Many B2B industries floundered in the wake of the COVID‐19 pandemic, while others adapted to serve new purposes. The shipping and logistics industry is a prime example of an industry that changed drastically to stay afloat—and some believe those changes are here to stay.

Here, we dive into how the industry changed and what that has meant for B2B advertising in relation to shipping and logistics brands.

Shipping and Logistics Industry Sees High Demand Despite a Reduced Workforce

Stay‐at‐home orders, mandated lockdowns, and social distancing made even the most mundane tasks, such as grocery shopping, difficult. Instead of making the trip to stores and malls, businesses and consumers alike turned to eCommerce solutions.

At the same time, individuals stopped traveling as vacations were discouraged and conferences and other events were postponed or cancelled.

The result? Airlines looked to these empty passenger spaces as extra cargo room.

Some airlines devoted this extra space to ensuring that medically fragile passengers could still reach high‐ quality treatment or that medical supplies such as masks and ventilators made it to where they were needed.

Others used this space to keep up with the high demands of online orders and print mail.

At the same time, sea shipments had problems with staffing due to social distancing regulations and travel embargos. Others suffered as warehouse management went virtual.

“The big change to the market is that everyone now realizes the criticality of digitalization,” explains Jeff Wehner of Haven, Inc. “With staff working from home, forced to be virtual full time, companies have realized the incredible power of technology.”

Wehner says that the previous lack of digitalisation was due to an unwillingness to change. Now that the change was forced, the digitized processes are likely here to stay.

Shipping Companies Plan for the Future

The industry is also adapting to what it sees as longer‐term challenges and changes.

First up is a holiday season with little travel, meaning there is a high demand on shipping space and handling capability as people mail more gifts than usual. DHL expects to see more than a 50% increase in shipment quantities compared to the same time period in 2019.

Soon after the holiday season, many companies hope to be distributing a COVID‐19 vaccine. Many companies have been preparing for this in advance, looking ahead to assess and increase their ability to store vast numbers of vaccines at unusually low temperatures.

These future plans ensure that, at least for the time being, business will continue booming for shipping and logistics companies.

MediaRadar Insights

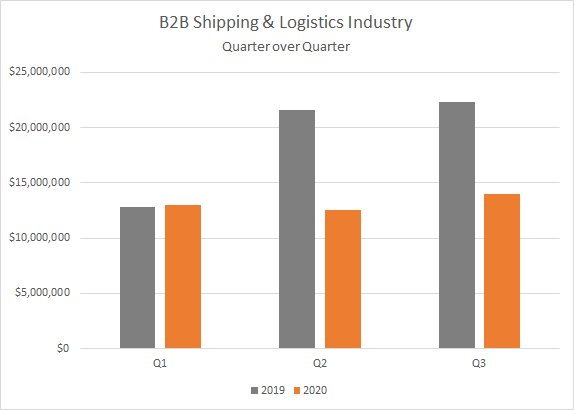

This analysis looks at the behaviors of the top B2B shipping and logistics industry advertisers from January through October of 2020 and compares that activity to the same period in 2019.

The shipping and logistics industry may have adapted, but it didn’t happen all at once—and it doesn’t mean that the B2B advertising industry profited from the quick transition.

For example, in the first three quarters of 2019 there were 4.5 thousand B2B shipping brands spending $73.5 million. The same period in 2020 saw 5.7 thousand brands spending $48.2 million. Though the number of brands grew, overall spend fell 34%. This points to more companies advertising in the industry, but their spending is conservative.

The spend distribution across print and digital media was more balanced in 2020 than in 2019—due to a slight increase in digital spending, but mostly a significant reduction in print. Print spending dropped 53% between 2019 and 2020. Digital spend went up slightly—an increase of nearly $1 million (a 2% increase).

When we look at total spending across digital and print, print spending made up 65% and digital spending made up 35%. In 2020, B2B companies spent about 46% spent in print and 54% spent in digital. Each quarter B2B advertisers have spent about $13 million across these two formats.

The top 10 brands spending in both digital and print media in 2020 accounted for only 15% of total ad spend in this category, indicating that there are many different campaigns running concurrently.

As shipping and logistics change course in response to COVID-19, advertising budgets have decreased. But it’s important to note that the lack of ad spend doesn’t necessarily indicate that the industry itself is suffering—companies are doing well and may not feel a strong need to advertise during this time.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.