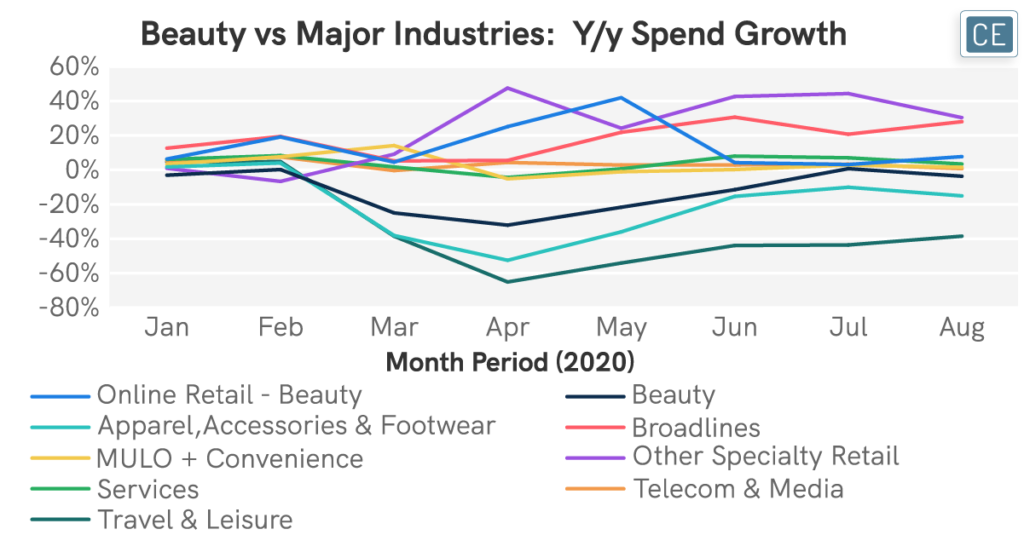

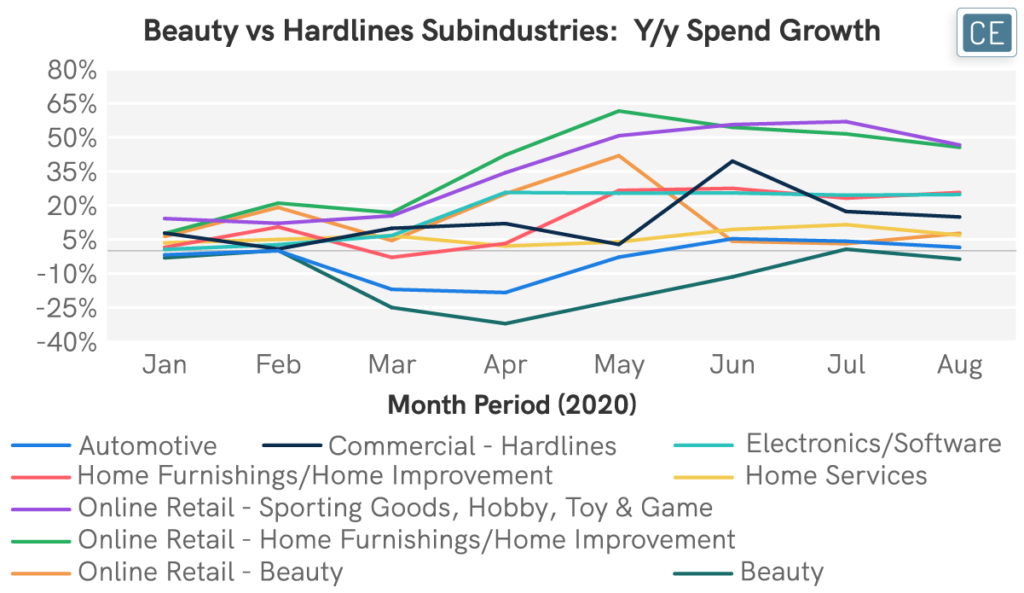

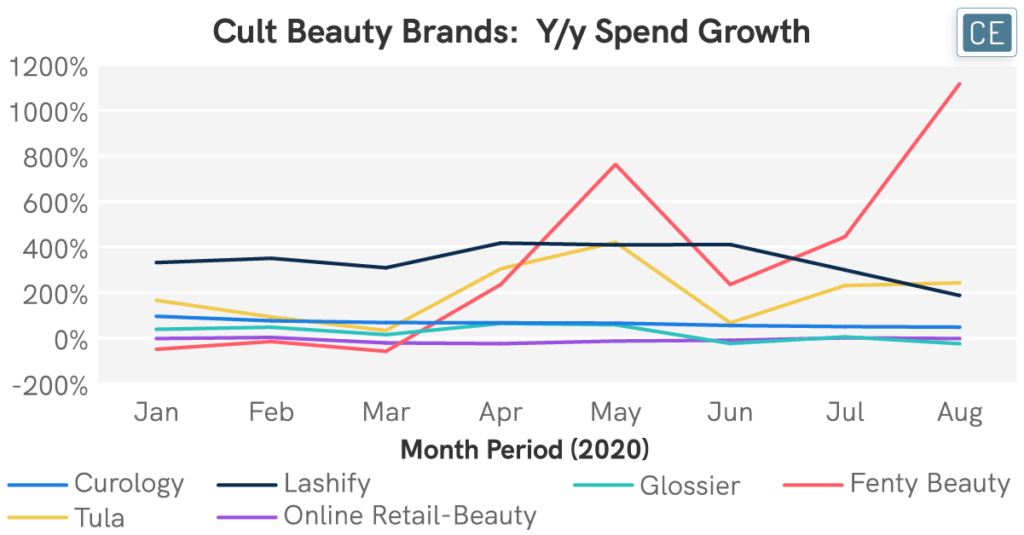

Among the many categories hit hard by the COVID-19 pandemic has been the Beauty sector. Year-over-year Beauty spend dropped by a quarter in March 2020 and by a third in April 2020 as quarantines and stay-at-home orders meant that beauty shoppers didn’t have anywhere to go out to, limiting the need for products such as lipstick and haircare. Indeed, beauty sales declines were sharper than any industry outside of high-contact Travel & Leisure and Services. Sales growth was lower than any other subindustry within the Hardlines group, as home improvement beat out self-improvement. Yet, Online Beauty’s niche brands fared surprisingly well. Even beyond more widespread channel shifts to e-commerce, breakout cult beauty brands such as Curology, Lashify, Glossier, Fenty Beauty, and Tula have seen growth well above the subindustry for much of the last year.

