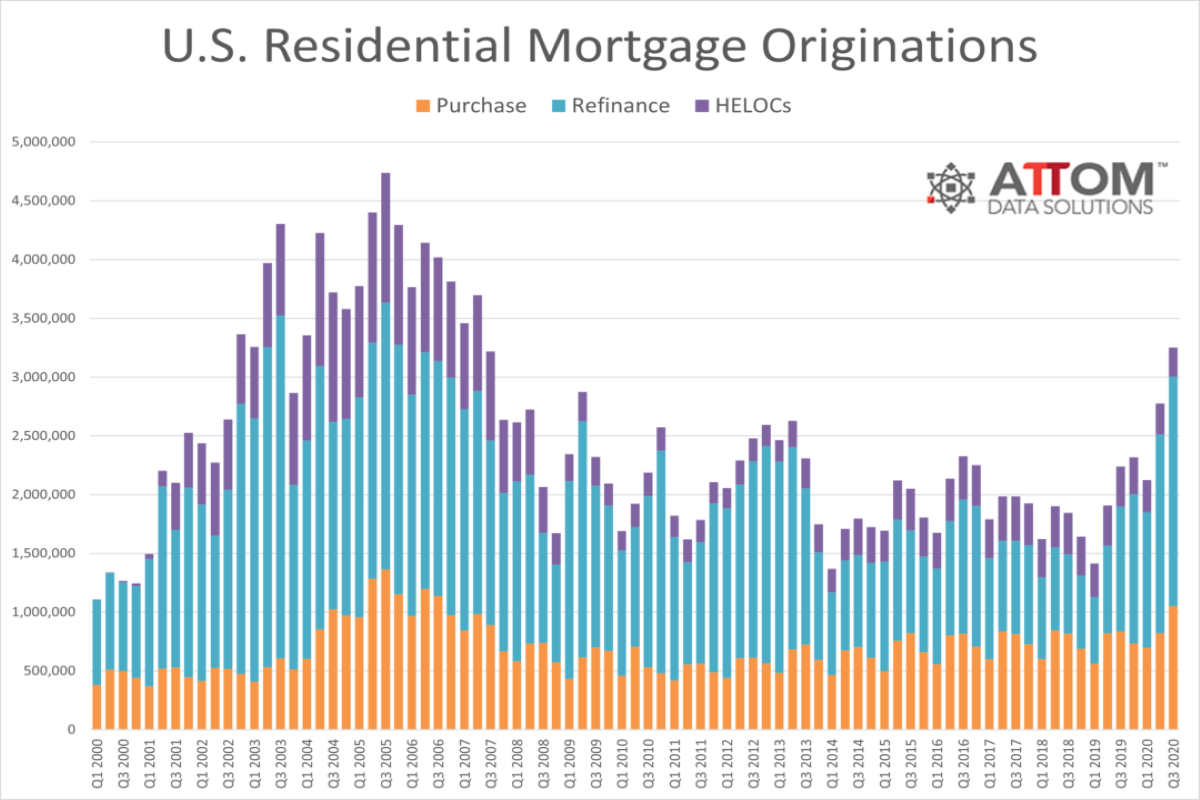

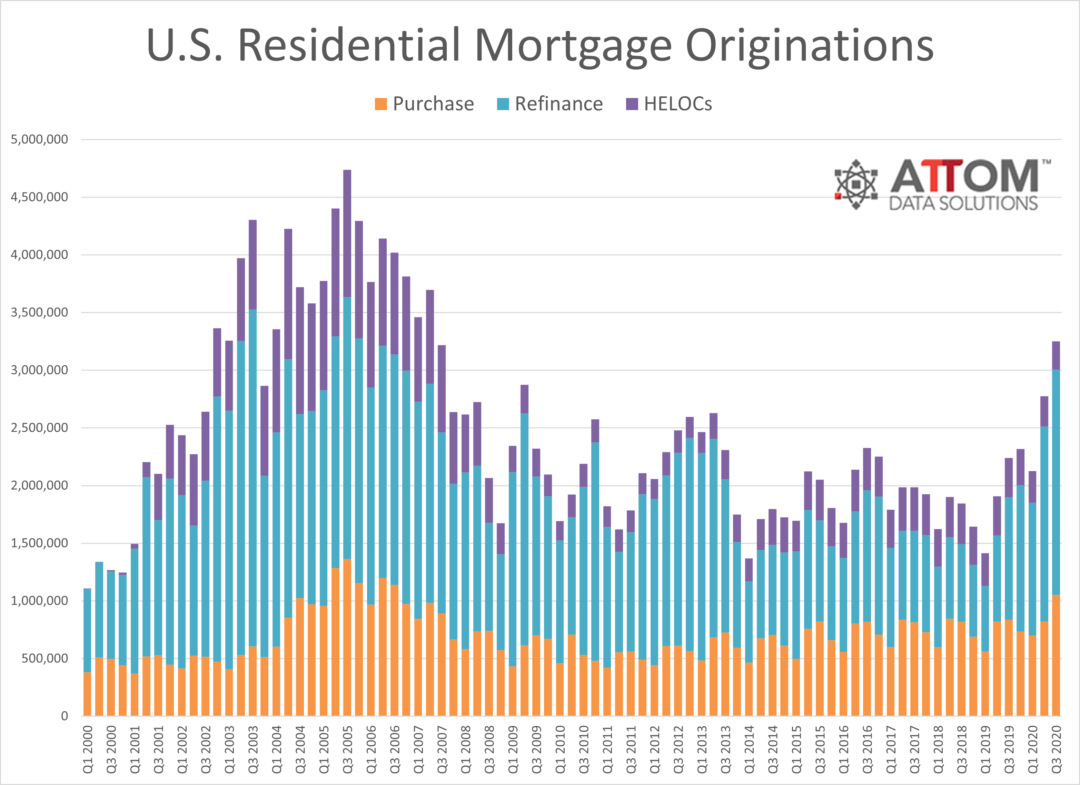

ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its third-quarter 2020 U.S. Residential Property Mortgage Origination Report, which shows that 3.25 million mortgages secured by residential property (1 to 4 units) were originated in the third quarter of 2020 in the United States. That figure was up 17 percent from the prior quarter and 45 percent from the third quarter of 2019, to the highest level in 13 years.

With interest rates dipping below 3 percent for a 30-year fixed-rate loan, home mortgages originated in the third quarter of 2020 represented an estimated $974.1 billion in total dollar volume. That number was up 20 percent from the second quarter of 2020 and 52 percent from a year ago, to the highest point since 2005.

The increases came in part from a jump in purchase mortgages, which grew faster on a quarterly basis than the number of refinance loans for the first time in more than a year.

Lenders issued roughly 1.05 million home-purchase mortgages in the third quarter of 2020, up 28 percent from the second quarter and 25 percent from the third quarter of 2019. The dollar amount of purchase loans jumped to $336.3 billion in the third quarter of 2020, a 35 percent increase from the prior quarter and a 36 percent increase from a year ago.

Refinance activity, meanwhile, continued to represent the majority of home loans and kept growing, but at a smaller quarterly pace than purchase lending. The number of refinancing loans went up only 16 percent from the second quarter to the third quarter of 2020, to 1.96 million, while the amount refinanced increased 15 percent, to $587.6 billion.

As a result, the amount of money lent to buyers taking out new mortgages in the third quarter of 2020 represented 34.5 percent of all lending, up from 30.6 percent in the second quarter of 2020; the portion refinanced by owners rolling over old mortgages dipped from 63.1 percent in the second quarter of 2020 to 60.3 percent in the third quarter of 2020.

While purchase and refinancing activity increased, home equity lending continued declining, with the dollar volume dipping another 1 percent in the third quarter to the lowest level since 2014.

