In this Placer Bytes, we dive into the December performance of Costco and analyze the holiday season for malls.

Costco’s 2020 End

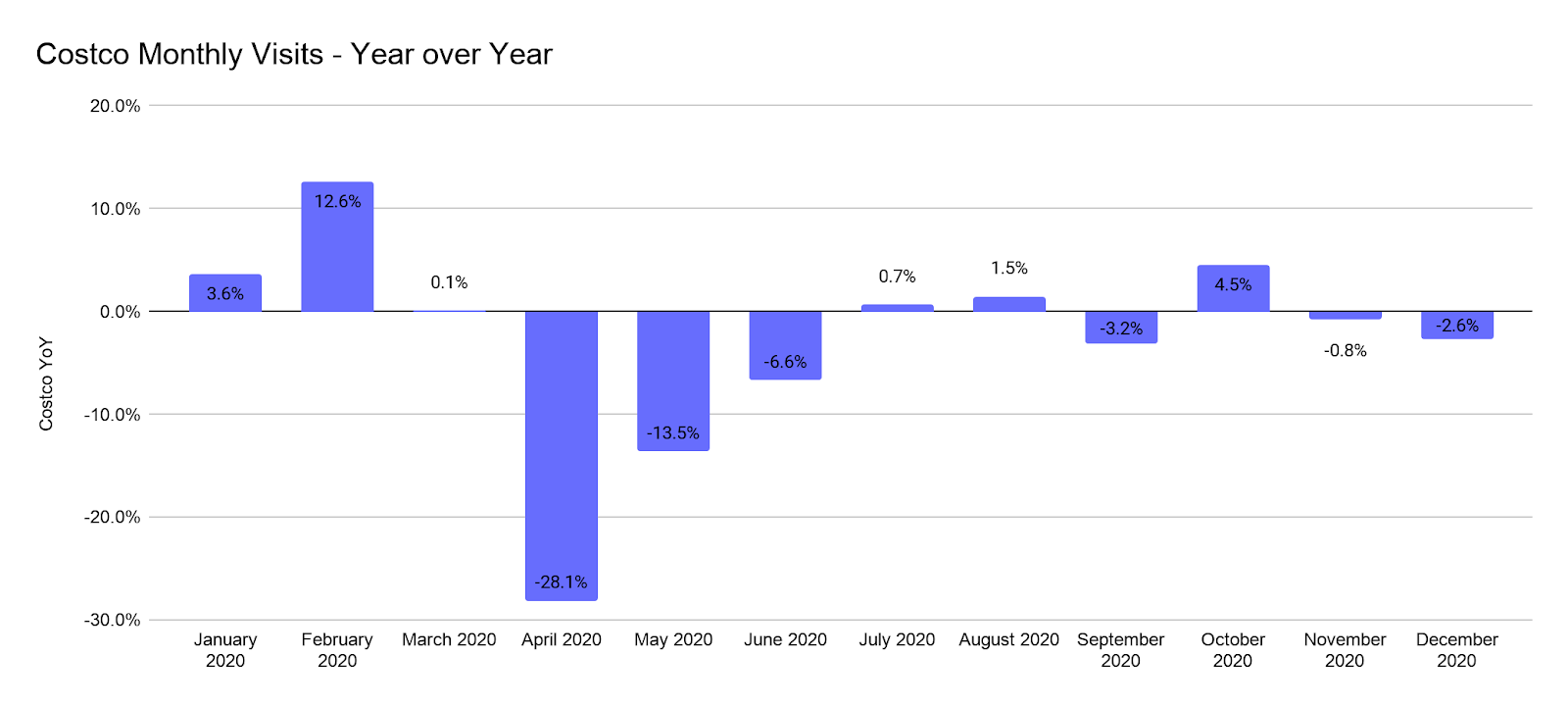

Costco began 2020 with significant year-over-year growth in January and February, and a slight increase in March before seeing the effects of COVID take over in April. Yet, by July, visits were back to year-over-year growth even as visit durations increased giving the brand the combined benefits of more visits and more impactful visits, likely indicating larger basket sizes.

