With COVID cases resurfacing just in time for the holidays, we took a look at several hotels and airports to see how the pandemic affected the country’s holiday travel plans.

People are Flying.. Sort of.

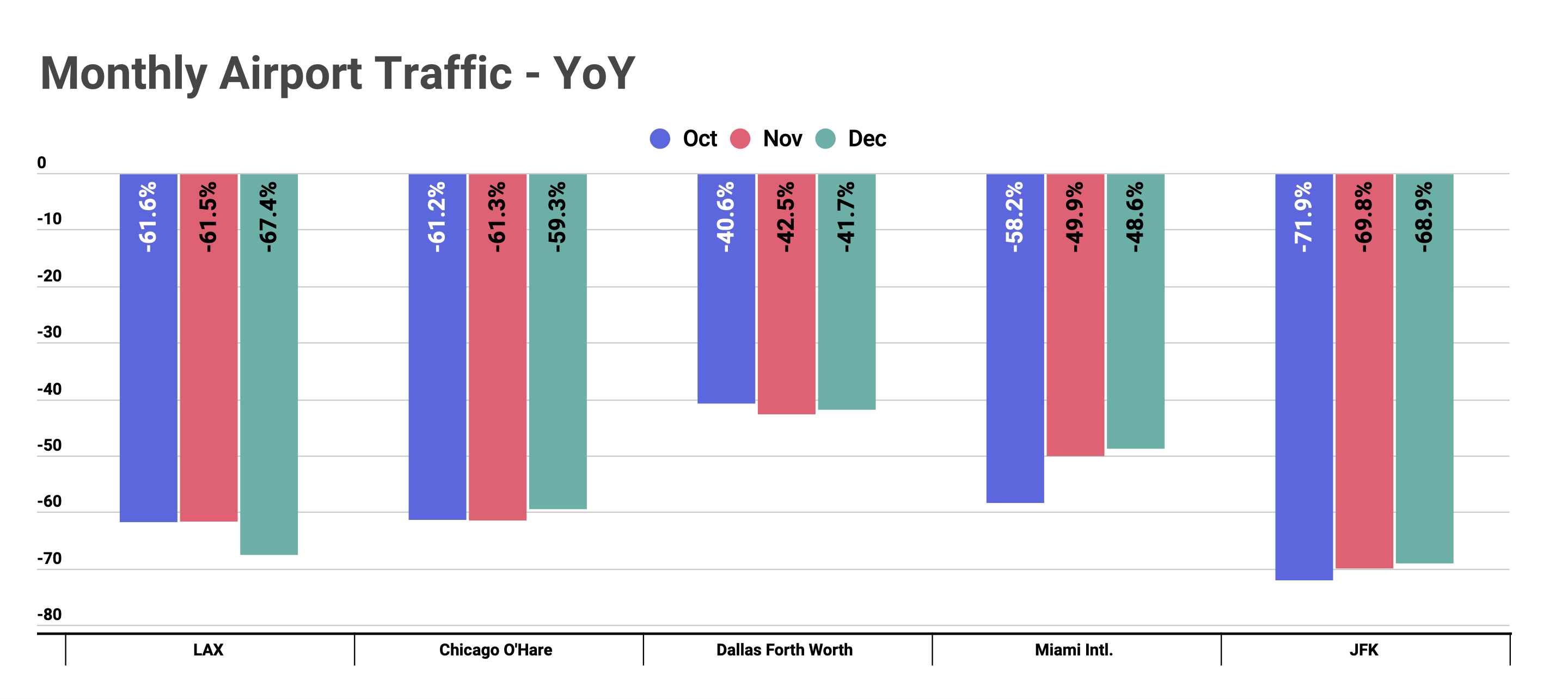

While showing signs of a recovery, overall airport traffic was still down significantly during the holiday season – one of the normal peaks for travel. When looking at October through December, we see traffic slowly recovering into the holiday months. Every airport except for LAX – unsurprisingly a city at the epicenter of the COVID resurgence – measured slight improvements in the year-over-year visit gap. Dallas Fort Worth International Airport saw visits closest to 2019 numbers, while monthly visits to JFK were still down an average of 70.2% year over year for the three months.

