Turkey’s hotel average daily rate (ADR) has grown exponentially in recent months despite the global pandemic depressing rates most everywhere else in the world. Globally the impacts of COVID-19 have weighed heavily on hotel performance, but in Turkey, several unique macroeconomic factors have aligned to impact rate over and beyond the effects of the pandemic.

Inflation station

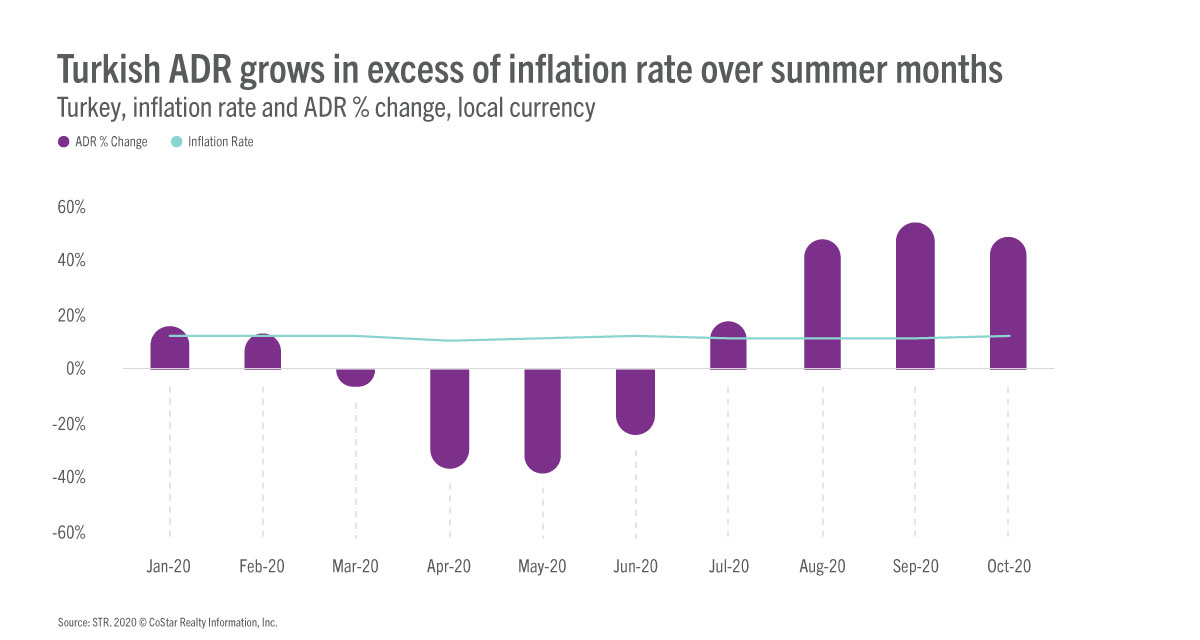

Turkey has targeted a 5% inflation rate for the past eight years, but the country is no stranger to above-target inflation—since 2017, annual inflation has topped 11%. Year to date, inflation sits at 11.8%, well above target but in line with prior year patterns.

As inflation rises, the purchasing power of the lira declines, which makes it even more important to understand the relationship between rate and inflation. If ADR doesn’t increase in excess of the inflation rate, hoteliers are effectively cutting rate year over year.

Pre-COVID, hoteliers increased rates almost exactly in line with inflation, maintaining their purchasing power from 2019 and growing real ADR in January and February. The initial months of the pandemic proved difficult, as nominal rates declined from March to June even as inflation remained stable near 11%. However, from July through October, ADR outperformed inflation by a wide margin, suggesting another underlying cause may be contributing to the abnormally high growth.