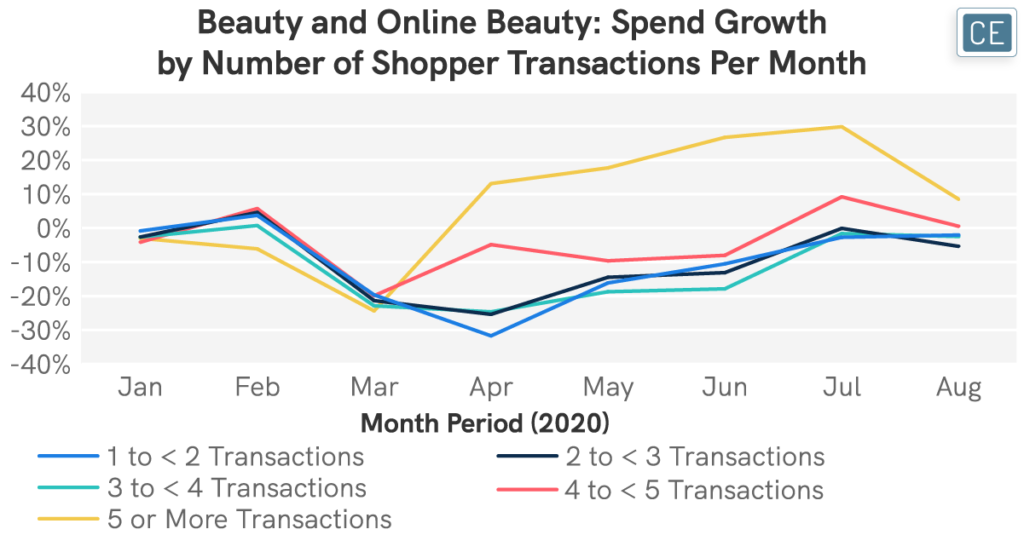

As might be expected given the pandemic, any growth in beauty is coming not from those who use it functionally, but from hobbyists. Those who love experimenting with new brands and use products recreationally even when stuck at home, represented in our data by those making five or more transactions in a month, have seen a surge in spend, especially after stimulus checks were issued in April. April spend growth in Beauty among those making at least five transactions per month was up +13%, accelerating to +18% in May, +27% in June, and hitting +30% in July. This is despite negative y/y Beauty spend in the first three months of the year among this group, and declines in spend among all other transaction frequency buckets for April, May, and June. In fact, while those making at least five Beauty transactions saw double-digit spend growth in April, those making only one transaction, two transactions, or three transactions saw double-digit declines and even those making four transactions saw a -5% decline. This may be a large part of the tailwind cult beauty has seen for the past few months, as experimentation with new products becomes a stay-at-home hobby.

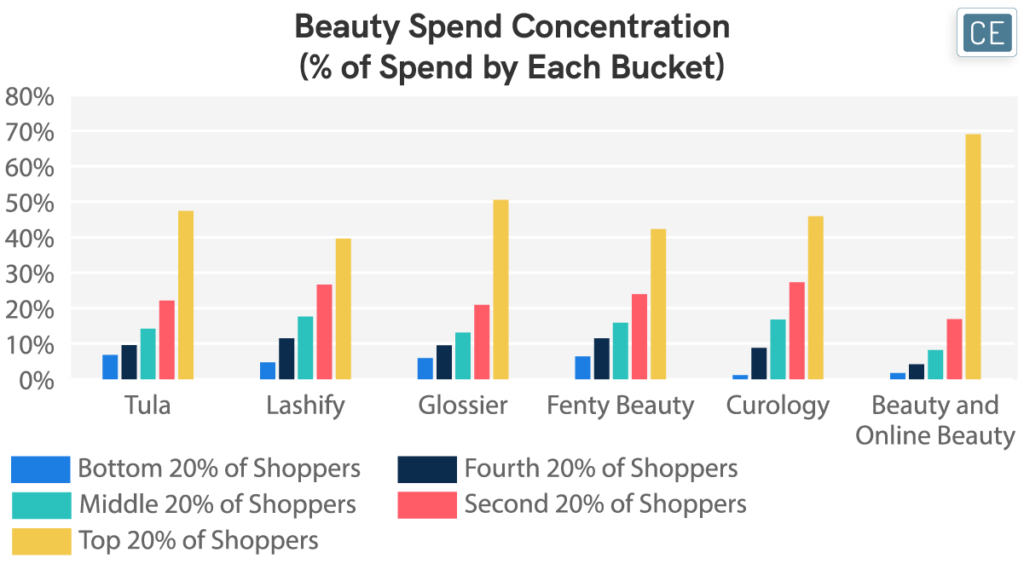

This experimentation isn’t universally good for cult beauty brands, however. It means less brand loyalty and more diversification among shoppers’ go-to brands. In general, the top 20% of Beauty shopper individuals by spend account for 69% of total sales. For most cult beauty brands, however, that concentration is much lower. The top 20% of spenders only make up 50% of sales for Glossier, 47% for Tula, 46% for Curology, 42% for Fenty Beauty, and 40% for Lashify.

With CE Vision, users can see how their own industries and subindustries are growing versus other sectors of the economy. They can find the fastest growing brands within their subindustry and benchmark their own performance. They can also easily see whether less or more frequent shoppers are driving industry or individual company growth and benchmark spend concentration among their own shoppers versus their industry as a whole or key competitors.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.