Will Athleisure’s Strong Position Hold?

In a year dominated by headlines around the struggles of apparel, the wider athletic apparel and athleisure space outperformed.

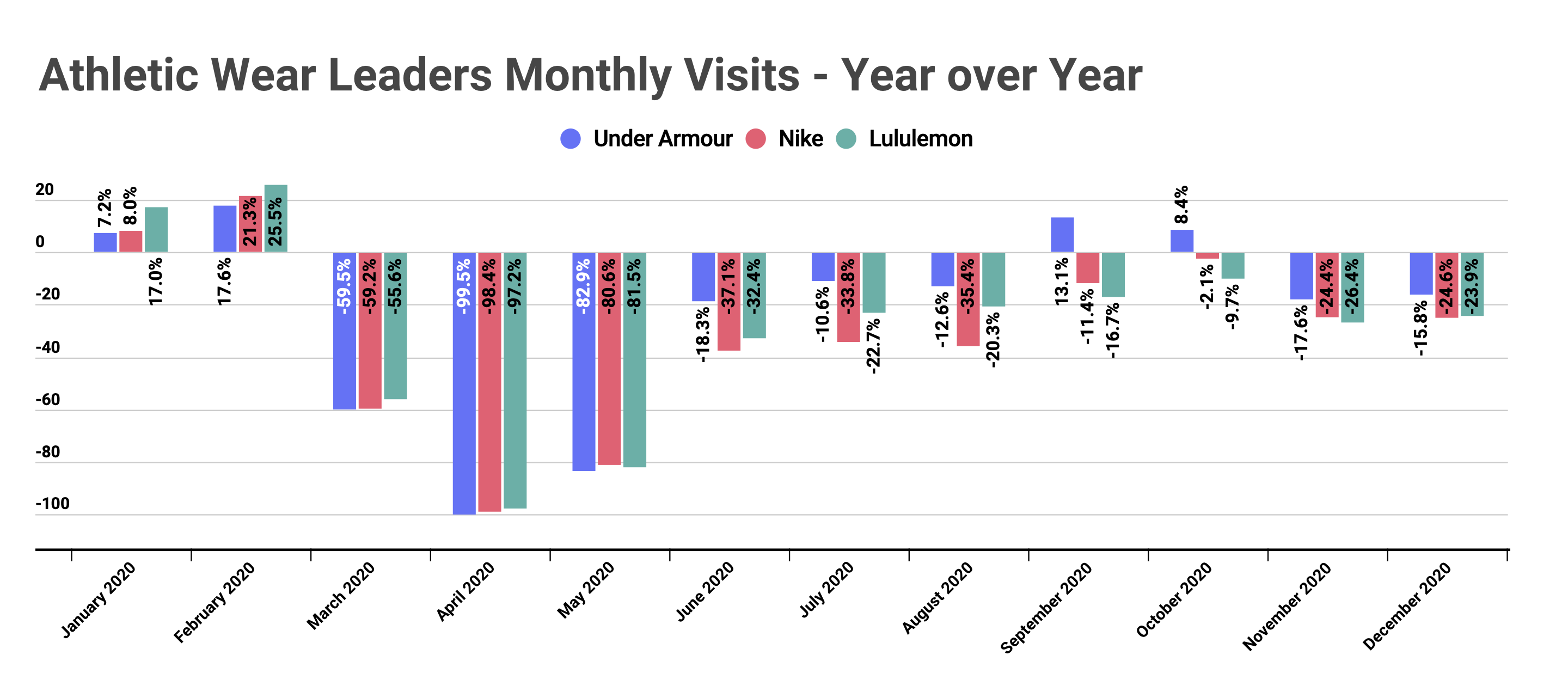

When analyzing Under Armour, Nike and Lululemon we see all three brands enjoying year-over-year growth in January and February before the pandemic brought visits to a screeching halt. The three also recovered exceptionally well with visits down just 2.1% and 9.7% year over year for Nike and Lululemon respectively in October, while Under Armour saw 8.4% year-over-year growth that same month. Yet, the resurgence of COVID cases in November hit these brands hard with November and December seeing significant increases in the visit gap.

