Our Quarterly Indexes are back! Make sure to check out our new format here. In our indexes, we analyze a large number of brands within a given sector to dive into the factors driving success for the wider category.

One of the sectors most heavily impacted by the pandemic was the fitness space. The inability to have large crowds indoors inherently limited the sector’s ability to reach its full offline potential. But Q4 was especially important because it marked the final point for analysis before an absolutely crucial Q1 – annually, the biggest quarter for fitness chains.

So, how is the sector trending?

Moving in the Right Direction

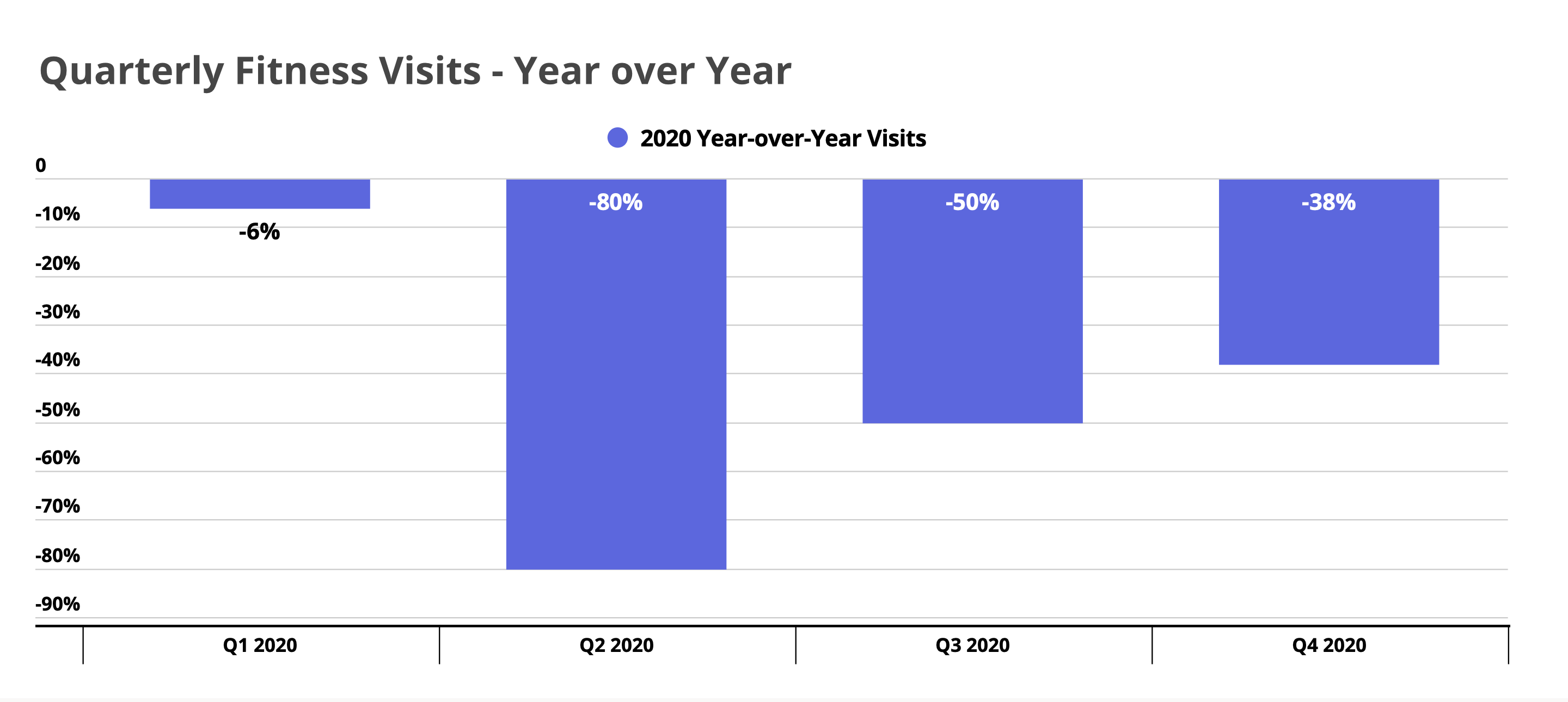

After seeing visits down 6% in Q1, the sector saw a near-total collapse with visits down for the group 80%. Yet, the progress since then has been significant, with visits down 50% in Q3 and 38% in Q4. Clearly, this is still a significant obstacle to overcome, but the magnitude of the decline is shrinking. It is also critical to remember that limits on visitor counts, lockdowns – even only partial – and concerns over COVID had a severe impact on this specific segment.

