J.C. Penney recently announced the closures of 154 stores across 38 states. We decided to look at the affected stores to find out how their human traffic patterns have been impacted by COVID-19 policies in their respective states.

In general, we found that J.C. Penney stores that are closing are actually getting more visitors currently than stores that will stay open. On its face, this seems odd, but by digging a little deeper into the data, the underlying context influencing each closure becomes more clear.

Pre-pandemic performance outweighs reopening spikes

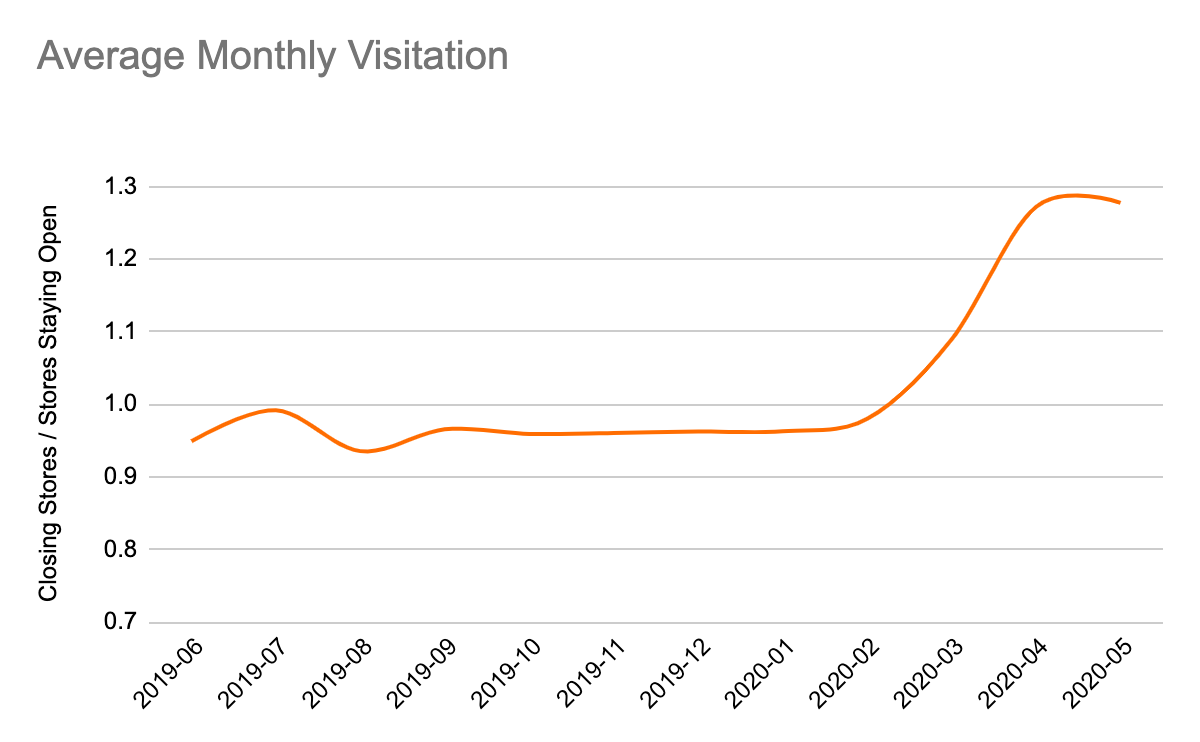

On average, the J.C. Penney stores remaining open in affected states had about 4% more traffic over the 8 months leading up to March, 2020 vs. stores that are closing. But stores that are closing have outperformed those staying open by 23% since the reopening process began. The chart below shows the average visitation to closing JCPenney stores nationwide as a percentage of visitation to stores remaining open:

More J.C. Penney closures reported amidst pandemic.

The visitation ratio remains steady between 0.9 and 1.0 until the beginning of the nationwide COVID-19 response, at which point it rapidly climbs above 1.2. This is in line with broader recovery in the clothing retailer sector.

Based on that fact, the most obvious explanation is that there is a higher concentration of stores closing in states with less restrictive COVID policies, including Oklahoma and South Dakota.

