It was a holiday season those in retail will never forget, however they might try. Just as many retailers were moving ever closer to 2019 visit levels, the COVID pandemic not only made its impact felt, but actually surged just prior to a critical Black Friday weekend.

But, what did this mean for the sector as a whole? And were there any silver linings to a holiday retail season defined by such tremendous obstacles to success? We analyzed the location analytics of over 30 top retailers to see.

The Overall Picture – Offline Retail’s Tremendous Resiliency

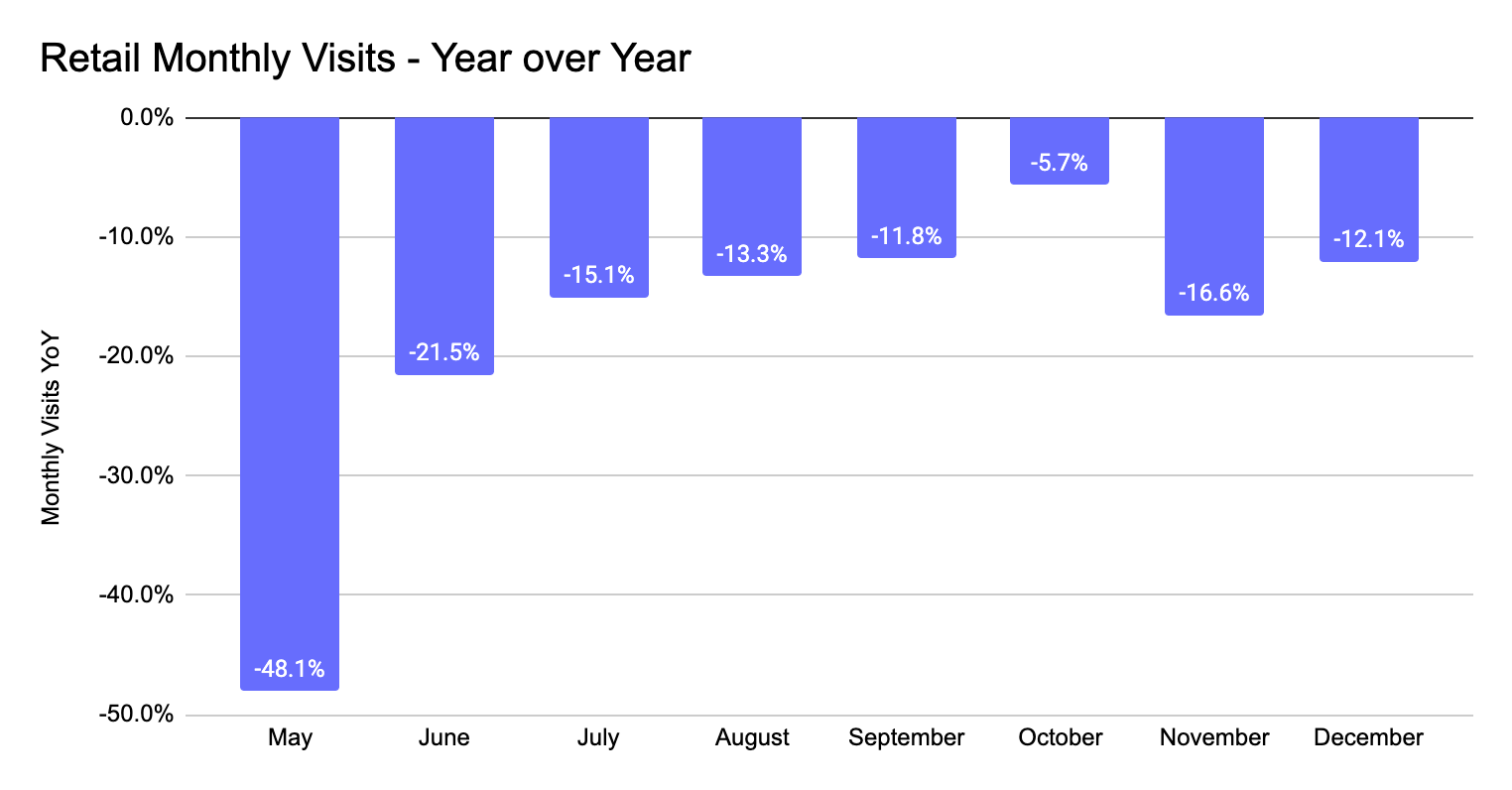

When analyzing the group overall, we see that there has been a clear and marked level of progress when looking at average monthly visits year over year. October brought the group average within 5.7% of 2019 levels, but a resurgence of COVID cases struck just as the sector was heading into Black Friday week.

The result was a huge step back with visits down 16.6% year over year, the worst mark for the group since the retail recovery began in earnest in June. Yet, just as significant was December, showing a huge improvement with visits down just 12.1%. This was aligned with where visits had been in September and ahead of August levels, even though it was being measured against a normally very significant December period.

