“Buy now, pay later” may as well be America’s motto. Credit has always been an important driver of the economy, but a new batch of installment payment brands making microloans to consumers have come onto the scene recently as major disruptors to more traditional credit cards. Even PayPal is getting in on the action with its newly launched Pay In 4 service. Many of these plans exist in partnership with retailers, taking on the risk of spreading out payments on items like a high-end pair of jeans or a stationary bike, or even less expensive items like a tub of moisturizer. At times they don’t even charge a fee to consumers for this service, while at others they charge rates well in excess of what a credit card might. In today’s Insight Flash, we evaluate which of these companies has been the most successful to date, how much return business is driving sector growth, and what the demographic profile of these shoppers is like.

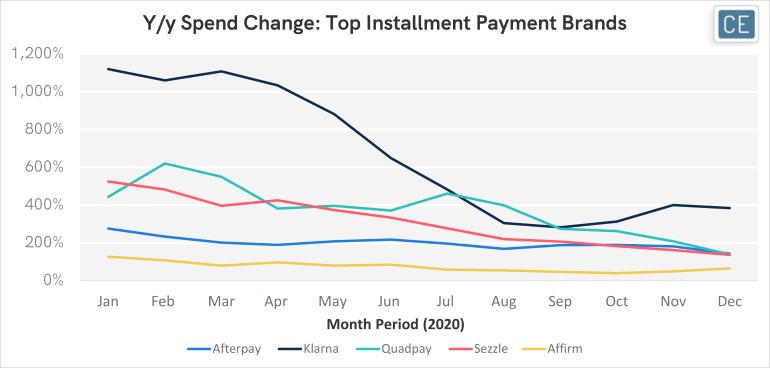

One interesting thing that emerges from looking at spend growth among these brands in 2020 is that most have shown a deceleration. Although one might have thought that a cash crunch from COVID-related unemployment would fuel growth in borrowing, stimulus checks and more favorable payment terms from credit card companies may have put a damper on installment payments. Additionally, many of the partners for these companies are beauty and fashion brands which overall had less demand with shoppers quarantined at home. Still, Klarna saw the strongest growth in our data among these brands for almost every month of 2020, including the largest holiday boost in growth in November and December.

Installment Payment Growth

Note: Data tracks each payment to these brands made with credit and debit cards, not total retailer purchase amount

Shoppers seem to be satisfied. The number of repeat shoppers at installment payment brands has continued to rise throughout 2020, with December repeat shoppers 1.9x the number in January. Interestingly, new shopper levels haven’t risen as fast, and were relatively flat through August, rising slightly in the fall, but seeing a bigger boost for holiday shopping in November and December.

New/Repeat Shoppers

Note: Among Afterpay, Affirm, Klarna, Quadpay, and Sezzle; anyone who shopped any of those brands at least once previously is considered a repeat shopper for the group even if using a different brand at a later period

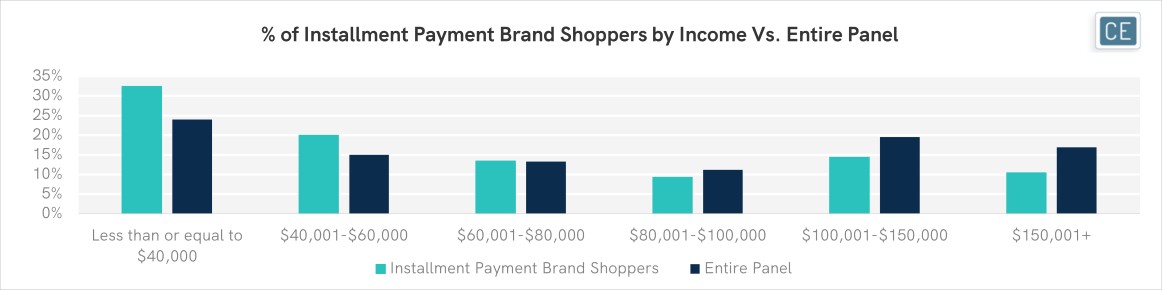

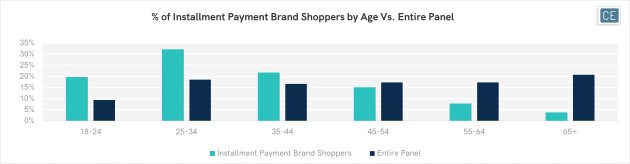

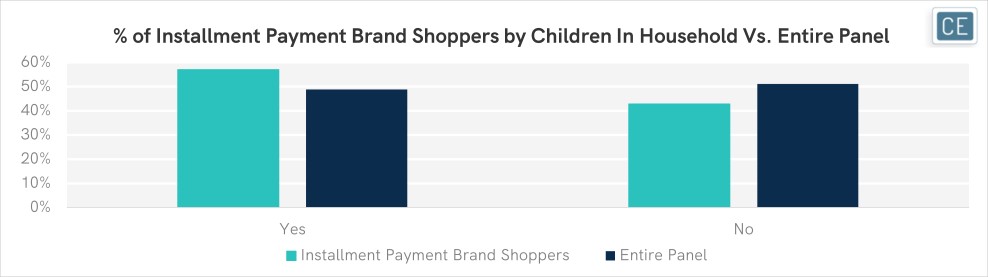

The demographics of these services are unsurprising. Over half of users make less than $60,000 per year, and two-thirds make less than $80,000. One-fifth are 18-24 years old, over twice the percentage of shoppers in our panel overall. One nonintuitive demographic is that these services do skew more towards households with children, with 57% of users having kids vs. 51% for our panel overall.

Demographics

Note: Among Afterpay, Affirm, Klarna, Quadpay, and Sezzle ; Calendar 2020

Understanding the growth drivers of a new type of payment can help companies decide whether they want to partner with one or all of these providers in their day-to-day operations. Seeing how frequently customers come back to use these services and whether they capture attractive demographics may even lead some to decide to launch their own services. CE Vision’s extensive capabilities allow users to analyze these companies and assess opportunities in full.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.