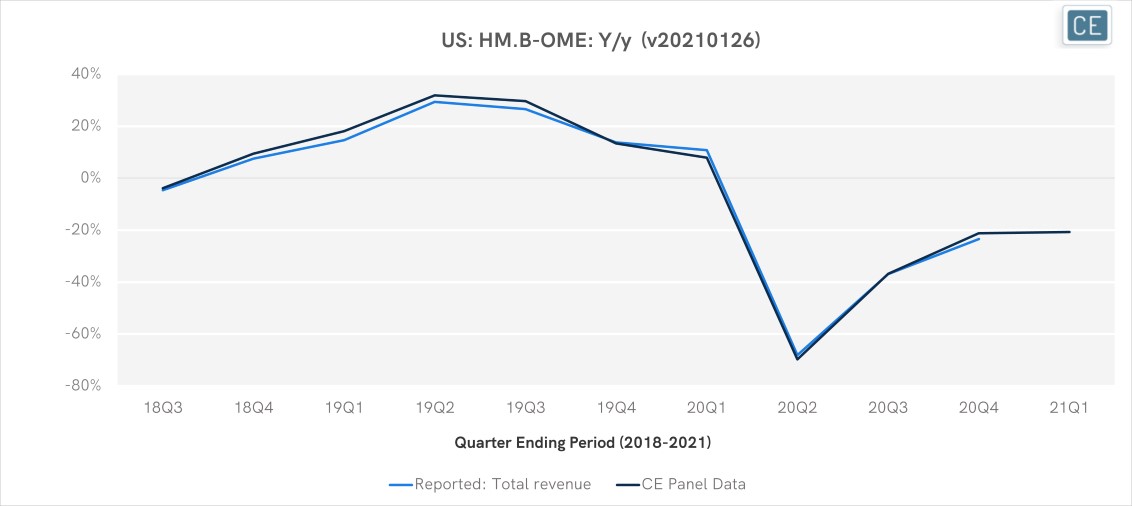

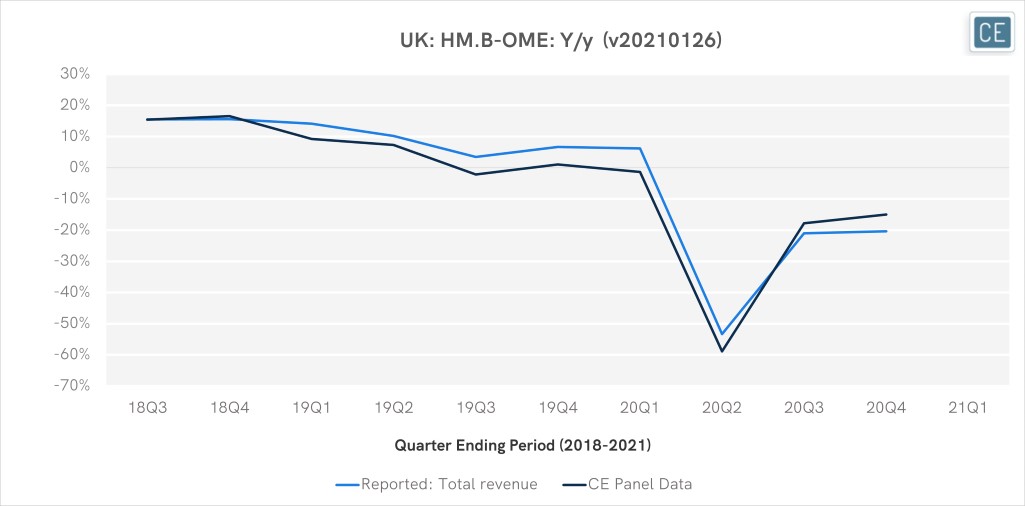

Consumer Edge data has been a strong predictor of H&M sales growth in both the US and the UK. But, the similarities between the markets may end there. In this week’s Insight Flash, we compare trends in both markets to assess differences in growth rates, which months are the most important to monitor trends, and brand performance. The US and the UK markets behave very differently, making it crucial to be able to track trends in both.

Throughout 2019, H&M saw stronger spend growth in the US. That created a higher platform to fall from, however, and as sales dropped precipitously in both the US and UK due to the COVID-19 pandemic, the US saw a sharper fall. Indeed, H&M spend growth actually turned positive in the UK in the late summer and early fall, with the largest gap in August during back-to-school season when UK spend was up 9.7% y/y but delayed school reopenings drove US spend down -26.4%.

