In this Placer Bytes, we dive into the Q4 performances of McDonald’s and Whole Foods and one element that prepared Amazon for a stellar Q4.

McDonald’s – The Rich Getting Richer

McDonald’s is among the best-positioned brands in 2021 with a high value offering that should be particularly appealing in a year likely to be defined by continued economic uncertainty. Even more, it has the mechanisms in place to thrive even without sit-down visits with strength in drive-thru, takeaway, and delivery.

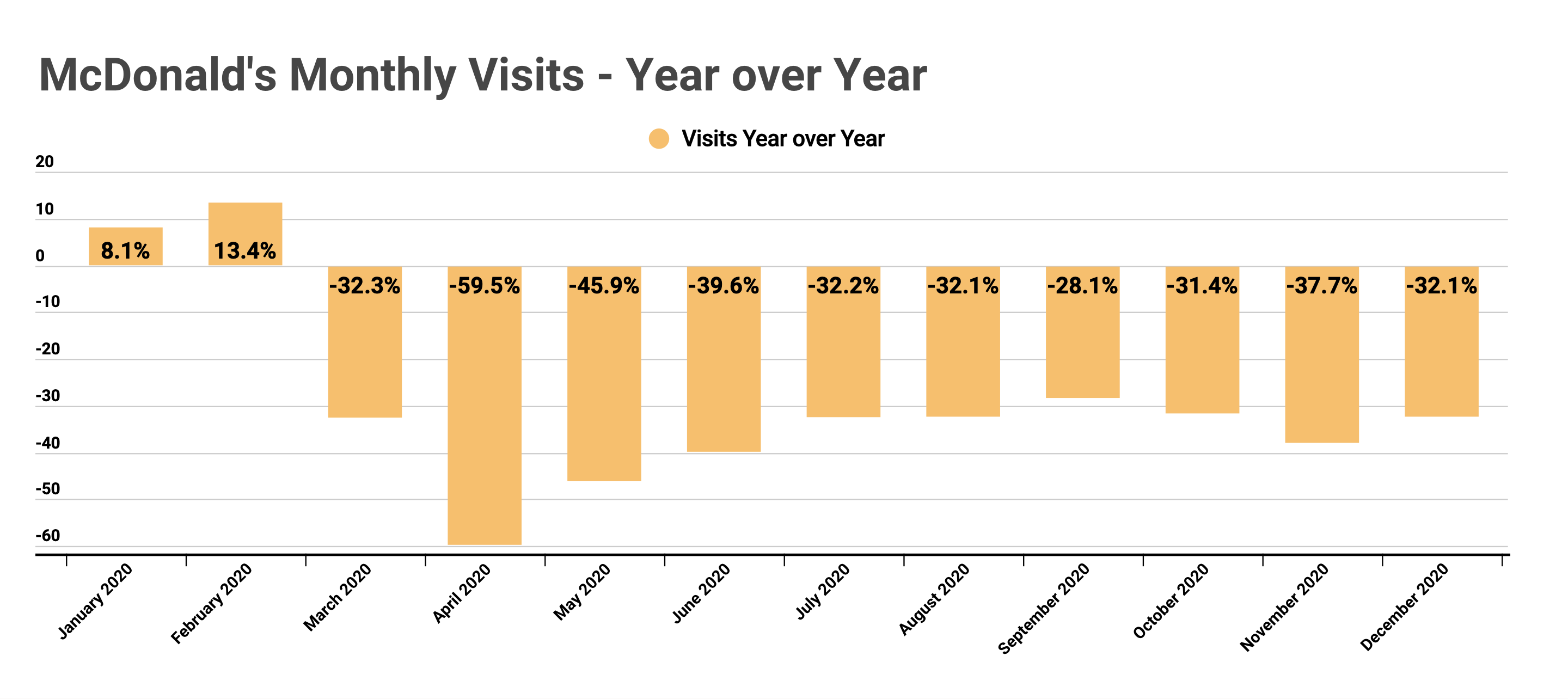

But even with all of these factors working in its favor, more good news is on the way. After seeing the visit decline gap increase in November to 37.7% year over year, something most retailers saw as COVID surged, the December numbers were already back in line with October visits.

