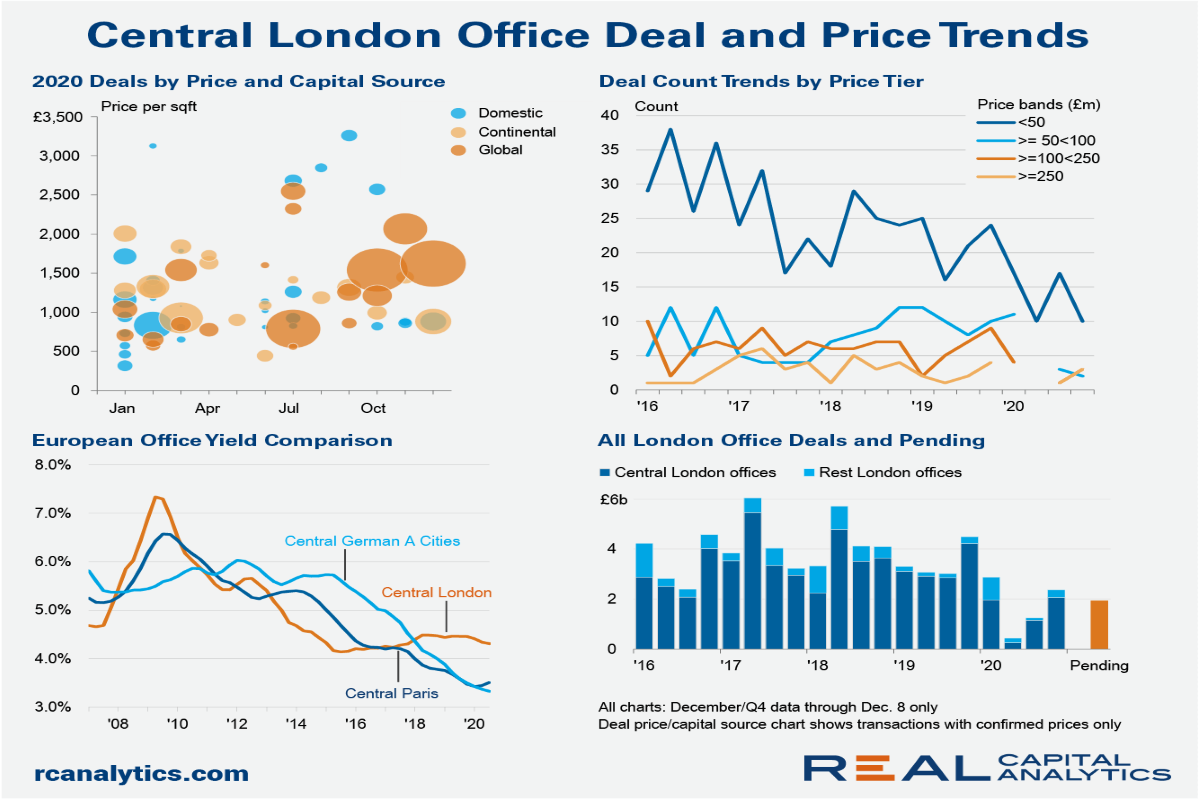

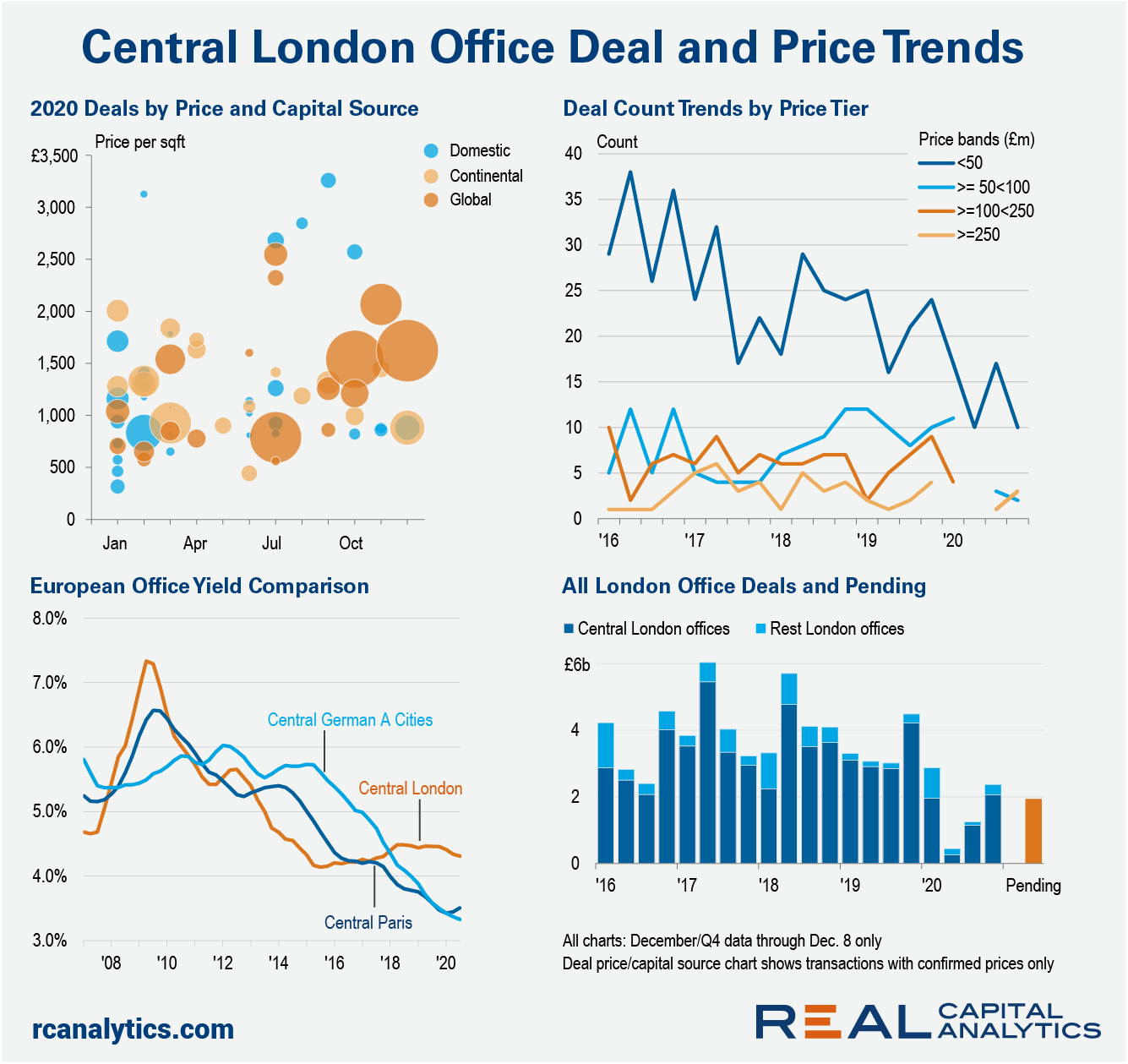

Dealmaking for Central London offices froze in the second quarter of 2020 with the onset of the pandemic. Only 10 properties changed hands, making it the weakest quarter on record, worse even than the depths of the Global Financial Crisis. There are now signs of a recovery — aided by a string of large deals by overseas investors — though the market is not yet out of the woods.

Sun Venture of Singapore grabbed the headlines in December with the acquisition of two properties in The City, London’s financial district, for £552 million ($740 million) at a 4.3% yield. These purchases followed the private investor’s debut London purchase in July, buying Commonwealth House from BA Pension Trustees and Nuveen Real Estate (UK).

Other overseas buyers have also completed their maiden European purchases in London, or are close to the finish line. Hong Kong’s Lifestyle International bought BP’s office in the St James’s district for £250 million while Suntec, a listed player from Singapore, is poised to acquire a 50% share in the Nova development in the Victoria neighborhood for £430 million. AGC Equity Partners also reentered the London market for the first time since 2013, buying One London Wall Place from Brookfield for £477 million.

Link REIT’s purchase of The Cabot in July is notable. Not only was it the Hong Kong-based investor’s first acquisition in Europe, but the building was previously slated to be acquired by Blackstone, a deal that collapsed in March. Sun Venture’s acquisition of Commonwealth House is another example of a deal which emerged after the original buyer pulled out.

London remains the number one destination for new entrants to Europe and has accounted for close to 40% of capital spent by buyers new to the European market over the last decade. Of note, the largest pending transaction involves Alphabet (Google), which is acquiring their Central Saint Giles office complex for £700 million. Alphabet would be paying £986 per square foot, which is below the Central London average.

