In this Placer Bytes, we dive into Tractor Supply’s success and analyze what’s hurting IKEA.

Tractor Supply Continues to Rise

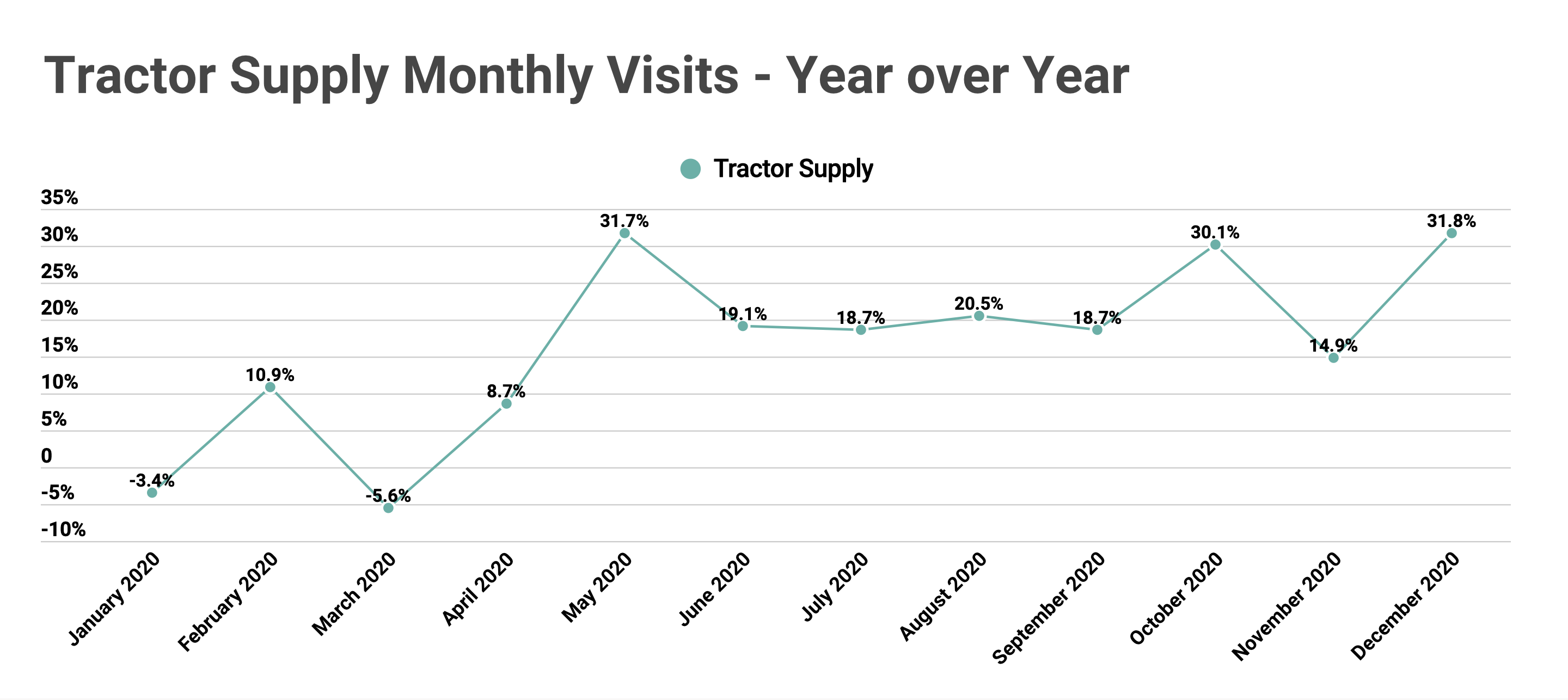

While Home Depot and Lowe’s get the bulk of the attention for the home improvement surge, one brand that has matched their impressive runs is Tractor Supply. The company has seen a huge surge since the onset of the pandemic, and the company seemingly got stronger as the year progressed. Visits in October, November, and December were up 30.1%, 14.9%, and 31.8% year over year, with the latter marking the highest year-over-year mark for the brand in 2020. This marked a powerful end to a year where the average month saw visits up 16.3% year over year even with January and March showing year over year visit declines.