Weekly Visits Reveal More

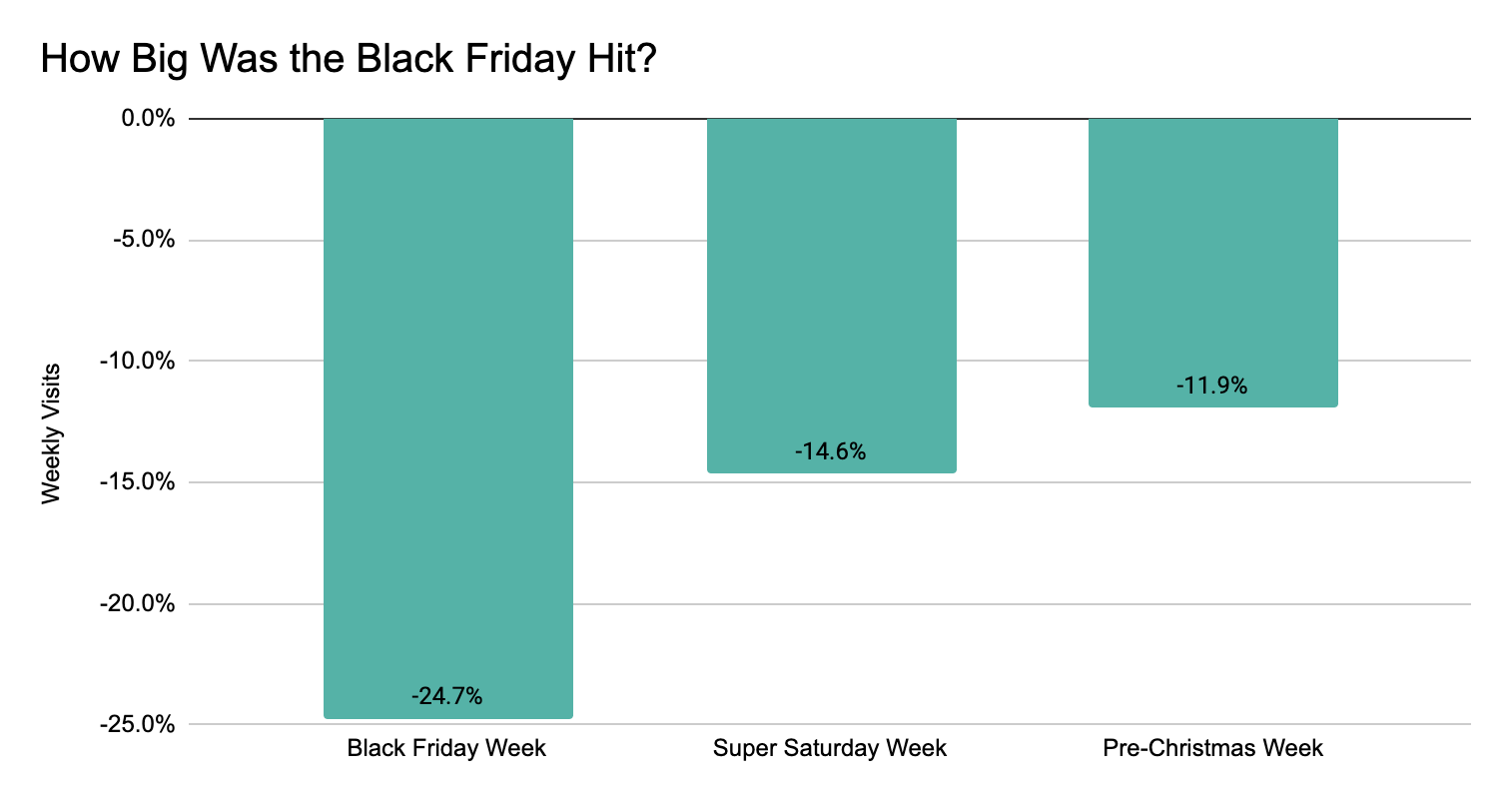

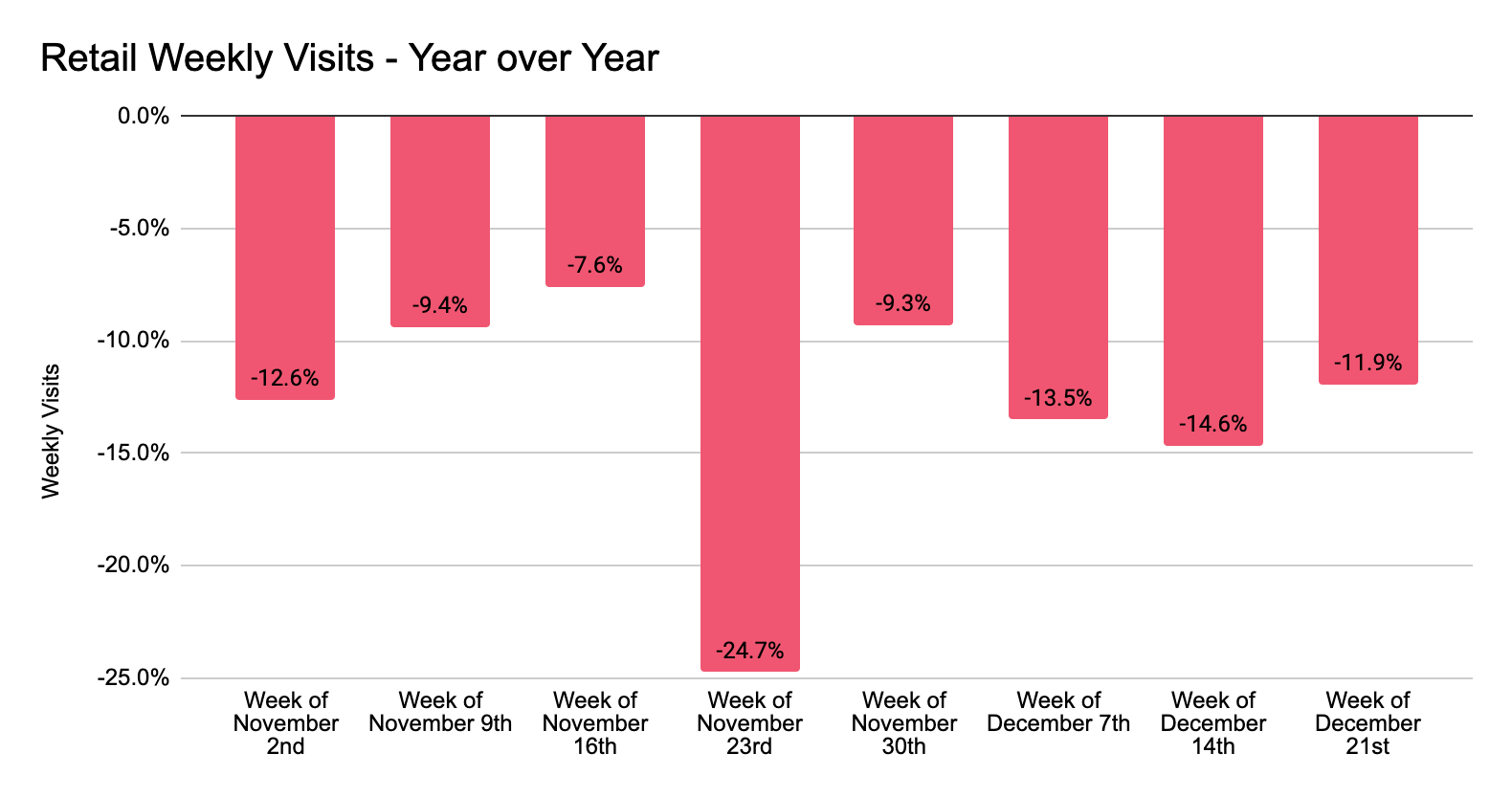

Weekly visits show the devastating impact of Black Friday’s 2020 decline even more. Visits for the week were down 24.7% year over year, the worst mark for the wider group in months. Yet, from this nadir, the retailers analyzed did see a significant improvement across the board. By the week of Super Saturday, visits were down just 14.6% year over year and the week heading into Christmas was down just 11.9%.

And this ‘second wave’ of recovery is extremely important and did more than just end the year on a high point. Firstly, it showed the tremendous resiliency of offline retail to recover yet again so quickly after a resurgence of COVID cases. Shoppers have consistently shown that when allowed to return to retail, they will. Secondly, it showed the ability to recover even when compared to significant peaks. Part of the reason that the year-over-year visit gap on Black Friday week was so significant is that the normal peak reach is equally massive.

Yet, the same is true of Super Saturday week or the days heading into Christmas. And while the gaps still remained, they were far more manageable for the brands measured.

Retail’s Secret Weapon?

