When lockdown orders went into effect during COVID-19, consumers increasingly turned to online retailers for necessities. For the beauty industry, this meant a renewed interest in beauty subscription boxes. DTC beauty box companies offer subscriptions (usually monthly or quarterly) and an additional ecommerce platform for purchasing beauty and makeup products. This analysis explores how the major beauty box players have changed over the past five years, as well as how sales and customer growth have been impacted by the pandemic.

Beauty subscription box sales remained elevated in 2020

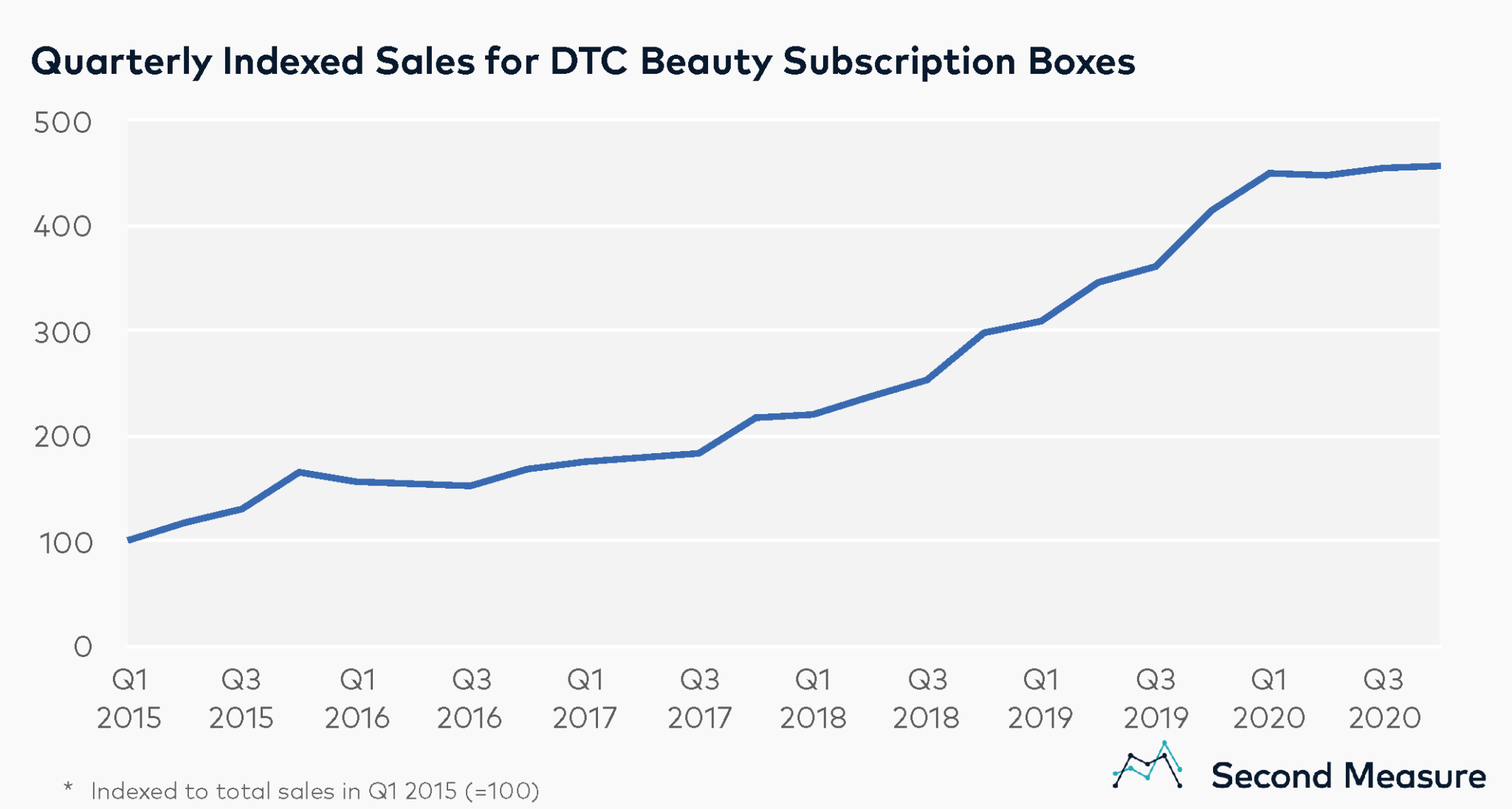

Since 2015, total sales for a chosen competitive set of subscription beauty and makeup boxes (Allure, Birchbox, BoxyCharm, FabFitFun, GlossyBox, and Ipsy) have more than quadrupled. While some brands reported an uptick in cancellations in March 2020, beauty box sales overall remained elevated throughout 2020. Early in the pandemic, several beauty boxes adjusted their offerings to include more personal care and wellness items, such as hand sanitizer and vitamins.

It is worth noting that beauty subscription boxes have some variation in their business models. For example, FabFitFun ships out every three months, while Birchbox, Ipsy, and BoxyCharm are on a monthly basis. Some boxes allow customers to pay per month, or for multiple months (3 months, 6 months, 12 months) up front. In addition, some beauty subscription boxes like FabFitFun and BoxyCharm offer a curated selection of full-size products, while others like Ipsy and Birchbox offer sample sizes of products instead.