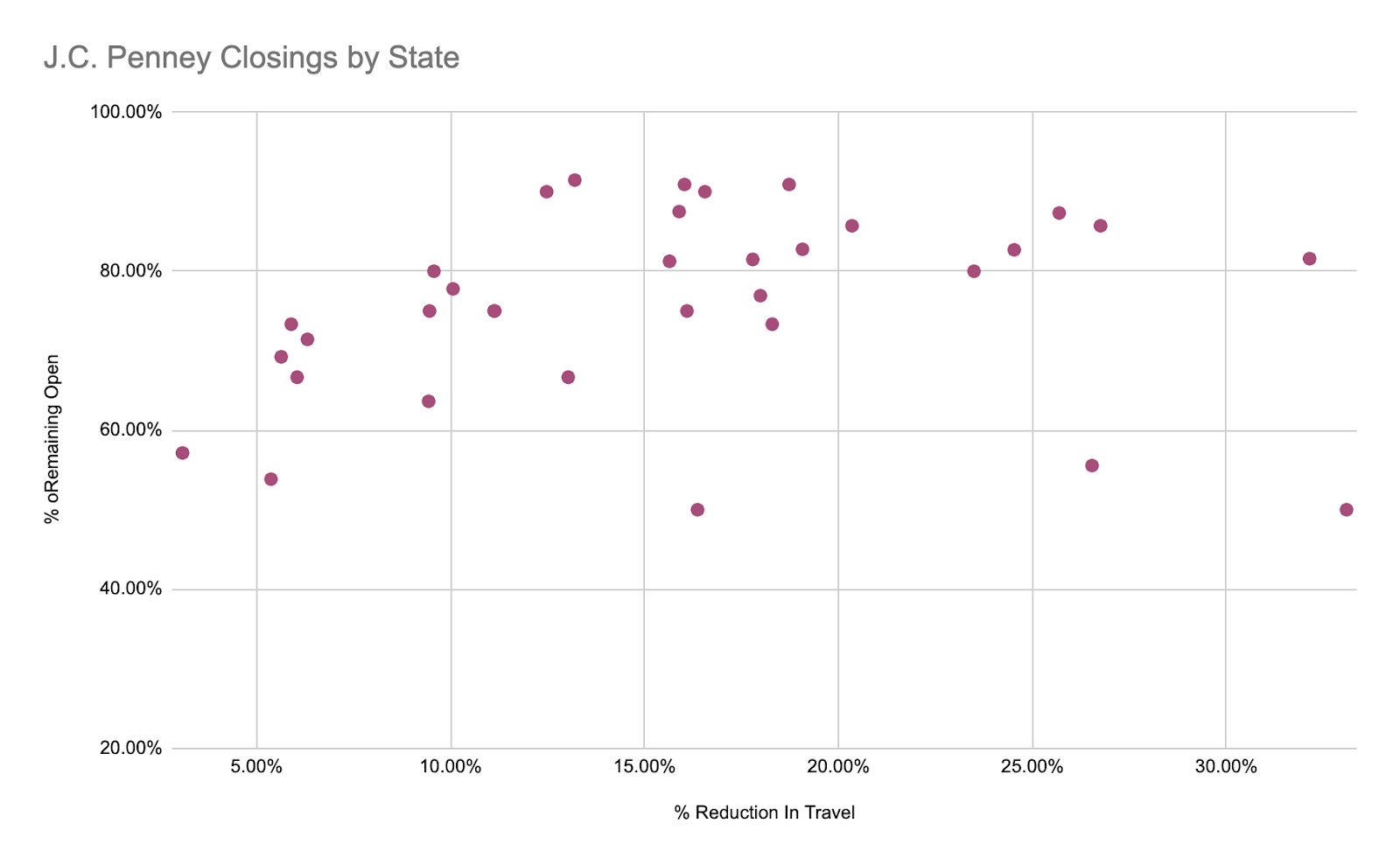

The chart below (X-axis) shows the relationship between how much a state’s residents have reduced the amount they travel in the last week relative to a baseline of Jan & Feb 2020 – a proxy for the effectiveness of state intervention. The Y-axis represents the percentage of that state’s J.C. Penney locations that will remain open.

Beyond a few outliers there is a strong correlation between state adherence to social distancing practices and the fraction of that state’s J.C. Penney locations that will survive 2020. One way of interpreting this result is that J.C. Penney’s strategy for this round of closures is to keep stores operating in states that - at least currently - are demonstrating greater austerity in pandemic-era policies and business environments.

However, when we zoom further in, we can see how specific local factors in each marketplace, including long term mobility patterns, seem to play a role in determining which stores will close.

