Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Latin America region.

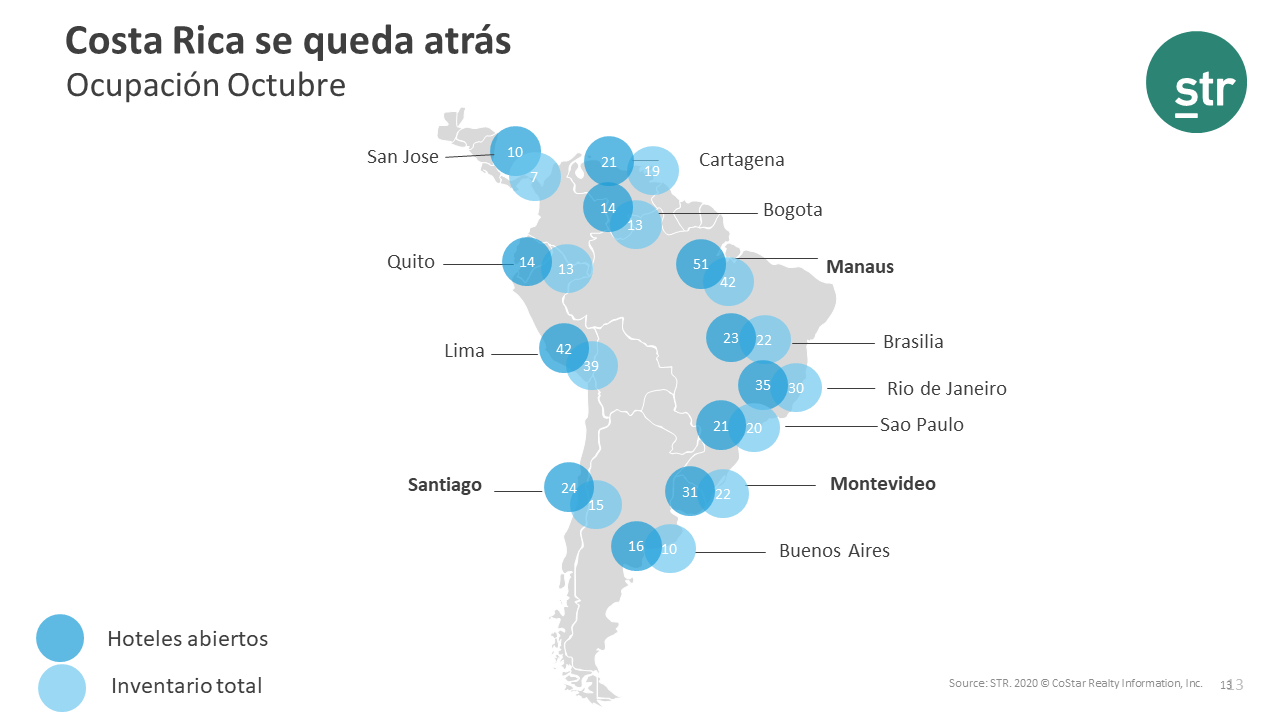

Some markets heading in the right direction

In October, Manaus posted the highest occupancy level (51%) in Latin America followed closely by Lima (42%), Rio de Janeiro (35%) and Montevideo (31%). Hotels in San Jose posted the lowest occupancy levels in the region at just 10%.