FabFitFun has surpassed Ipsy to lead the pack

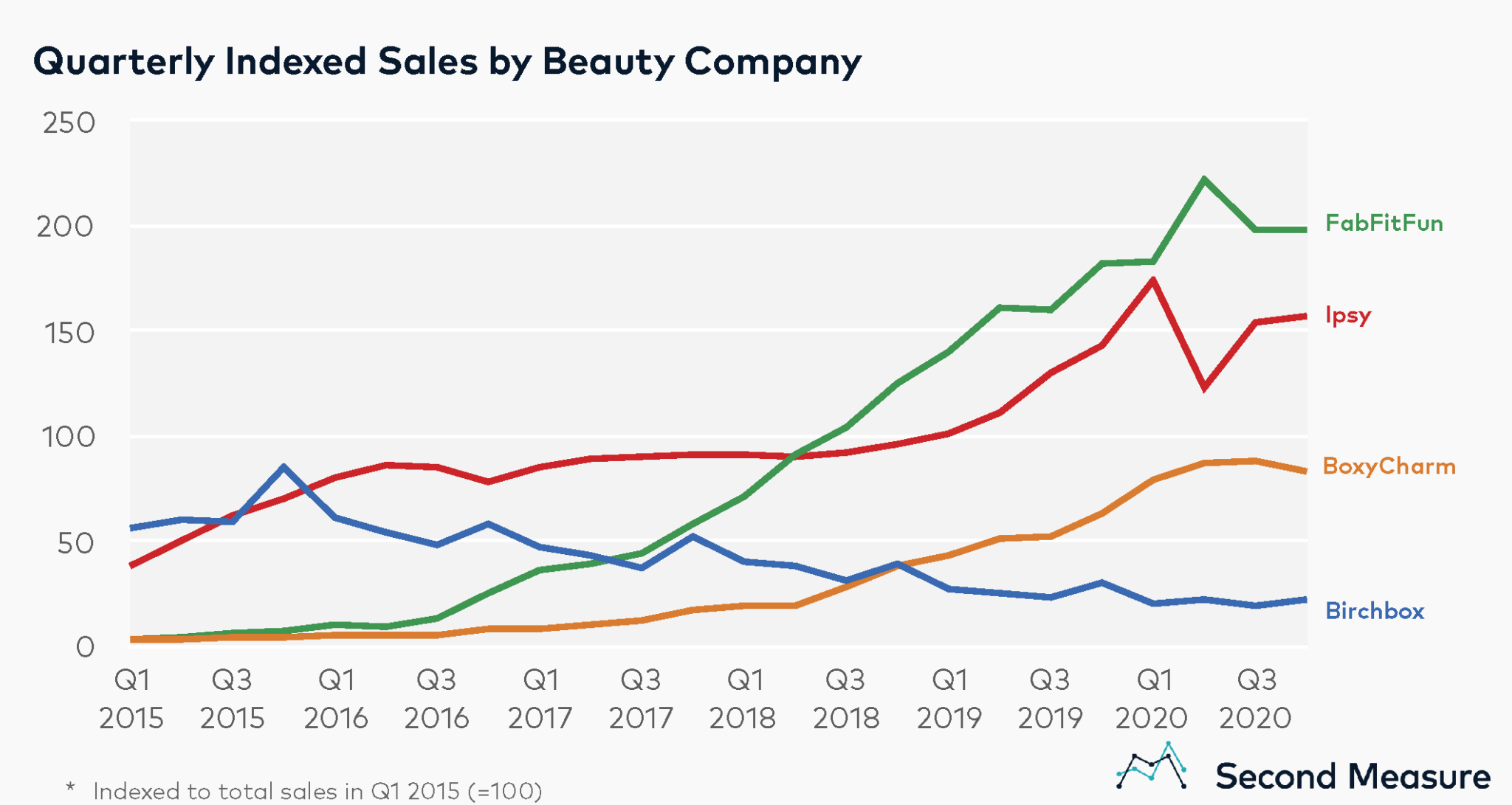

Although Birchbox, one of the first beauty boxes, was the industry leader through 2015, quarterly sales at Birchbox have been surpassed by FabFitFun, Ipsy, and BoxyCharm. Since 2018, FabFitFun has had the highest quarterly sales among this competitive set. Sales at FabFitFun have roughly tripled since Q1 2018 and peaked in Q2 2020, during the early months of the COVID-19 pandemic.

Among these four competitors, Ipsy experienced the most volatility as shelter-in-place orders went into effect. Taking a closer look at pandemic spending, Ipsy’s sales nearly doubled in March, before dropping to less than half of its pre-pandemic levels in April. By May, sales recovered and remained steady through the end of the year.

Notably, Ipsy and Birchbox, which primarily ship out sample sizes of beauty products, generate lower average transaction values than BoxyCharm and FabFitFun, which ship out full-size products. In Q4 2020, the average transaction value at Ipsy amounted to $17.86, compared to $78.85 at FabFitFun.

Ipsy boasts the most customers and highest customer retention

While FabFitFun has the highest sales among the competitive set as of Q4 2020, Ipsy has maintained the lead in terms of customer counts. The number of customers at Ipsy has remained relatively stable since 2017, with only slight declines in 2020. However, FabFitFun and BoxyCharm have been growing their customer bases, with BoxyCharm’s customer growth rate outpacing that of its competitors since Q4 2018.

Ipsy also has the highest customer retention in the competitive set. Among customers who made their first purchase at Ipsy in December 2019, 34 percent of customers made a repeat purchase 12 months later.

Other retailers have also experimented with beauty boxes

Some drugstores, big box retailers, and other beauty brands have experimented with beauty subscription boxes. Sephora previously offered the Play! beauty subscription box, which was retired in April 2020 and replaced with one-off sets of beauty products, known as “Sephora Favorites.” Macy’s and Walmart currently offer beauty subscription boxes, as well.

As more players enter the industry, consumers can choose from beauty subscription boxes at a variety of price points that specialize in clean beauty, offer full-size products rather than samples, or send products that also incorporate health and wellness products. With more choice than ever and the continued adoption of DTC subscriptions to fulfill needs during COVID-19, beauty boxes are becoming an integral part of consumers’ self-care routines.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.