The Michigan example: City stores stay while the Upper Peninsula is abandoned

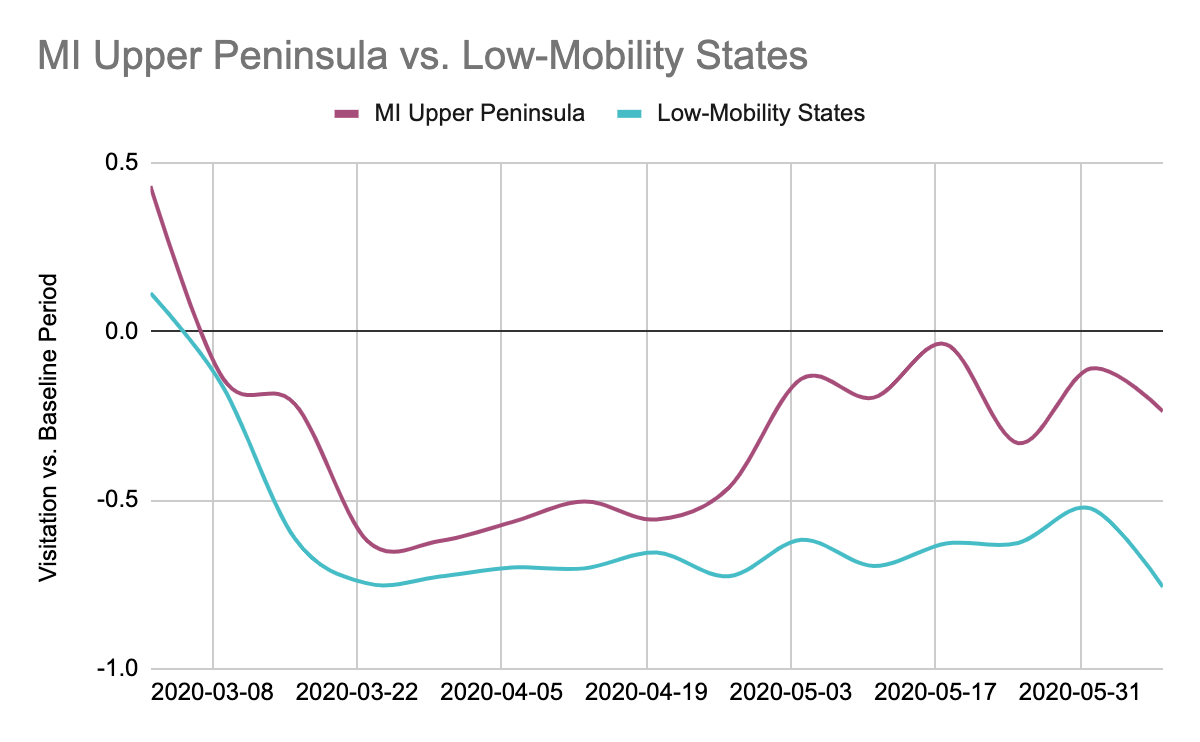

As of this writing, Michigan has a Social Distancing score of F though that improves to as high as a C in the Upper Peninsula region where J.C. Penney have announced three store closings: Petoskey, Alpena, and Cadillac. True to trend, these stores are currently experiencing ‘boom’ periods relative to J.C. Penney’s stores in more restrictive states.

But these spikes are largely a result of each store’s relative isolation, i.e. they are in smaller towns vs cities, they draw visitors from a larger geographic area than most city stores, and they benefit from summer seasonal traffic spikes. These factors seem to have worked against the Upper Peninsula locations in J.C. Penney’s decision-making process.