Exchange rate extravaganza

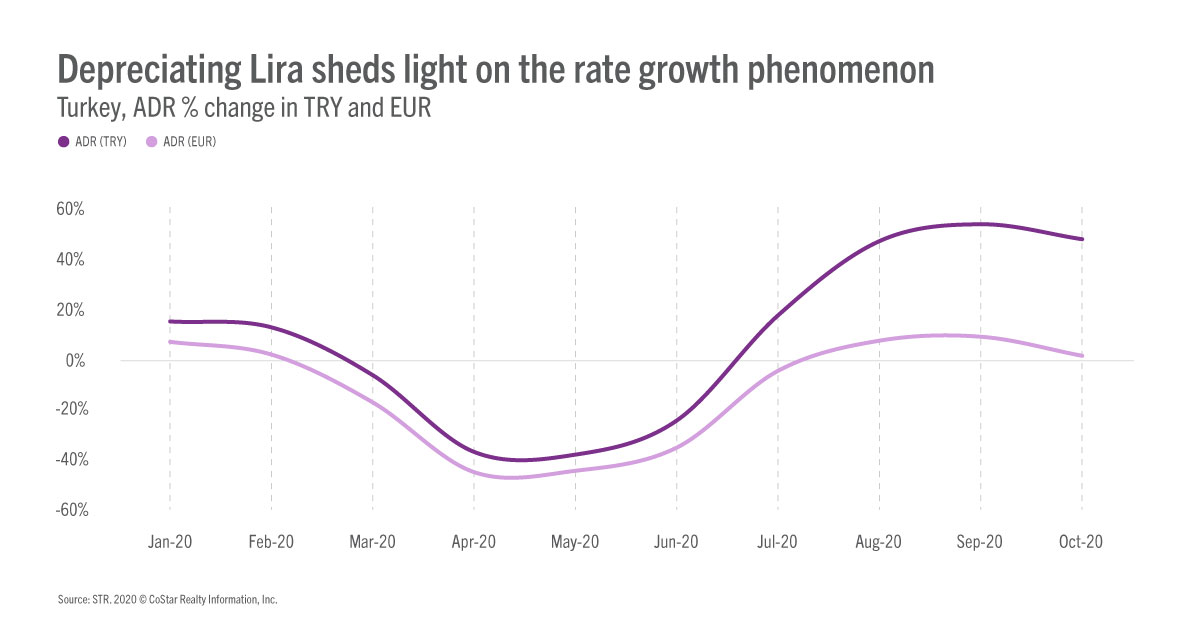

A series of political maneuvers and decreasing investor confidence in the Turkish central bank’s independence led to a currency crisis, with the TRY-EUR exchange rate tumbling from 6.05 TRY/EUR on 1 January to 9.74 TRY/EUR on 31 October, a staggering 38% loss in value over the 10-month period.

As just over half of international arrivals to Turkey in 2019 originated in Europe (source: Tourism Economics), such rapid devaluation would, in normal times, drive demand as the relative cost of international travel declined. Some demand did materialize, and hotel occupancy broke 40% in August, September, and October, with improvements each month even as European occupancy outside Turkey deteriorated.

Despite drastically reduced demand and international travel restrictions, Turkish hotel rates rose in excess of the lira’s devaluation, meaning that the relative price of a hotel in Euros increased year over year despite the currency crisis. ADR growth in Euros, however, is much more muted in comparison to growth in Lira, suggesting that the latter’s depreciation is causing falsely optimistic ADR growth trends.

High inflation and currency devaluation are interconnected and both indicators are important factors in Turkish hotel rate growth this year. However, one final, COVID-related factor sheds additional light on the ADR growth phenomenon.

Closure conundrum

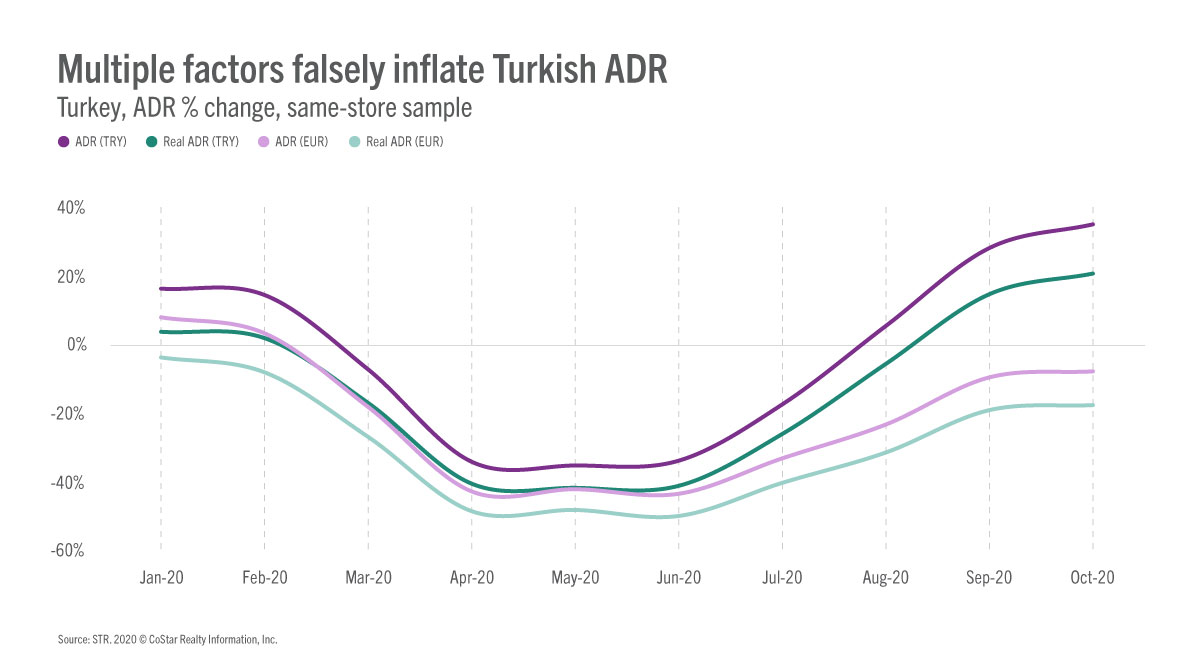

In most of the world, luxury and upper upscale hotels closed in record numbers, depressing ADR from 2019 as their higher rates were no longer included in industry totals. In Turkey the opposite occurred, and higher-end hotels remained open while midscale hotels closed in such high numbers that STR could no longer report on the segment, shifting industry ADR to reflect higher-end hotels.

A look at same store sample data confirms that hotel closures may be the final culprit causing sensational Turkish rate growth.

Applying the inflation rate and exchange rate to a same-store sample of hotels—hotels that reported data in 2019 and 2020 and did not temporarily close during lockdown—reveals that while nominal and real ADR did improve in 2020, it was almost entirely a result of Turkey’s currency crisis. ADR in Euros declined year over year from March to October in nominal terms and for all of 2020 when accounting for inflation.

Takeaways

While the COVID-19 pandemic has impacted hotel performance in new and unusual ways, other performance drivers do still exist and can affect performance. For Turkey, macroeconomic performance shifts driven by political considerations pushed nominal ADR sky-high year over year, but a detailed rate breakdown reveals that Turkish hoteliers see minimal-to-no real ADR growth in 2020.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.