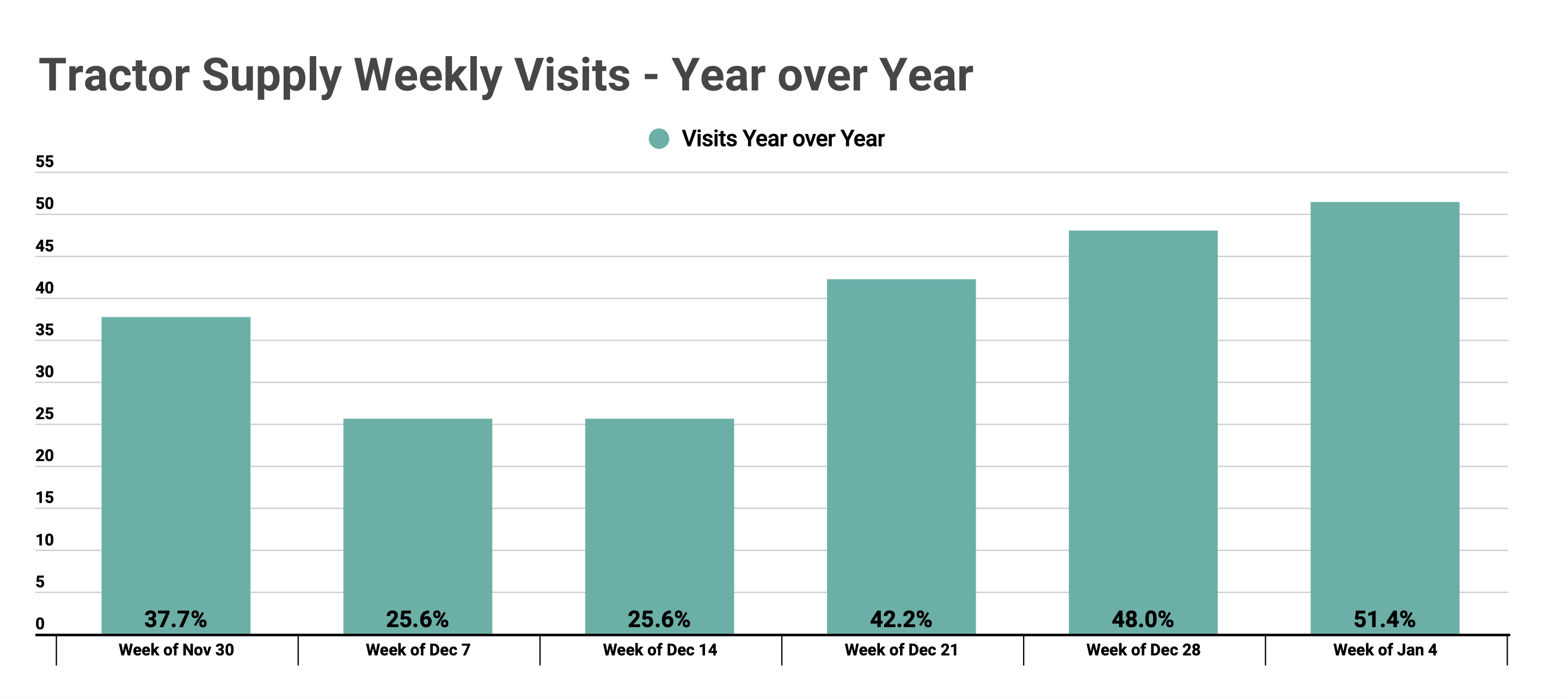

And the end of year push is even more impressive when analyzing it at a weekly level. Visits to Tractor Supply locations were up 42.2%, 48.0%, and 51.4% the weeks beginning December 21st, 28th, and January 4th. This means that not only did Tractor Supply see a huge traffic jump heading into the year’s end, but this increase continued into the new year. And this could have wider industry ramifications.