Spend Growth

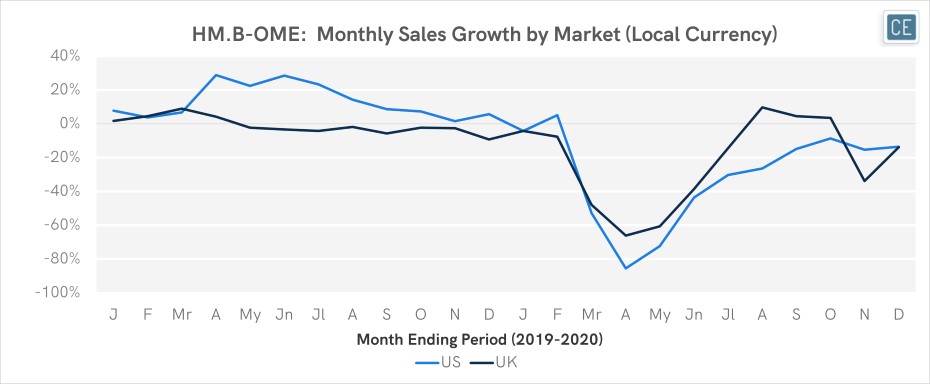

The timing of spend growth isn’t the only important difference across the two markets. US and UK shoppers also exhibit differences in when each is most likely to shop H&M. Although the Pandemic has led to some distortions since then, in 2019 US shoppers spend was more concentrated in the holiday season in November and December, representing 19.6% of total year sales versus only 17.7% for the UK. In contrast, UK shoppers bought more from H&M in the spring around Easter and leading into May, 17.9% versus only 15.8% for the US.

Monthly Sales Distribution

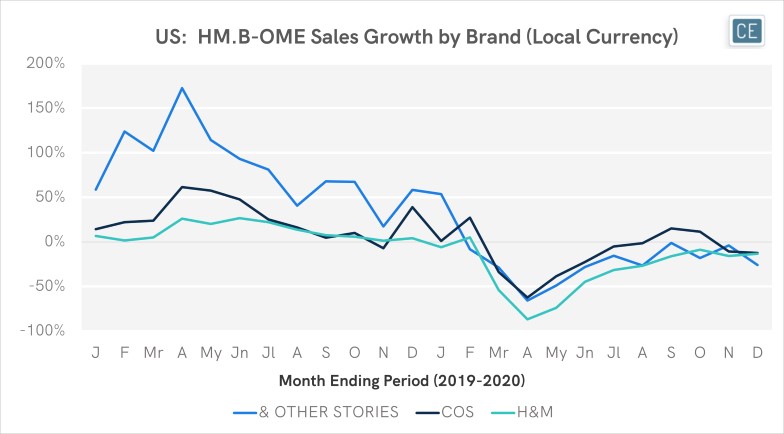

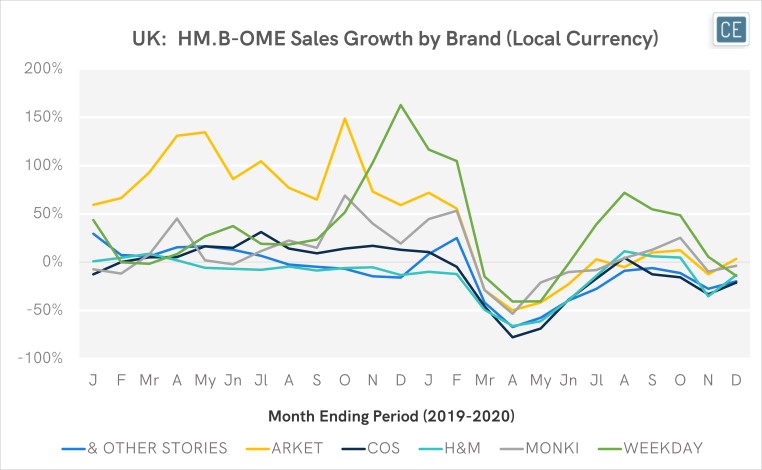

Within the H&M parent, shoppers in different geographies have been trending towards different brands. In the US, high-end & Other Stories was seeing the strongest spend growth throughout 2019, with Cos and its timeless basics taking over in 2020 in line with broader industry Pandemic fashion trends. In the UK, this paradigm is flipped. Basics appeared to be more popular even pre-pandemic, with lifestyle brand Arket growing the fastest throughout 2019. In late 2019 and through the pandemic in 2020, street style brand Weekday became the higher growth brand.

Brand Spend Growth

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.