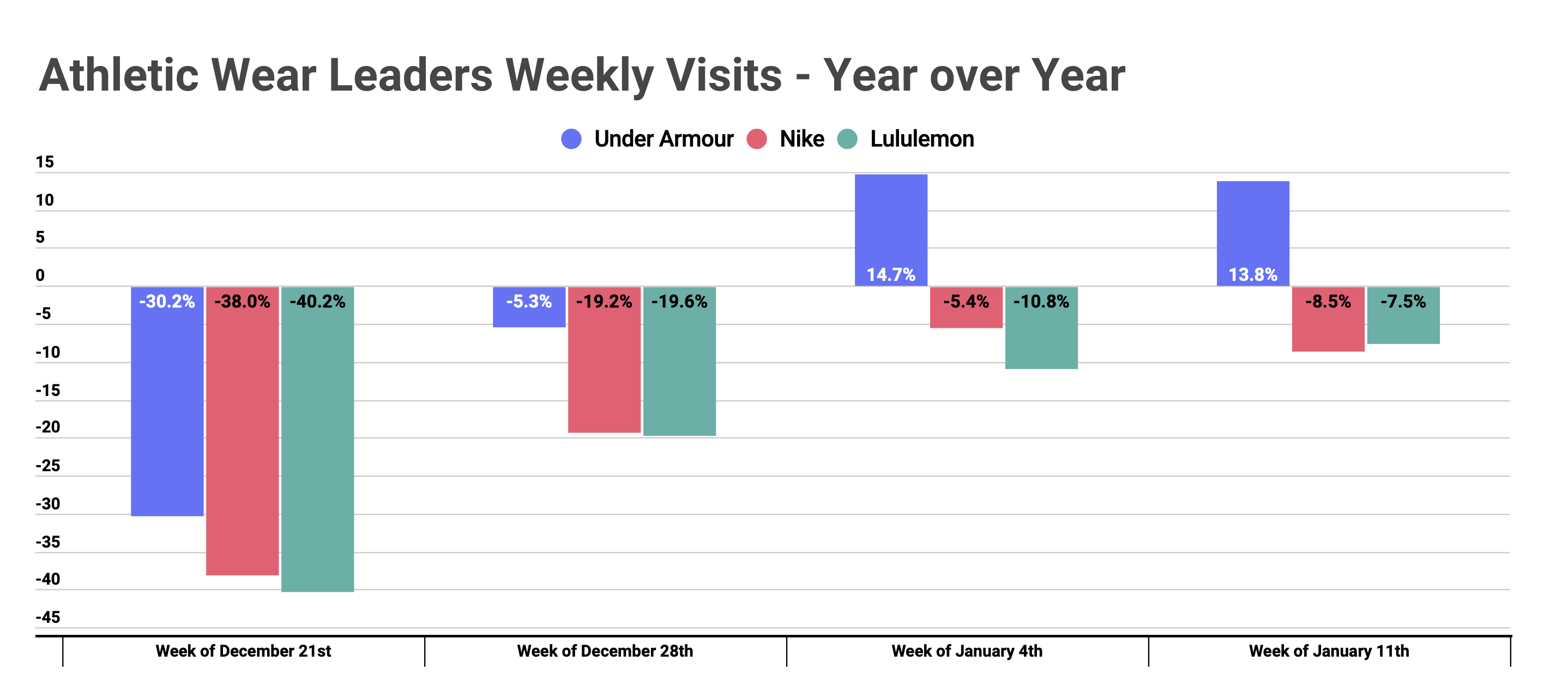

But diving a level deeper paints a more optimistic picture to the latest COVID effect. While the offline performance of these brands was assuredly affected by the rise of COVID cases, they have already been showing signs of a return to strength. Visits the week of December 28th, marked a huge step forward across the board. Under Armour saw visits down just 5.3%, compared to 30.2% down the week of the 21st. Looking at this same period, Nike saw that visit gap shrink from 38.0% to 19.2% and Lululemon saw it drop from 40.2% to 19.6%.

And the pace continued into early 2021. The weeks beginning January 4th and 11th saw visits down an average of just 6.9% year over year for Nike, and just 9.1% for Lululemon. Under Armour actually saw visits up 14.3% year over year, though much of this centers around a wider surge for the brand coming off a period of relative difficulty in recent years. Nonetheless, the arrow for these brands is clearly pointing up. Health and wellness are taking center stage and few brands address that need from an apparel perspective better than these. Additionally, the ability to work or learn from anywhere certainly gives a boost to more comfortable apparel options. Should these brands prove capable of continuing to ride this wave and maximize these trends, they could enjoy an exceptional 2021.