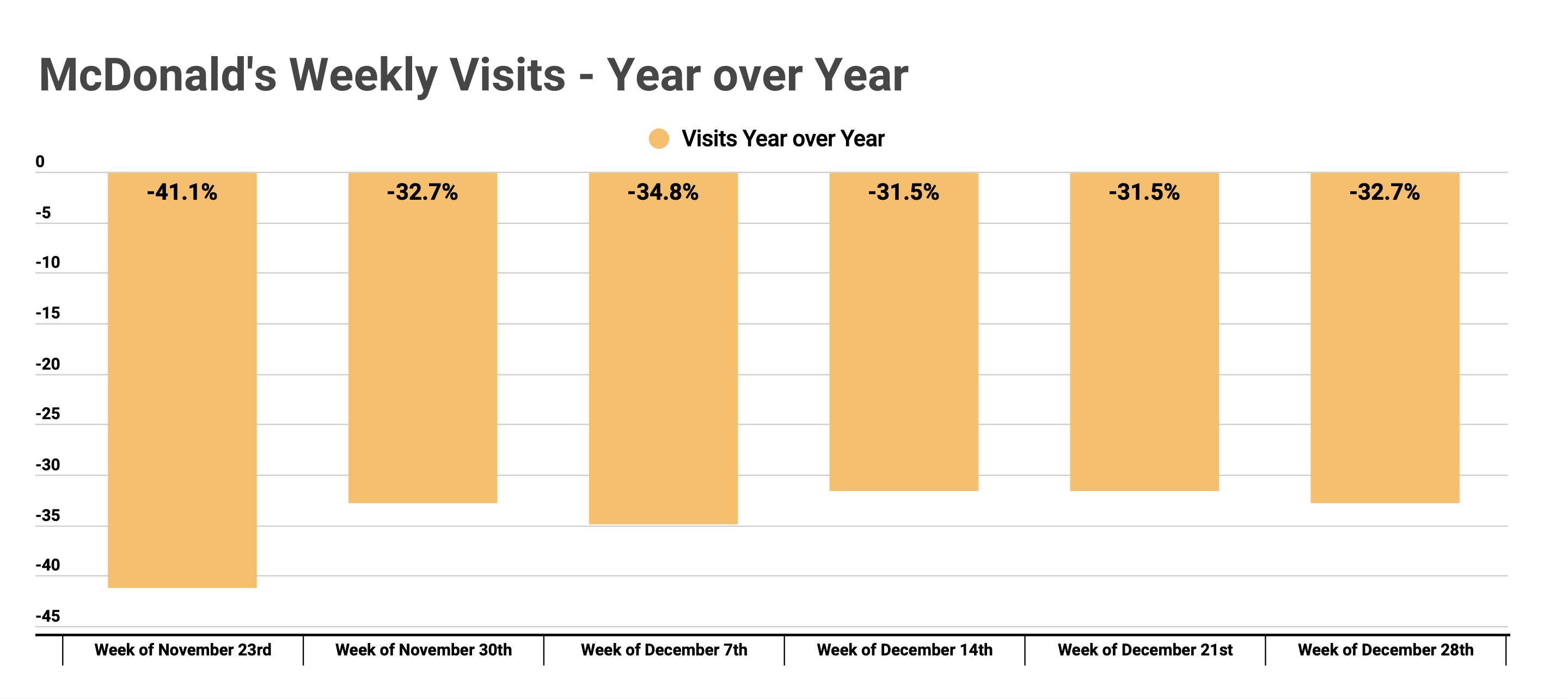

Weekly visits showed the recovery with even greater clarity. After seeing visits down as much as 41.1% year over year the week of November 23rd, the weeks of December 14th, 21st, and 28th down just 31.5%, 31.5%, and 32.7% respectively.