The overall rise in home lending during the third quarter resumed as the virus pandemic continued spreading throughout the United States, damaging major sectors of the economy. While the national unemployment rate dropped in the third quarter, it remained more than twice as high as it was when the pandemic began surging through the country in March.

“The home-loan industry got even busier in the third quarter of 2020, with the housing market still operating as if the recession brought on by the pandemic didn’t exist. Buyers and owners, lured by low mortgage rates, kept lining up for loans at levels not seen in more than a decade,” said Todd Teta, chief product officer at ATTOM Data Solutions. “The one difference in the third quarter was that purchase lending beat out refinance activity for the first time in more than a year. However, we do cautiously note again, as we have with other recent market reports, that the pandemic and other factors could come together and halt the market boom. In the meantime, the third quarter stands out as another banner quarter for lenders.”

Purchase originations rise 25 percent from second quarter to third quarter in half the nation

Lenders originated 1,050,624 purchase mortgages in the third quarter of 2020, up 28.1 percent from the second quarter of 2020 and up 25.4 percent from the third quarter of 2019, to the highest level since the third quarter of 2006.

Residential purchase mortgage originations increased from the second to the third quarter of 2020 in 204 of the 215 metro areas that have a population greater than 200,000 and at least 1,000 total loans (94.9 percent) and increased by at least 25 percent in 115 metro areas (53.5 percent). The largest quarterly increases were in Springfield, IL (up 233.5 percent); Savannah, GA (up 158 percent); Barnstable Town, MA (up 132.7 percent); Scranton, PA (up 85.6 percent) and Bridgeport, CT (up 77.5 percent).

Metro areas with at least 1 million people and the biggest quarterly increases in purchase originations were Boston, MA (up 75.3 percent); Hartford, CT (up 52.6 percent); San Jose, CA (up 49.8 percent); Los Angeles, CA (up 43.3 percent) and St. Louis, MO (up 42.2 percent).