The Silver Lining – Visit Duration Gaps Shrinking

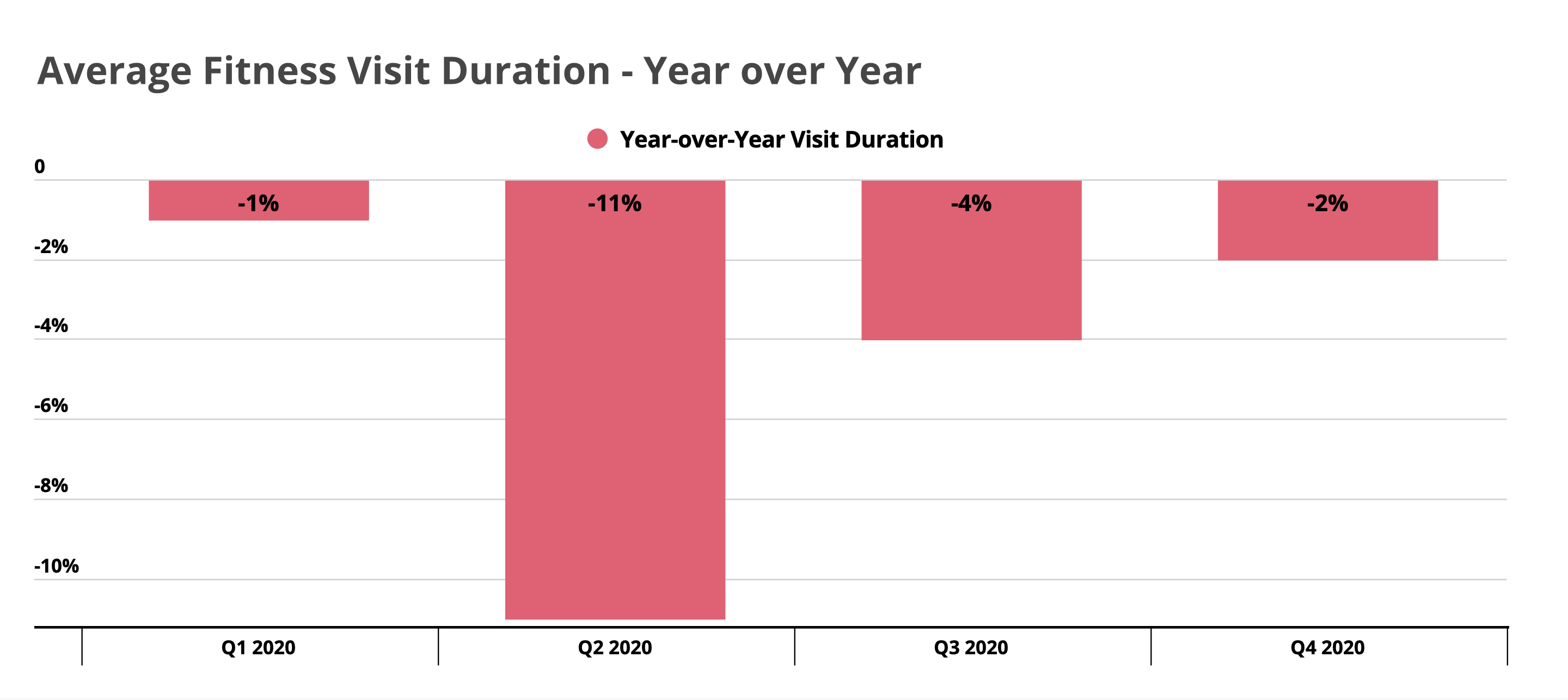

There has been a lot of talk around the renewed focus that the pandemic has placed on health and wellness. And there are some signs that the shift could offer a long-term benefit to the fitness sector. Visit duration for gym-goers was down 2% in Q4 year over year, after having been down 4% in Q3 and 11% in Q2.

This means that while visitors were coming less often, they were coming for more substantial visits. This provides a strong indication that the primary concern limiting visits is COVID and not a reduced affinity for the gym in and of itself. Even more, if this trend continues to hold as visit gaps shrink, it could suggest that there will be a resurgence for gyms capable of wooing back visitors.