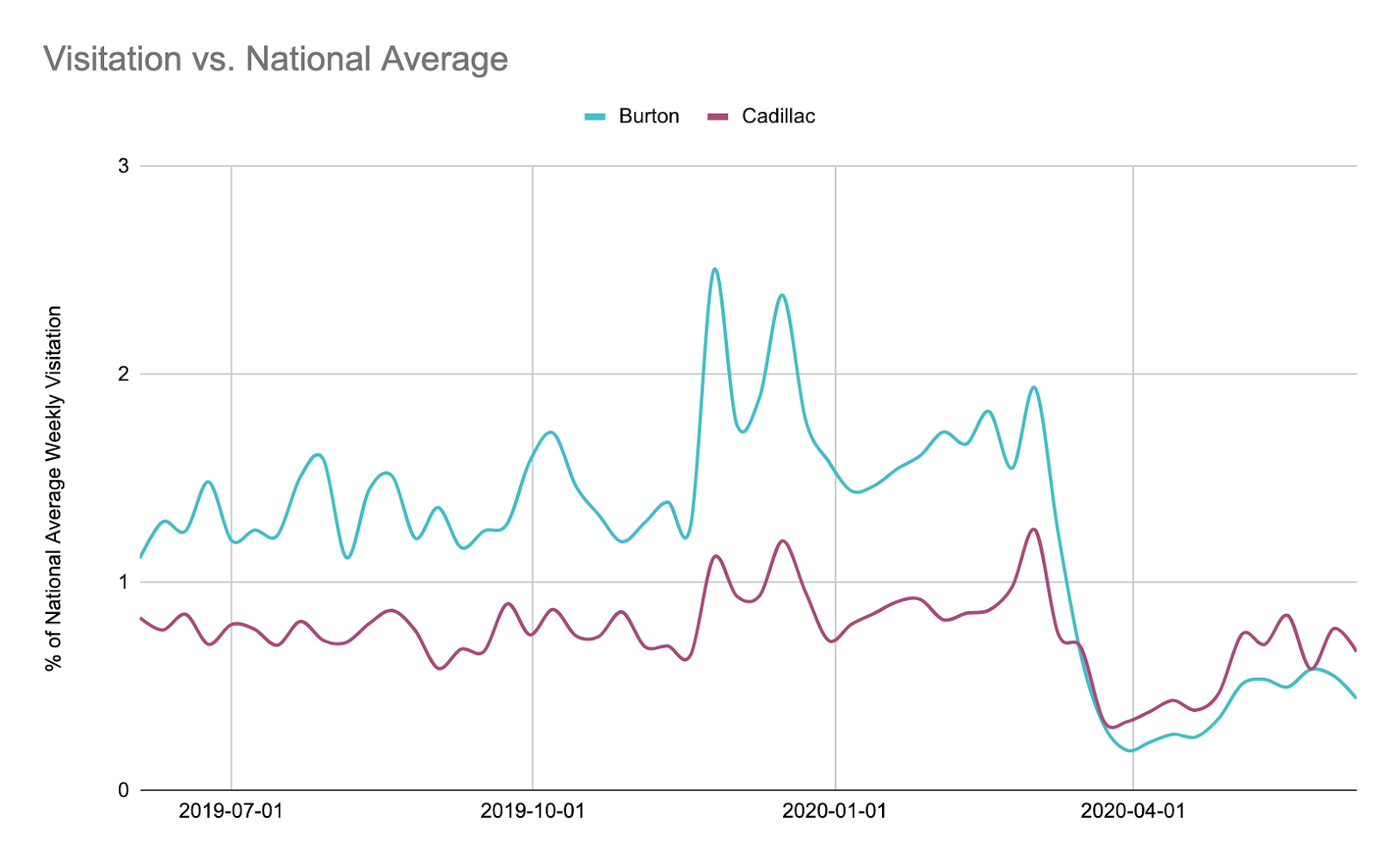

The J.C. Penney store in Cadillac, MI provides a particularly interesting case study. Strategically located as a gateway to both the Upper Peninsula’s cottage country and Michigan’s interstate ferry service with Wisconsin, the Cadillac location appears an odd choice for closure at first blush. Foot traffic in the store has reached as high as +63% versus 2019 levels on May 4th and the looming summer season would seem to portend more opportunity.

But on closer examination of historical human mobility data at the Cadillac store, J.C. Penney’s rationale for closure becomes clearer. Like at other J.C. Penney locations, foot traffic at the Cadillac location has lagged against local competitors for the last 12 months.

Throw out the brief peak experienced by many retailers in the first week of May, and we see that even before COVID-19 ever hit in early March, the Cadillac store was underperforming versus 2019 figures by an average of about -23% – right about where the store’s traffic has dropped back to in recent weeks, signalling that the lag versus more urban locations is probably a long term trend.

Quick change

In reviewing the data at-hand, it’s fair to say that changes in human mobility and state policy in the wake of COVID-19 had something to do with which J.C. Penney locations survived this round of closures..

Our analysis shows that J.C. Penney has favored keeping stores open that are a) in more restrictive states, and b) in more densely trafficked locations. It will be interesting to see if other clothing retailers follow a similar pattern.

To learn more about the data behind this article and what Unacast has to offer, visit https://www.unacast.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.