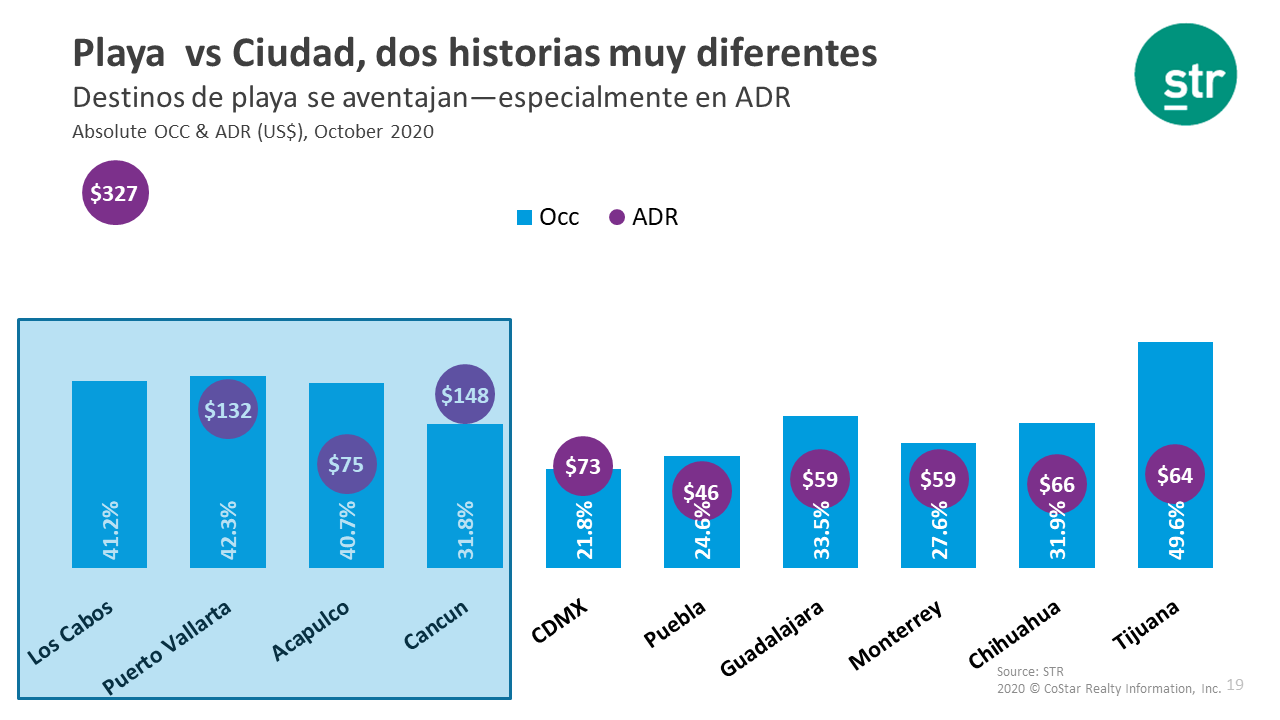

Beach markets in Mexico are leading the recovery

Like what we have seen in other countries, beach markets are leading recovery in Mexico. In October, Puerto Vallarta posted the country’s highest occupancy level (42.3%) followed closely by other beach destinations such as Los Cabos (41.2%) and Acapulco (40.7%). For comparison, Ciudad de Mexico posted the lowest occupancy level during the month.