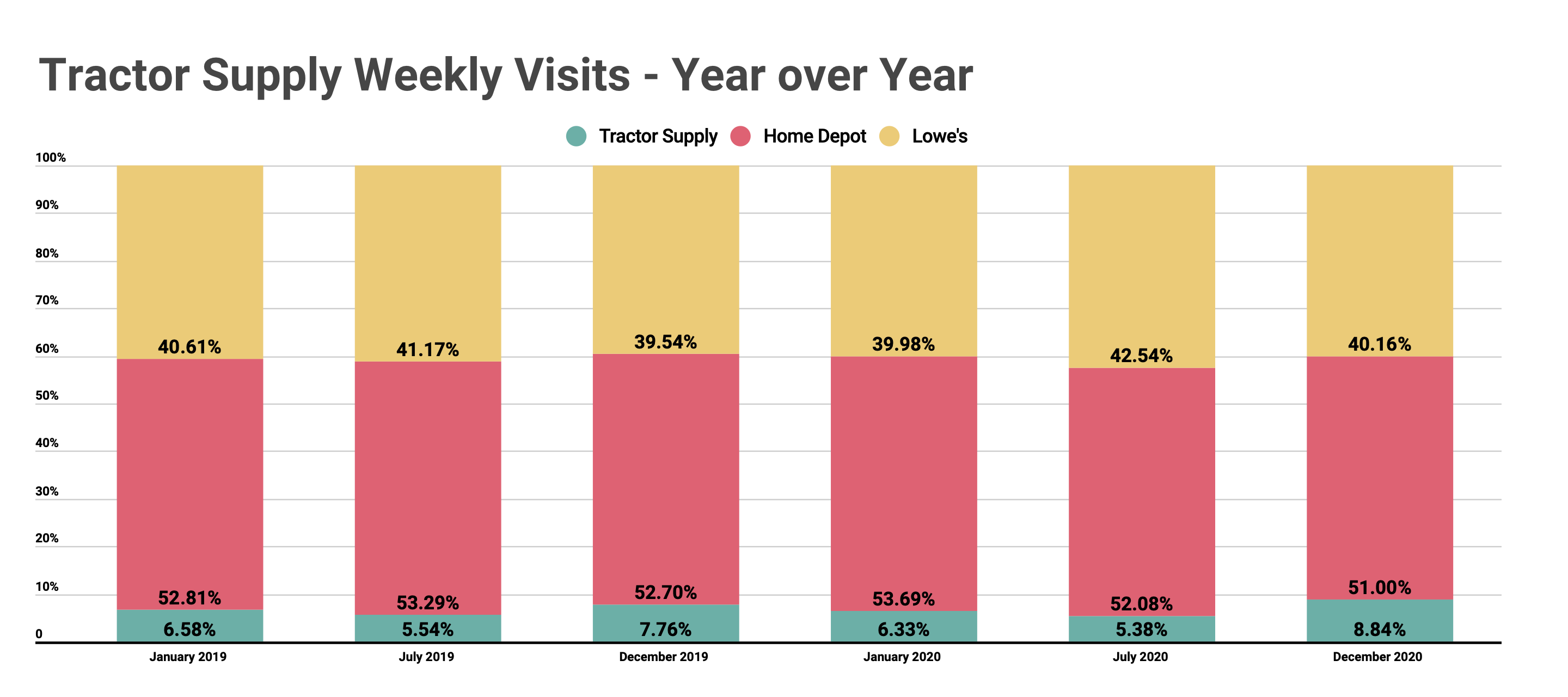

While Tractor Supply saw strong growth throughout the year, it failed to dent the overall visit share when compared with industry giants Home Depot and Lowe’s. Yet, December may mark an important turning point. While both January and July saw lower visit share for Tractor Supply compared to these home improvement leaders, December saw the brand cut into that gap. Clearly, the two larger players still have a sizable advantage, but it does serve as a powerful indication that Tractor Supply could have a higher upside than previously thought.

