Last year was a dismal year for travel. But as vaccines and other safety measures roll out, change is already happening.

Whether it’s cycling trips to tour sites important to the Civil Rights movement or an overdue visit to see grandparents, travel will be a meaningful part of 2021.

As the industry recovers, advertisers can provide answers to the question at the top of many consumers’ minds: where to next?

It’s Been A Year Since The First Major Lockdown, And People Are Restless

It’s been a year since Wuhan went into lockdown, placing strict limits on the movement of 11 million people between January and April. As the ripple effects spread across the world, the US experienced the greatest economic downturn since the Great Depression.

However, it’s not news that the public health crisis hurt certain industries more than others.

The travel and hospitality sectors plummeted as people were ordered to stay home and popular destinations were temporarily shut down.

While traveling was off limits, too expensive, or too risky in 2020, many have high hopes for 2021. Widely-available rapid tests and the approval of vaccines have made travel safer.

“The availability of vaccines and testing will get people comfortable with traveling,” Raymond James airline analyst Savanthi Syth explained. “You’ll see the leisure and the visiting friends and relative travel should come back, relatively quickly.”

Syth expects a 70-80% return in leisure airline travel this summer, when last year, travel was down by 50%.

As quarantine regulations loosen and restless travelers gain confidence, airlines will see their passengers board again.

China as a Case Study

In many ways, the US can expect to see travel trends follow those that played out in China.

Primarily, this means that domestic travel will begin to increase before international travel.

During China’s “golden week,” which occurred the first week of October in 2020 and included two separate Chinese holidays, more than 637 million people traveled domestically, generating approximately $68.6 billion in tourism revenue according to the Chinese government.

Of course, China put different safety measures in place to make this possible. But urgent vaccine distribution will now enable growth in American economic and travel activity.

This uptick of domestic travel can already be seen in the US. Online travel and booking websites are experiencing an increase in searches, and the industry expects to see a shortage of available vacation rentals in the summer of 2021.

International travel, however, could be much slower to bounce back as countries deal with the pandemic differently and at varying rates. Currently, international travel is down 70% from this time last year. Many countries have closed their borders to Americans, and the US is now requiring negative COVID tests for those entering the country from abroad.

Experts are citing China’s uptick in domestic travel as a sign that the public is ready to travel again, and will fill that desire with domestic travel while international travel is limited. They also point to this travel boom as an indicator that the tourism market will bounce back sooner rather than later.

2021 Advertising Insight for the Travel Industry

As the public begins to feel safer, travel-related brands can have more confidence in their advertising investments.