The Brands to Watch

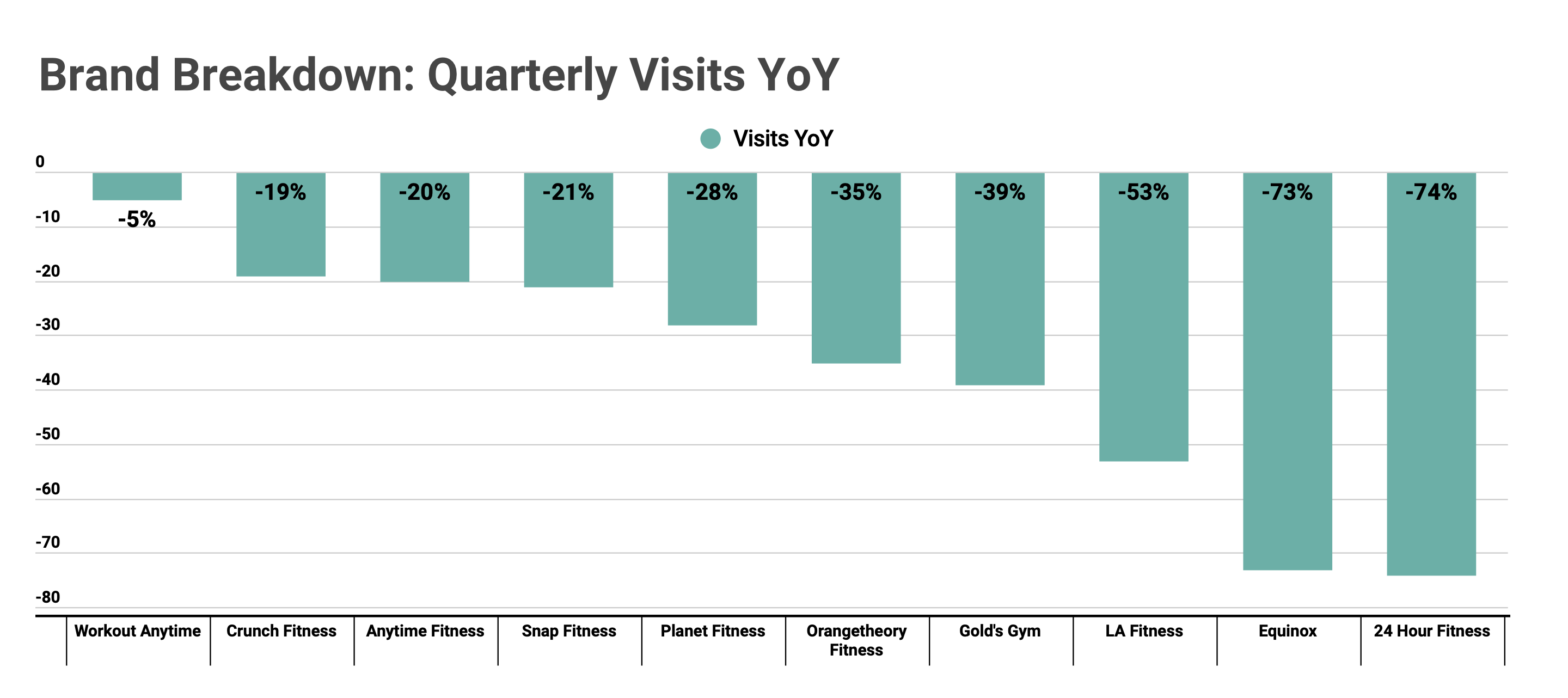

Another important element to analyze when looking at the wider fitness sector is just how large a gap exists between the respective recoveries of specific brands. Workout Anytime saw its visits down just 5% in Q4, while 24 Hour Fitness saw a reduction of 74% during that same period.

And different approaches could have very different results. Planet Fitness, one of the brands we expect to have very strong 2021, brings a value orientation that could be especially effective considering the wider economic uncertainty caused by the pandemic. On the other hand, brands with a more direct orientation towards cities could see their recovery efforts limited by an exodus from these cities, reductions in work commutes, and more students avoiding urban centers.

Conclusions

The pandemic presented a uniquely difficult situation for the fitness sector, which relies on large numbers of people being in the same place at the same time. Yet, there are real signs that the sector is recovering both in terms of the number of visits and the magnitude of visits.

But the sector is not homogenous. Brands that orient themselves towards the suburbs and are defined by a value orientation could have a significant advantage in the short term. Additionally, the wider struggles of some brands will likely present opportunities to those who are better oriented to the current environment.

Will the sector continue its recovery? Which brands will lead the way?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.