IKEA

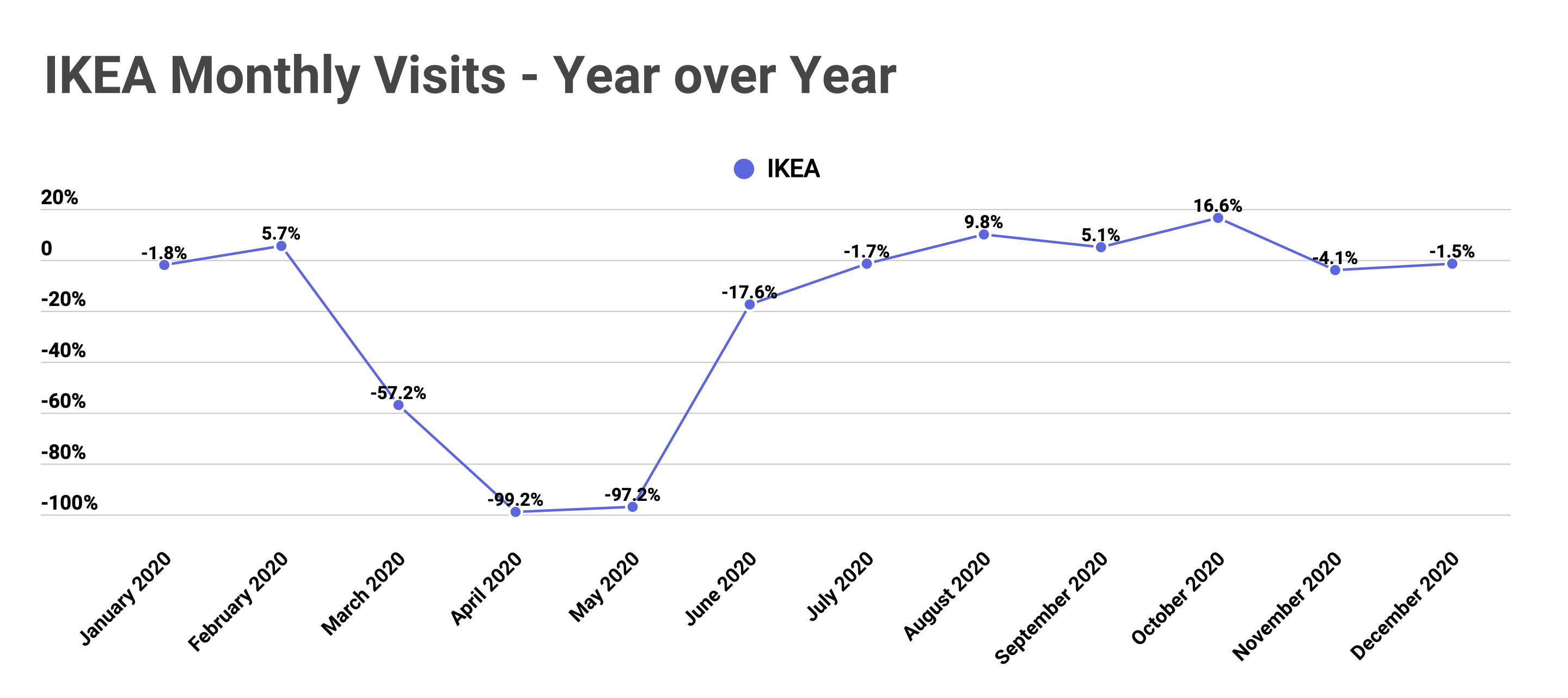

IKEA is a challenging brand to analyze. They saw a major dip in visits early on in the pandemic and were still seeing year over year visit gaps in June and July. Then the brand saw a sharp change with visits up 9.8% in August, 5.1% in September, and 16.6% in October. At the time, it seemed like IKEA had found a new level of performance, and the company was joining other home goods and home improvement players in the realm of ongoing growth.

But, just as quickly, visits turned back to year-over-year declines. November visits were down 4.1%, and while December marked an improvement, visits were still down 1.5%.

But it is possible that even these declines should actually be seen as a strength for IKEA. The brand is oriented to providing students, city dwellers, and others with high value, easy to use products. And currently, cities are much less inhabited than normal and less people are moving. An additional factor that IKEA relies on is weekend visits. IKEA is notoriously excellent at optimizing site selection to minimize cannibalization, but this means that locations tend to be located a bit farther away. As a result, the brand sees a larger dependence on weekend visits than other players in the category.