The London market is overwhelmingly oriented towards cross-border capital, but there are a handful of domestic acquisitions to report. For instance, M&G Real Estate spent £112 million on Fleet Place House, buying the asset from a Chinese state-owned developer. The acquisition, though, was reportedly on behalf of an unidentified Asian investor, emphasizing the appetite for London commercial property from the region.

One of London’s advantages is that there is usually someone, somewhere who wants to buy real estate in the city — it is a truly global asset class and doesn’t always function in the same way as other commercial real estate markets. The best example is after the tumult of the Brexit vote in mid-2016. Fund redemptions forced a variety of assets onto the market, and these were acquired by a coterie of ultra high net worth individuals, mostly operating out of Hong Kong. The injection of investment was not sufficient to keep driving up prices, but it helped to provide a short-term floor.

Nevertheless, the Brexit vote has had a longer-term impact on Central London; following the referendum, the market slipped from first to 16th in RCA’s rankings of the world’s most liquid commercial real estate markets. With a trade deal still to be struck with the European Union, there is potential for more disruption, but the Covid-19 pandemic could prove to be a more severe long-term disruptor to working lives if office occupiers do significantly downsize their footprints.

In this uncertain environment, owning prime, well connected office space that can adapt to changed use patterns is desirable. Additionally, talk that the ongoing trend of centralization and urbanization will go into reverse is as yet unproven; to boot, vaccines are now being deployed.

Finally, London looks cheap in comparison with other major European cities when considering yield trends. In Germany, as the market talk goes, two might be the new three percent, but in London four is still four.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.