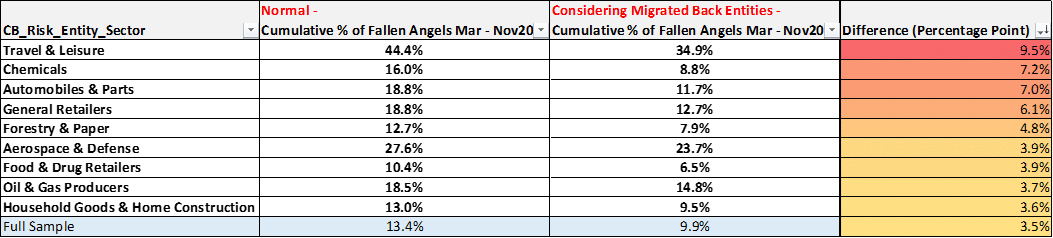

Few industries have been impacted more severely by the COVID-19 pandemic than Travel & Leisure. According to Credit Benchmark, which captures the credit risk views of over 40 of the world’s leading financial institutions, 44% of companies in the global Travel & Leisure sector fell from investment grade to high yield between March and November of 2020. That means the consensus credit risk scores for these so-called ‘fallen angels’ fell below the bbb- threshold at some point during the pandemic.

Today, however, nearly 10% of those ‘fallen angels’ have managed to claw their way back to investment grade status. As the chart below indicates, the Travel & Leisure sector has seen the largest migration back to investment grade status of any other sector. All told, of the 189 companies included in the Credit Benchmark Travel & Leisure aggregate, 84 companies have earned the ‘fallen angel’ distinction over the course of this year, but 18 of those have recovered, leaving the current number of ‘fallen angels’ in the sector at 66, representing roughly 35% of the sector.

RECOVERED FALLEN ANGELS

While that is still far from a rosy credit quality outlook for the sector, the number of Travel & Leisure companies that have bounced-back to investment grade status suggests that some of the downgrade activity that occurred throughout the pandemic may have been premature.

Overall, across all sectors tracked by Credit Benchmark, 13.4% of firms in the sample have been classified as ‘fallen angels’, and just 3.5% have migrated back to investment grade.

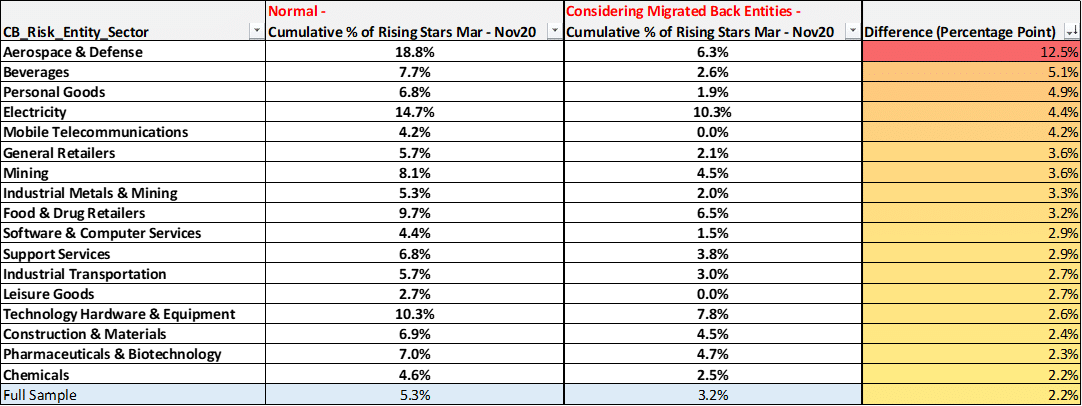

On the flip side of this equation, Credit Benchmark has also tracked ‘rising stars’, or firms that have seen their consensus credit scores move from high yield to investment grade. Within this group the aerospace and defense sector stands out for having a number of constituents climb into investment grade during the pandemic, only to fall back into high yield territory again.

As the chart below indicates, 18.8% of firms in the aerospace and defense sector rose from high yield to investment grade between March and November of 2020, but 12.5% of them have since been downgraded again.

SPUTTERING RISING STARS

Across all industries, 5.3% of firms have been labelled ‘rising stars’, and 3.2% still hold this status. The net between the two indicates 2.2% of firms may have been prematurely upgraded.

With COVID-19 cases continuing to surge globally and geopolitical volatility mounting, these numbers are likely to see further dramatic shifts in the coming months. We will be monitoring this data monthly.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.