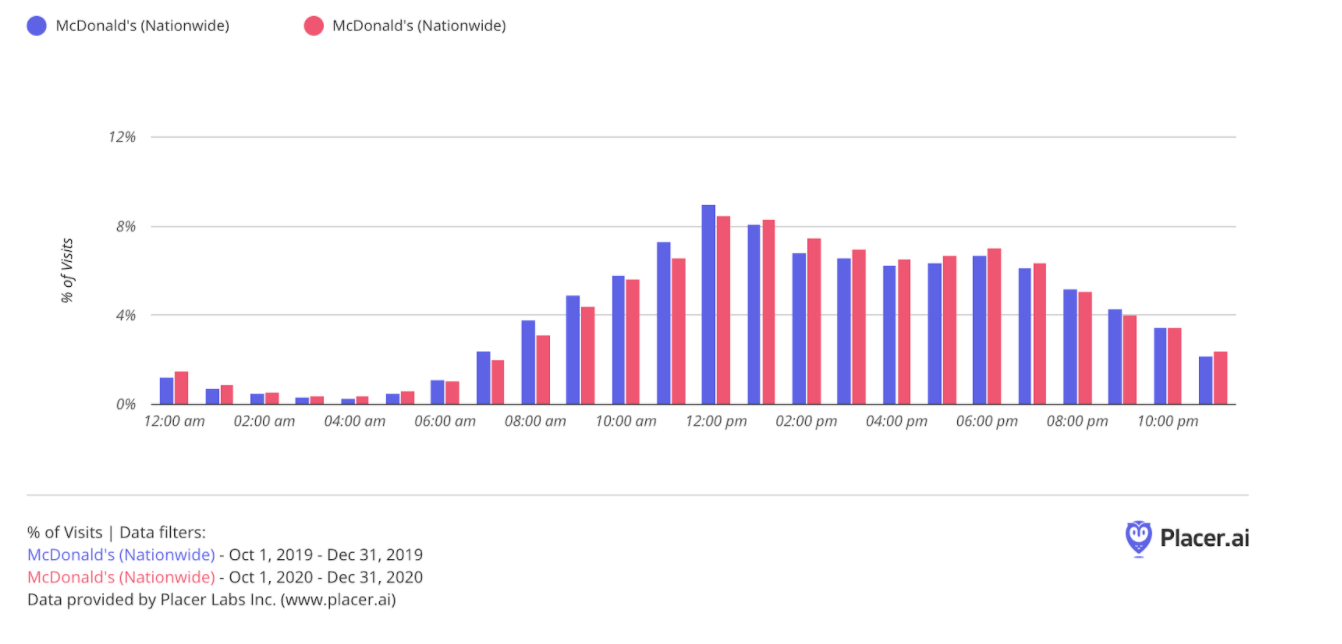

And we are still seeing McDonald’s operate without one of its core strengths – morning visits. Declines in normal work and school routines have led to a strong decline in morning visits. In Q4 2019, visits between 6 – 10 AM amounted to 12.2% of the brand’s daily visits, a number that dropped to 10.6% in 2020. Considering the massive scale of McDonald’s, this is a huge amount of visits being left behind. If the brand proves capable of continuing its visit rebound, while sustaining delivery and drive-thru strength and closing even some of the morning visit gap – the company could be poised for a huge 2021.