Citi Trends Opening 100 New Stores

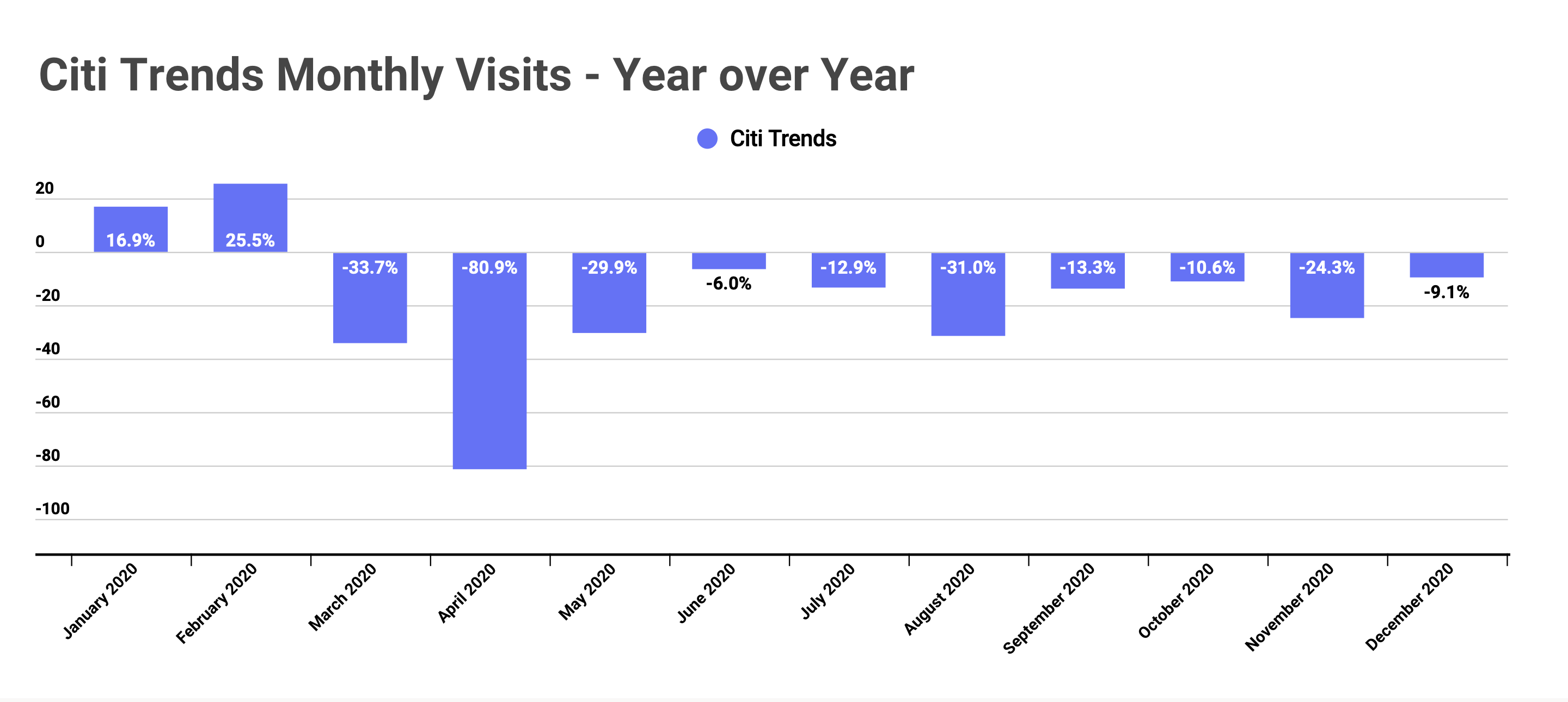

In 2020, average monthly visits for Citi Trends locations were down 14.7% in Q4 – so why is the brand expanding? Beyond the fact that this performance was relatively strong considering the pandemic environment, the key is to look pre-COVID. Visits in January and February were up 16.9% and 25.5% year over year respectively following a 2019 where monthly visits were up an average of 16.8% year over year.