But December visits were down again as a resurgence of COVID cases hit, with a heavy emphasis on key regions for Costco. After seeing visits up as much as 4.5% in October, visits in November dropped 0.8% and December saw the visit gap grow to 2.6%.

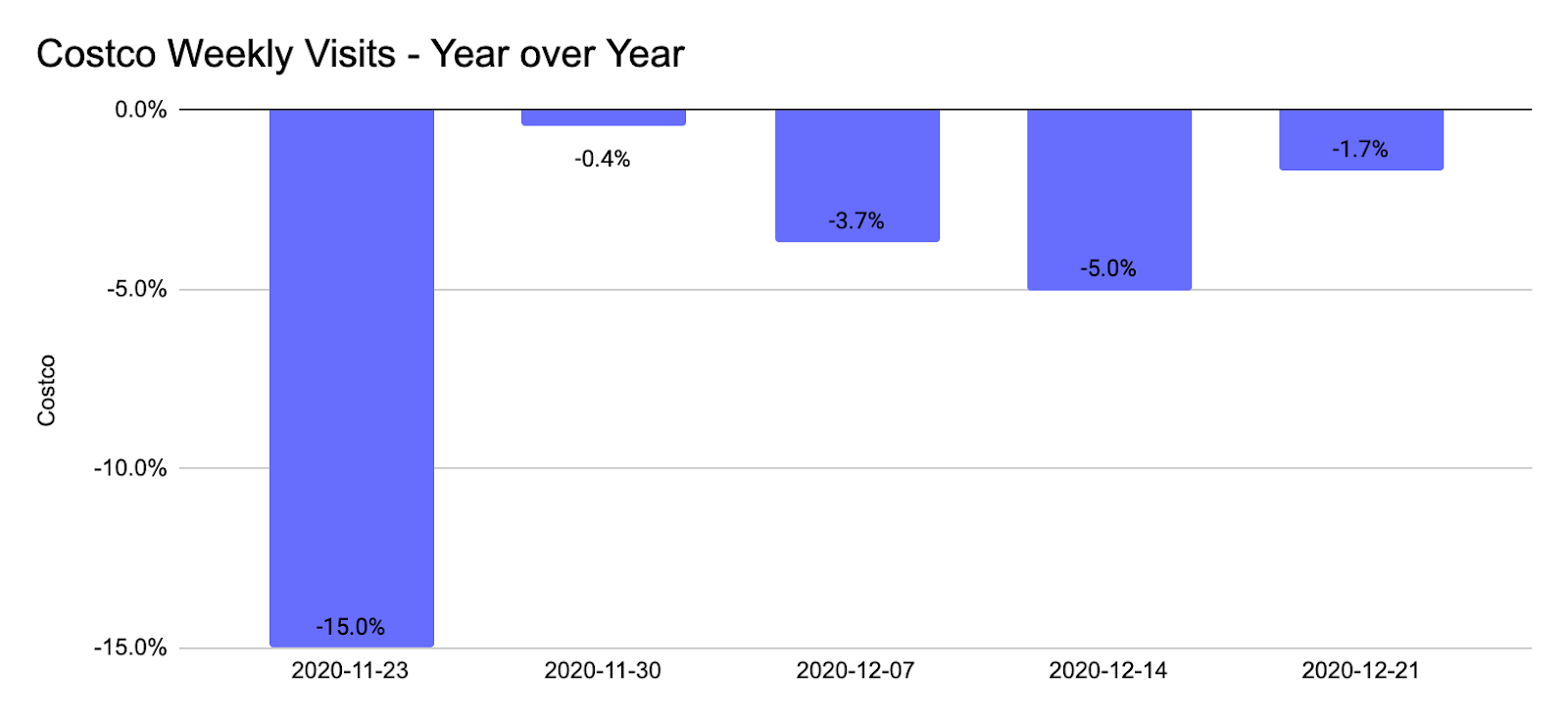

Yet, timing is everything. And for Costco it does appear that the only thing limiting visits was COVID-related. By the week beginning December 21st, visits were back to being down just 1.7% year over year. Even more, the decline during that week might actually be related to the breakdown of days. In 2019, the pre-Christmas buzz fell on already strong weekend days giving Costco a bigger boost. In 2020, these visits happened during the weekday, likely limiting that peak.

