For many corporate strategy and business development groups, finding other brands with the right balance of similarities and synergies to form a partnership can be a challenging task. The ideal partner should be among the most successful in its industry, with best-in-class growth rates. The two companies should have similar demographics, attracting the same customer base but also creating opportunities to bring in incremental shoppers. Finally, it is important to look at data on cross-shop between the two brands to make sure that even given a similar demographic, there is high customer overlap at the outset of the partnership. Target and Ulta have both been very successful in recent years in forming such partnerships, from Target’s outsourcing of its pharmacy business to well-known brand CVS to Ulta’s ability to attract exciting new beauty product lines to its shelves. Given that, it should not be surprising that our data confirms their recently announced partnership, which includes the rollout of Ulta shop-in-shops in Target stores, fits all the criteria for a successful relationship.

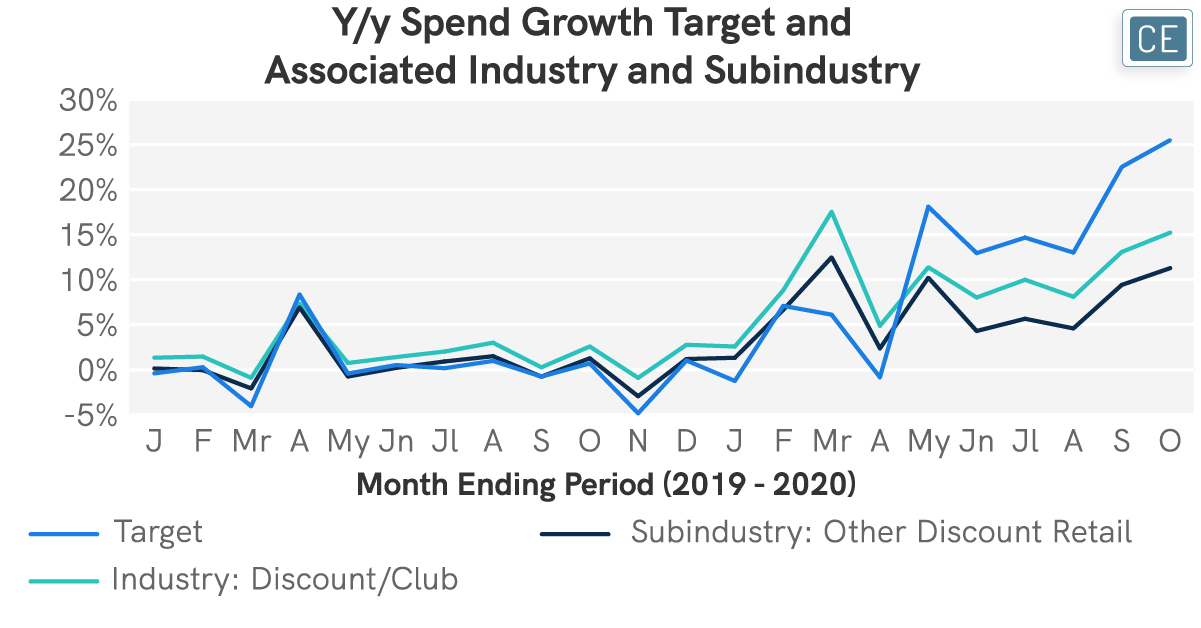

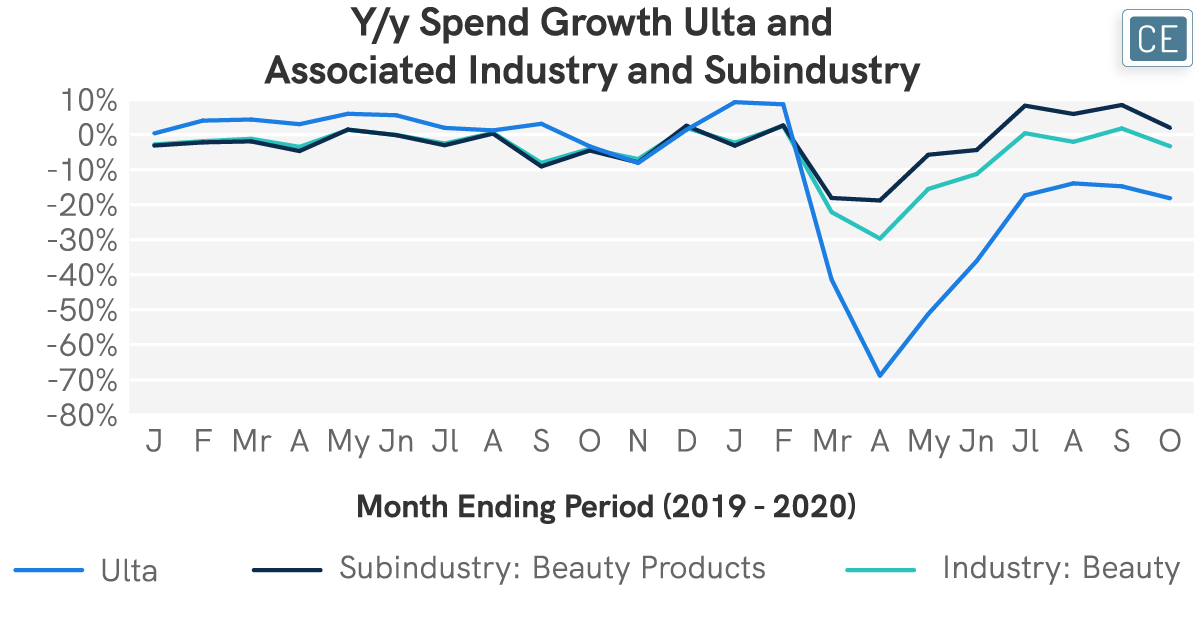

Both companies have dramatically outperformed their respective competitive sets in recent months. Target’s quick pivot to enhanced e-commerce capabilities following COVID-19 quarantines led to y/y spend growth rates 1.5x the broader Discount/Club industry in May through October of 2020. And while Ulta’s growth has been hampered somewhat by COVID store closures, for most of 2019 it had been growing spend at a much higher rate than the overall Beauty industry.