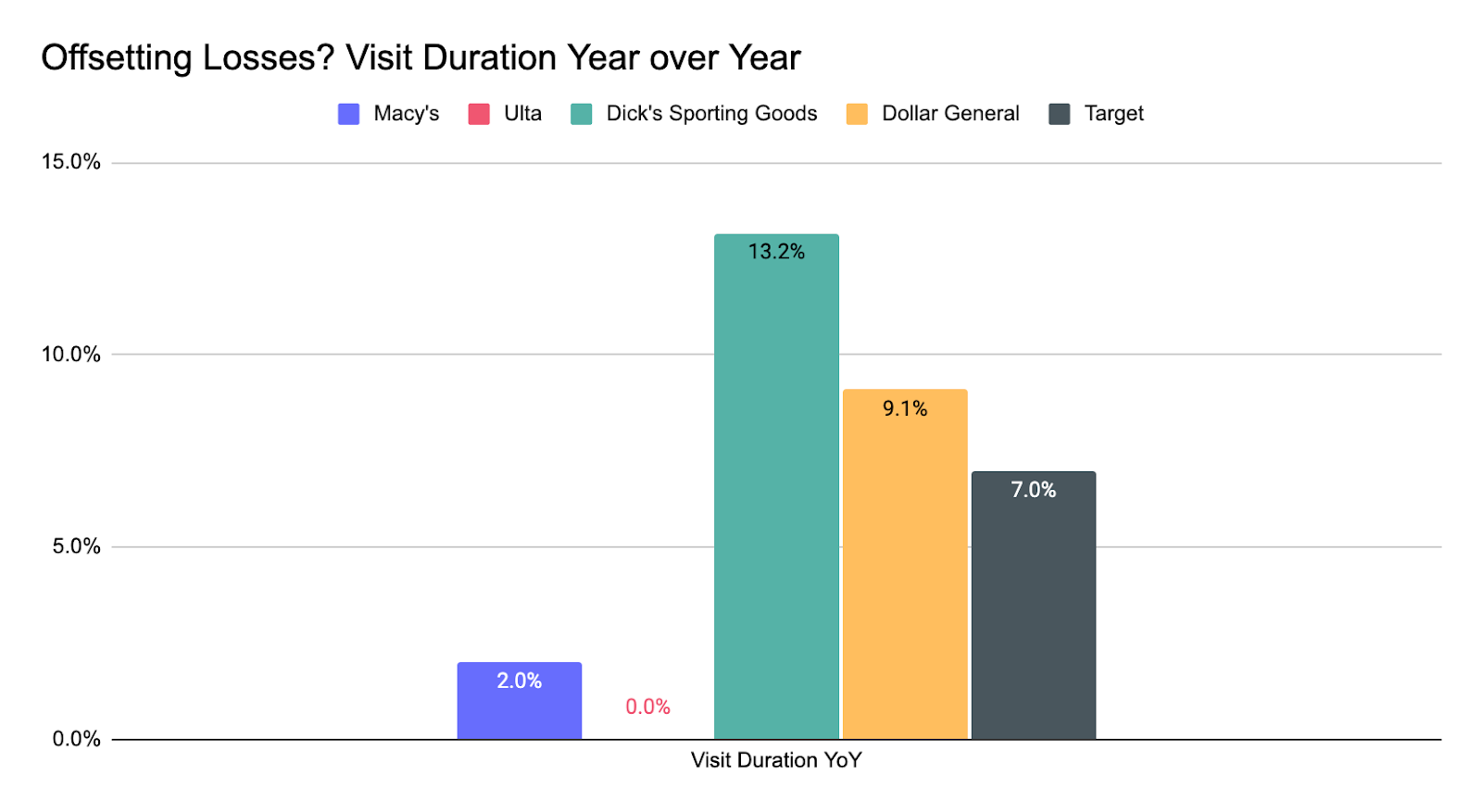

But one element that could have a dramatic effect on how ‘bad’ the retail season really ends up being is basket size. We have discussed at length the shift to mission-driven shopping that pushed more visitors to accomplish more with each visit. And this was indicated heavily by visit duration, where the length of stay not only indicated a higher likelihood of conversion, but a potentially larger conversion as well.

And this holiday season saw that trend sustain across sectors. Target, Dollar General and Dick’s Sporting Goods saw visit duration up 7.0%, 9.1% and 13.2% respectively during the holiday season, and even Macy’s – one of the hardest hit brands by the pandemic – saw a 2.0% increase in visit duration. If these brands managed to drive larger basket sizes with these extended visits, they may prove capable of offsetting some of the expected losses – and this doesn’t take into account the potential impact of digital channels.