Counter to the national trend, residential purchase mortgage lending decreased from the second quarter to the third quarter of 2020 in just 11 of the 215 metro areas analyzed in the report (5.1 percent). The largest decreases were in Sioux Falls, SD (down 60.1 percent); Myrtle Beach, SC (down 17.5 percent); Cedar Rapids, IA (down 16.6 percent); Ann Arbor, MI (down 14.5 percent) and Baltimore, MD (down 7 percent).

Aside from Baltimore, one other metro area with at least 1 million people had a quarterly decrease in purchase originations, Pittsburgh, PA (down 3.6 percent).

Refinance mortgage originations up 16 percent from second quarter

Lenders issued 1,955,668 residential refinance mortgages in the third quarter of 2020, up 15.7 percent from the second quarter of 2020 and 84.5 percent from the third quarter of 2019.

Refinance activity increased from the second to the third quarter of 2020 in 183 of the 215 metropolitan statistical areas analyzed in the report (85.1 percent) and rose by at least 25 percent in 56 metro areas (26 percent). The largest quarterly increases were in Laredo, TX (up 73 percent); Clarksville, TN (up 60.4 percent); Scranton, PA (up 58.6 percent); Erie, PA (up 50.3 percent) and Visalia, CA (up 48.8 percent).

Metro areas with at least 1 million people with the biggest increases in refinance activity from the second quarter to the third quarter of 2020 were Tucson, AZ (up 38.4 percent); Virginia Beach, VA (up 37.8 percent); Richmond, VA (up 35 percent); Las Vegas, NV (up 32 percent) and San Jose, CA (up 31.8 percent).

Metro areas with the biggest declines in refinancing loans from the second to the third quarter of 2020 were led by Sioux Falls, SD (down 51.2 percent); Myrtle Beach, SC (down 44.7 percent); Springfield, IL (down 40.9 percent); Pittsburgh, PA (down 29.5 percent) and Ann Arbor, MI (down 28.1 percent).

Aside from Pittsburgh, metro areas with at least 1 million people where refinance mortgages decreased from the second to the third quarter of 2020 included Rochester, NY (down 14.8 percent); Detroit, MI (down 9.6 percent); Grand Rapids, MI (down 9.6 percent) and New Orleans (down 7.1 percent).

HELOC originations down 7 percent from the prior quarter

A total of 244,555 home equity lines of credit (HELOCs) were originated on residential properties in the third quarter of 2020, down 7.1 percent from the previous quarter and down 28.7 percent from a year earlier. The latest number marked the lowest point since the first quarter of 2014.

Residential HELOC mortgage originations decreased from the second to the third quarter of 2020 in 58.3 percent of metropolitan statistical areas that have a population greater than 200,000 and sufficient data to analyze. The largest decreases were in Ann Arbor, MI (down 56.5 percent); Sioux Falls, SD (down 51.4 percent); Atlantic City, NJ (down 49 percent); Pittsburgh, PA (down 42.7 percent) and Spartanburg, SC (down 42.2 percent).

Counter to the national trend, residential HELOC mortgage originations stayed the same or increased from the second to the third quarter of 2020 in 41.7 percent of metro areas analyzed for the report. The biggest increases were in Corpus Christi, TX (up 170.4 percent); College Station, TX (up 100 percent); New Haven, CT (up 93.2 percent); Bridgeport, CT (up 83.3 percent) and McAllen, TX (up 80 percent).

FHA loan share rises

Mortgages backed by the Federal Housing Administration (FHA) accounted for 336,272, or 10.3 percent of all residential property loans originated in the third quarter of 2020. That was up from 9.4 percent of all loans in the second quarter of 2020, but down from and 13.2 percent in the third quarter of 2019.

Residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 283,216 or 8.7 percent of all residential property loans originated in the third quarter of 2020, the same percentage as in the previous quarter but down slightly from 8.8 percent a year ago.

Median down payments and total amount borrowed hit new highs

The median down payment on single-family homes and condos purchased with financing in the third quarter of 2020 was $20,775, up 48.9 percent from $13,950 in the previous quarter and 68.6 percent from $12,325 in the third quarter of 2019. The latest figure was the highest recorded since at least 2000.

The median down payment of $20,775 was 6.6 percent of the median sales price for homes purchased with financing during the third quarter, up from 5 percent in the previous quarter and up from 4.7 percent a year ago.

Among homes purchased in the third quarter of 2020, the median loan amount was $275,500 – also a new high since 2000. The amount was up 10.3 percent from the prior quarter and 24.2 percent from the third quarter of last year.

Report methodology

ATTOM Data Solutions analyzed recorded mortgage and deed of trust data for single-family homes, condos, town homes and multi-family properties of two to four units for this report. Each recorded mortgage or deed of trust was counted as a separate loan origination. Dollar volume was calculated by multiplying the total number of loan originations by the average loan amount for those loan originations.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.