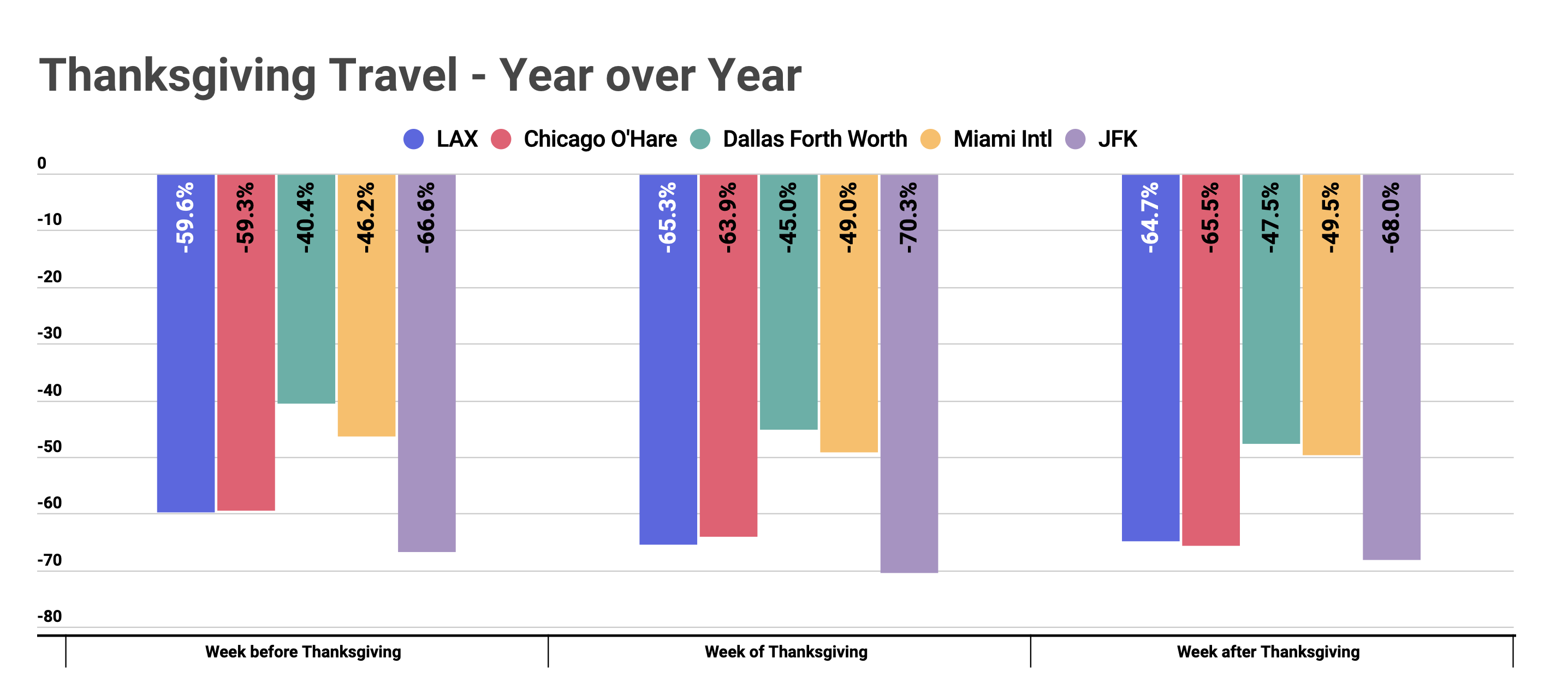

And when analyzing Thanksgiving travel, which typically drives heavy airport traffic, we see visits that still lagged far behind. Average visits for the airports were still down 58.7% for that week, slower than than the week prior to Thanksgiving, where weekly visits were down an average of 54.0% but slightly better than the week following Thanksgiving, where traffic was down 59.0%