The Highlights

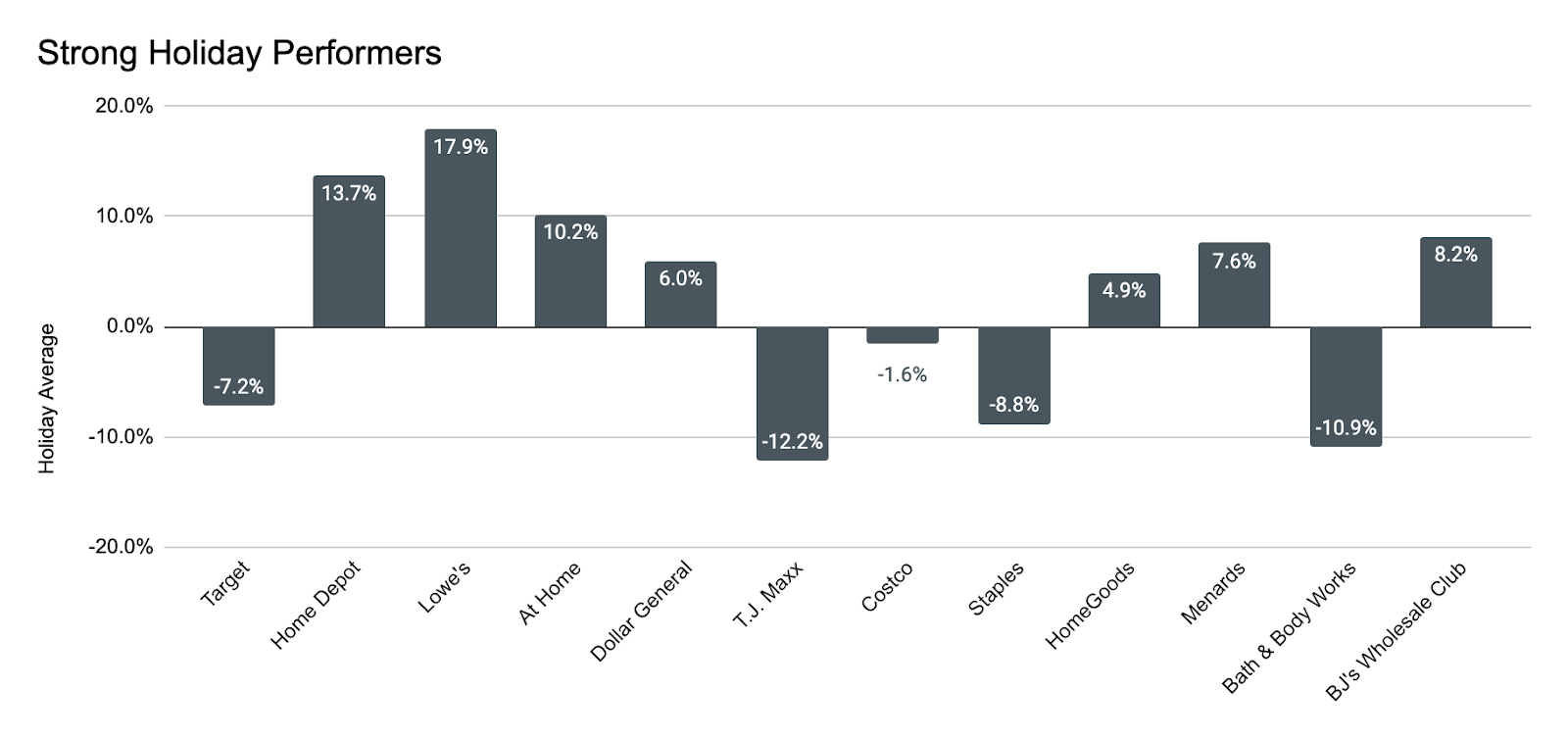

Visit duration wasn’t the only positive during the holiday period. Many brands saw exceptionally strong performances, especially when comparing them to other players in their space. Target saw visits down 7.2%, but this was ahead of Walmart, and came as the brand saw a huge increase in visit duration. Critically, these numbers are being compared against the exceptionally high peaks Target hit in 2019.

But others showed strength as well. Home Depot and Lowe’s continued their 2020 surges with visits up 13.7% and 17.9% year over year respectively. At Home, HomeGoods and BJ’s continued strong campaigns with visits that rose 10.2%, 4.9% and 8.2% year over year. And not all brands with declines should be seen in a negative light. Bath & Body Works managed a visit rate that was down just 10.9% year over year, ahead of competitors and especially strong considering how often locations are found in hard hit malls and regions. T.J. Maxx was also down 12.2% during the period, but this far outpaced the wider apparel sector further establishing the brand and the off-price segment as one to watch in 2021.

Yes, the holiday season was especially challenging for offline retailers. However, there are very strong positive takeaways as well. The rapid recovery post-Black Friday indicates that the consumer demand is still very high and visitors are ready to return when able. There were also continued shifts in visit behavior that could significantly offset losses.

How significant will the recovery be in early 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.