According to ATTOM Data Solutions’ newly released 2021 Rental Affordability Report, owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 63 percent of the U.S. counties analyzed.

The annual report noted this trend is occurring despite median home prices increasing more than average rents over the past year in 83 percent of those counties and rising more than wages in almost two-thirds of the nation.

ATTOM’s 2021 rental affordability analysis incorporated recently released fair market rent data for 2021 from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics along with public record sales deed data from ATTOM in 915 U.S. counties with sufficient home sales data.

The analysis revealed the most populous counties where home prices are rising faster than rents are Los Angeles County, CA; Cook County (Chicago), IL; Harris County (Houston), TX; Maricopa County (Phoenix), AZ and San Diego County, CA.

The analysis also named the largest counties where rents are rising faster than prices. Those areas included Kings County (Brooklyn), NY; Queens County, NY; New York County (Manhattan), NY, Bronx County, NY and Allegheny County (Pittsburgh), PA.

According to the report, renting the typical three-bedroom property requires at least a third of average weekly wages in 55 percent of the counties analyzed.

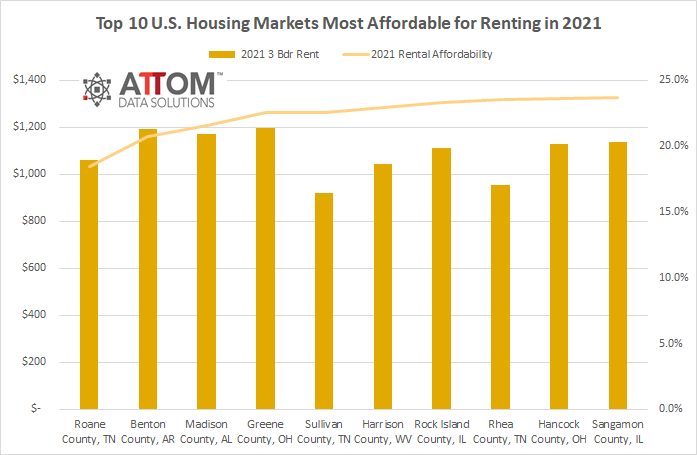

The report stated that the most affordable markets for renting are mostly in the South and Midwest, led by Roane County, TN (outside Knoxville) (18.4 percent of wages needed to rent); Benton County (Rogers), AR (20.7 percent); Madison County (Huntsville), AL (21.6 percent); Greene County, OH (outside Dayton) (22.5 percent) and Sullivan County (Kingsport), TN (22.6 percent).

In this post, we dig deeper into the data to uncover the complete list of the top 10 most affordable housing markets for renting in 2021. Rounding out the top 10 are: Harrison County, WV (23.0 percent); Rock Island County, IL (23.4 percent); Rhea County, TN (23.5 percent); Hancock County, OH (23.6 percent); and Sangamon County, IL (23.7 percent).

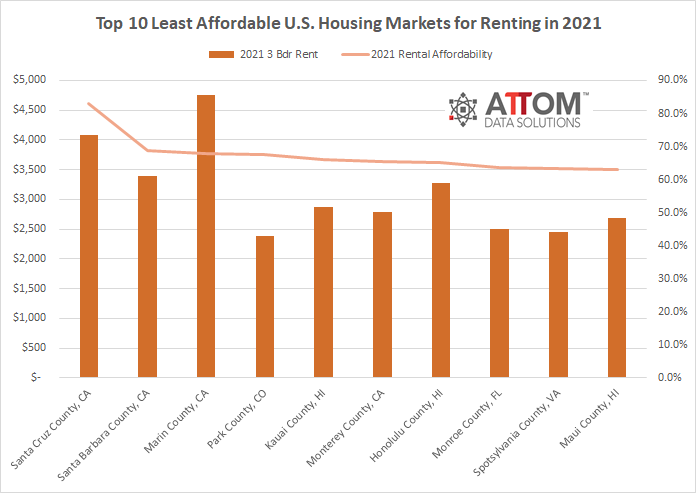

ATTOM’s 2021 rental affordability analysis also reported that the least affordable markets for renting are mostly in the West, led by Santa Cruz County, CA (82.9 percent of average wages needed to rent); Santa Barbara County, CA (68.7 percent); Marin County, CA (outside San Francisco) (67.9 percent); Park County, CO (outside Denver) (67.5 percent) and Kauai County, HI (66 percent).

In this post, we dig deeper into the data to uncover the complete list of the top 10 least affordable housing markets for renting in 2021. Rounding out the top 10 are: Monterey County, CA (65.5 percent); Honolulu County, HI (65.2 percent); Monroe County, FL (63.8 percent); Spotsylvania County, VA (63.4 percent); and Maui County, HI (63.2 percent).

ATTOM’s latest rental affordability report noted that wages are increasing more than average fair market rents in 81 percent of the markets analyzed, including Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA and Orange County, CA (outside Los Angeles).

The report also noted that average fair-market rents are rising faster than average wages in 19 percent of the counties analyzed, including Harris County (Houston), TX; Tarrant County (Fort Worth), TX; Fresno County, CA; Pinellas County (Tampa), FL and Macomb County, MI (outside Detroit).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.