Christmas Travel Bright Spot

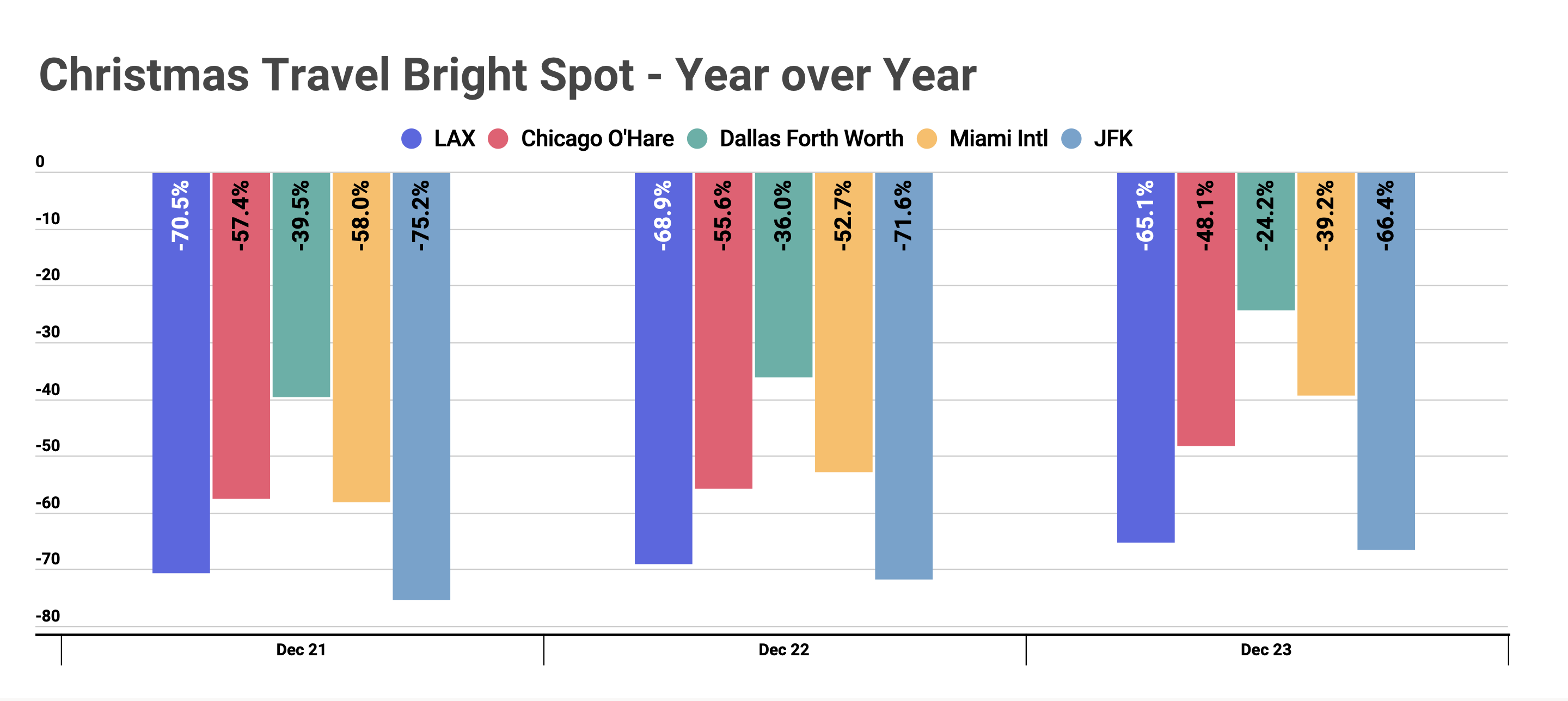

But, the one bright spot has to be Christmas travel. December 23rd, two days before Christmas has been dubbed the busiest time to travel around the holiday. So, we decided to take a deeper look into this day and the days leading up to it. When looking at year-over-year data for December 21st, 22nd and 23rd, we see that traffic on the 23rd was in fact the best trafficked day among the days for each airport.

