Changes in consumer buying patterns led to a drop in Black Friday and Cyber Monday digital game revenue in 2020. Game spending is still on track for a record-breaking 2020 but consumer anticipation for next-generation consoles and the growing popularity of subscription services diminished the importance of the holiday weekend as a main revenue driver.

Spending on PC games during the weekend was up 6% year-over-year, but this was more than offset by a 13% decline in console earnings. Unmet demand for the PlayStation 5 and Xbox Series X|S likely depressed spending on digital console games. The current console transition is more seamless than past ones, with both console families allowing players to purchase a game on an older device and upgrade to the new-gen version at a later point. However, some gamers appear to be waiting to get a new console before starting recent major titles. In order to experience the whole game in the best possible way, they are holding off on purchasing the PlayStation 4 and Xbox One versions entirely.

Another factor in the decline is the rapid growth of subscription services like Xbox Game Pass, whose October 2020 user numbers were up 216% year-over-year. These Netflix-style services provide access to a large library of games at a fixed monthly price, and gamers do not have an incentive to seek out Black Friday deals on older titles they can already play through their monthly subscription.

“Despite the lower numbers on Black Friday through Cyber Monday, spending on digital games is growing significantly this holiday season,” said Carter Rogers, Principal Analyst at SuperData, a Nielsen company. “Even individuals who might have bought physical games at brick and mortar retailers in a normal year are opting for the convenience and safety of downloading games.

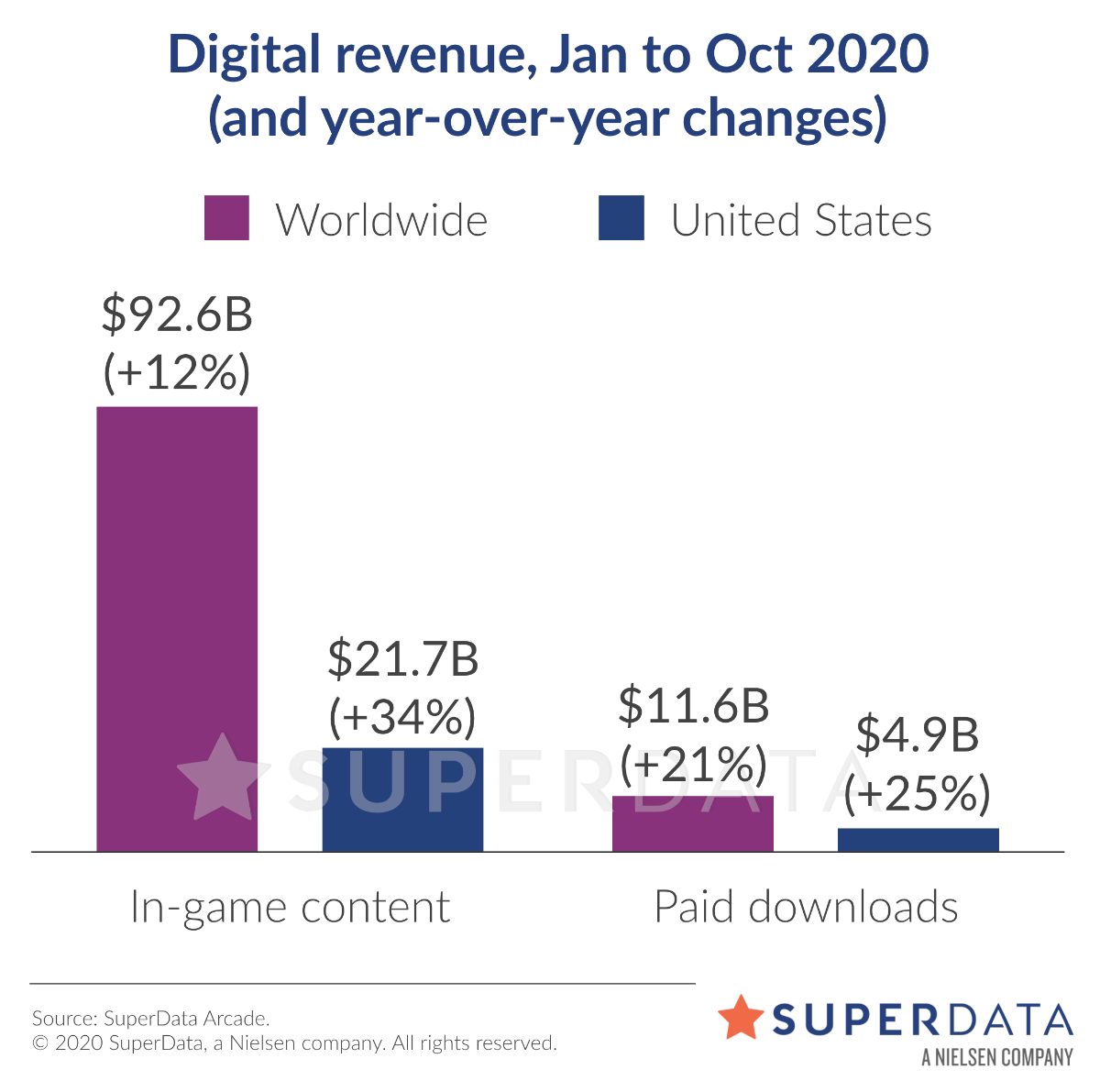

As live-service games grow in popularity, players did seek out Black Friday and Cyber Monday in-game content deals for titles they have already invested significant time and money in. For example, Grand Theft Auto Online vehicles were on sale, limited-time item bundles were available in The Elder Scrolls Online and Apex Legends players received bonuses when purchasing loot boxes. Through the end of October 2020, global in-game content sales accounted for 89% of digital games revenue.

In-game item sales and upfront purchases of games grew much faster in the US than the worldwide average in the months leading up to Black Friday. From January to October 2020, US digital game spending was up 32% year-over-year compared to 13% worldwide. This was attributable to a combination of more widespread COVID-19 outbreaks in the US (which limited access to other types of leisure activities) and consumers being more accustomed to spending on digital games than in other markets.

Digital games are expected to maintain their momentum through the holiday season. On Christmas Day 2019, the amount spent in digital console storefronts in North America was four times higher than the daily average during the rest of the year as players used game gift cards they received as presents on digital storefronts. Unlike Black Friday weekend, Christmas Day spending will likely be up in 2020 since many people will be receiving all-digital consoles as gifts.

Past the holiday season, the gaming industry is poised to see pent-up demand for the major releases of next year. Titles such as Halo Infinite and Deathloop were delayed partially due to the impact of COVID-19 on production, and their arrival next year will help boost game spending even as COVID-19 is brought under control.

To learn more about the data behind this article and what SuperData has to offer, visit https://www.superdataresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.