Growth vs. Industry

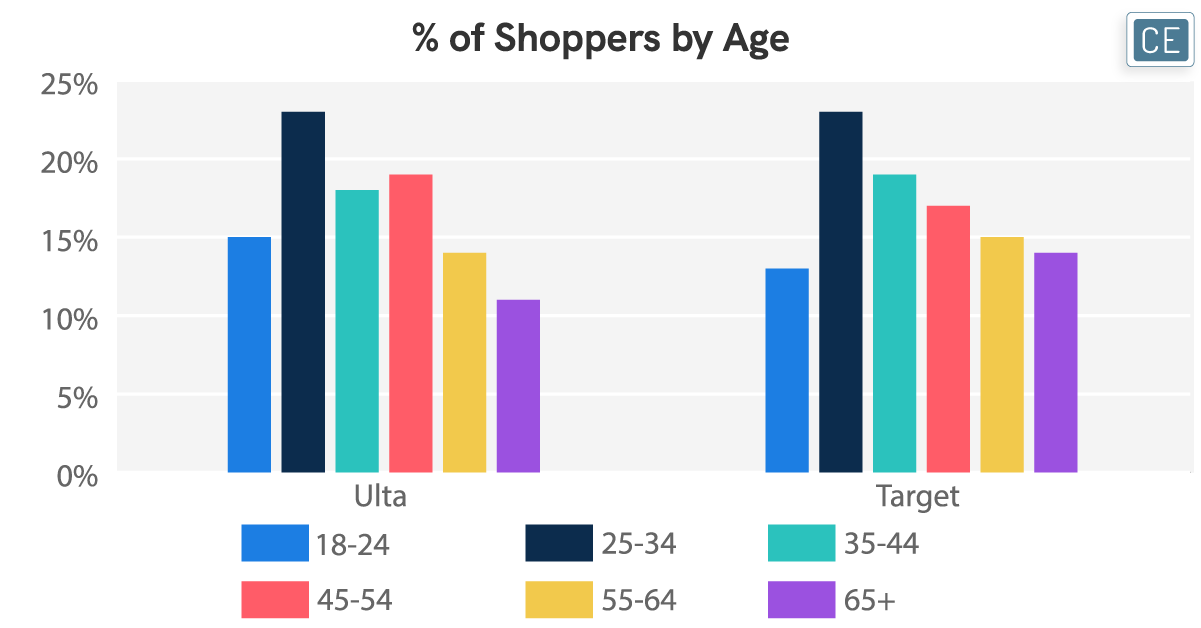

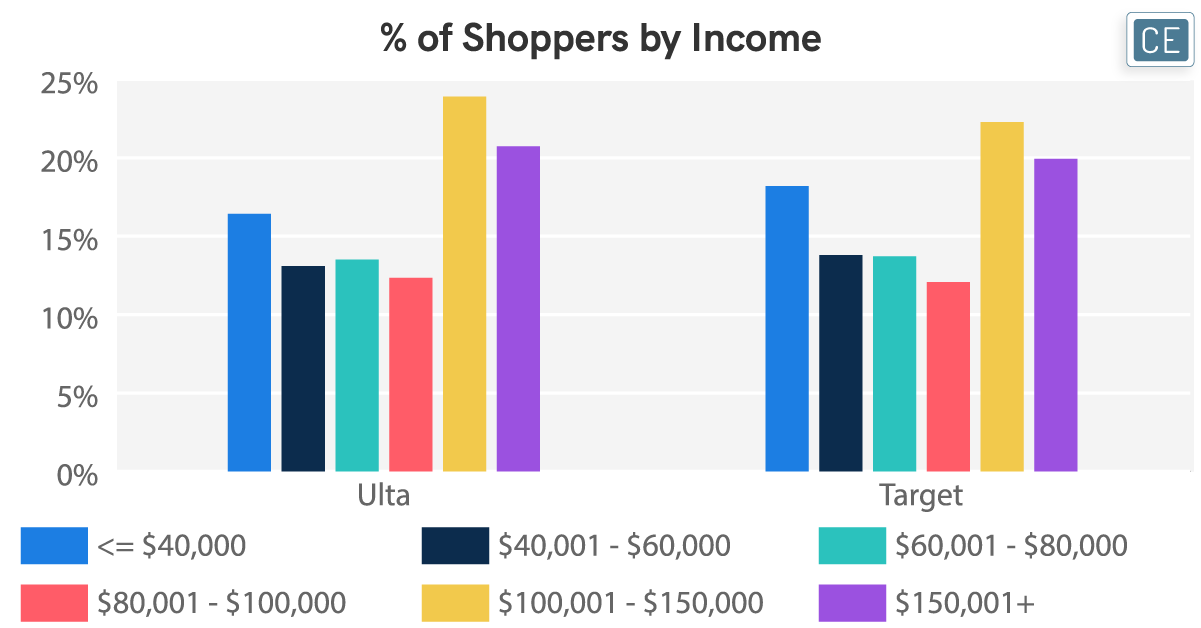

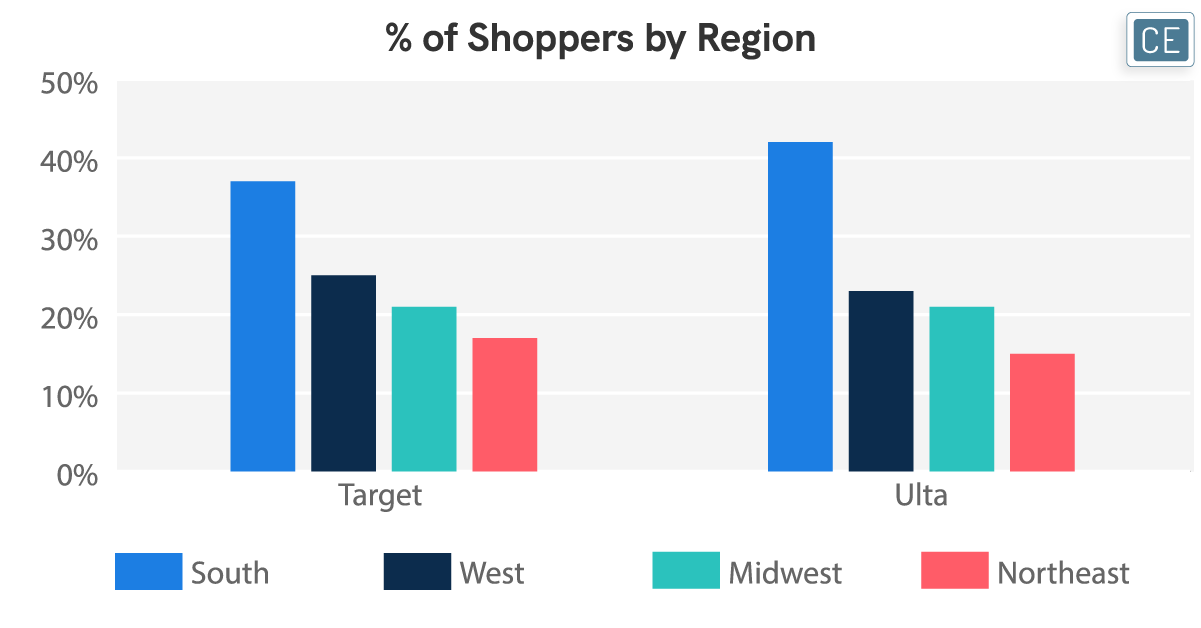

Target and Ulta have a very similar demographic mix, which means Target shoppers are very likely to be drawn to an Ulta shop-in-shop, and that the concept might draw in Ulta shoppers for additional Target visits. Both companies see 25-34 year olds as almost a quarter of their shoppers at 23%, but Ulta does have slightly more shoppers in the 18-24 year old group and the shop-in-shop could drive this demographic to engage with Target at a younger age. Similarly, Target’s slight skew to 65 year olds may create a new audience for some of Ulta’s beauty brands. Both companies skew high income as well, with over 40% of shoppers making over $100,000 per year. One area of concern is how much geographic overlap there is between Target and Ulta. A shop-in-shop arrangement can be a great way for a company like Ulta to quickly expand its geographic footprint, but Target and Ulta’s similar footprints could lead to cannibalization of existing Ulta stores if customers take advantage of the convenience of buying their beauty products while they are already at Target for other essentials.