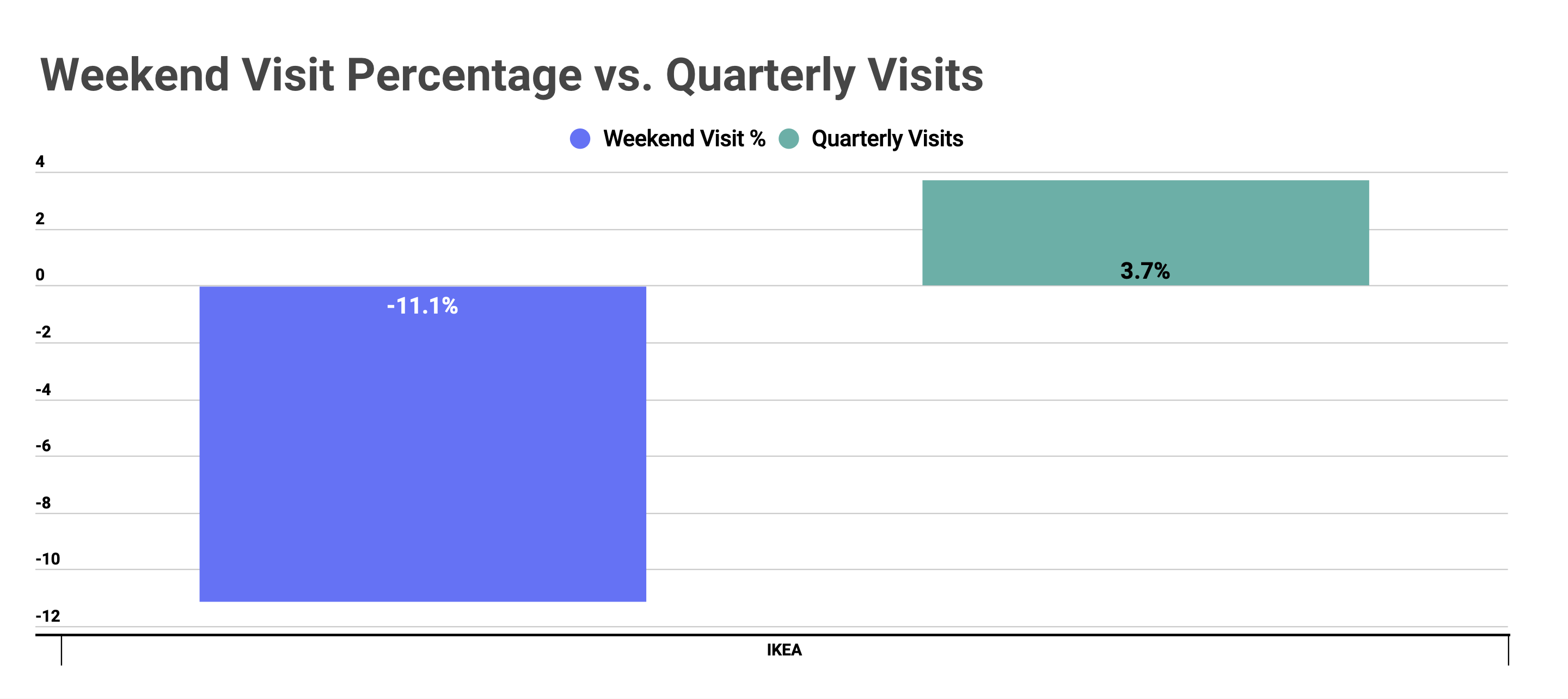

And this is exactly the type of visit that has been impacted by the pandemic. Weekend visits percentage in Q4 was down 11.1% for IKEA, yet overall visits were still up 3.7% – thanks largely to a great October. Essentially, IKEA was driving growth even when the wider situation was less than ideal. This could indicate that as things return, the brand could see a very significant bump.

Can Tractor Supply continue to improve its position? Will IKEA show strength in adverse conditions?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.