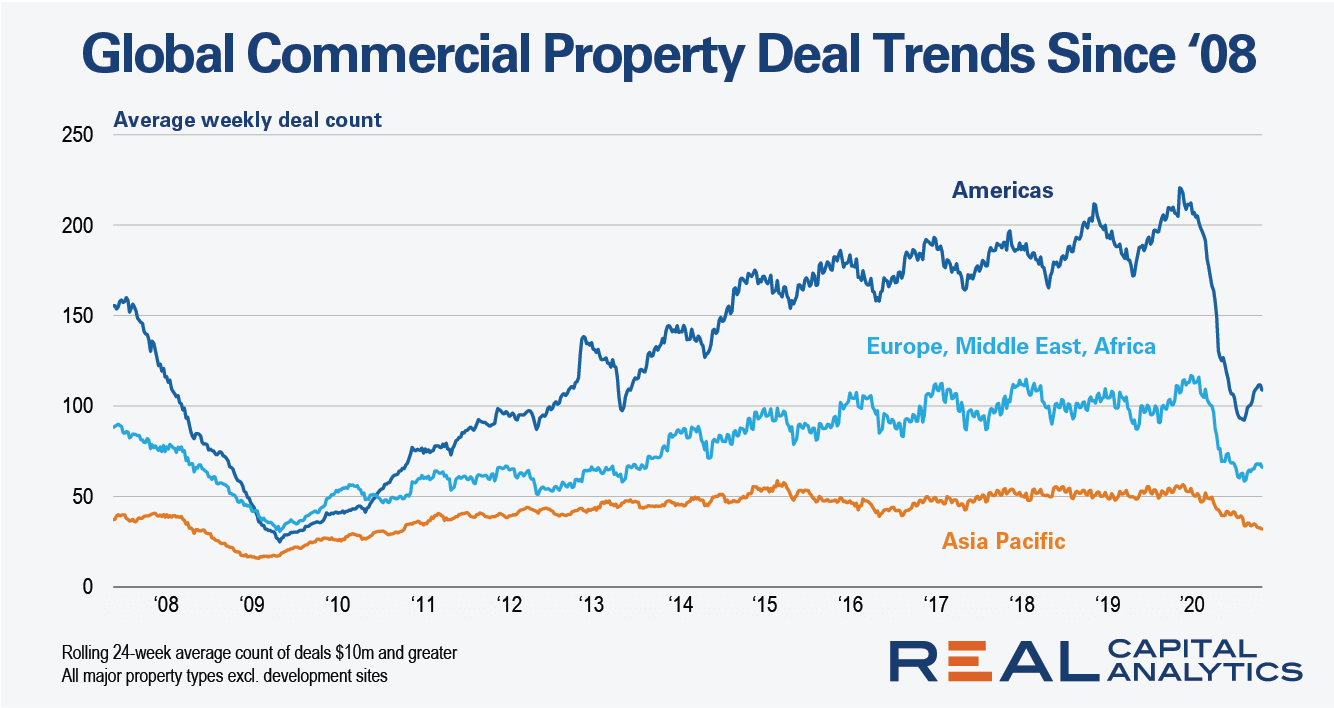

In July, after the first full quarter when we saw the global impact of the Covid-19 maelstrom, we studied the drop in global commercial real estate activity with a historical perspective going back to the Global Financial Crisis (GFC).

Today, the chart plotting the average weekly deal count for the three global zones reveals more about the decline caused by an extraordinary crisis.

For the Americas, the fall in average deal flow maintained its pace until a low point of 92 deals per week in late September, some six months after the first sweeping lockdown measures in the U.S. This was a level nearly 60% lower than the highest deal count figure at the close of January.

Commercial real estate deal flow persisted nonetheless, driven by an appetite for the industrial and apartment sectors. Hence came an uptick, looking more dynamic than 2009’s slow recovery.

In Europe, Middle East, Africa (EMEA), where lockdown easings took place during the summer before the virus kicked in again, the flow in the number of income-producing real estate transactions followed a similar trajectory to the Americas.

The rolling average deal count dropped to barely 60, half the level of the first quarter of 2020, before the start of an upward trend – common after the summer in Europe, yet much more modest this year. For the record, it took five years for the EMEA region to return to pre-GFC deal levels after that downturn.

The APAC region seems not to have reached the worst level in dealmaking so far. The direction of the trend in the average weekly count over the past six months is still descending.

The tally is now 43% lower than at the beginning of the year, whereas the difference between the top and the bottom before and after GFC was no more than a 36% decline and happened over a two-year period

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.