Demographics

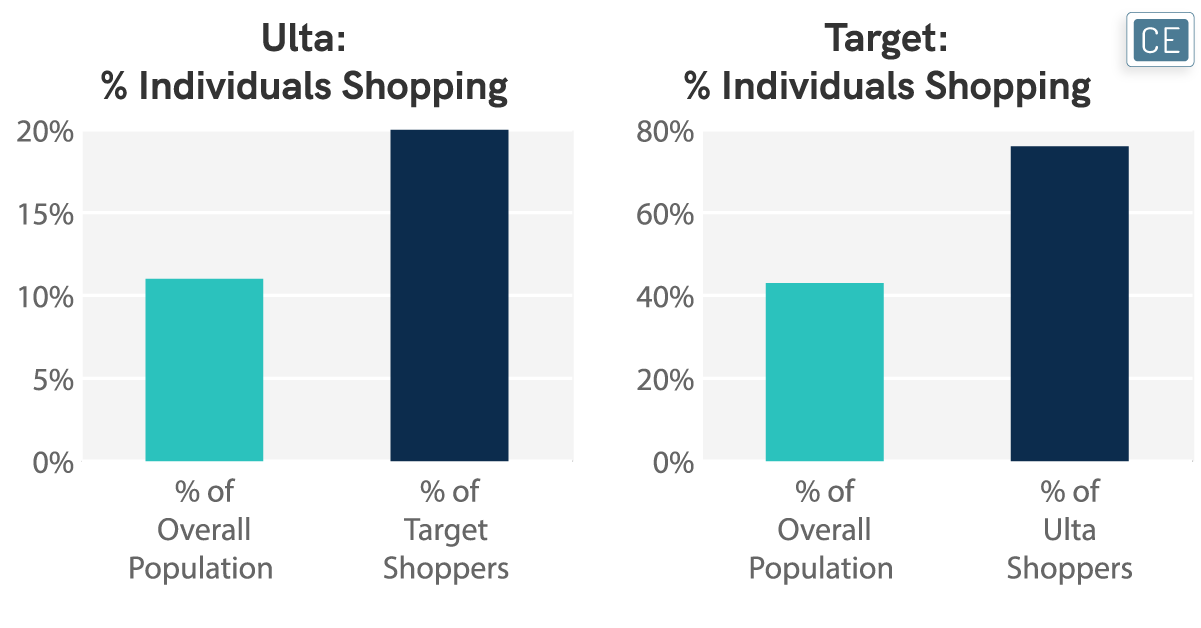

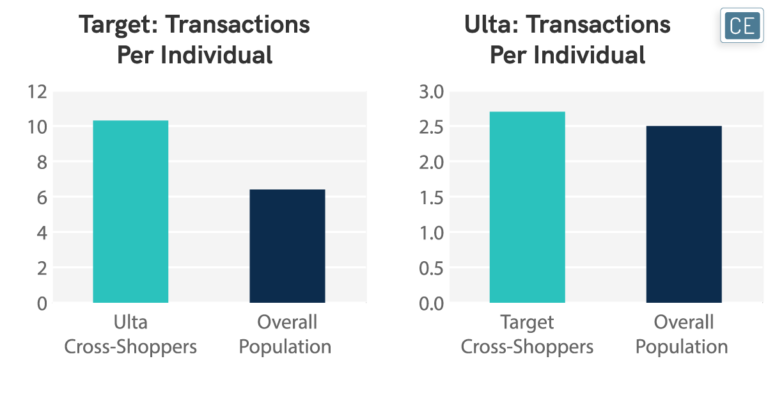

Demographics are a good indicator of customer overlap, but the best measure is actual behavior. If the same people are shopping both Target and Ulta, that is a strong indication that the two companies will see synergies from a shop-in-shop. The cross-shop benefits in this case are extraordinarily symmetric. Ulta shoppers are 1.76x as likely as the overall population to shop at Target, and Target shoppers are 1.76x as likely to shop at Ulta. These cross-shoppers are more engaged as well. Ulta shoppers on average made 3.9 more trips to Target in 2019 than the overall population, and spent 63% more. The differential was slightly smaller but still present for Ulta, with Target shoppers making on average 0.2 more trips to Ulta in 2019 than the overall population, spending 5% more.

Cross-Shop

Finding partnership opportunities can help drive growth for a company and help it take advantage of another brand’s expertise in building its own business. CE Vision offers several tools to help companies source partnerships as well as evaluate opportunities if approached. The platform includes dashboards to easily list all of CE Vision’s ~9,000 merchants and sort by which ones are growing the fastest in a specific industry, which ones are most leveraged to similar demographics as your company, and which ones have the highest cross-shop and wallet share with your brand. These metrics can also be tracked individually for specific partners, leading to robust analysis of partnership opportunities.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.