And not only is the pre-pandemic strength important but also the post-COVID potential. The brand’s value orientation during a period of economic uncertainty could provide a powerful opportunity, and when combined with the pre-COVID track record, speaks to a good reason to expand quickly.

Can Amici Turn Friendly’s Around?

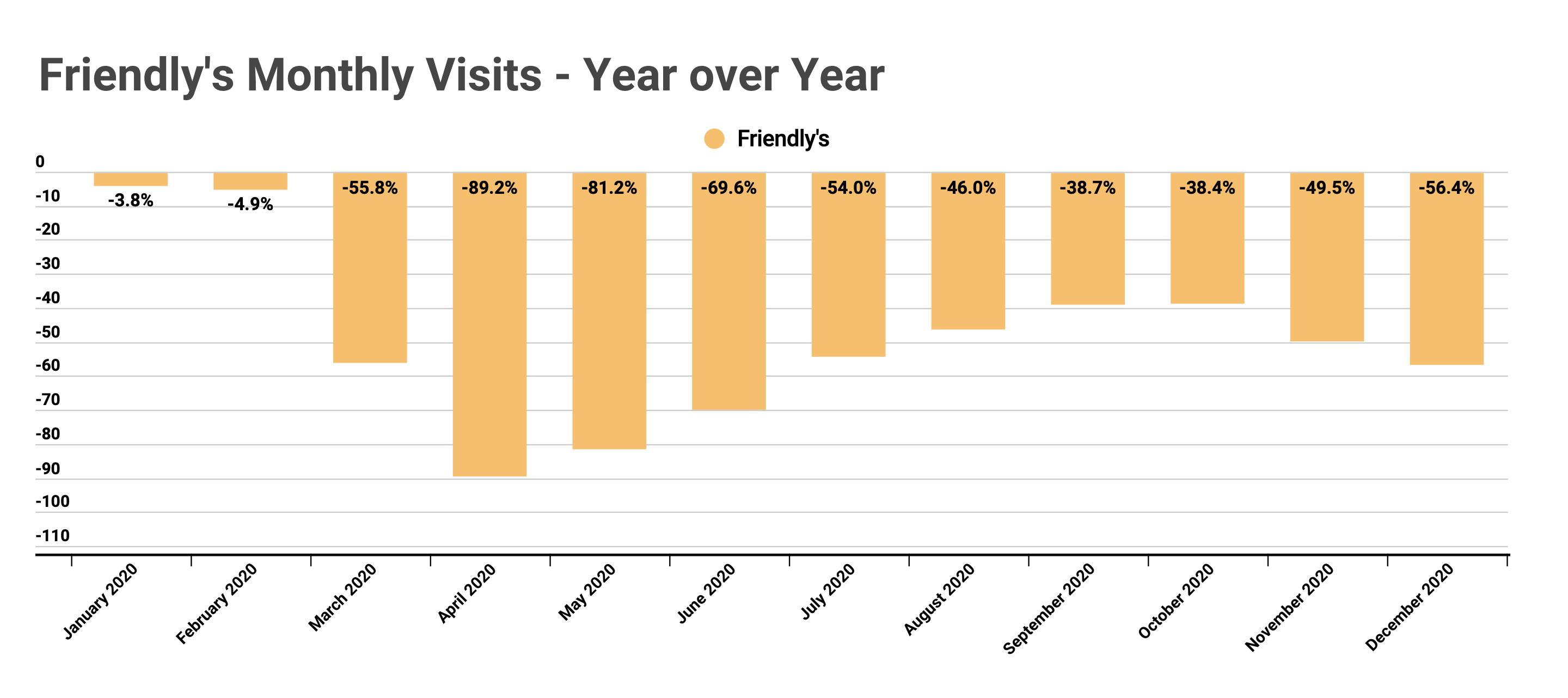

The sitdown restaurant sector has been facing challenges for years and the pandemic certainly didn’t help. So why was Friendly’s an acquisition target? Beyond a relatively low cost, the brand saw visits down just 3.8% and 4.9% in January and February of 2020. While this is nothing to shout about from the rooftops, it is far better than 2019, when monthly visits were down 18.3% on average.

Could this show signs of a potential turnaround? Absolutely. Is it a guarantee in the current environment? Definitely not.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.