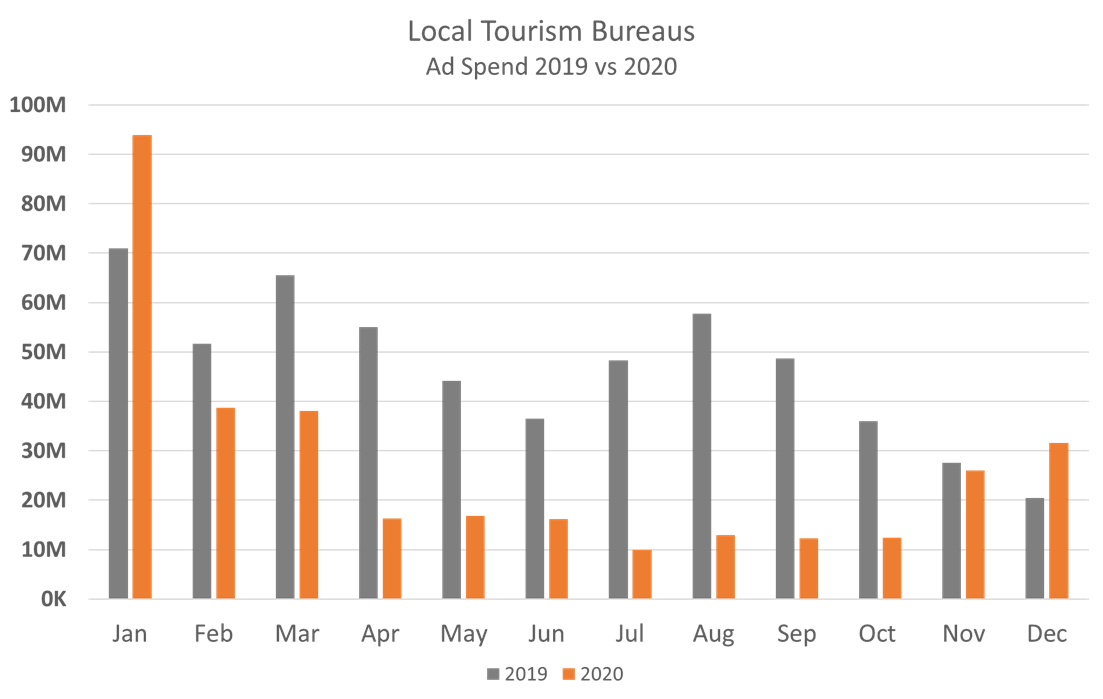

The trend towards domestic tourism and travel means more opportunities for local tourism bureaus to appeal to their own communities. In January of 2020, local tourism saw healthy YoY increase. Once the pandemic struck, these numbers plummeted and regional tourism was down 44%.

By December, these numbers were already improving, with regional tourism seeing a 54% increase in YoY spending for the month of December.

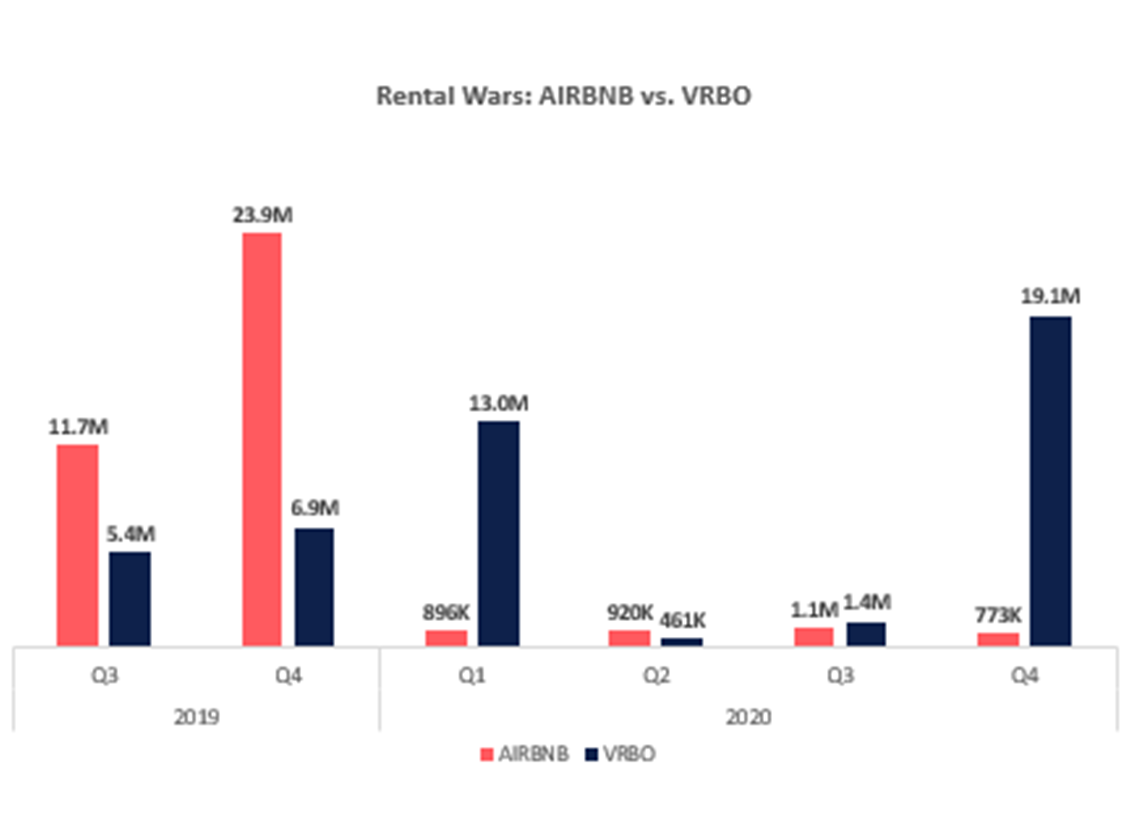

When it comes to local tourism, Airbnb is one of the biggest providers of giving a more ‘local’ experience to domestic travelers.