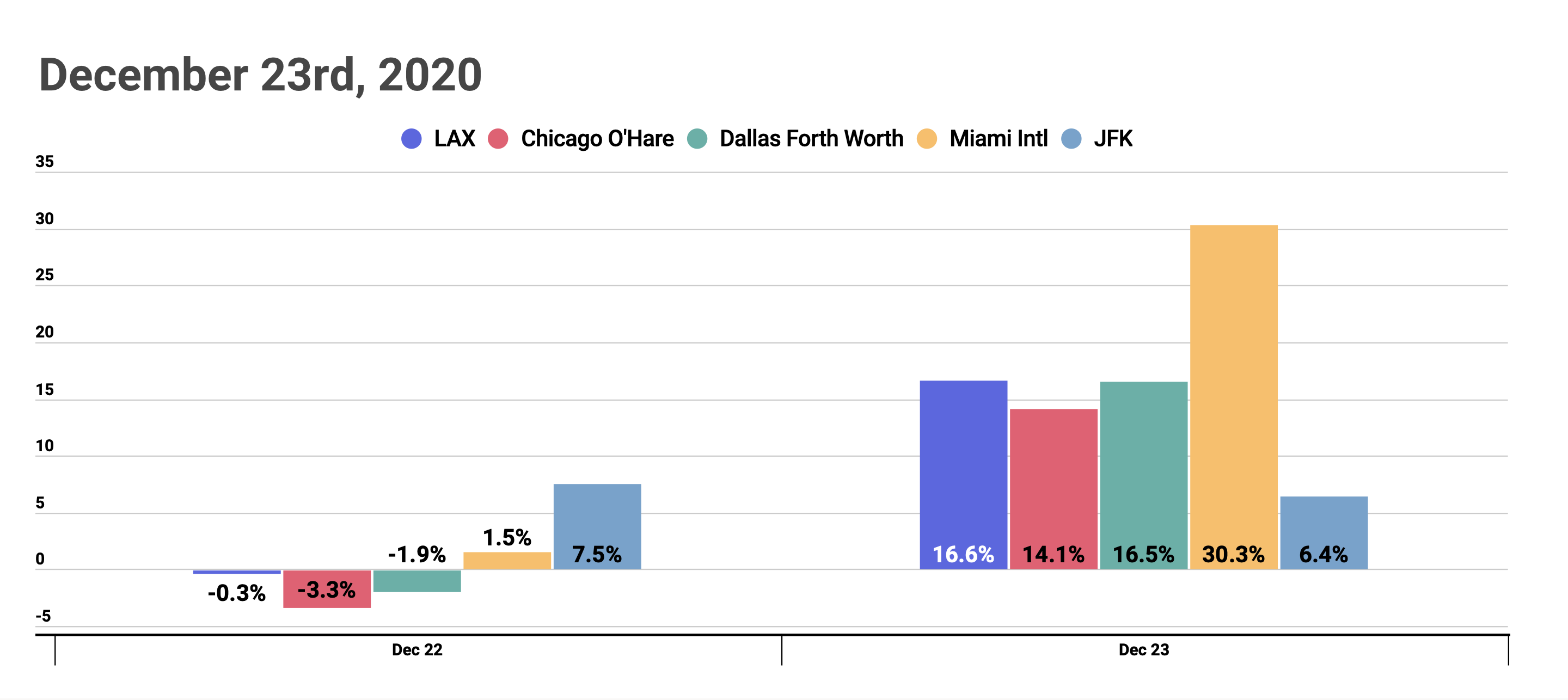

Traffic for DFW International Airport on Dec 22nd was down 36.0% and just 24.2% on December 23rd – a 12.2% jump closer to pre-COVID levels. And this pattern goes for all airports analyzed. Chicago O’Hare saw a similar leap toward 2019 numbers with traffic down just 48.1% for December 23rd, compared to 55.6% on December 22nd. And, if we look specifically at those days leading up to Christmas only for 2020, we see just how significant travel was on that particular day for 2020. Visits to these airports jumped massively, day-over-day. Most notably for Miami International Airport, whose visits jumped from 1.5% above on December 22nd to a staggering 30.3% above on the following day, December 23rd.

So, while airport traffic is still far from ‘normalcy,’ December 23rd remains supreme among holiday travel days.

What about Hotels?

