Source: https://str.com/data-insights-blog/covid-19-webinar-summary-5-key-points-total-accomodations-update

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in alternative accommodations.

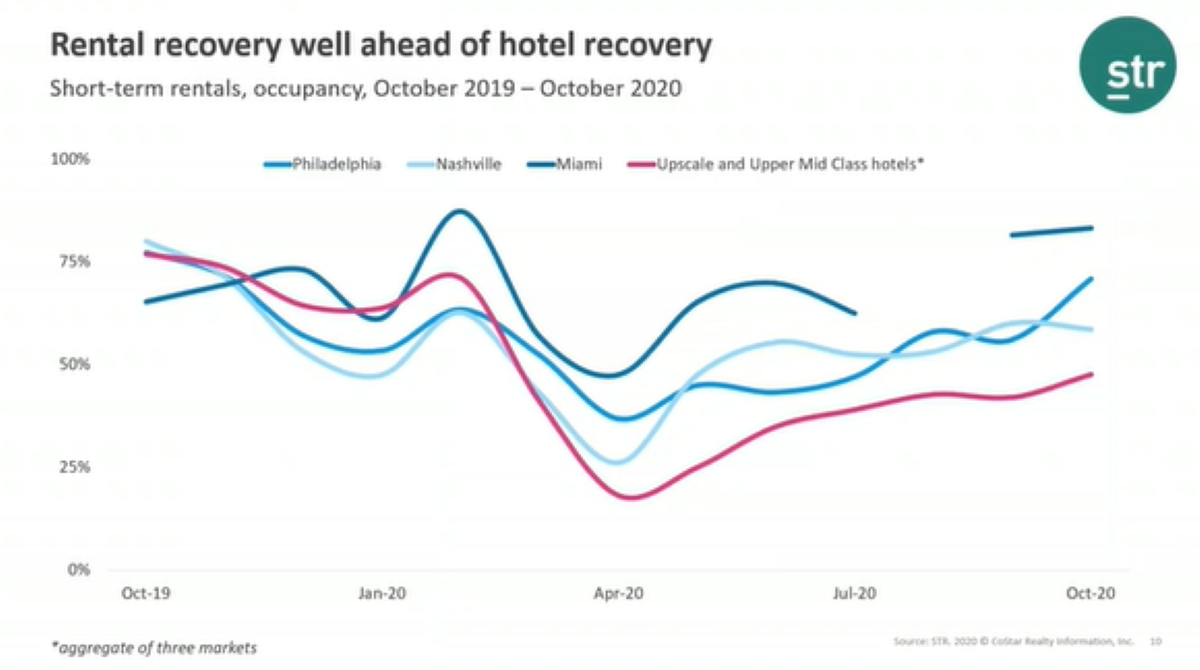

Short-term rentals well ahead of hotels

In October, short-term rental occupancy in Miami was over 80% due to the need for larger quarantine or self-isolation space as well as essential or health care workers requiring a longer length of stay.

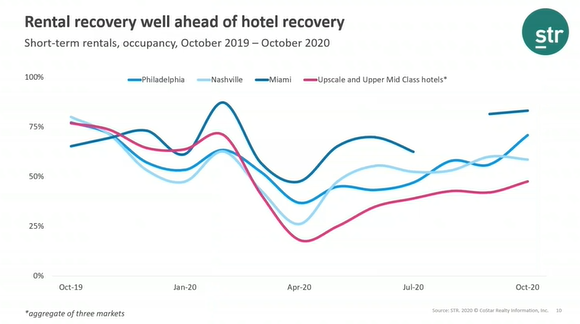

Length of stay up dramatically

Short-term rental average length of stay (ALOS) has dramatically increased across Miami, Nashville and Philadelphia. Nashville, for instance, went from an ALOS of 2.6 days in October 2019 to 5.4 days in October 2020, due to increased usage from healthcare workers as well self-isolation and long-term guests.

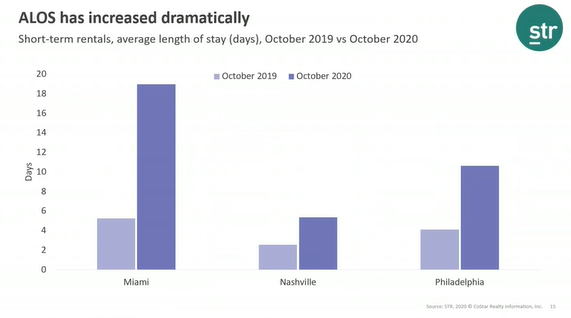

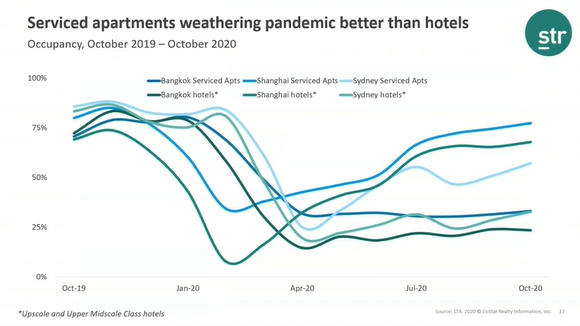

APAC serviced apartments outperform hotels

Serviced apartments are outperforming hotels in Asia Pacific markets. Both hotels and serviced apartment occupancy in Bangkok, a market reliant on international demand, reflects the lack of international tourists. For comparison, Shanghai is almost back to normal. In October, serviced apartments occupancy was 77.5%, the highest occupancy level since December 2019.

Serviced apartments occupancy in Sydney is growing much faster than hotel occupancy due to quarantine demand and strict quarantine rules in the city.

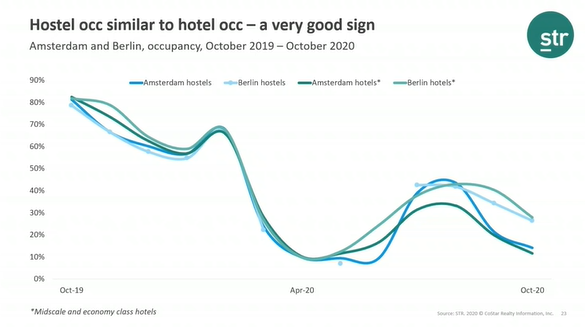

Europe: Hostels vs. Hotel occupancy

In October, occupancy was similar in both hostels and hotels in Berlin and Amsterdam. Although occupancy is low in both markets, hostels have managed to shift their business models to overcome the perceptions around cleanliness and safety to being based on a social experience.

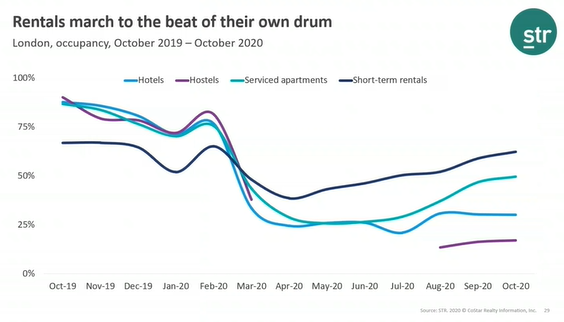

Short-term rentals persist

Short-term rentals saw a 62% occupancy level in October, while hostels, hotels and serviced apartments started to slow down due to summer months ending.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.