Yet, Airbnb was one of many travel companies to decrease their advertising presence last year. They cut advertising costs from $1.18 billion in the first three quarters of 2019, to $545.5 million in 2020. Meanwhile, Vrbo, a key competitor, took advantage of their competitor’s absence to increase spending. The company outspent Airbnb 10:1.

Amid the increased spending from their primary competitor, and the new pressures that come with being a public company, we predict AIRBNB ad dollars will return in 2021.

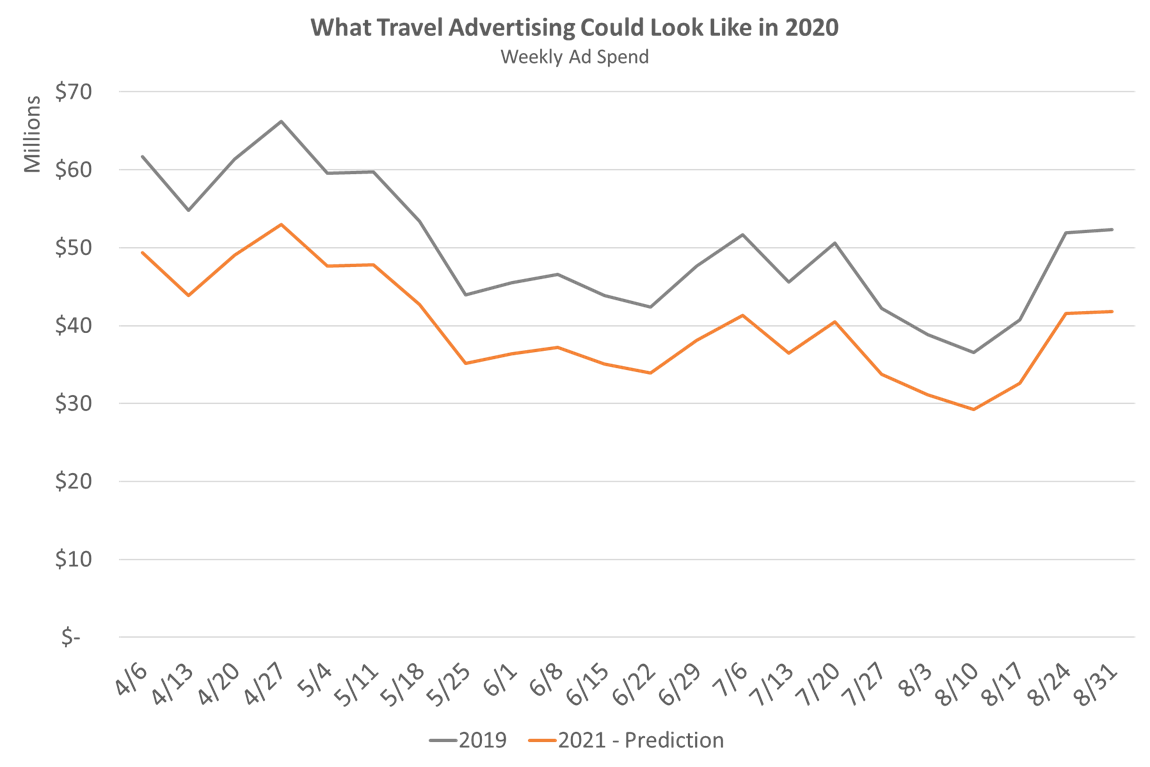

As consumer get more comfortable, we expect to see an overall return in dollars. However, the return won’t be immediate or complete.