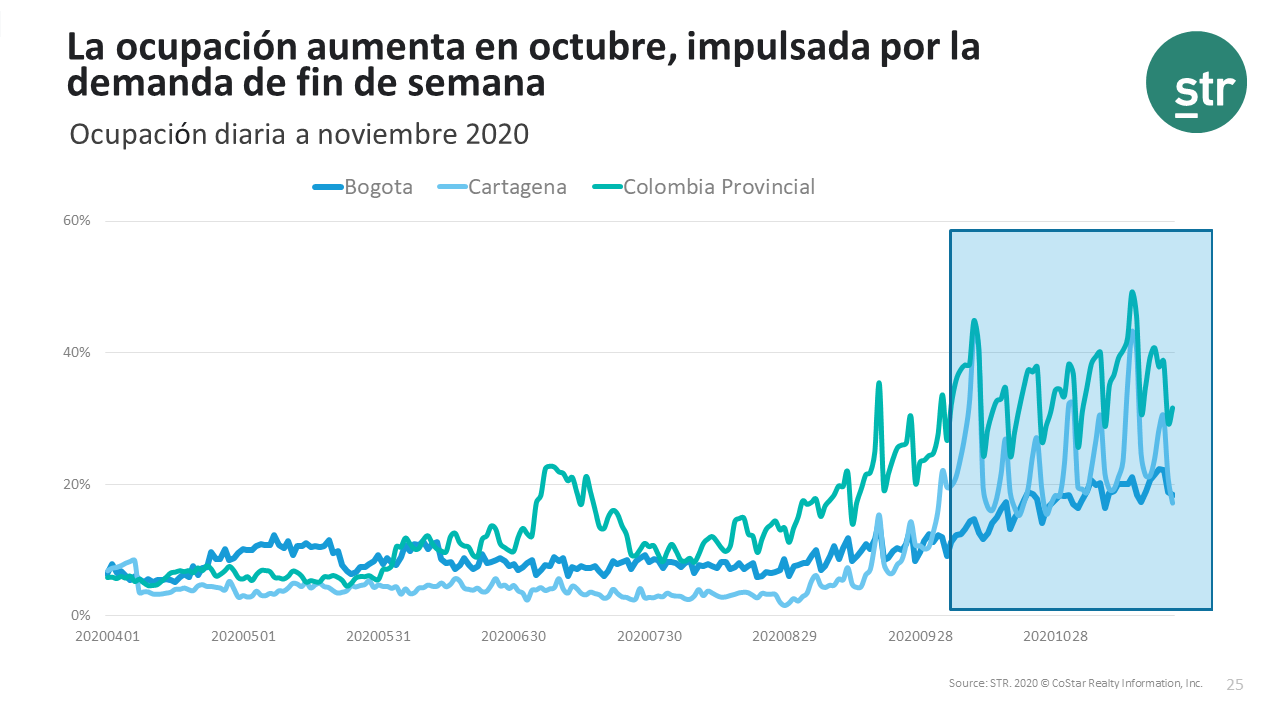

Colombia: weekdays vs. weekends

Overall, hotel performance in Colombia is still highest on Saturday night compared to any other day of the week.

Colombia Provincial saw its highest occupancy level (49.2%) on 14 November (Saturday). For comparison, on 18 October (Sunday), the market posted its lowest occupancy level (24.3%) for the period of 1 October through 23 November.