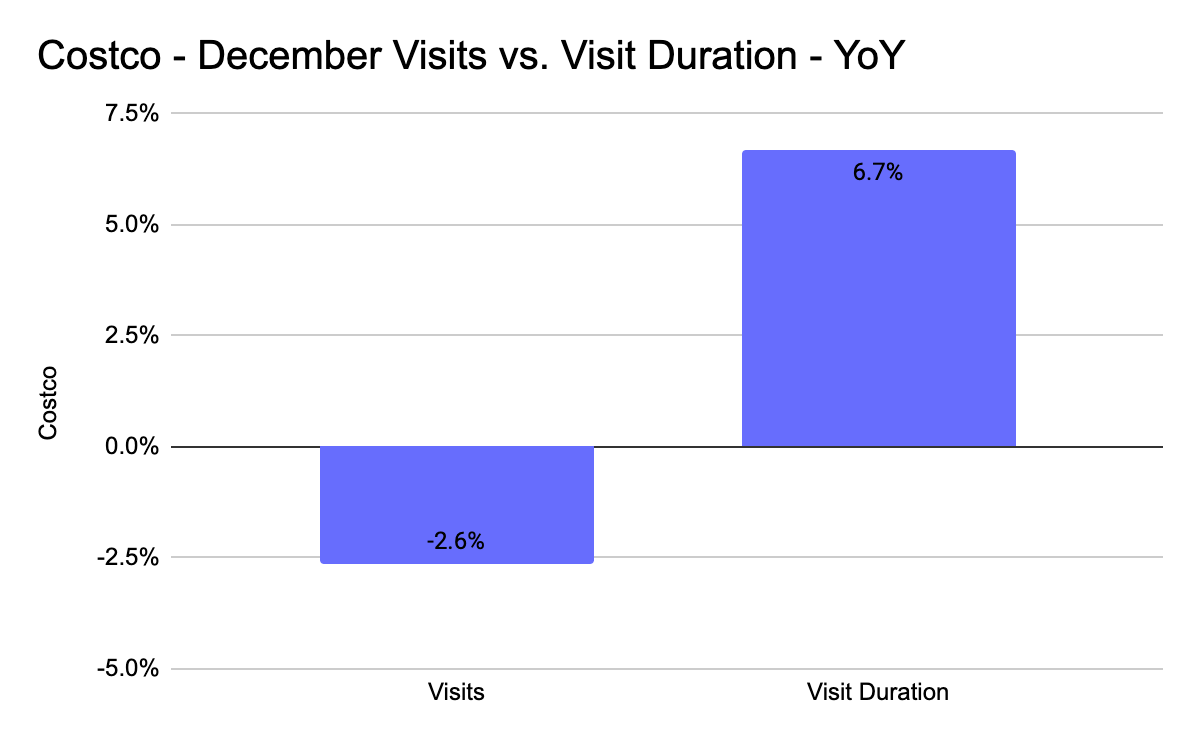

However, the real sign of strength for Costco again came in the form of visit duration. The brand saw a massive 6.7% jump, a huge increase especially considering the already long average visit duration for a wholesale club.

This could be a critical factor in understanding how they have performed so well amid the pandemic, and why 2021 could be even better. Yes, there are fewer visits in December, but, with visitors spending more time at locations, this ‘drop’ may actually be explained by less of a need for more visits, as shoppers accomplish more with each one. And even more, the visit declines are not large, indicating that there are many new customers as well. Considering the ‘stickiness’ of the club model, the brand’s value orientation and the continuation of visit duration increases, Costco could be heading into 2021 stronger than ever before.

How Bad Were the Holidays for Malls?