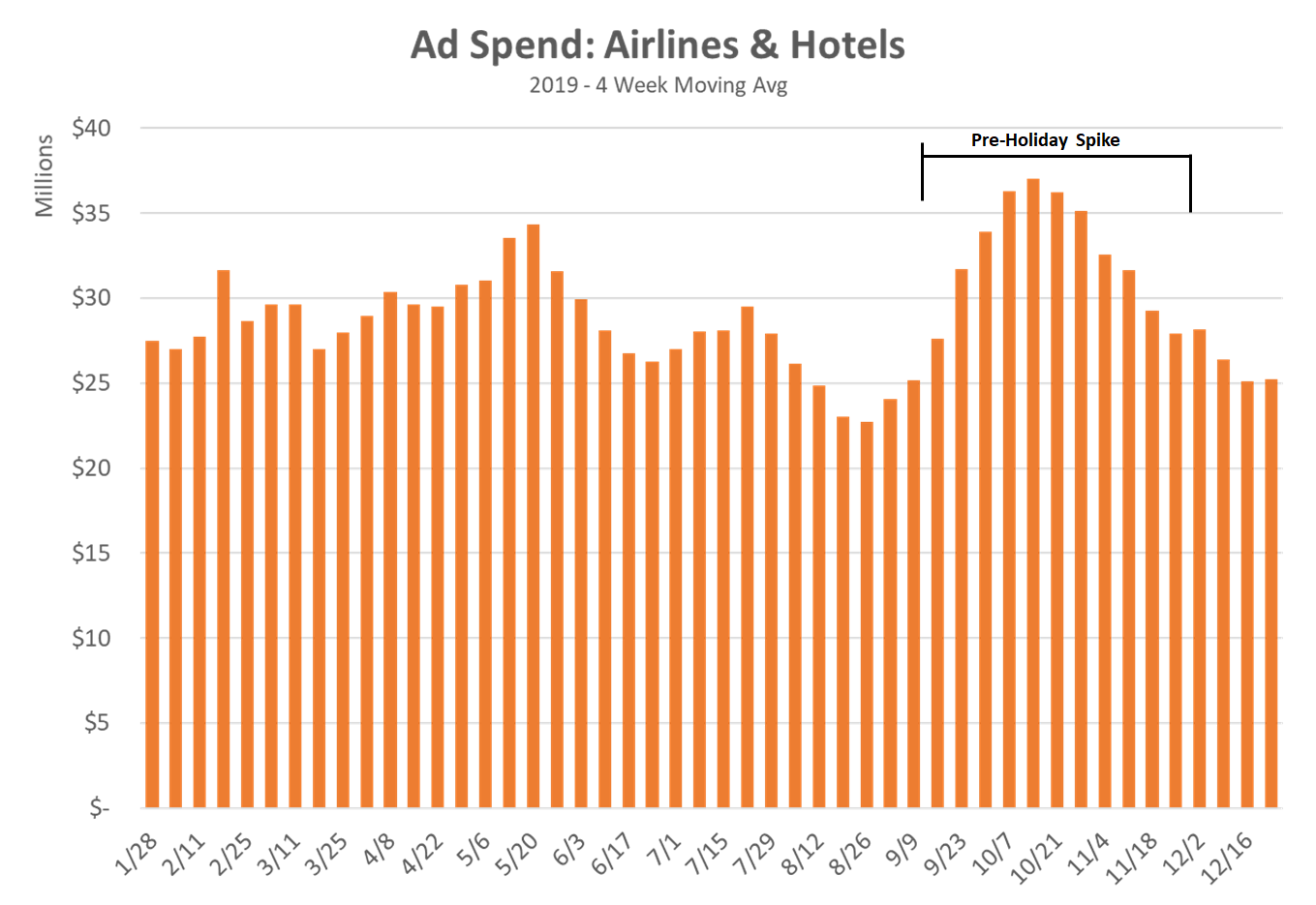

As seen in the 2019 airline and hotel numbers, travel brands’ spending tends to peak in the fall as travelers look ahead to the holiday season. In 2020, spend during the peak season was still down 65% YoY.

Because the peak spending time is later in the year, this gives advertisers more time for the population to be vaccinated. If a large portion of the population is vaccinated by the fall, the world could return to normal in time for their peak spending months. Brands would likely spend closer to their normal levels.

However, when taking into all the companies and sub-categories of the travel industry, we don’t expect a full recovery of ad spending in 2021, even if consumers are experiencing a collective restlessness.

Just as Syth expects a 70-80% return in leisure airline travel this summer, we expect similar patterns in advertising spend this year. However, as the vaccine is distributed, the gap between spending levels could become smaller. We’ll continue monitoring how companies respond to consumers who are ready to go somewhere new.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.