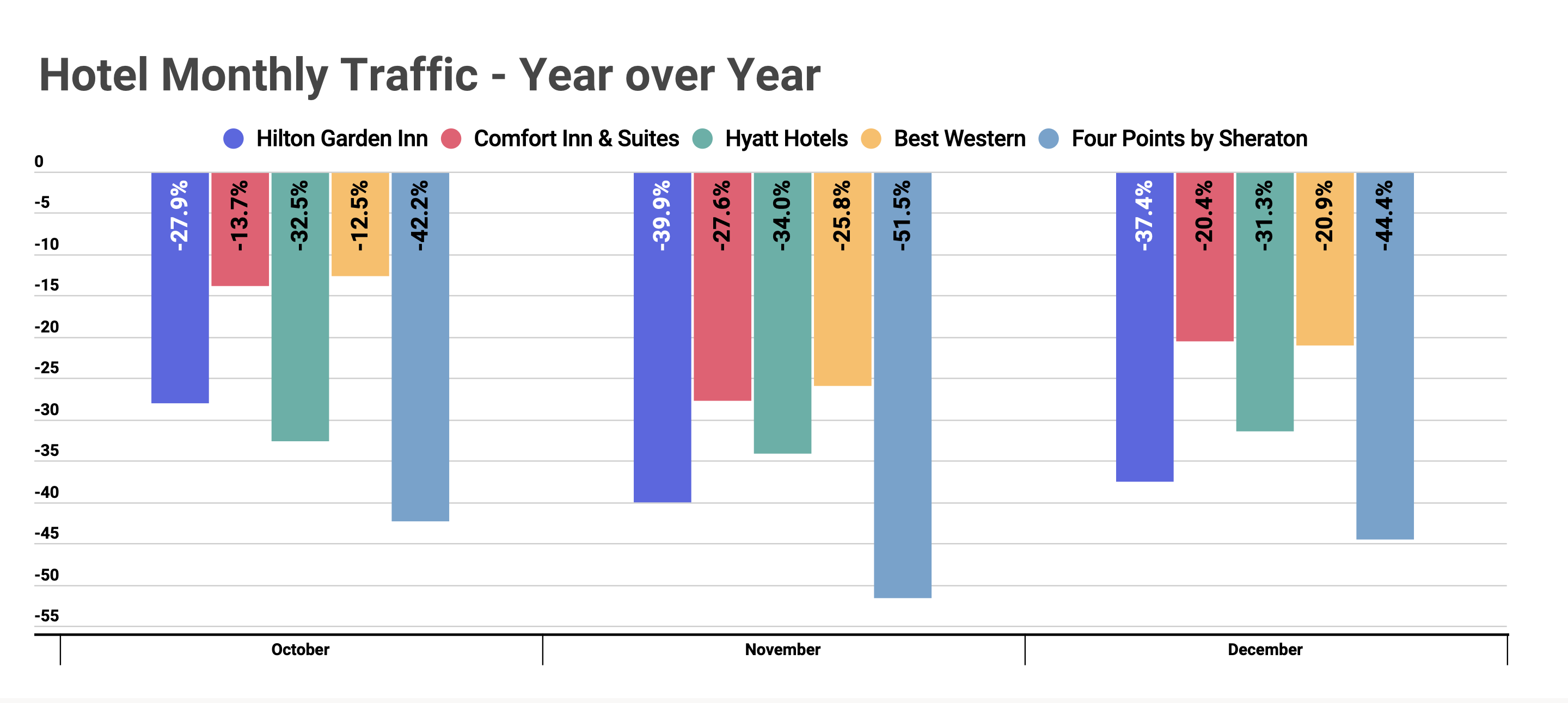

The overall travel industry took a hit during this pandemic, including hotels. And while the industry was seemingly bouncing back quite nicely, with average traffic down just 25.7% in October for the hotels analyzed, November fell a bit off pace.

Visits fell significantly from October to November for all hotel chains measured, but traffic returned quite nicely in December. Traffic to the Four Points by Sheraton jumped from 51.5% down to 44.4% down, and Comfort Inn and Suites also saw a big step toward normalcy with visits down just 20.4% in December, nearly 7.0% up from the month prior – speaking volumes for the December travel boost.