Amazon & Whole Foods

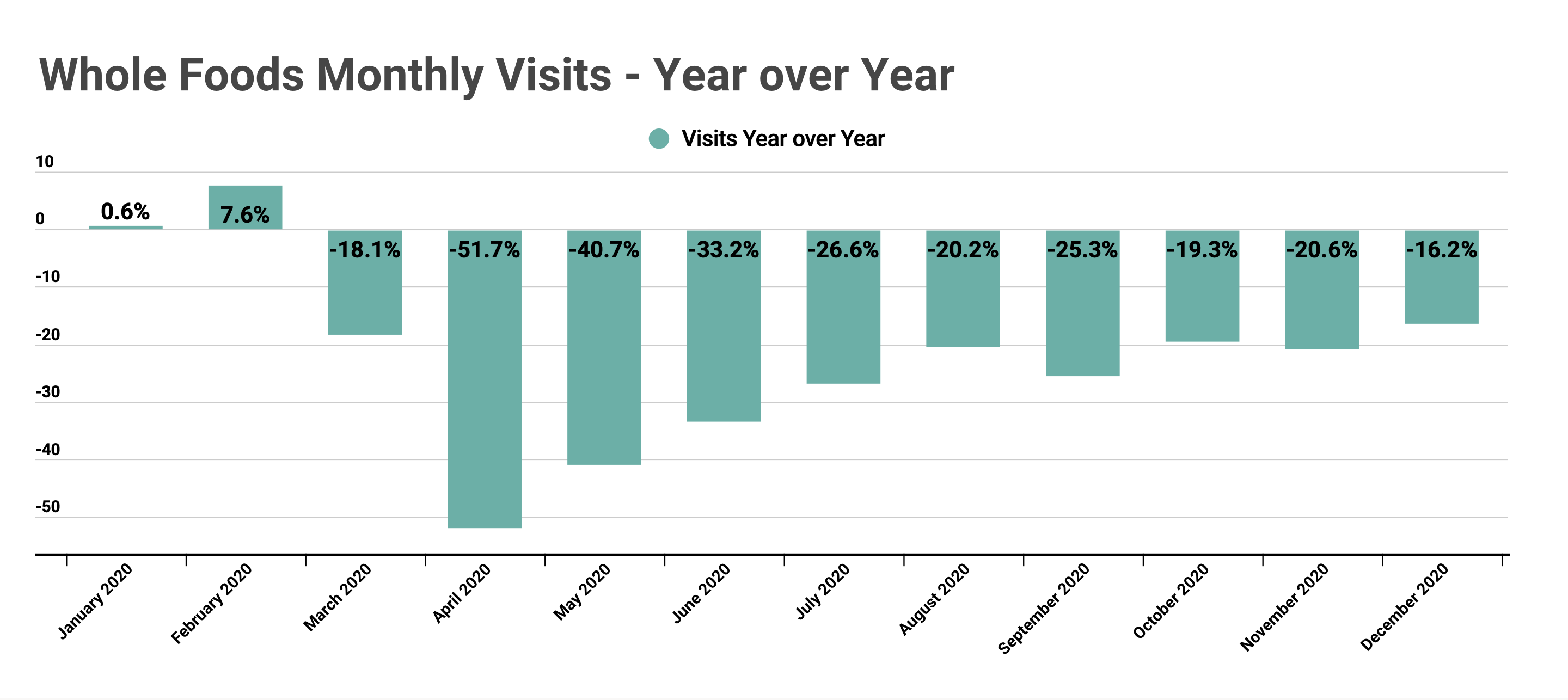

In a thriving sector like grocery, Whole Foods was among the few to face real and tangible struggles. The approach that gave it strength, a focus on urban areas and high-end products, turned into a significant obstacle as the pandemic raged. Yet, the brand had an impressive end to 2020, watching average monthly visits go from down 24.1% year over in Q3 to down 18.7% in Q4. This included a final month where visits were down just 16.2% year over year, the best mark the brand achieved since February.

