In a recent blog post, we covered how the summer months provided U.S. hotels with an increase in leisure travelers, a welcome change that lifted the industry from the pandemic performance lows of the spring. Naturally, we expected that leisure travel to dry up and overall hotel performance to retreat due to the return to school and a persistent lack of corporate and business travel. However, a closer look at September data from a variety of popular vacation spots showed that some markets extended that leisure-driven performance into the early fall and even outperformed the same month last year. It appears that many leisure travelers made the most of the remaining warm weather, ahead of possible new COVID-19 travel restrictions around the country.

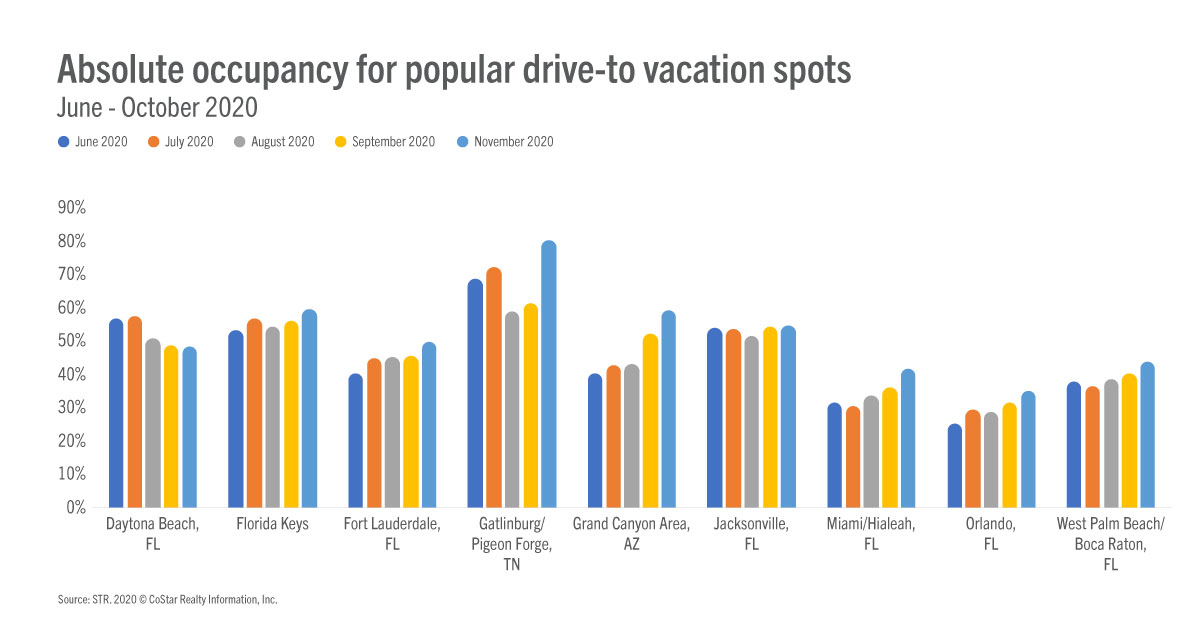

For this analysis, we focused on some of the top drive-to vacation spots as a major trend this year has shown travelers hitting the road rather than fly amid a pandemic. We looked at several Florida beach markets, the Gatlinburg/Pigeon Forge, Tennessee submarket, and the Grand Canyon Area submarket in Arizona.

Since COVID-19 began, year-over-year growth in any hotel performance metric has been rare across the globe. However, two popular Florida beach markets bucked that trend with September growth in occupancy, average daily rate (ADR) and revenue per available room (RevPAR).

Daytona Beach experienced 10.9% occupancy growth, an 11.7% rise in ADR, and a 23.9% increase in RevPAR when comparing September 2020 with September 2019. This was a continuation of Daytona Beach’s rising performance throughout the summer months. Once October began, however, year-over-year growth did not continue, though ADR held steady with only a 2.1% decline from October 2019. While that year-over-year growth dissipated, the market continued to increase RevPAR month over month, growing from US$51.43 in September to US$55.37 to October.

The Florida Keys was also a strong performer in September 2020, recording 14.2% occupancy growth, a 16.0% ADR increase, and a 32.4% jump in RevPAR year over year. Like Daytona Beach, the Keys experienced only a slight year-over-year ADR decline of 0.6% in October. The market also experienced substantial growth month over month, with occupancy, ADR and RevPAR increasing from September to October 2020.

Other notable examples of year-over-year ADR growth in September 2020 came in Fort Myers (+10.6%), Sarasota (+7.6%) and West Palm Beach/Boca Raton (+8.7%) in Florida as well as the Gatlinburg submarket (+8.1%).

Finally, several of the locations that we examined experienced growth across the three key metrics from August to September 2020 even though year-over-year growth did not occur. This was observed in the Fort Lauderdale, Jacksonville, Miami, Orlando and West Palm Beach markets in Florida, as well as the Gatlinburg and Grand Canyon Area submarkets.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.