Black Friday did not produce surges of their usual magnitude. Super Saturday weekend was strong but the day itself still lower than 2019 levels, and even Turkey Wednesday fell short for many grocers.

Yet, like they have proven all year, the grocery sector is uniquely capable of adapting to the current challenges. And once again, even where other days fell short, the sector found another boost.

This time in the form of pre-Christmas shopping, and interestingly, it helped further break down the core roles that different types of grocery players are playing.

The Pre-Christmas Bump

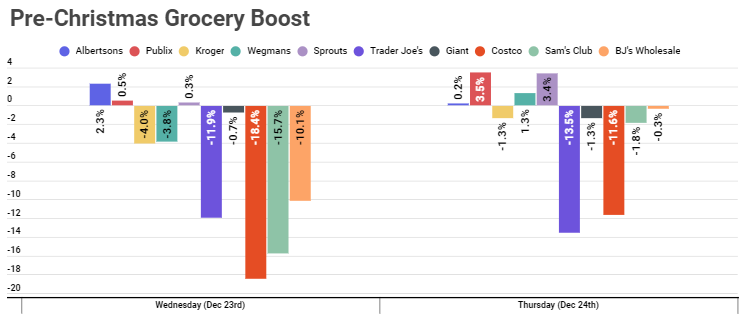

Even if the number of guests shrunk in 2020 as a result of COVID, there was still a jump in visits in the days leading up to Christmas. Looking at seven top supermarket chains nationwide, saw an average year-over-year decline of just 2.5% on December 23rd and 1.1% on December 24th. These numbers are especially impressive considering they are being compared to very high performing days from 2019.

And, in fact, if we remove Trader Joe’s, the non-traditional grocer among the group, those numbers improve significantly to an average 0.9% decline on the 23rd and a 1.0% increase on the 24th. Comparing this to another high performing sector, wholesale clubs, shows those players down an average of 14.7% and 4.5% on December 23rd and 24th respectively.

Ending the Year on a High

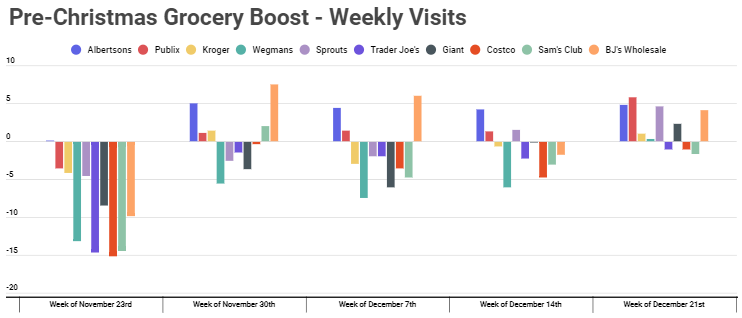

And this jump drove a fitting end to 2020, with all of the measured grocery brands driving strong year over year visit metrics when compared with the period that preceded it. The average weekly year-over-year visit change for these seven brands was actually up 2.5%, the best it has been for this collective group since August. Albertsons saw its 2020 continue to the end with visits up 4.8% for the year, while Publix and Kroger ended on a high with visits up 5.8% and 1.0% respectively. Unsurprisingly, all three are brands we have high hopes for in 2021. Even Sprouts, a brand that had seen its fair share of struggles in 2020, saw visits jump 4.6% year over year, continuing on the moment that began weeks prior.

Informing Grocery Differentiation

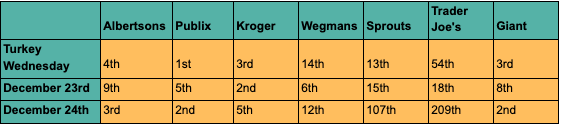

But the distinctions between the brands are also evident in the data. The two days leading into Christmas ranked as some of the strongest of 2020 for Albertsons, Publix, Kroger, Wegmans and Giant. But for Trader Joe’s and Sprouts, they were far less important in the overall scheme. For example, while the 23rd and 24th were the 5th and 2nd most trafficked days for Publix nationwide, they were only the 18th and 209th most trafficked for Trader Joe’s.

The takeaways here are important as they further deepen the divide between the ‘do-it-all’ traditional grocer and the niche player. Critically, this doesn’t mean that the ‘niches’ are all that small. Wholesale clubs and Trader Joe’s themselves have proven that there is a huge market for brands that don’t check all of the boxes for a standard supermarket trip. Nonetheless, it does give a potentially significant boost to the brands that do, as the continuation of certain trends including a shift to grocery at the expense of restaurants is expected in 2021.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.