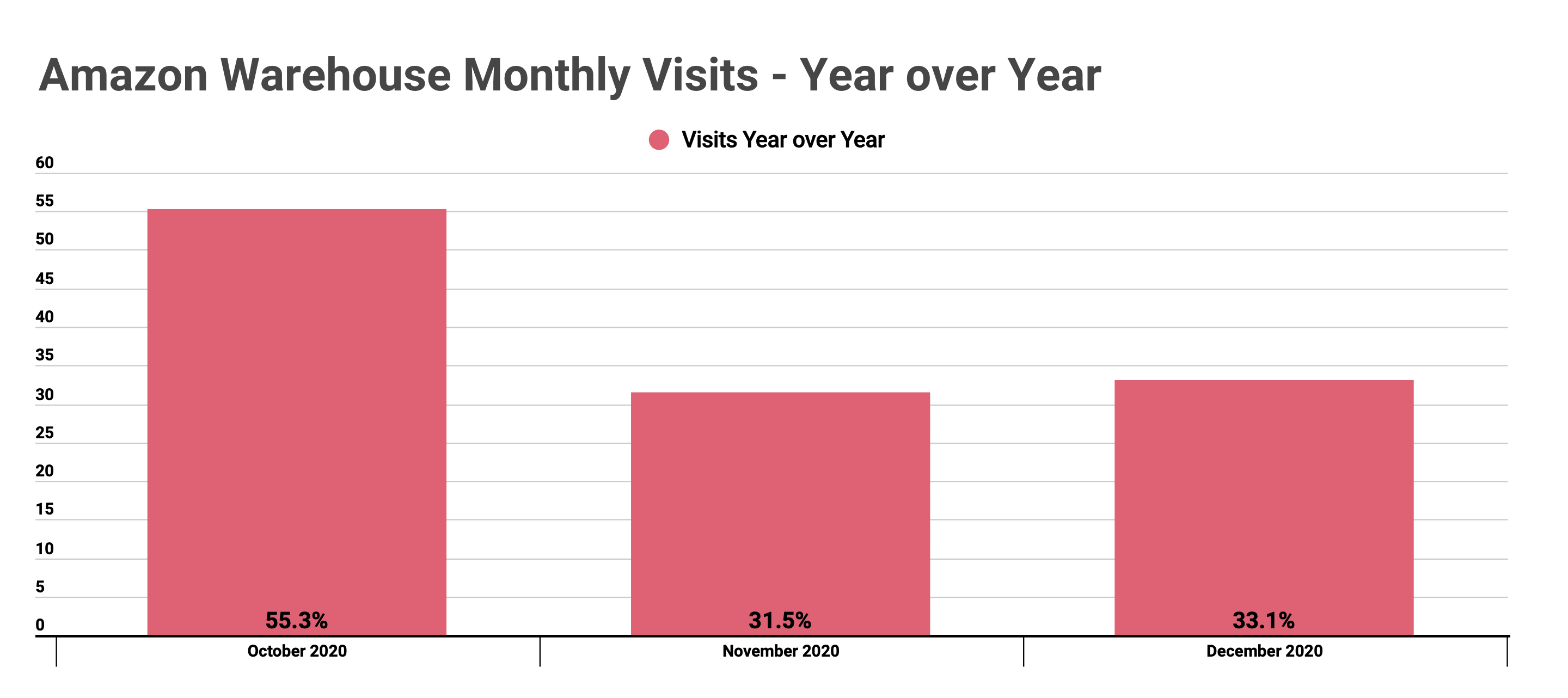

And a Whole Foods rebound wasn’t the only positive Amazon saw in Q4. Over the holidays, the brand delivered a record-breaking number of packages. How? By being exceptionally well prepared for the surge they were going to see. Visits to Amazon warehouses surged 55.3% in October, 31.5% in November, and 33.1% in December. These year-over-year increases mark a clear strategy by the brand to stay ahead of the huge online ordering demand that was exacerbated by the pandemic. Notably, October likely saw the biggest rise because in 2020 it hosted Prime Day, when that would normally take place in July. Ultimately, it shows just how focused Amazon was on maximizing the opportunity in front of it, something that continues to set the eCommerce giant apart.

Can McDonald’s dominate 2021? Will the Whole Foods recovery pick up pace?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.