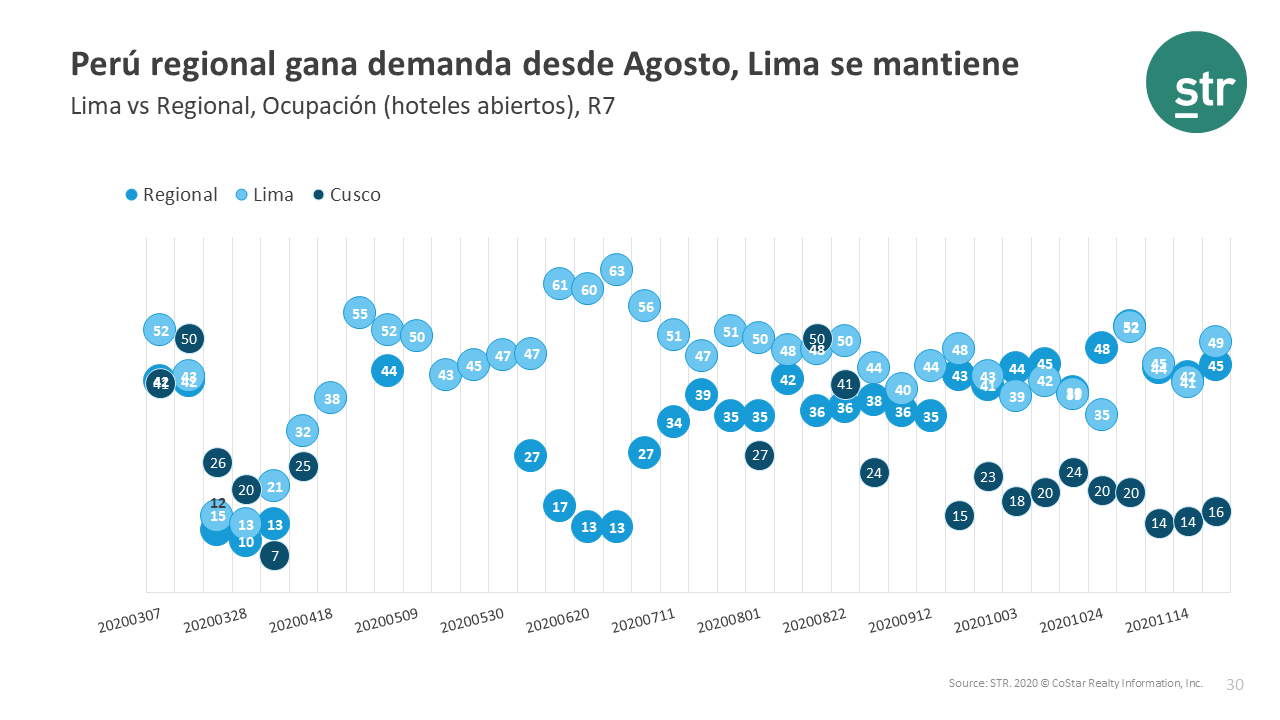

Regional destinations ahead in Peru’s recovery

Peru’s regional destinations led the earliest stage of recovery in the country thanks to the demand of national tourists.

In the week ending with 31 October, the Regional Peru market, as defined by STR, saw its highest occupancy level (52%) since isolation began on 16 March—that was one of the earliest, strictest, and longest lockdowns in Latin America. For comparison that same week, Cusco posted an occupancy level of just 20%.

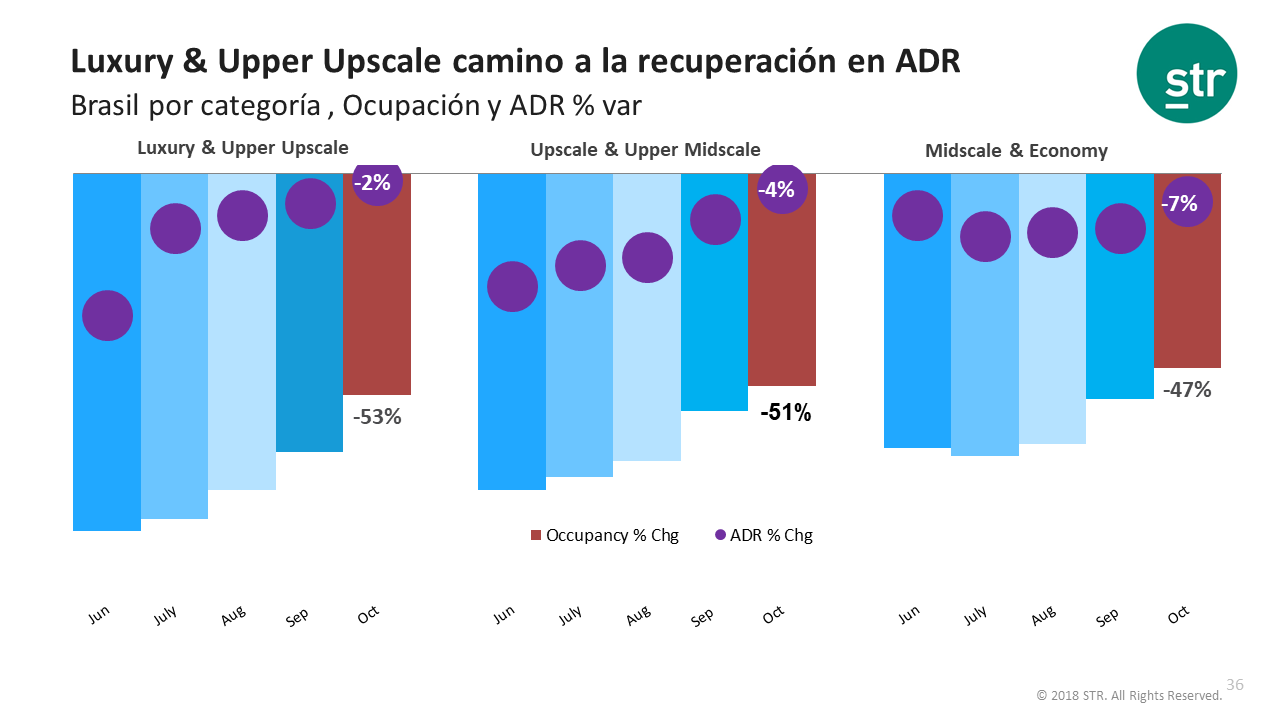

Brazil: Luxury & Upper Upscale recovering ADR quicker

Luxury and Upper Upscale hotels posted just a 2% decrease in ADR compared with October of 2019. Midscale and Economy saw a 7% ADR decrease for that same month.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.