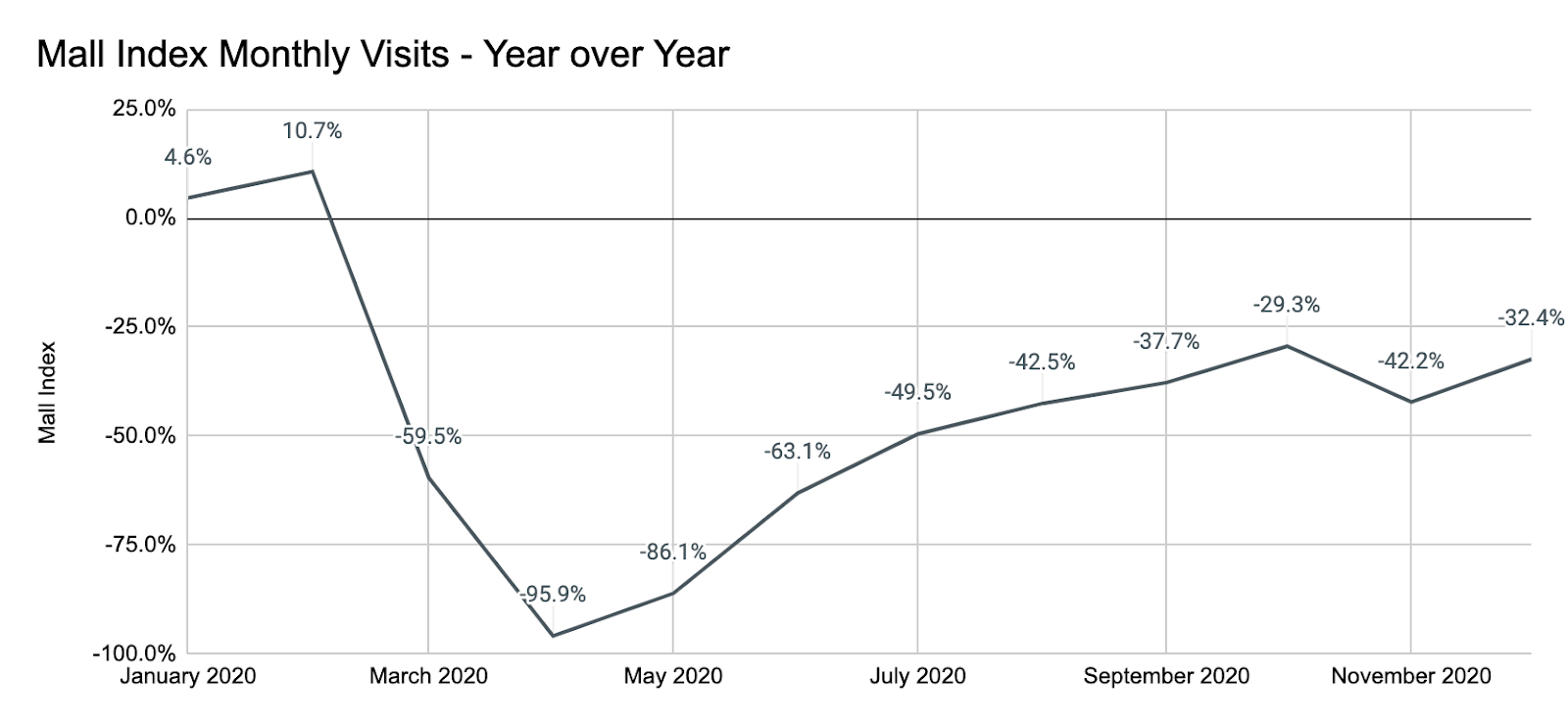

Analyzing mall data has made us among the most bullish when it comes to the future potential of the mall sector, even in the near term. And analyzing mall performance over the holidays only deepens that feeling. Analyzing over two dozen top tier malls across the country shows the strong start to 2020 for the sector as a whole. But after bringing visits within 30% of 2019 numbers by October, the resurgence of COVID cases caused the visit gap to balloon to 42.2% in November.

Yet, December once again showed the resilience of consumer demand and the desire of shoppers to return to top malls. Visits were down just 32.4% year over year, only slightly behind the mark set in October. And importantly, this is putting mall visits up against December 2019, which was an exceptionally strong month for the segment.

The immediate nature of the post-Black Friday recovery, the strength in early 2020 and the height reached in 2020 amid exceptionally difficult circumstances all reinforce the idea that 2021 could be much kinder to indoor malls than many expect.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.