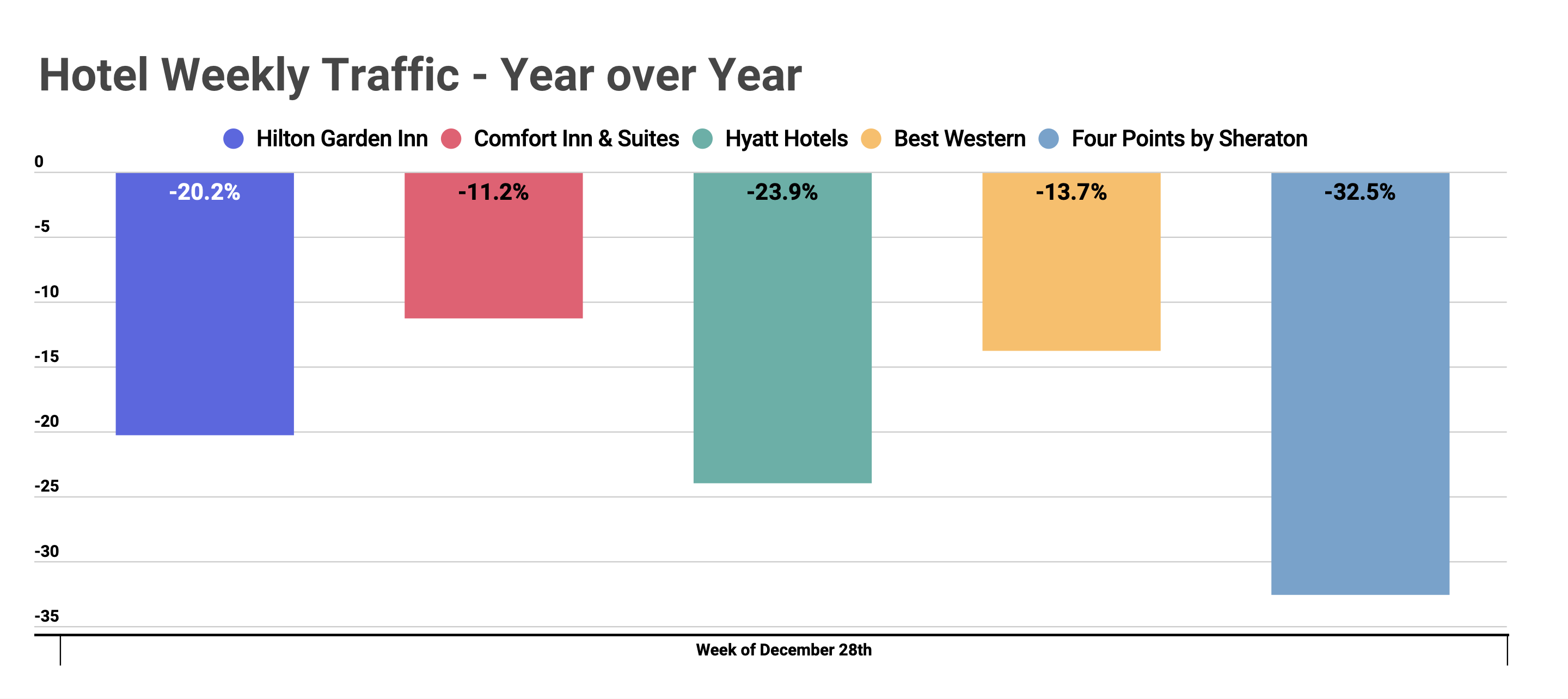

The final week of December, post-Christmas through the new year, also garnered impressive results for each hotel measured, generating one of their best-trafficked weeks since the start of the pandemic.

Takeaways

While airports and hotels seemingly slowed down across the holiday season, it’s not to say they won’t bounce back even stronger in 2021. When we last analyzed the travel industry these same airports and hotels were even farther away from 2019 levels. JFK was down nearly 90.0% in August, compared to December, where visits were down just 69.0%. And, the Best Western was down 21.0% in August compared to December where visits were down 13.7% – far closer to pre-COVID levels. So, even with COVID surging again in the states, airports and hotels, while still struggling are making leaps back to normalcy.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.